- Bitcoin’s “Cup & Handle” pattern pointed to a bullish run, closely following the S&P500 and Gold

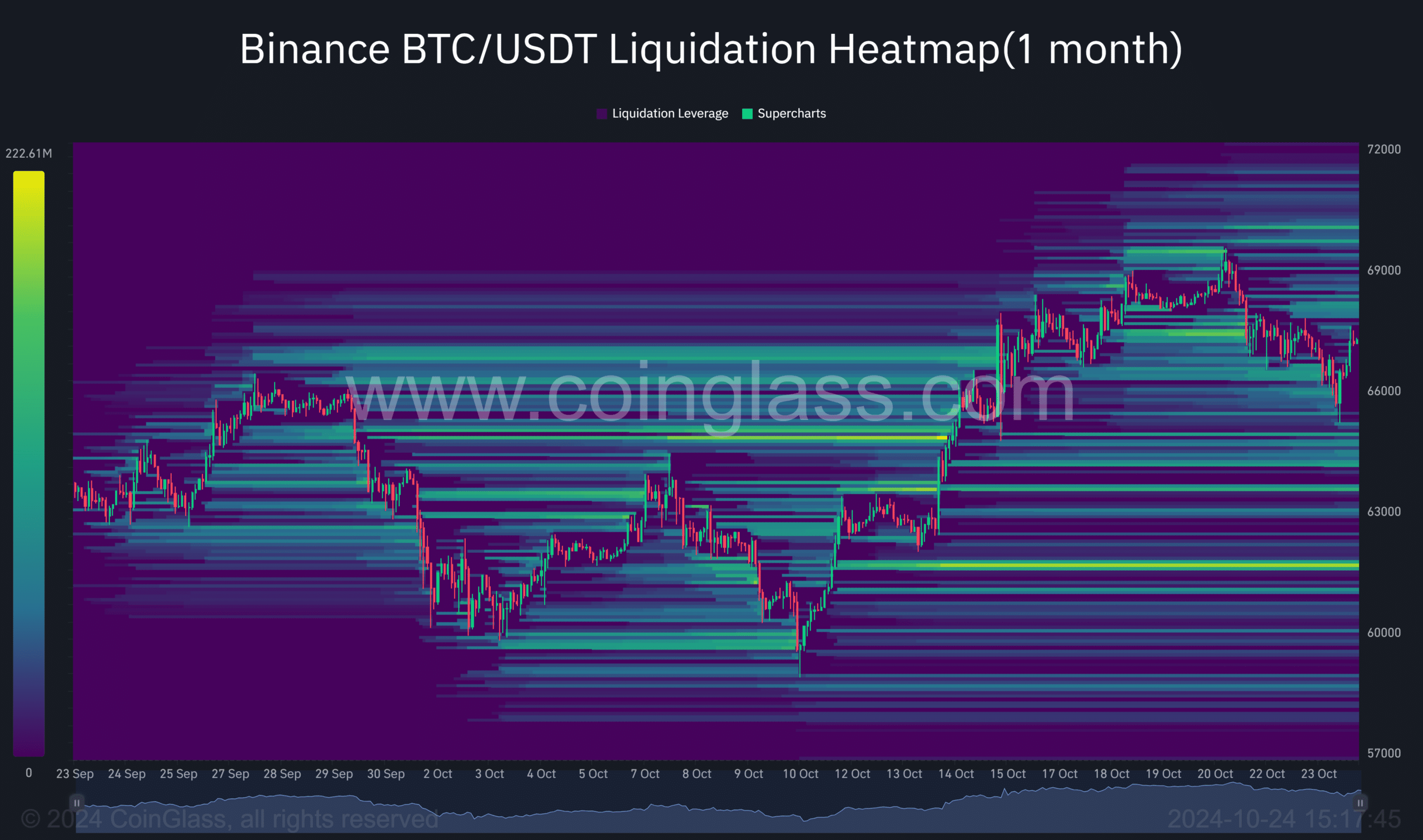

- A potential BTC rebound to $69,785 could liquidate $91.32 million in shorts

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bull and bear runs. The current “Cup & Handle” pattern Bitcoin is displaying is reminiscent of the S&P500 and Gold, which historically have been strong indicators of a potential bullish run for the world’s largest cryptocurrency. If history repeats itself, we could be looking at a price target of $230k over the coming months.

