- Bitcoin bull run is at high risk of losing momentum to alternative assets as volatility increases.

- Large HODLer support is essential for maintaining a parabolic run.

As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous bull runs and bear markets. This current Bitcoin [BTC] bull run is undeniably impressive, but as I always say: “In every market, there’s a time to buy, a time to hold, and a time to sell – knowing the right moment can make all the difference.

Unlike previous periods after elections, this time around is quite different. Traditionally, when Bitcoin [BTC] reached a risky stage, investors usually avoided it. However, the trend seems to be shifting now.

This particular instance, less than a week has passed since the outcomes were disclosed, yet Bitcoin has already registered three new record peaks, with the most recent soaring to $81K.

The current surge in Bitcoin’s value strongly indicates the direction that the cryptocurrency community is pushing towards in the financial world. They are promoting digital assets as a protective measure against inflation and centralized authority.

Without a doubt, Bitcoin’s allure as an investment category is significant, but it’s equally clear that the impact of speculative trends on its price cannot be overlooked.

Over the last seven days, the bullish trend has remained strong; however, for this upward momentum to persist, certain critical factors need to fall into place.

If these conditions don’t fall into place, a bearish pullback could not only halt the Bitcoin bull run but potentially erase the gains made so far.

Bitcoin bull run could slow

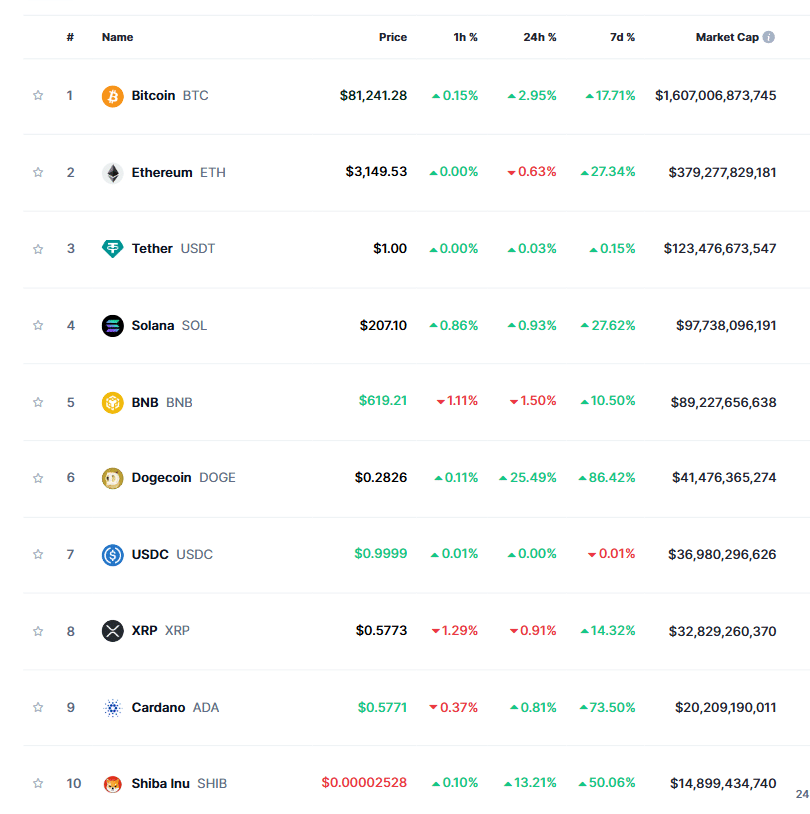

2 days back, Bitcoin’s market share dropped slightly to 58.5%, experiencing a small daily increase of 0.19%. Meanwhile, Ethereum‘s [ETH] influence expanded by 3%, accompanied by a more substantial rise in price by 5% within the same timeframe. This pattern during a Bitcoin bull run hints that altcoins are seeing a strong resurgence, potentially drawing focus away from BTC.

Generally speaking, this transition often occurs when traders believe Bitcoin’s price has peaked, opting instead for less expensive alternatives like altcoins.

Consequently, Bitcoin’s strong weekly advance to a record high of $81K has significant implications for its peers. In fact, some alternative cryptocurrencies are approaching triple-digit growth rates.

