- Bitcoin’s accumulation was strong among custodial wallets.

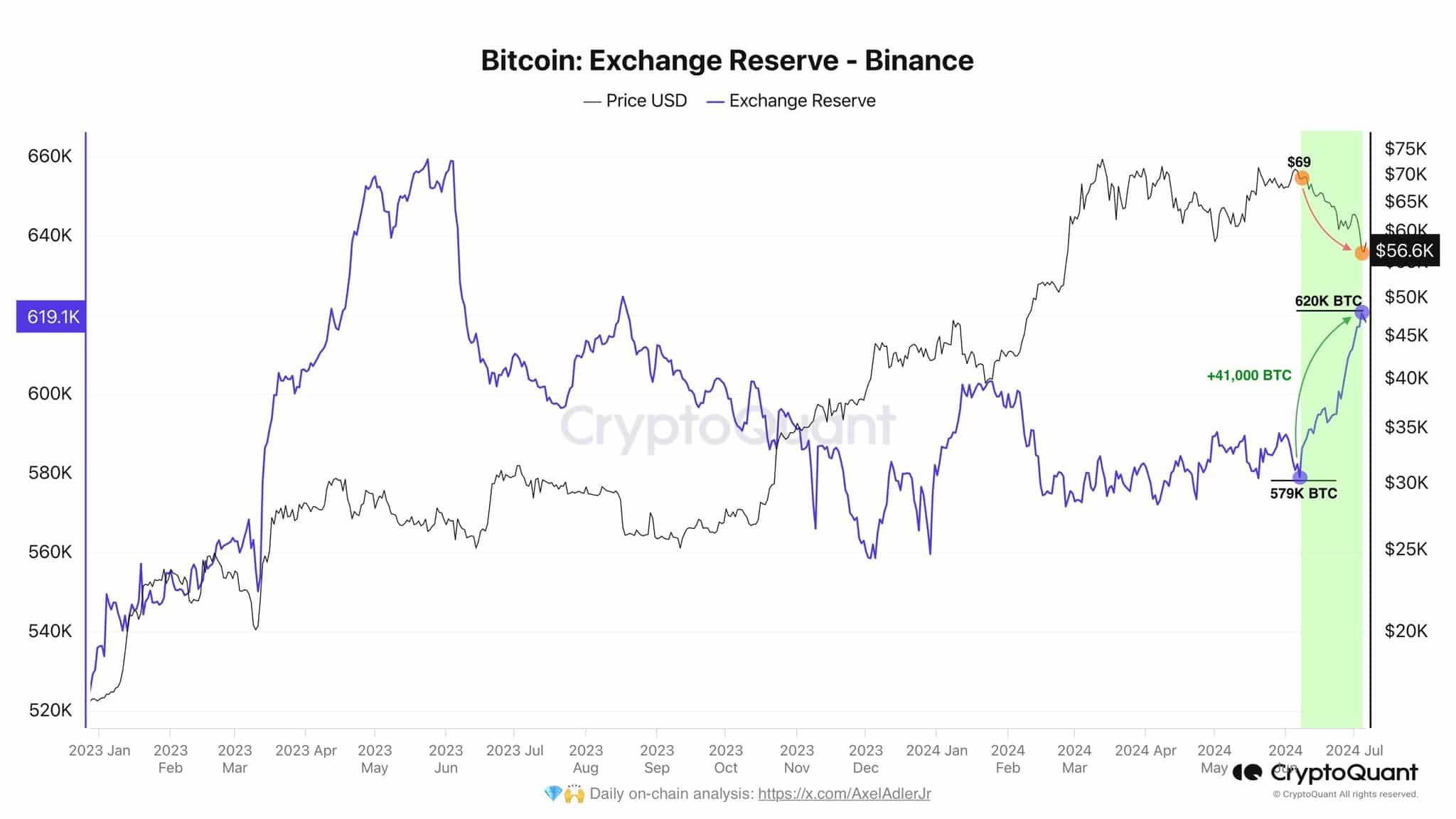

- The largest crypto exchange, Binance, has added to its reserves, just like in early 2024.

As an experienced analyst, I believe that the recent accumulation of Bitcoin among custodial wallets and large exchanges like Binance is a strong signal for the long-term health of the market. The fact that these entities are adding to their reserves despite the current price correction suggests that they see value in BTC and are positioning themselves for future gains.

