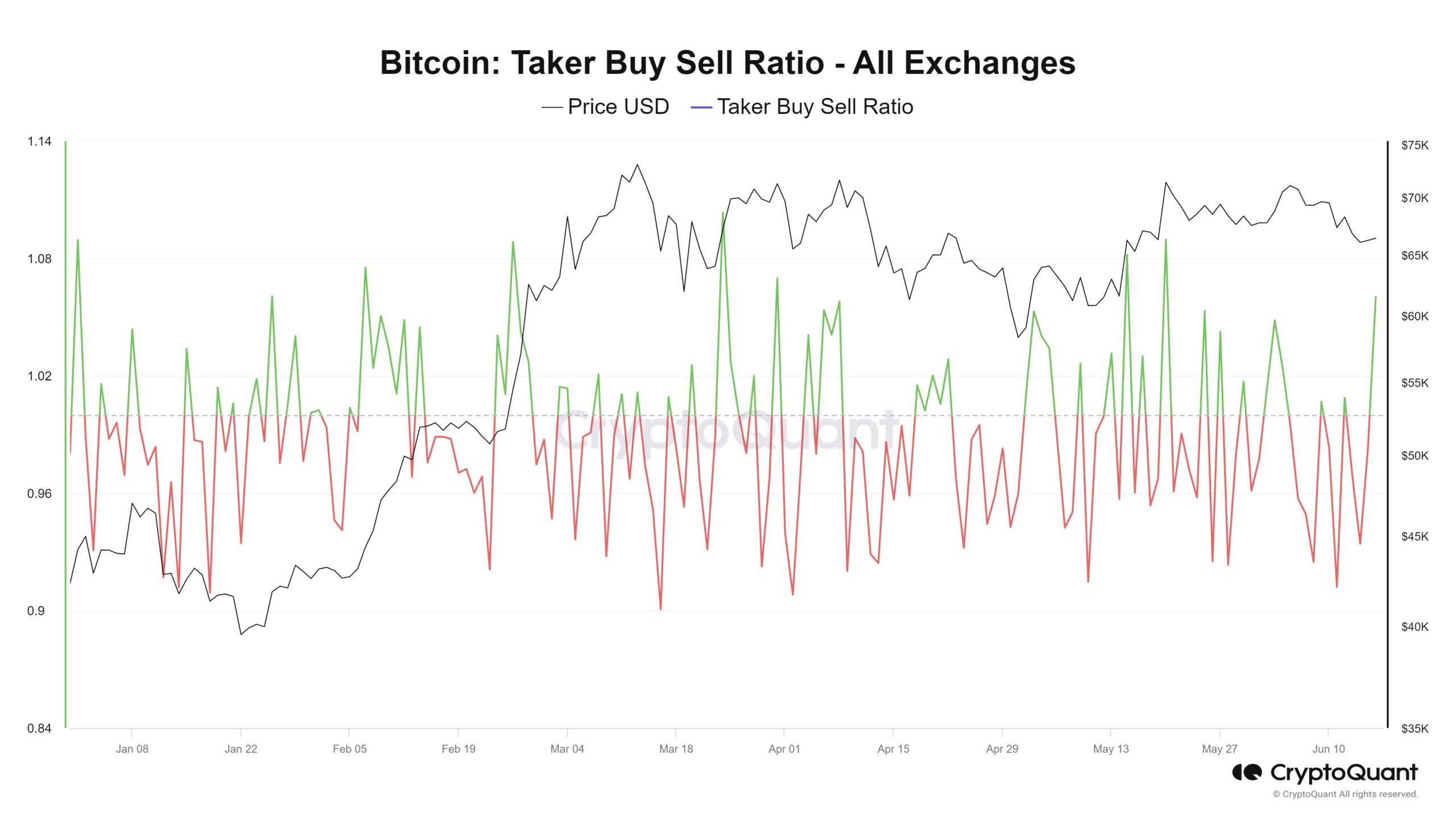

Based on my analysis as a researcher, I find the recent development in Bitcoin’s Taker Buy Sell Ratio intriguing. The metric’s shift above one suggests that buying pressure has exceeded selling pressure across most exchanges, indicating a potential shift towards a bullish sentiment. This trend could lead to an increase in BTC price soon. However, it is important to note that this is just one metric and should not be taken as the sole indicator of market sentiment.

Over the last several days, the cost of Bitcoin [BTC] has dropped significantly, reaching new lows with each passing day. However, a specific indicator indicates that the price could potentially rebound in the near future.

Bitcoin takers and sellers

According to AMBCrypto’s examination of the Bitcoin Buy-Sell Ratio on CryptoQuant, there has been a recent upward development.

