- Bitcoin could be set for a long period of stagnation, as the death cross occurs on 30DMA & 365 DMA.

- BTC has moderately recovered on daily charts by 2.58%.

Over the past 24 hours, Bitcoin [BTC] has experienced a strong upswing, reclaiming the $100k level.

Over the past few hours, there has been a retreat in Bitcoin’s price. Currently, it is being traded at approximately $99417, representing an increase of 2.58% on the daily chart.

This temporary retreat indicates Bitcoin’s difficulty in sustaining an uptrend, leading to a period of standstill that experts are forecasting could result in a downturn for the cryptocurrency market.

According to CryptoQuant analyst Yansei Dent, there could be a prolonged period of little or no change in cryptocurrency prices, based on the appearance of what’s known as a “dead cross.

Death Cross emerges on Bitcoin’s active addresses

According to Dent’s examination, Bitcoin appears to be going through a period of slow growth or decline, as indicated by the decrease in active addresses, suggesting a possible loss of momentum.

As he explains, a ‘death cross’ has formed between the 30-day moving average (DMA) and the 365 DMA. This technical indicator suggests a decrease in short-term investor activity, which could be a warning sign for a potential downturn.

Historically, similar trends in active addresses tend to align with bearish market conditions, serving as red flags or signs of a potential downturn.

Furthermore, our analysis indicates a downward trend in transactions from Q4 2024 onwards. This trend suggests a potential prolonged period of market stability or stagnation in the medium to long term.

Given that these circumstances persist, it’s possible that Bitcoin might find it challenging to sustain its upward momentum unless there are broader signs of market recovery.

What does it mean for BTC charts?

Significantly, lessened activity and the appearance of what’s known as a “death cross” suggest that the market’s underlying strength might be waning. This could potentially make it difficult for Bitcoin to maintain its upward trajectory.