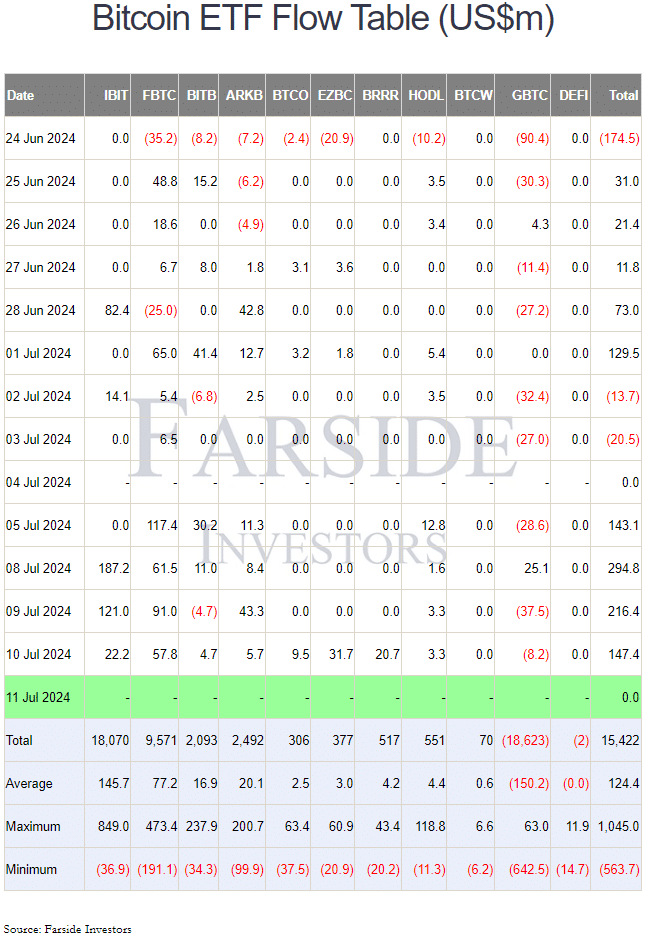

As a crypto investor, I’ve noticed some promising developments in the Bitcoin market lately, despite its recent dip below the $60k price mark. One of these positive signs is the consistent inflow of funds into Bitcoin ETFs over the last few days. This trend indicates a bullish sentiment among investors and suggests that they are accumulating more Bitcoin during this price drop.

Has the significant purchasing demand propelled Bitcoin to a pivotal point, capable of surmounting the downturn experienced over the last month? Or is this merely a temporary bounce-back before a period of stabilization ensues? Traders must weigh their options carefully.

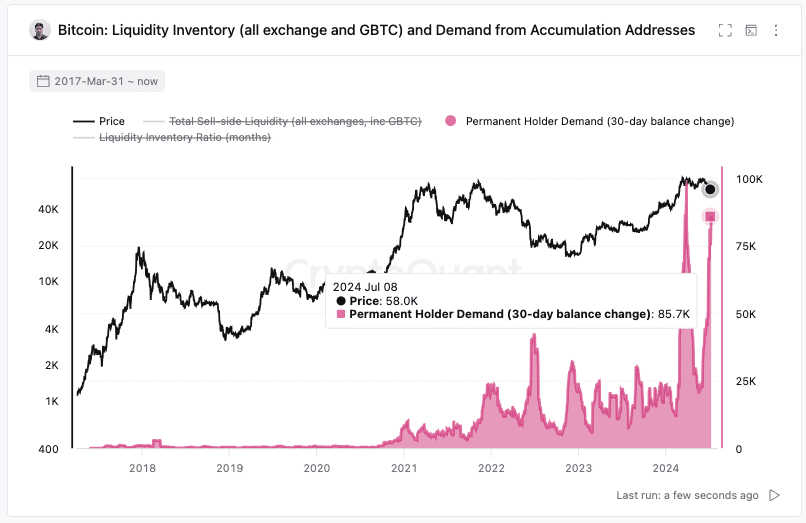

Bitcoin permanent holders add to their positions

According to crypto analyst Axel Adler’s recent post on X (previously known as Twitter), approximately 41,000 Bitcoins have been accumulated in Binance’s reserves since the Bitcoin price correction started about a month ago.

