- In the fleeting passage of a single day, Bitcoin has ascended by a modest 1.04%.

- To maintain its regal status, the king coin must steadfastly remain above the hallowed ground of $96k.

In the week that has passed, Bitcoin [BTC] found itself ensnared in a web of consolidation, as if caught in a philosophical quandary, unable to reclaim its former glory and ascend to loftier heights.

Thus, it lingers around the pivotal $96k mark, a threshold deemed critical by the astute analyst Shayan of CryptoQuant, who, like a modern-day oracle, gazes into the murky waters of market sentiment.

Why $96k is key for Bitcoin

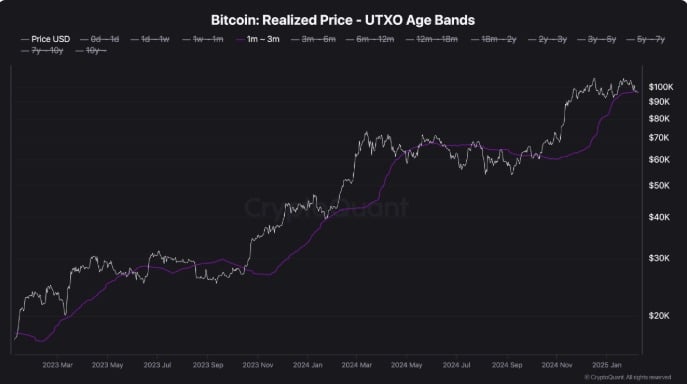

Shayan, in his sagacious analysis, has noted that the realized price for the 1–3 month cohort of Bitcoin rests at the fateful $96k.

Historically, when our noble BTC descends to this level after a period of ascension, it serves as a bastion of support, suggesting that short-term holders remain resolute in their convictions, even as the tides of price surge around them.

To hold above this sacred threshold is of utmost importance, as it fortifies the bullish sentiments of the market, thereby enhancing the prospects of a prolonged upward journey.

However, should Bitcoin falter and slip beneath this critical support, a tempest of fear may sweep through the market, ushering in a phase of distribution akin to a tragic play where the hero meets his downfall.

Thus, the forthcoming movements around this juncture will be pivotal in determining the trajectory of Bitcoin’s fate in the short to mid-term.

Can BTC hold above $96k?

As Bitcoin remains ensconced around the $96k mark, one must ponder whether this kingly coin can maintain its lofty position and bolster the spirits of its short-term holders.

According to the analysis of AMBCrypto, despite the absence of upward momentum, investors remain optimistic, believing that another surge is on the horizon, much like a hopeful farmer awaiting the rains.

