- Bitcoin struggled to maintain the $65,000 level amidst market volatility.

- Analysts provided conflicting views on whether Bitcoin has reached its lowest point.

As an experienced analyst, I have closely monitored the volatile Bitcoin market and its recent struggles to maintain the $65,000 level. The ongoing downward trend, with Bitcoin losing nearly 5% over the past two weeks, has caused significant concern among investors and traders.

As a researcher studying the cryptocurrency market, I’ve noticed that despite Bitcoin’s [BTC] efforts to maintain its value above the $64,000 mark, there has been a recent downturn in its price.

Its price fell by approximately 0.6% in the past 24 hours to a current valuation of $65,619.

The continuing decrease in Bitcoin’s value, resulting in a loss of almost 5% over the previous two weeks, has raised alarm amongst investors and dealers.

What are the experts saying?

Amid these fluctuations, notable crypto analysts are weighing in with varied perspectives.

Renowned digital currency expert CrediBull Crypto expressed a measured optimism regarding X, formerly known as Twitter, hinting that the price of Bitcoin may have hit its lowest mark. In more straightforward terms, CrediBull believes Bitcoin’s value might have bottomed out on X.

“It’s possible that the bottom of Bitcoin’s price drop has occurred with this current Support and Floor Price. However, there’s a chance we could still experience further declines. Yet, I wouldn’t be shocked if that support level holds and marks the end of the downtrend.”

I advocate for prudence, underlining the importance of identifying a definitive bullish indication or robust trend before taking substantial trading actions.

Alternatively, Skew, a well-known trader, pointed to the latest trading actions on significant exchanges as a reflection of the current market mood.

I observed noticeable purchasing activity on Coinbase and Bitfinex. However, Binance showed signs of persistent sell pressure.

If we’re looking at the range between $66,000 and $67,000, this is a crucial zone to observe market activity. Should demand continue to outpace supply within this range, it may indicate ongoing absorption. However, if this balance shifts in favor of supply, we could expect further price decreases due to intensifying downward pressure.

As a crypto investor, I’ve come across the notion that the existence of higher prices for immediate delivery, or spot markets, in comparison to the futures markets can be an encouraging sign. Moreover, when the cost of borrowing in the futures markets is low, it could potentially set the stage for market recovery.

Fundamental outlook on Bitcoin

The Bitcoin market is experiencing a significant number of sell-offs during this time of doubt.

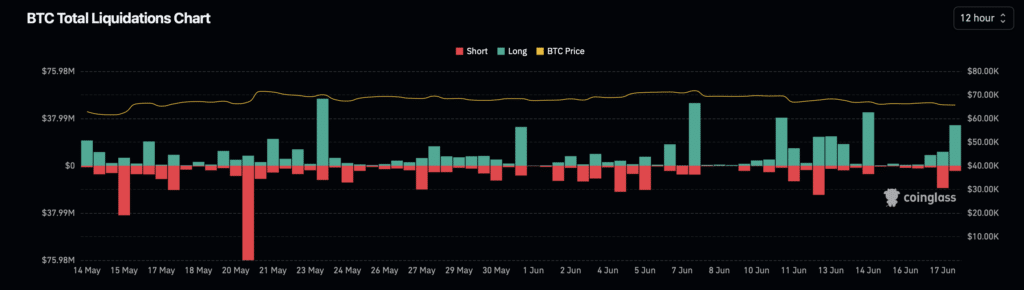

According to Coinglass’ recent data, approximately 173,662 traders faced liquidation within the last 24 hours, resulting in a substantial total of $456.43 million in settlements. Among these, Bitcoin traders contributed around $70.24 million to the overall liquidations.

As an analyst, I’ve noticed that despite encountering various obstacles, the Bitcoin network experienced a surge in new user participation.

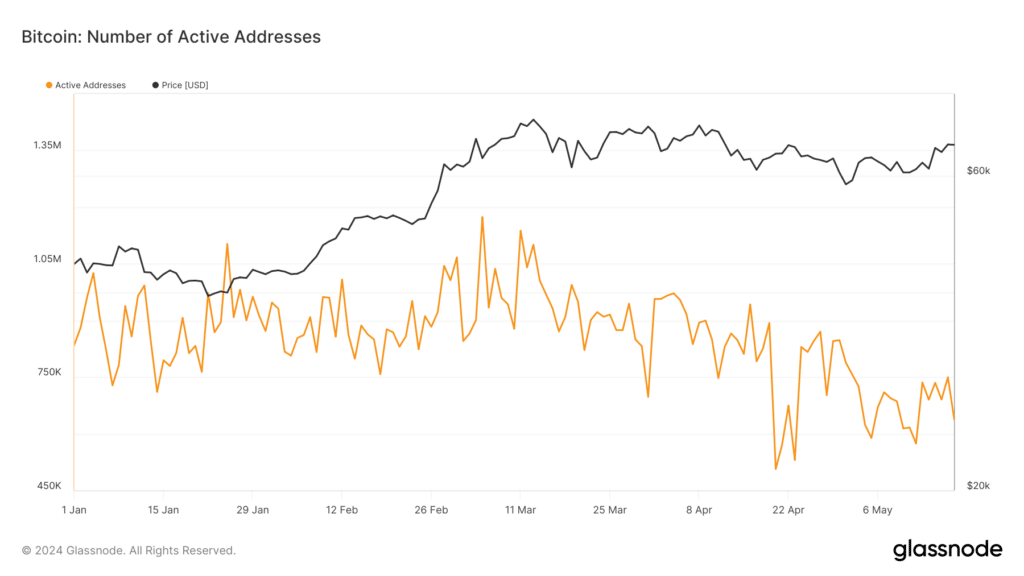

According to AMBCrypto’s interpretation of Glassnode’s statistics, there has been a significant increase in the formation of new Bitcoin wallets. The figure rose from approximately 550,000 in April to more than 700,000 currently.

As a researcher studying this phenomenon, I would interpret an increase in newly registered addresses as a potential indicator of renewed interest from newcomers or reactivated users. This development could contribute to market stabilization and initiate a phase of recovery.

As a crypto investor, I’m glad to hear the generally positive outlook from AMBCrypto. Moreover, I’m particularly encouraged by the bullish stance taken by CryptoQuant analyst Ki Young Ju regarding Bitcoin’s future. He believes in Bitcoin’s long-term potential.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Based on his conviction, the median cost basis for Bitcoin investors hovered near the $47,000 mark, implying that many continue to enjoy profits even after the latest dip from record highs.

The robustness of Bitcoin investors, combined with the possibility of purchasing more at reduced costs, may pave the way for an upswing in the future, highlighting the intricate workings of the digital currency market.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-18 21:12