As a financial analyst, I would describe it this way: In January 2024, our organization acquired Bitcoins to bolster our reserves and enhance our liquidity. Subsequently, the Bitcoin market experienced a robust surge, surpassing the $40,000 threshold.

With their extensive background and knowledge, it’s plausible that they have been purchasing the dips for the past month. This information may not be newsworthy enough for traders to act upon immediately, but rather serve as a thought-provoking idea.

Ki Young Ju, the founder and CEO of CryptoQuant, pointed out that there has been an increase in the number of custodial wallets with no recorded outflows during the recent price downturn. Over the past month, these wallets have amassed approximately 85,000 Bitcoin, while about 16,000 Bitcoin were withdrawn from ETF reserves.

As a seasoned crypto investor, I’ve noticed an intriguing dynamic in the market recently. The astute long-term investors were taking advantage of the situation by purchasing more cryptocurrencies, while the ETFs catering to a more retail clientele felt compelled to react to their customers’ demands. This dichotomy highlights the potential disparity between the informed investment strategies of sophisticated players and the reactive tendencies of the retail investor base.

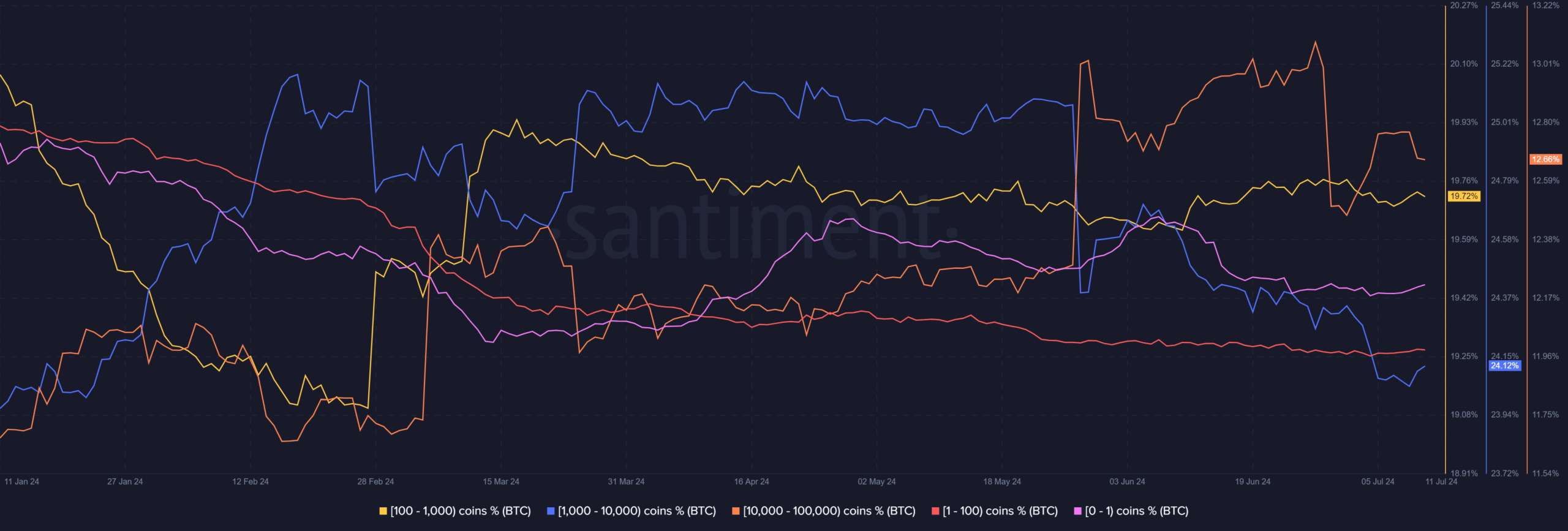

Examining whale behavior

The group of whales holding between 1,000 and 10,000 Bitcoins have been selling their cryptocurrency since mid-May, which is not a positive sign. In contrast, the cohort of whales with holdings between 10,000 and 100,000 Bitcoins bought aggressively in late May. However, they sold a significant amount during the last days of June.

Meanwhile, the smaller wallets with 100-1k Bitcoin also accumulated.