At this moment, Bitcoin (BTC) seems to be following a “Cup and Handle” pattern, similar to what’s been observed in both the S&P500 and Gold, as suggested by a recent tweet from an analyst. If this pattern holds, we might see a significant increase in Bitcoin’s price, potentially reaching up to $230k in the upcoming months after a bullish breakout.

As a crypto investor, I’m constantly wondering: Will this digital currency landscape mirror the trajectory of conventional assets, reaching my desired $1 million mark?

Shorts may fall…

If Bitcoin’s value suddenly surges back towards $69,785, it might lead to a highly dramatic sell-off or liquidation spree among investors.

At present, a total of $91.32 million could potentially be affected if the cryptocurrency market trends upward. Given the mounting market momentum, we can anticipate considerable price fluctuations in the near future.

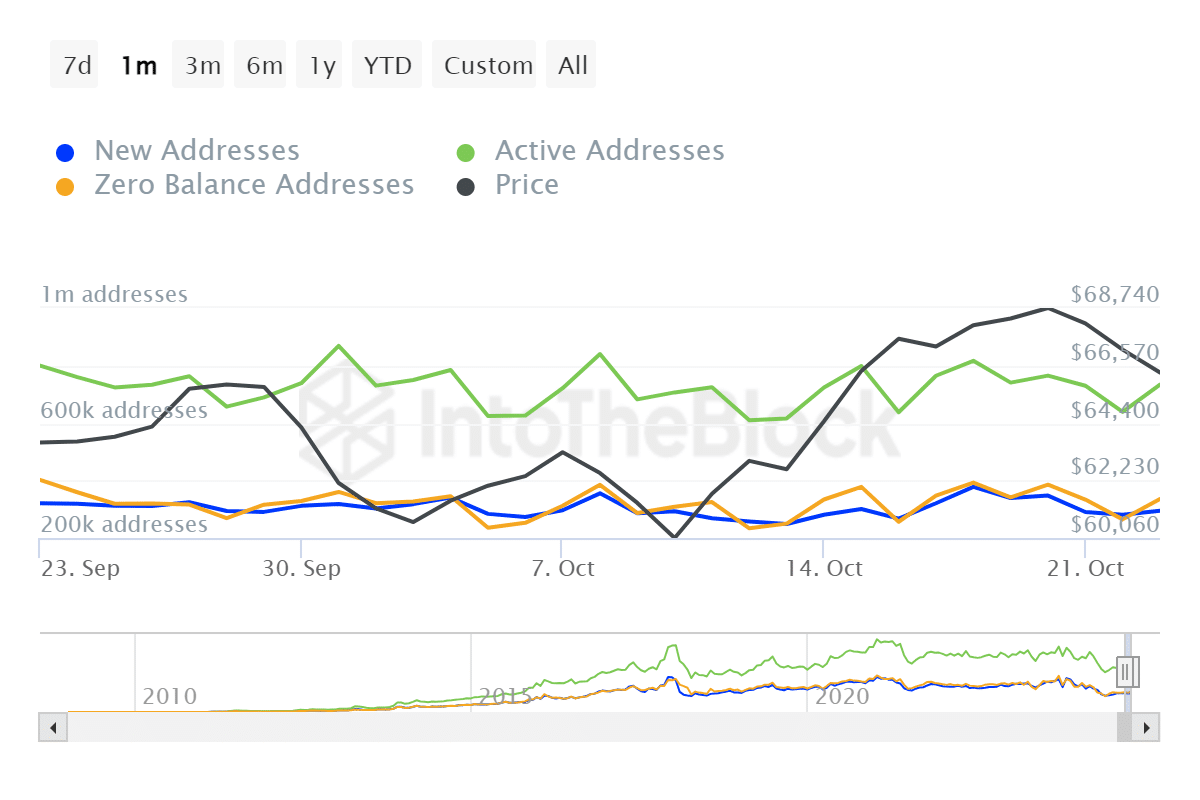

Bitcoin addresses surge on the verge

Based on additional examination of data from IntoTheBlock, there has been an increase observed in the count of active cryptocurrency addresses within the past 24 hours.

Lately, Bitcoin’s network has seen a significant surge in activity. In particular, the number of active addresses has increased by an impressive 14%, reaching approximately 733,000 addresses. This rise in participation suggests heightened interest and involvement, which could potentially boost the value of Bitcoin further.