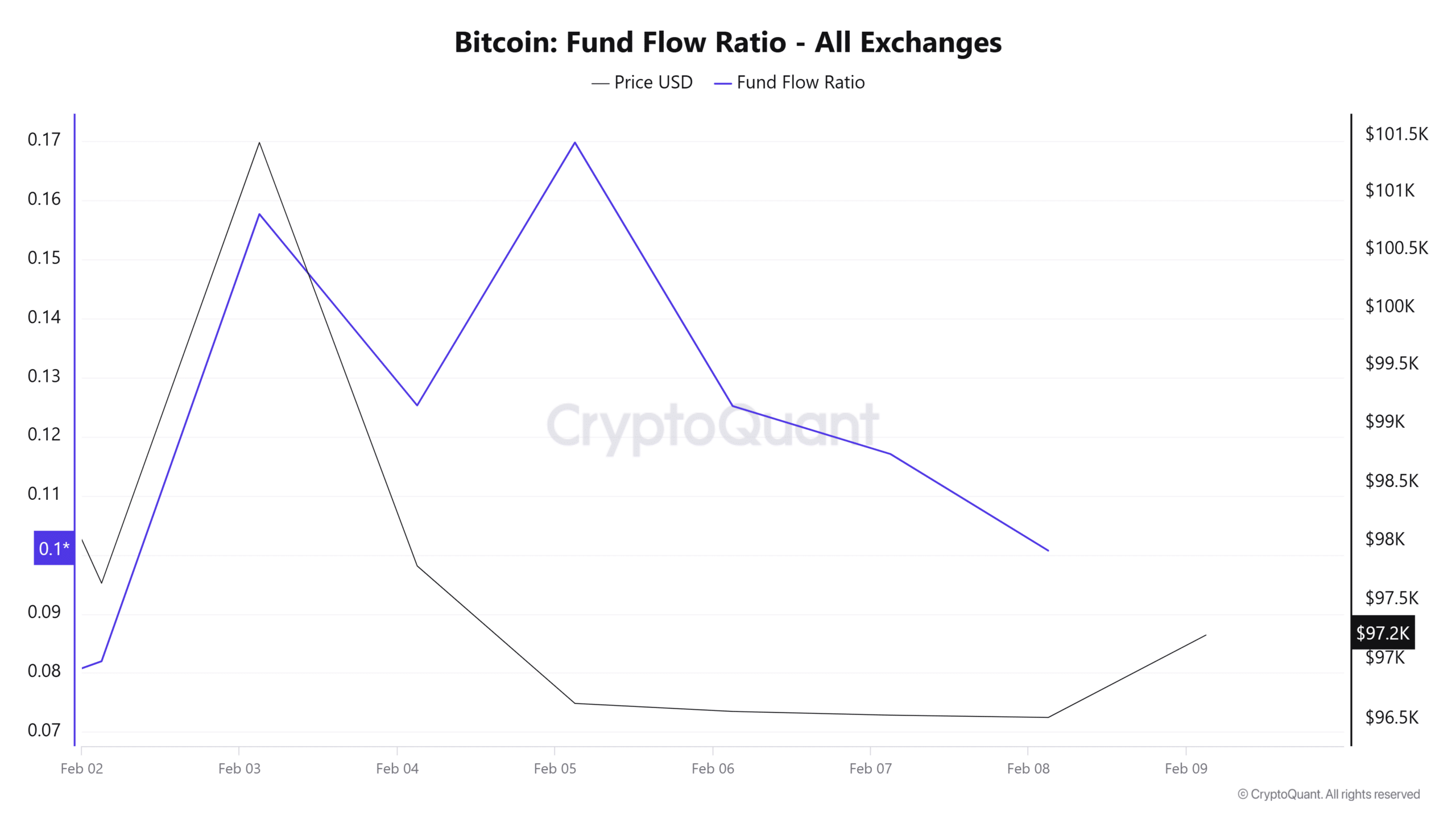

Forsooth! Bitcoin’s Fund Flow Ratio has dwindled for three consecutive days, indicating that a lesser portion of BTC transactions now involves exchanges.

This trend suggests that investors are clutching their assets tightly, rather than casting them into the market, a behavior often indicative of an accumulation phase preceding a price rise.

