-

Bitcoin’s historical post-halving patterns suggest a potential parabolic rally in the coming weeks.

Clearing liquidity below $50K leaves fewer barriers as BTC eyes $70K and new all-time highs.

As a seasoned researcher who has witnessed Bitcoin’s meteoric rise and fall over the years, I find myself cautiously optimistic about the upcoming weeks for BTC. The historical patterns following halving events suggest that we might be on the verge of another parabolic rally, with $70K and new all-time highs within reach. However, I’ve learned the hard way that cryptocurrency markets can be unpredictable, so I always keep a healthy dose of skepticism handy.

As Bitcoin (BTC) gets closer to significant resistance points, there’s a possibility of a significant price surge. Analysts are closely watching past price trends after Bitcoin’s halving events, as these occasions typically result in dramatic price escalations.

Based on the recent market trends, such as the significant dip below $50,000 followed by a surge in trading volume, it appears Bitcoin might be gearing up for a substantial increase, potentially reaching $70,000 and even higher levels.

Bitcoin halving patterns indicate potential rally

Historically, Bitcoin tends to see a substantial increase in price after its halving events occur, as these events decrease the number of freshly minted Bitcoins that enter circulation.

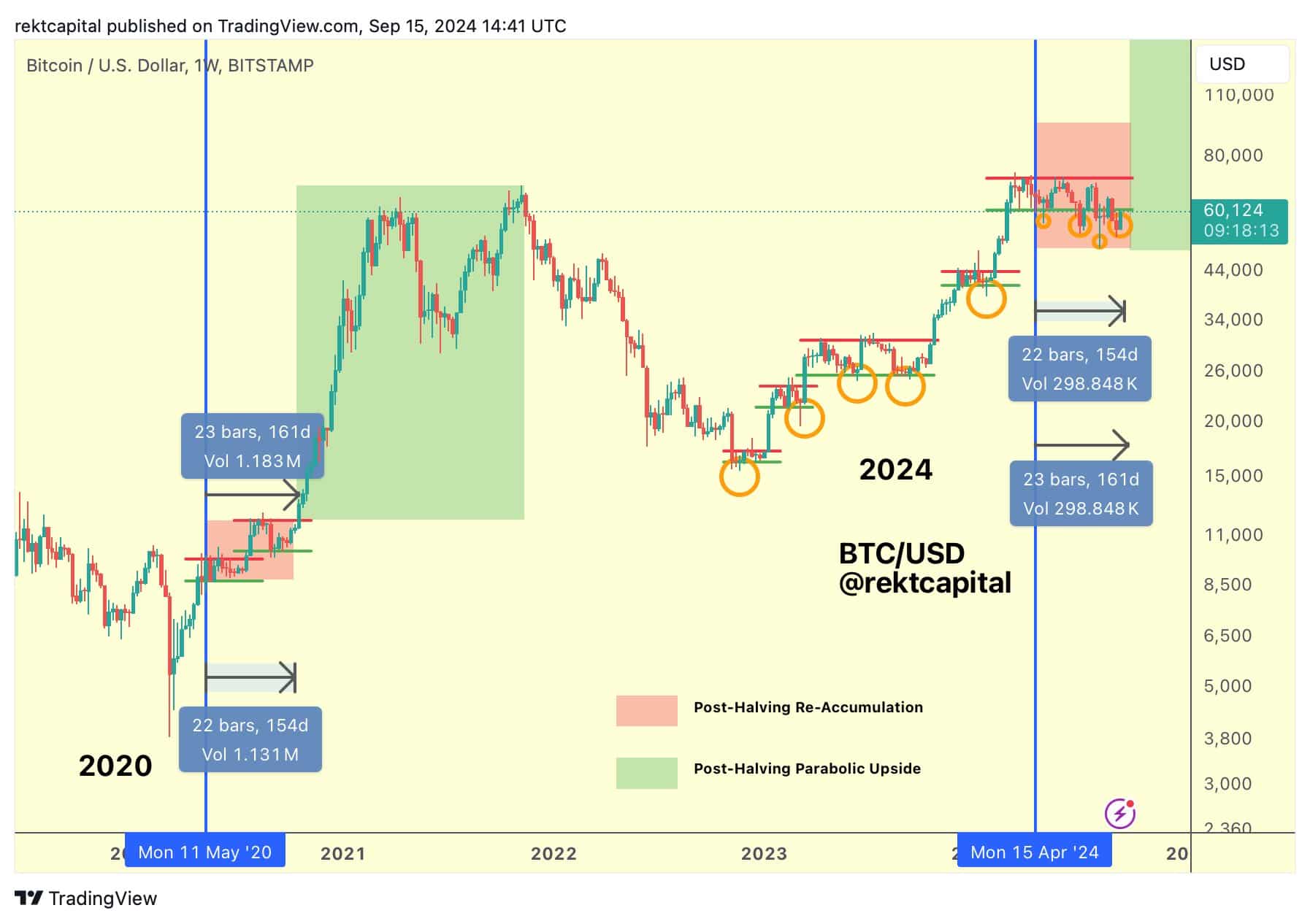

As per the analysis by Rekt Capital, a well-known cryptocurrency trader, Bitcoin appears to be on the verge of regaining its Accumulation Zone and aligning itself with the usual price behaviors seen following the halving event.

Reducing the supply by half usually results in a sudden scarcity, leading buyers to outnumber sellers, potentially driving up prices.

Adding that Bitcoin could break out in the next few weeks, Rekt Capital said,

Bitcoin is nearly back within its Accumulation Zone and aligning itself with the typical price patterns that occur after a halving event.