At the close of trading on the 15th of June, the chart showed that the ratio was moving below one, implying a bearish market outlook.

However, the metric has been rising as of the previous trading session.

As a crypto investor, I delved deeper into the market trends and discovered that this digital asset had surged beyond the $1 mark on certain exchanges. This uptick suggested a transitioning bullish sentiment, with a higher volume of buy orders being processed than sell orders.

At present, the BTC Taker Buy Sell Ratio has surpassed the threshold of one. Such a development signifies that demand for Bitcoin is stronger than supply on most cryptocurrency trading platforms.

The suggested shift indicates a growing optimism among market participants regarding Bitcoin. This development might pave the way for a possible price rise in the near future.

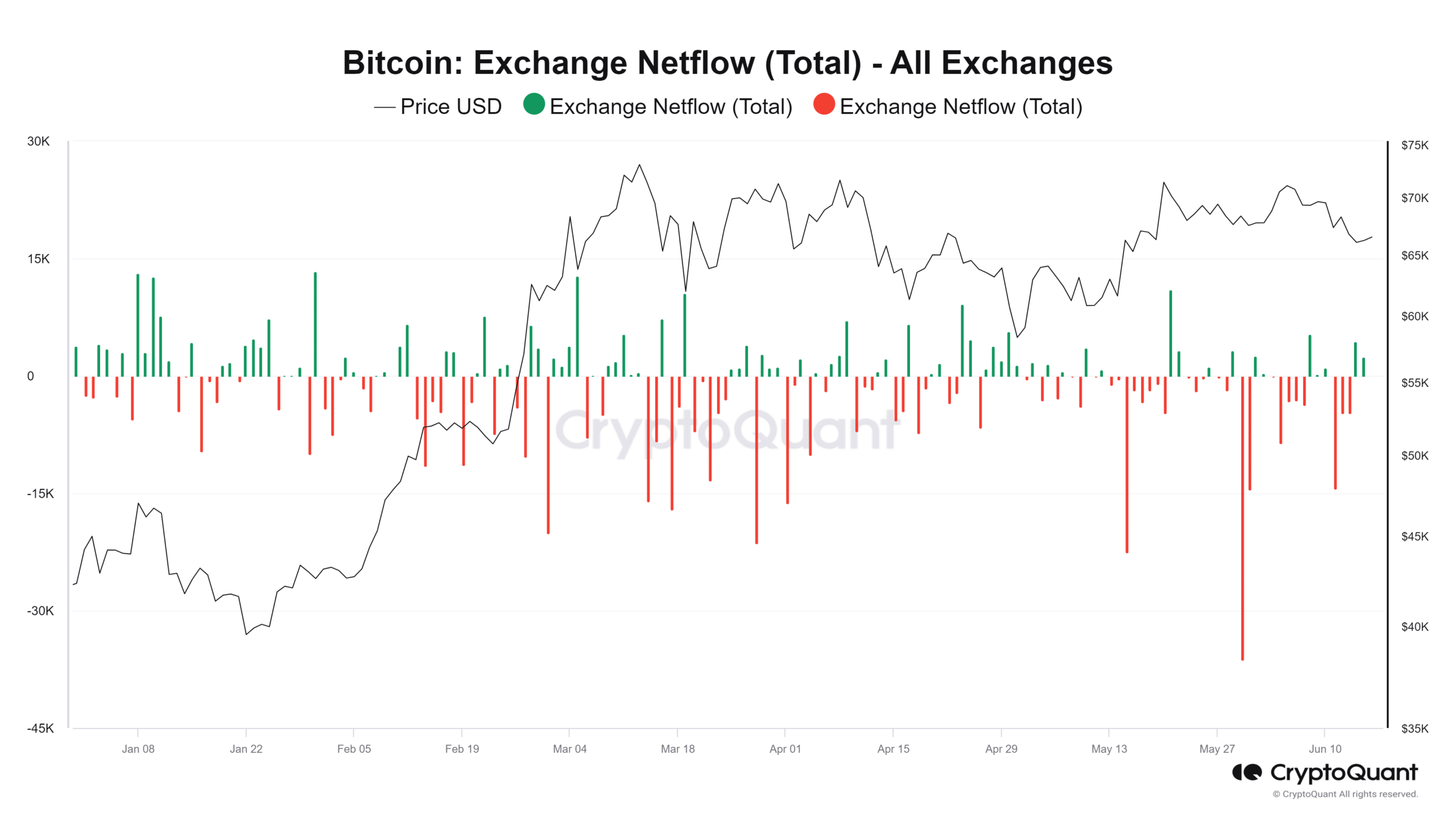

Inflows dominate, but there’s a catch

As a crypto investor, I’ve noticed that Bitcoin’s exchange netflow has shown a positive trend over the last few days. This means that more Bitcoins are flowing into exchanges than out of them. It could be an indicator of upcoming buy or sell pressure, so it’s essential to keep an eye on this development and consider adjusting my investment strategy accordingly.

