- As the whale ratio rises and put options multiply, one cannot help but wonder if Bitcoin is in for a spot of bother.

- The Options market, it appears, is revealing a rather anxious disposition towards downside protection.

Alas, dear reader, it seems that our beloved Bitcoin [BTC] may soon find itself navigating through treacherous waters. A most alarming increase in the activities of the great exchange whales, coupled with a growing sense of caution in the Options market, has begun to raise the eyebrows of the astute observer.

Indeed, as the exchange whale ratio ascends to its highest point in over a year, and the put options begin to outstrip their cheerful counterparts in both volume and premium, it appears that the traders are preparing themselves for potential misadventures ahead. One might say, “Oh dear!” as the winds of uncertainty begin to blow.

This shift in sentiment suggests that some of the most prominent players in the market are perhaps preparing to cast off their holdings, raising the specter of greater volatility in the days to come. How thrilling! Or perhaps not.

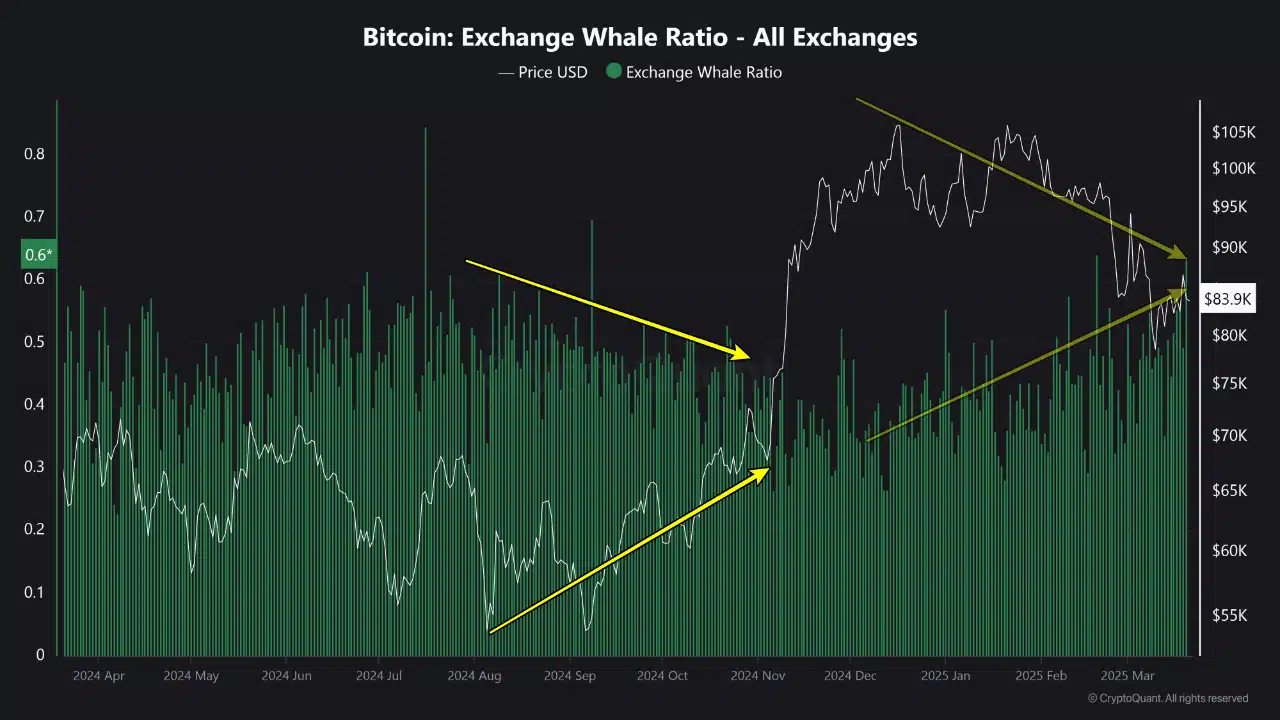

Exchange Whale Ratio – A Most Disturbing Signal of Potential Selling Pressure

Indeed, the Exchange Whale Ratio has climbed to a rather alarming 0.6, marking its highest reading in over a year. What a spectacle!

This spike indicates that our large holders, affectionately known as whales, are now responsible for a considerable share of Bitcoin making its way to exchanges. Historically speaking, such behavior has often preceded significant market movements, frequently hinting at a surge in selling activity. How very curious!

As the chart so eloquently demonstrates, similar spikes observed in mid-2024 were followed by notable price declines. A most disheartening trend, I daresay.

This latest increase coincides with Bitcoin’s recent price retracement from its all-time high—a signal that our whales may once again be reallocating their assets in anticipation of market weakness. If history is to be our guide, elevated whale ratio levels could indeed spell volatility ahead. How delightful!

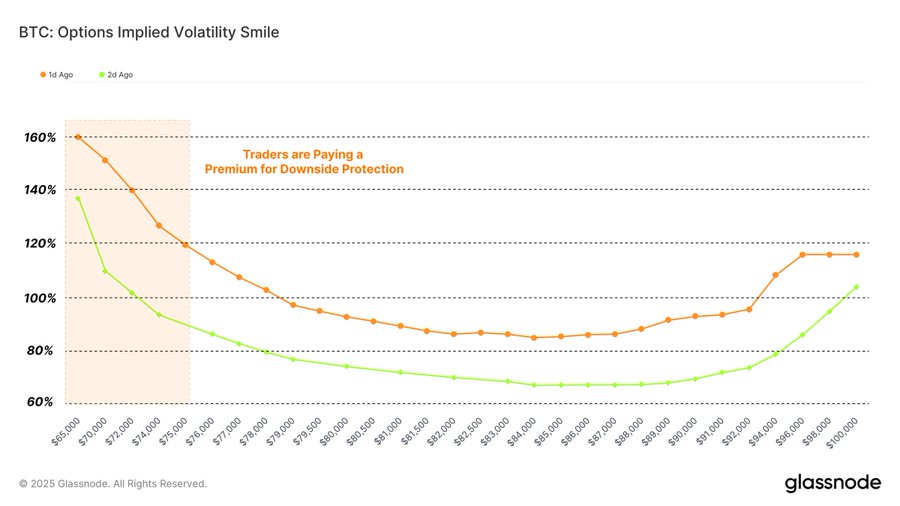

Bitcoin Options Market – An Increasing Demand for Downside Protection

Our dear Bitcoin’s Options market has also begun to exhibit signs of caution. How very prudent!

Options, those delightful instruments that allow investors to hedge against price swings, have revealed a distinct tilt towards risk aversion. The implied volatility smile chart showcases that traders are now paying a rather handsome premium for put options, particularly for strike prices beneath the lofty sum of $80,000. Fancy that!

This pattern may be interpreted as a growing demand for downside protection, as investors brace themselves for potential declines. How very sensible!

The steep leftward skew on the chart hints at an elevated fear of short-term volatility, reinforcing the broader market’s shift towards defensive strategies. This surge in put premiums is also a sign of investor sentiment turning wary, aligning with the on-chain whale activity while suggesting a more cautious outlook for Bitcoin in the near term. How utterly riveting!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-03-23 03:06