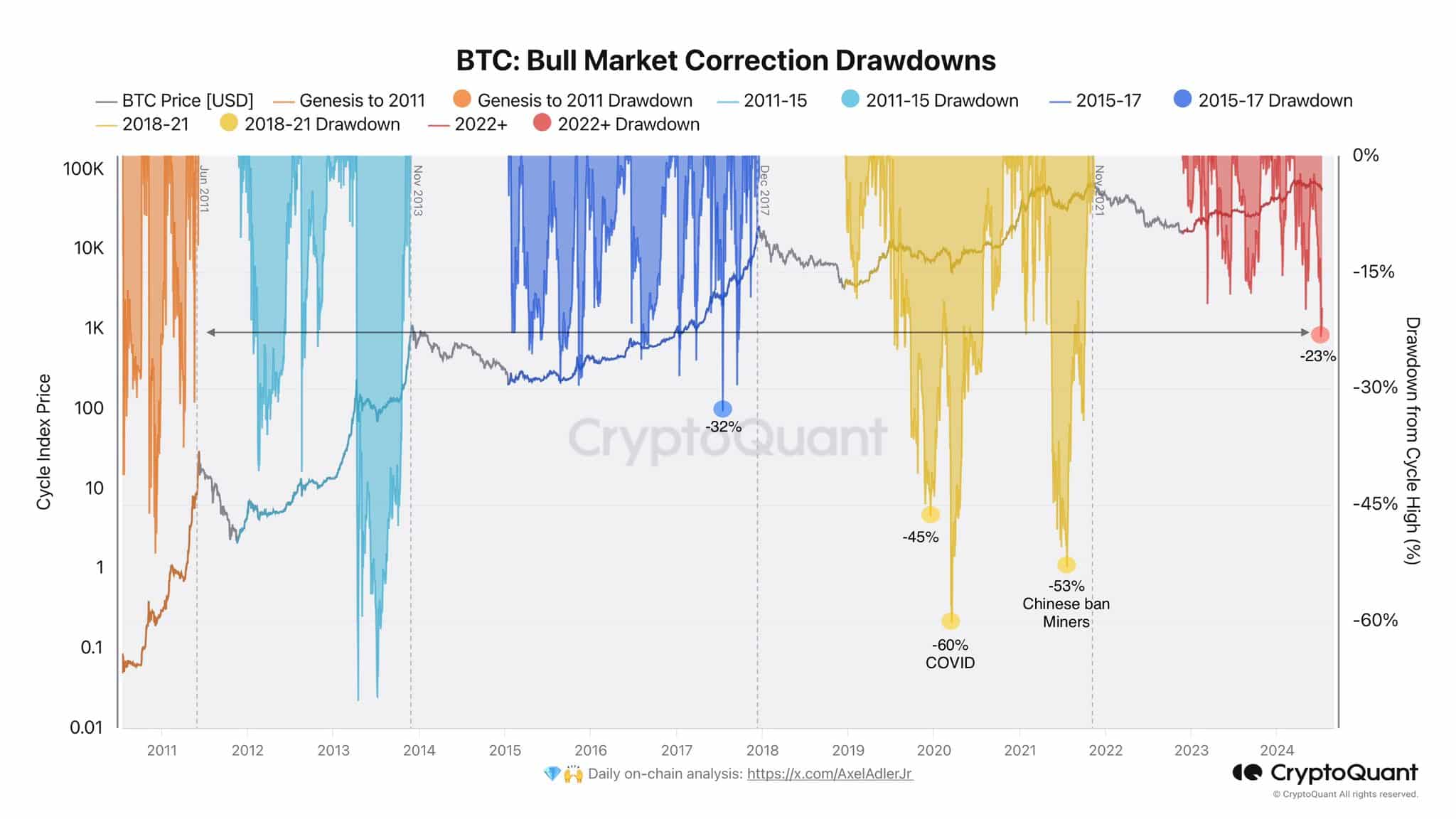

According to Axel Adler’s chart, it’s crucial for investors to keep a level head, given past market cycles marked by significant and abrupt price declines.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The current one might not be at an end, and $52k and $46k are the next levels to watch.

As a crypto investor, based on current market analysis, I believe we’re close to hitting the price bottom. However, there’s still uncertainty about how close we actually are. Therefore, it’s crucial for traders to remain cautious and prepare themselves for the possibility that the $52k support may be temporarily breached.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Quick Guide: Finding Garlic in Oblivion Remastered

- Gumball’s Epic Return: Season 7 Closer Than Ever!

2024-07-12 12:07