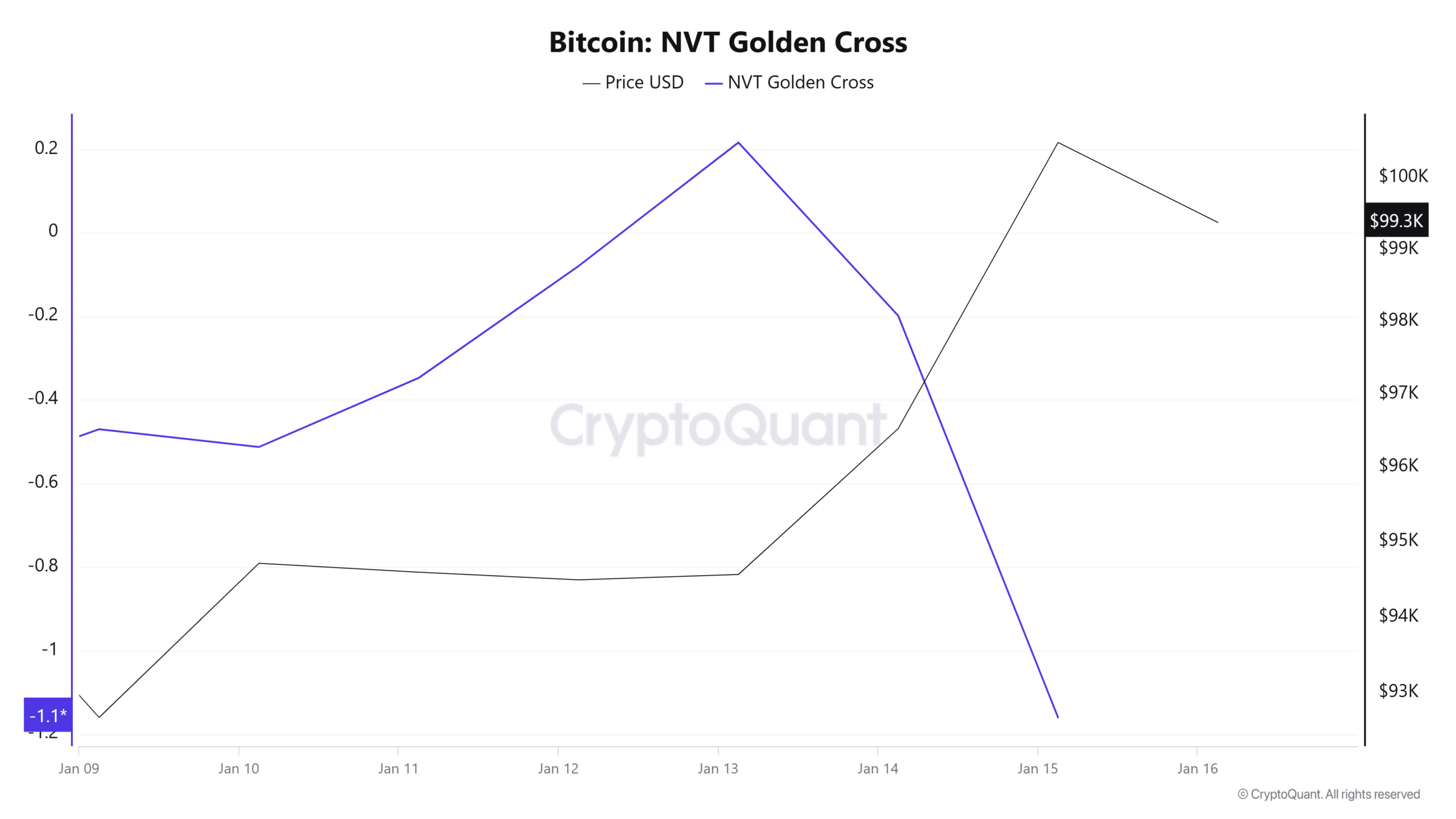

As a crypto investor, I’ve noticed a temporary downtrend indicated by the falling NVT Golden Cross. At the moment, it’s dipped into the negative zone, reaching -1.1.

When the NVT (Network Value to Transaction) golden cross turns negative, it indicates a possible decrease in Bitcoin’s market value compared to its transactional activity.

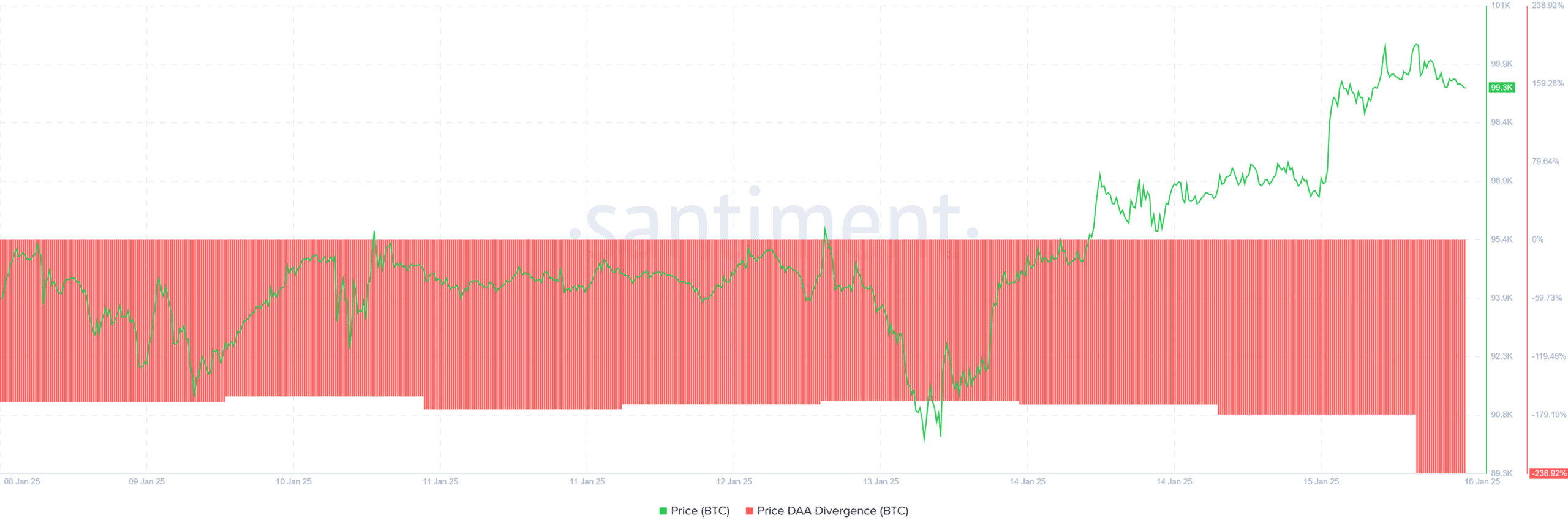

The decrease in network activity is also backed up by a dip in the DAA Divergence, suggesting that Bitcoin’s underlying market factors could be growing weak. This implies that the current Bitcoin price may not hold its ground for much longer.