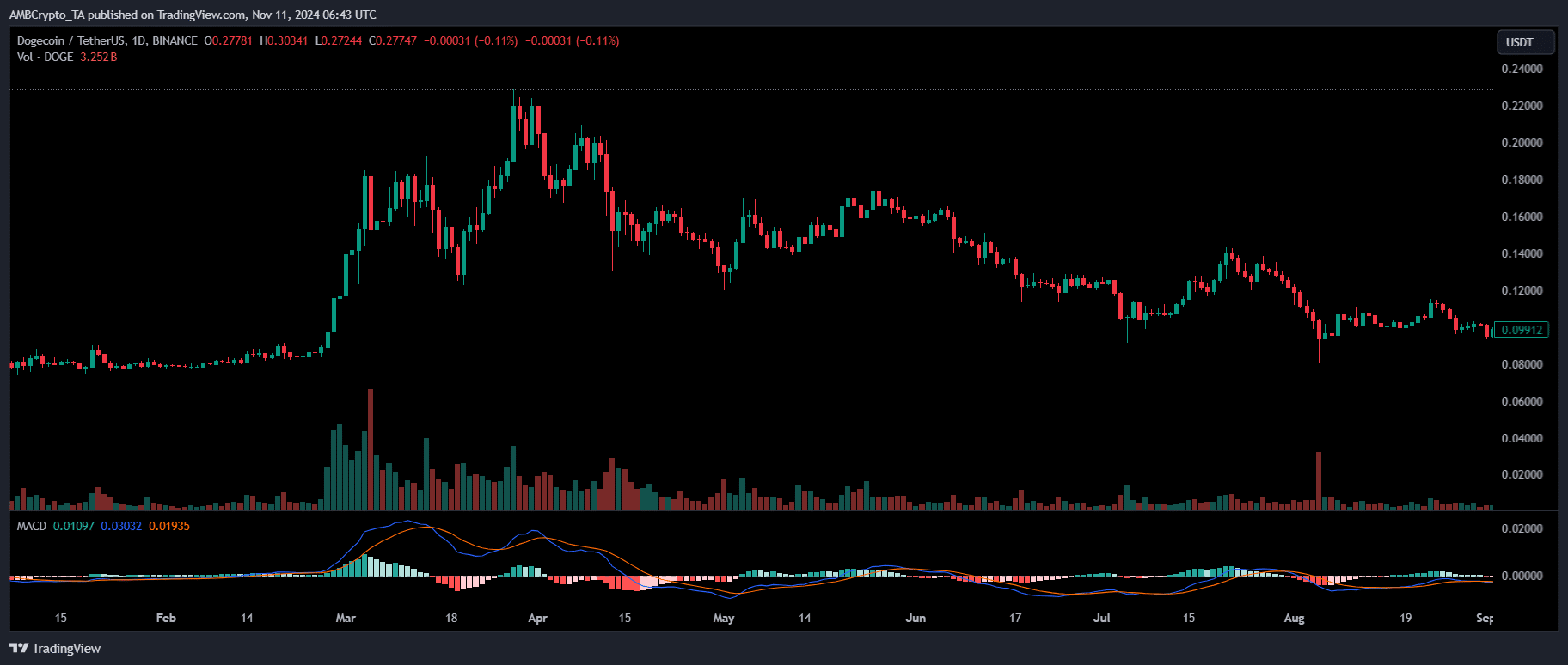

Looking at the daily price chart, AMBCrypto identified another pattern that supports this trend.

During each Bitcoin price surge (or “bull run”), the early push in prices is often driven by Bitcoin itself. However, as the cycle approaches its final stages, a large amount of money tends to shift from Bitcoin and move into alternative cryptocurrencies (altcoins).

Source : TradingView

For instance, during the March bull rally, after BTC hit an ATH of $73K, it consolidated below that price range. However, altcoins like DOGE spiked, reaching $0.20 in under 10 trading days.

We arrive at a crucial point, prompting us to ponder: Is the upward trend of Bitcoin coming to an end, with altcoins hitting new highs? Or, considering that this cycle differs from past ones, could Bitcoin still have potential for further growth?

Key conditions needed for BTC to reach $100K

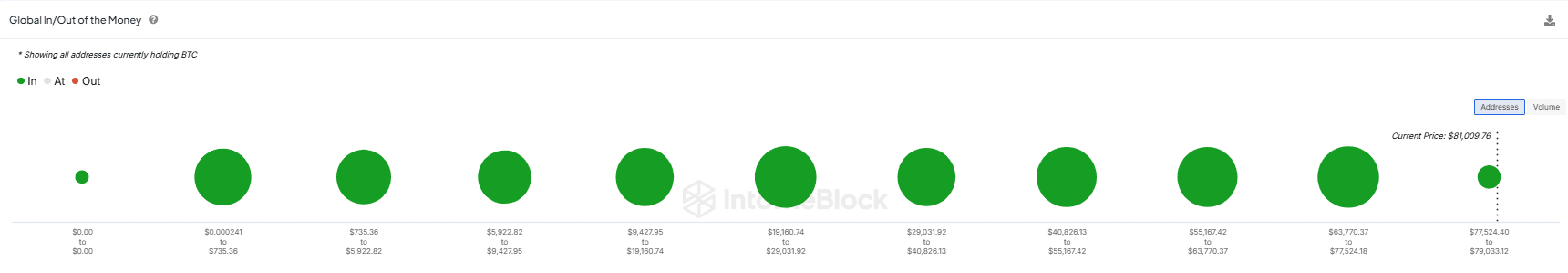

According to previous findings, for Bitcoin (BTC) to remain dominant over $80K, substantial investors (large HODLers) should view the current price as a favorable opportunity to invest. If this happens, it becomes difficult for bearish forces to instigate a decline in price.

The explanation is straightforward: The surge in Bitcoin’s price has led it to reach a fresh all-time high, resulting in everyone involved making a profit, as their initial investment costs were significantly lower than the current market value.

Source : IntoTheBlock

As BTC becomes more susceptible to market fluctuations due to inexperienced investors selling off, it’s the large-scale investors (whales) who are expected to provide support during potential price corrections, as the bullish momentum may diminish.

At present, a robust optimism about the market is noticeable, driven primarily by current economic and political circumstances. These factors are believed to maintain Bitcoin’s price within approximately $79,000 to $81,000.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

To maintain the upward trend of Bitcoin towards $100K, it is essential that the mentioned factors fall into place.

If they fail to do so, there might be a reversal happening sooner than anticipated, with bears potentially taking control in multiple areas of analysis.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-12 01:12