At first glance, this may seem like a negative indicator. However, upon closer inspection, it was found that the recent influx of funds is actually quite small compared to the large outflows seen over the past several weeks.

Although more Bitcoins have been transferred to exchanges lately, the dominant pattern of coins moving between wallets, both public and private, continues to indicate a robust accumulation trend. This persisting behavior might still signal a positive forecast for Bitcoin’s price.

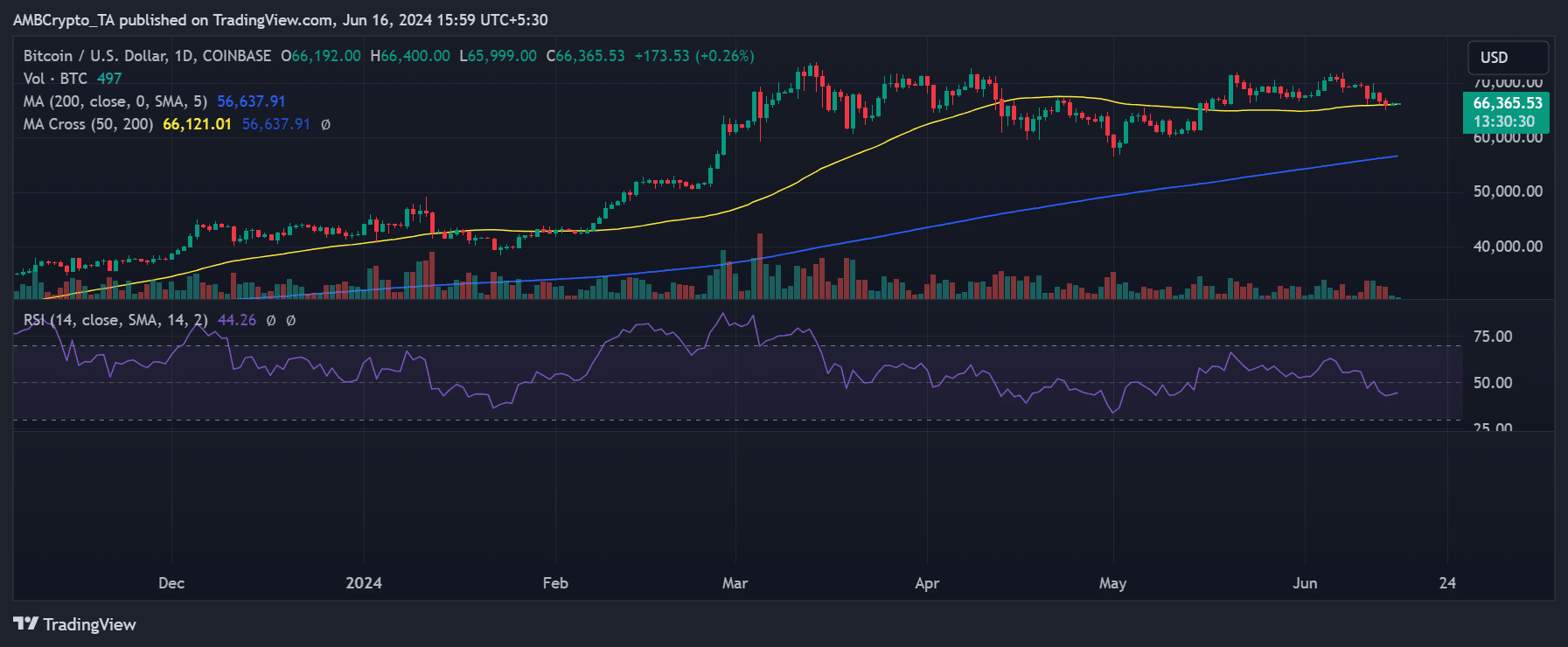

Bitcoin remains bearish

As an analyst, I’ve examined Bitcoin’s price action on a daily basis for AMBCrypto, and I’ve noticed a downward trend over the past few days. Despite brief upticks, these have failed to provide enough momentum to halt the decline.

As of this writing, BTC was trading at around $66,360 despite a minor uptrend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s price was putting pressure on its last line of defense at approximately $65,000. At present, Bitcoin continues to trade above this critical support level.

From my perspective as an analyst, the Relative Strength Index (RSI) for Bitcoin (BTC) has stayed beneath the neutral threshold. At present, the RSI hovers around the 45 mark, suggesting that the cryptocurrency is currently exhibiting bearish tendencies.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-17 03:03