Liquidity grab below $50K clears path for higher levels

On the 5th of August, Bitcoin underwent a significant liquidation event when its price dipped below $50,000, which removed a substantial pool of sellers. This situation presents a chance for Bitcoin to challenge higher price ranges again.

Based on Daan Crypto Trades’ statement, Bitcoin has broken through a significant pool of available funds (liquidity) at the $50K level, which leaves fewer such pools close by.

In the present Bitcoin price range, a lack of availability for buying or selling makes it easier for prices to rise significantly. Important groups of sellers still lie beneath $47,000, creating a crucial foundation that may prevent further drops in value.

Should Bitcoin sustain its current position above the specified support level, it could potentially carry on rising, with the significant hurdle at $70K looming ahead.

Upside targets above $70K and key resistance levels

In simpler terms, the estimated high point for Bitcoin’s increase is around $70,000, as this area contains a large concentration of buyers and sellers ready for action. Meanwhile, traders are keeping an eye on the $60,000 range, which represents a significant barrier that Bitcoin needs to surpass to maintain its rising trend.

Should Bitcoin overcome the current resistance level, it might propel itself towards approximately $70,000 and possibly establish new record-breaking peaks.

In other words, surpassing the $60,000 mark is essential for a lasting upward trend. Should Bitcoin continue to gather speed, it might mimic the typical pattern of post-halving price surges, potentially reaching over $70,000 and even higher.

Even though optimism prevails, potential dangers persist. The $47K point is crucial as a support level, with significant pockets of liquidity lying beneath this zone. If Bitcoin can’t maintain this critical support, it might face additional declines, possibly returning to the $47K region or even lower.

A fresh analysis by AMBCrypto indicates that Bitcoin is on an upward trend following a five-month slump, with its current value reminiscent of the prices seen in 2021 just before a significant surge. Moreover, open contracts for Bitcoin have experienced a rise compared to the previous year, hinting at possible price escalation if market circumstances become more favorable.

Bitcoin market sentiment and metrics

Currently, Bitcoin is being exchanged for approximately $58,654 per unit, and during the previous 24 hours, a total of $24.5 billion worth has been traded. This represents a slight drop of 2.54% in the last day, but an encouraging rise of 7.19% over the past week.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

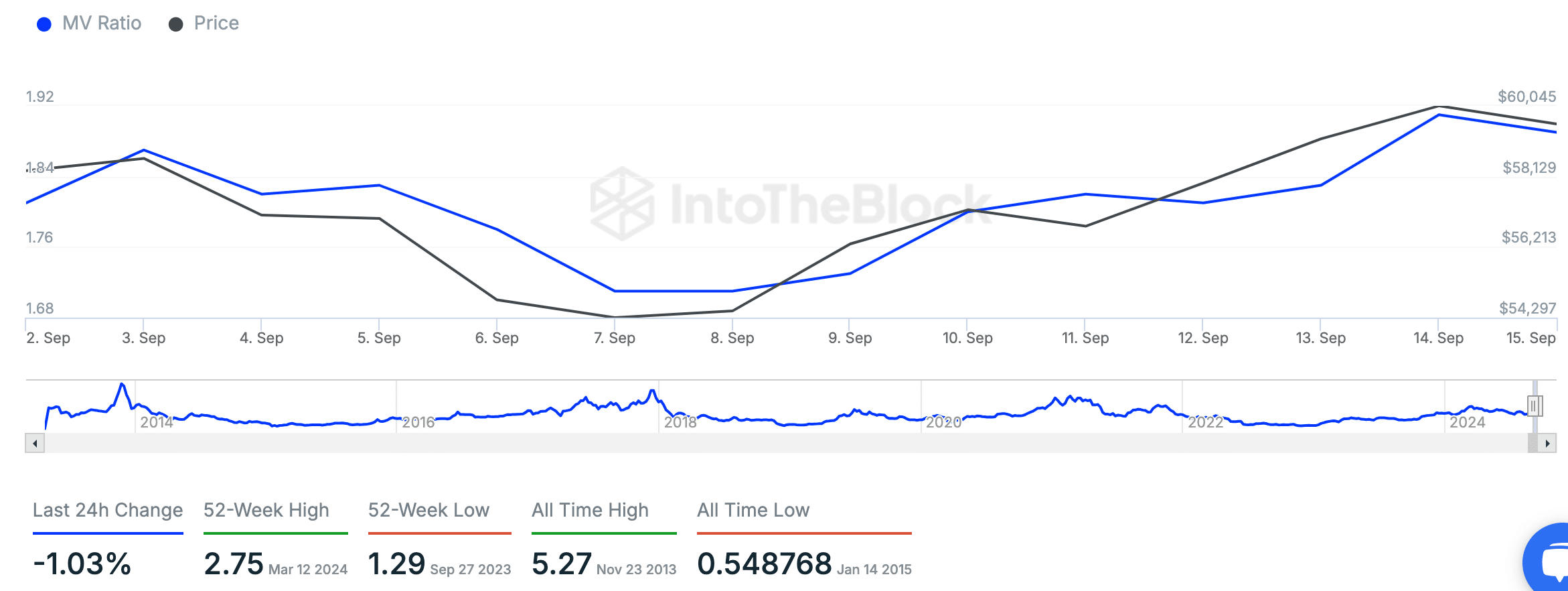

The MVRV Z-Score, a tool that compares Bitcoin’s current market value with its historical worth, is approaching 2.75, suggesting it’s overvalued. In the past, when this score exceeded 5.27, it typically signaled peak market points, as witnessed in November 2013.

As liquidity restrictions lessen and crucial milestones draw near, there’s a strong possibility that Bitcoin could experience a significant surge, with investors keeping a close eye on any price movement exceeding $70,000.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-16 19:36