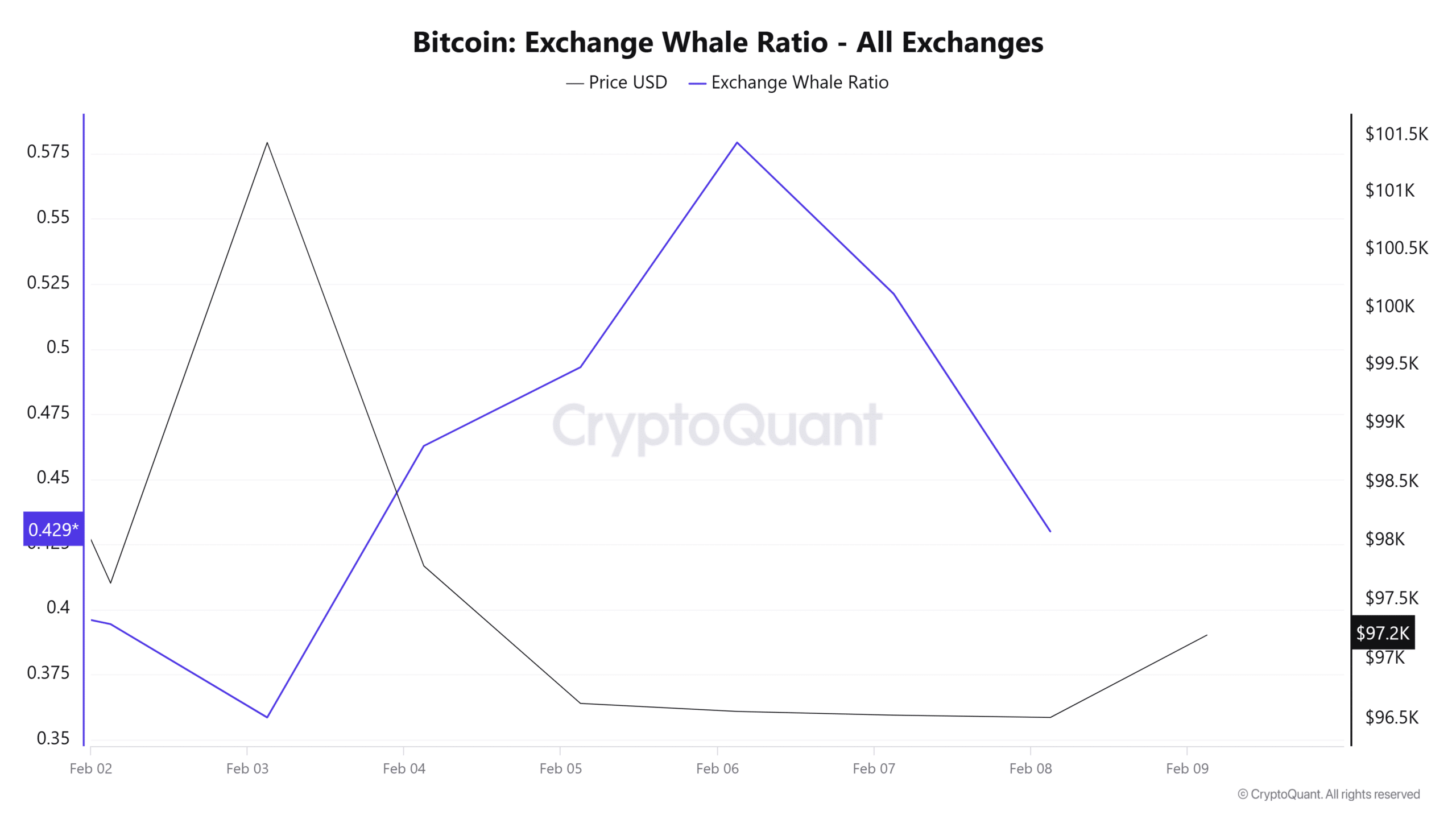

This accumulation appears to be particularly robust among the whales, as evidenced by the declining Exchange Whale Ratio, which has plummeted over the past three days.

This decline implies that these mighty creatures of the sea are holding onto their BTC, anticipating further price gains, much like a bear preparing for winter.

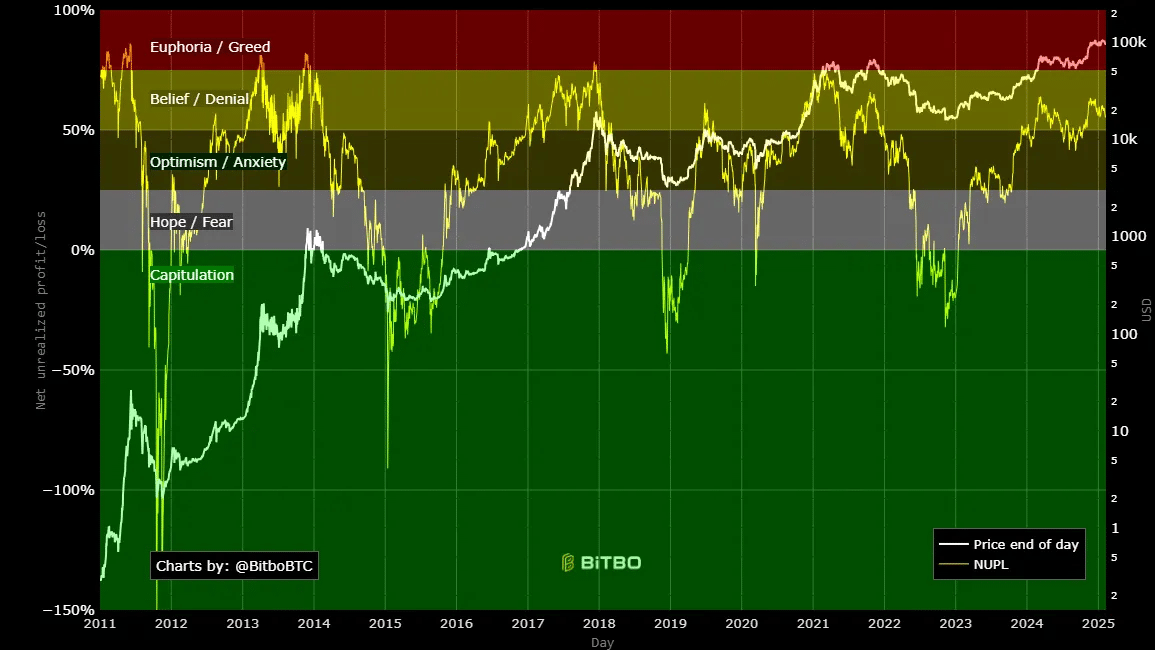

Finally, Bitcoin’s NUPL remains ensconced within the belief/denial zone, a liminal space where BTC still dances in a bullish phase, striving towards the heights of its cycle.

With NUPL at 58%, the uptrend still possesses ample room for growth before it reaches the pinnacle of the market.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

In summation, while Bitcoin has grappled with the challenge of maintaining its position above $96k, the crypto still possesses the potential for growth. With each gain, the confidence of short-term holders will be bolstered, further solidifying the bullish sentiments.

Should investors continue to harbor optimism, BTC may yet ascend beyond this level, eyeing the lofty $98,900, before confronting the formidable resistance at $100k. However, should it falter and fail to hold above this threshold, a descent to $94k may ensue, risking further decline, much like a tragic hero facing his inevitable fate.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-02-10 05:16