-

VanEck analysts believe that BTC could be set for a strong recovery

Analysts cited strong network activity and a decline in funding costs in BTC Futures

As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I find VanEck’s latest report on Bitcoin [BTC] intriguing. The strong network activity and declining funding costs in BTC Futures have been key indicators in past market recoveries, suggesting that we might be on the brink of another one.

As per VanEck’s monthly analysis on Bitcoin (BTC), the world’s leading digital currency has demonstrated impressive resilience recently. Notably, it appears to be following a similar pattern as its past market recoveries, according to their report.

According to analysts Mathew Sigel and Nathan Frankovitz from VanEck, an increase in Bitcoin’s network activity and a decrease in future funding costs may indicate a probable robust comeback.

As a crypto investor, I’ve noticed some exciting developments in the Bitcoin network. The number of Ordinal inscriptions has experienced a significant increase of approximately 83%, indicating a surge in activity that mirrors market recoveries we’ve seen before. Additionally, the cost for Bitcoin futures funding has decreased, suggesting a risk-taking atmosphere among investors, which is typically associated with market upswings.

BTC funding cost mirrors May and July recoveries

Significantly, the fees (funding rates) that traders pay to maintain perpetual Bitcoin futures contracts also decreased to comparable levels during the periods of recovery in May and July.

“Over the last month, the annualized cost of Bitcoin futures funding has decreased from approximately 11.6% to about 8.8%. This represents a reduction of around 24%. Such levels suggest a degree of risk tolerance comparable to that observed during market recoveries following significant price drops of more than 20% in May and July this year.”

Regardless of a promising outlook for Bitcoin, a dip in August reduced the number of profitable wallets by approximately 9%. According to the report, a vast majority or 84% of Bitcoin users still held unrealized profits. The remaining users, who were in the red, were predominantly short-term investors.

In contrast, the analysts highlighted that the latest declines were typical pullbacks that occur during Bitcoin’s bullish market phases.

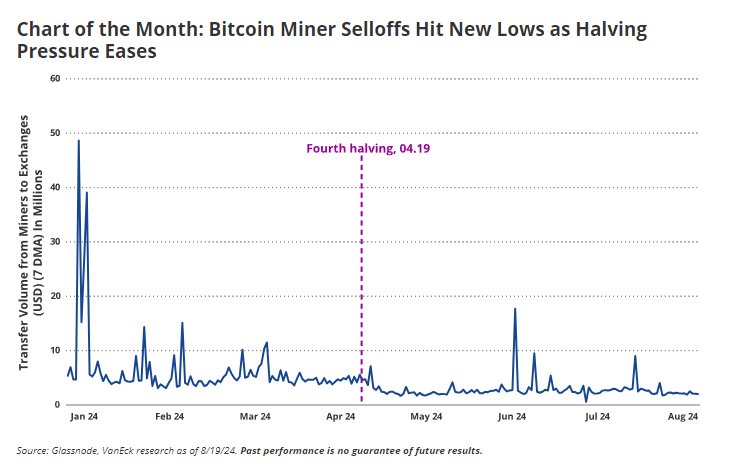

Additionally, there appears to be a decrease in Bitcoin miners’ selling activities, suggesting that the pressure they exert on the market is diminishing.

Over the last month, I’ve noticed a decrease of 21% in the transfer of volumes from miners to exchanges. This trend seems to indicate a possible stabilization among miners, perhaps as they adjusted to the increase in post-halving selling that was particularly high in June and July.

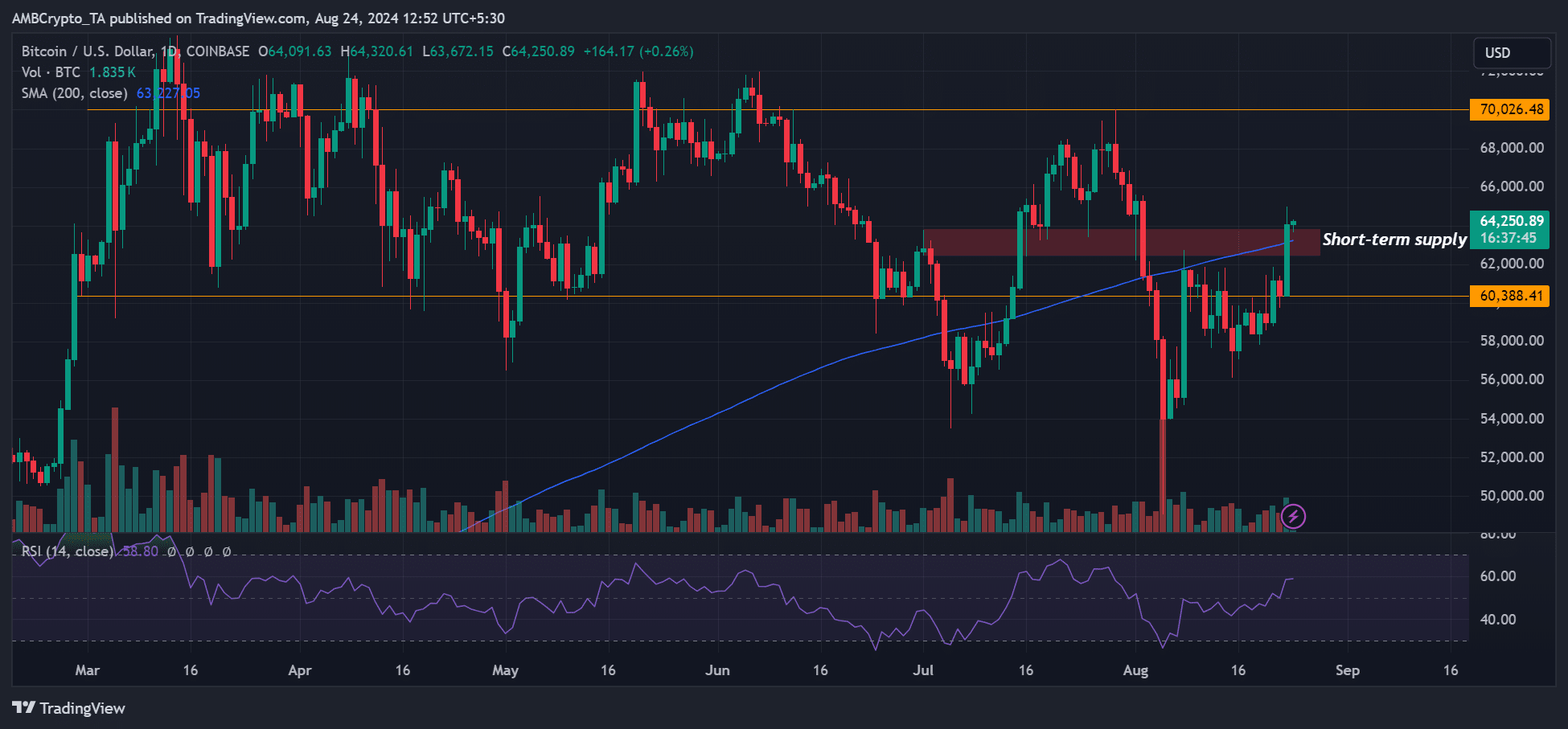

Currently, when I’m writing this, the long-term outlook for Bitcoin appears positive. It has surpassed the recent resistance zone at around $63,000 and regained its 200-day Simple Moving Average, indicating a bullish trend on higher timeframe charts.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-08-24 18:15