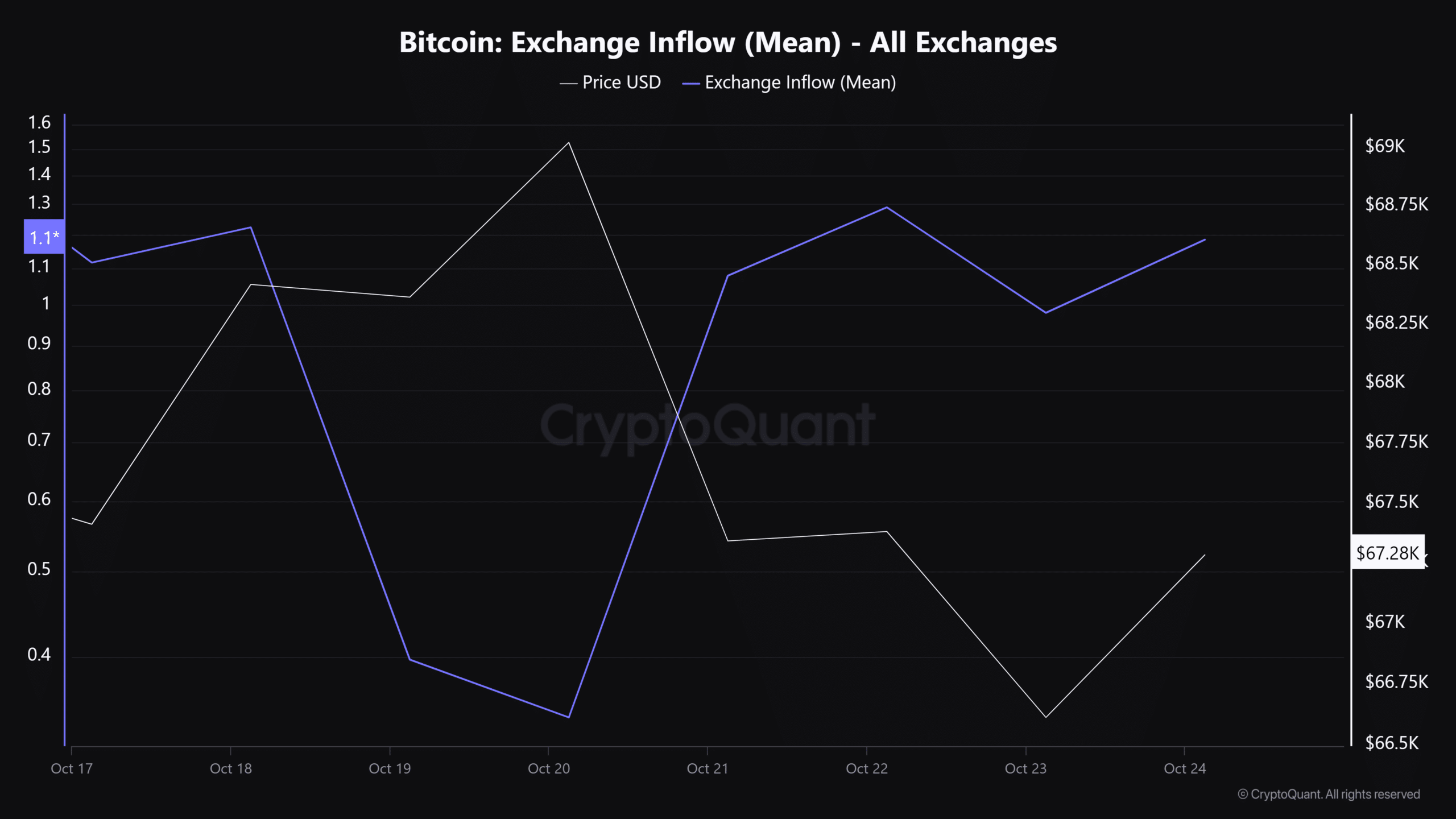

Exchange inflows add to a potential bullish rally

It’s important to mention that as many experts predict a strong upward trend for Bitcoin, it’s noteworthy that there has been a notable increase in its inflows recently. This is supported by the latest data from CryptoQuant.

Interpreting this as evidence, it suggests that Bitcoin’s Open Interest and demand are both exceptionally high. Additionally, various indicators hint that the cryptocurrency could potentially reach unprecedented heights, akin to reaching for the stars or “heading to the moon.

As Bitcoin mirrors the trajectory of established assets such as Gold and the S&P 500, the upcoming months may shape its destiny significantly.

Should the asset successfully attain its forecasted peak, it might trigger several possible repercussions across the broader economy.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-10-25 12:09