- Ah, our dear Bitcoin enthusiasts! Short-term holders are now sporting losses that truly eclipse even the FTX debacle—how charming!

- Instead of causing a full-blown panic, our intrepid short-term BTC investors are merely enjoying a prolonged stewing in their own caution.

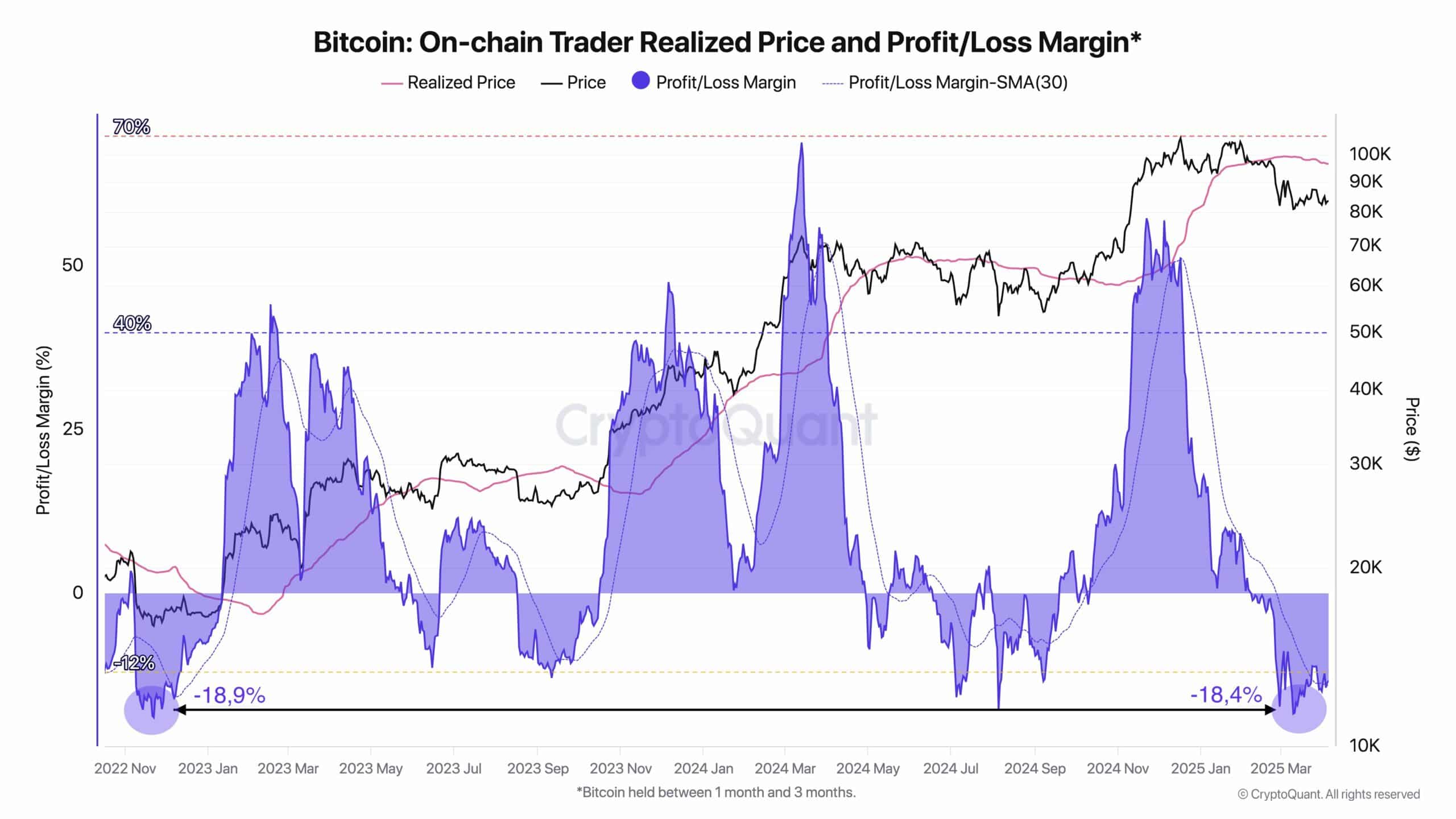

Since the sun graced us in early February, Bitcoin [BTC] traders have been nursing their wounds like the best of us after a particularly overzealous night out. Astonishingly, the current losses have outstripped even the delightful chaos of the FTX crash and the market correction of 2024!

Our short-term investors, bless them, are feeling the heat most acutely—especially those who’ve only been holding on for about one to three months. One might say it’s the perfect storm of misfortune wrapped in a tragedy!

With uncertainty hanging over the market like a sensitive opera singer, this trend of rising short-term losses leaves many pondering if we’re on the brink of an even juicier disaster or merely trapped in an interminable waiting room for a breakout.

A Tinge of Agony, Yet No Dramatic Exit

Oh darling, Bitcoin’s short-term holders are firmly in the red, sprawled out amidst losses worse than anything since that scandalous FTX escapade. Shall we send them a sympathy card?

One glance at the profit/loss margin plummeting to a rather dire -18.4% brings forth memories of the delicious -18.9% of late 2022—how positively poetic!

Yet, intriguingly, this isn’t inciting full-blown hysteria. While the market bleeds like a crummy sitcom drama, the signs of a mass exodus are absent, replaced by traders resolutely biting their lips, clutching their wallets, and practicing the fine art of waiting.

The ambiance? More “this better pay off,” less “quick, run for the hills!”

Bitcoin: A Tragic Comedy for Short-Term Schemers

Unlike our long-term aficionados who’ve danced through bear cycles before, these short-term holders seem to always waltz in as the curtains rise—right at the apex of the hype!

As BTC flirted with ecstasy around $84K in early March, many of these darlings dove right in, only to experience the slowest of bleeds instead of a dramatic crash—a real nail-biter!

It’s the worst kind of pain: drawn-out, confidence-shaving, and with less clarity than a foggy evening in London. The data suggests they’re now left holding the bag of realized losses, serving as a charming reminder that those who succumb to FOMO often face the music rather extravagantly.

FTX Echoes Resound

Our current predicament, while reminiscent of the magnitude of the FTX crash, certainly lacks the panicked chaos of yore. Once upon a time, losses were fueled by hysteria, contagion, and the clink of disappearing liquidity.

Today’s ambiance? Hesitant markets, decent liquidity, and Bitcoin still clinging to life above the $80K line. Quite the tale to tell over tea!

But oh, the pain is palpably real! Observers find themselves gazing closely at past dramas, and with loss levels now smashing through 2024’s correction, comparisons to November 2022 are growing rather impossible to ignore.

If history enjoys a good encore, the lurking specter of short-term capitulation may just be around the corner, ready to take the stage!

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-04-06 18:19