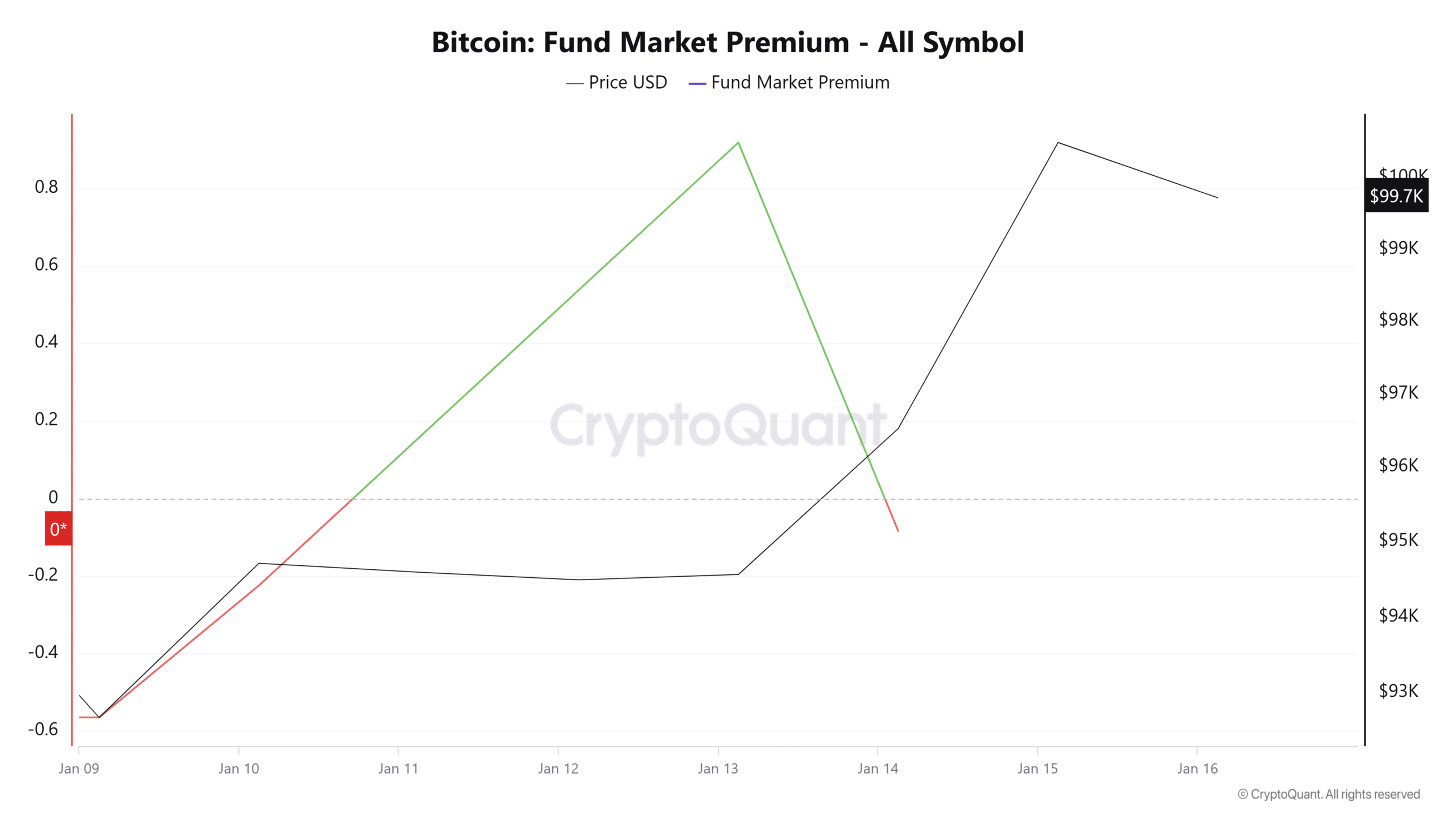

As a researcher, I’ve noticed a decrease in Bitcoin’s fund market premium to -0.08. This means that the futures prices are currently lower than the spot prices. Such a situation typically indicates a strong demand for taking short positions, suggesting investors are betting on a price drop in the near future.

– Read Bitcoin (BTC) Price Prediction 2025-26

Despite Bitcoin surpassing $100k in the last 24 hours, the current market conditions don’t seem robust enough to support a long-term upward trend.

Present profits are primarily due to speculative actions, notably after the unveiling of the latest U.S. inflation figures.

Consequently, as its foundations grow weaker, Bitcoin is expected to maintain its value within a fluctuation band between $94,000 and $100,000.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-01-17 03:04