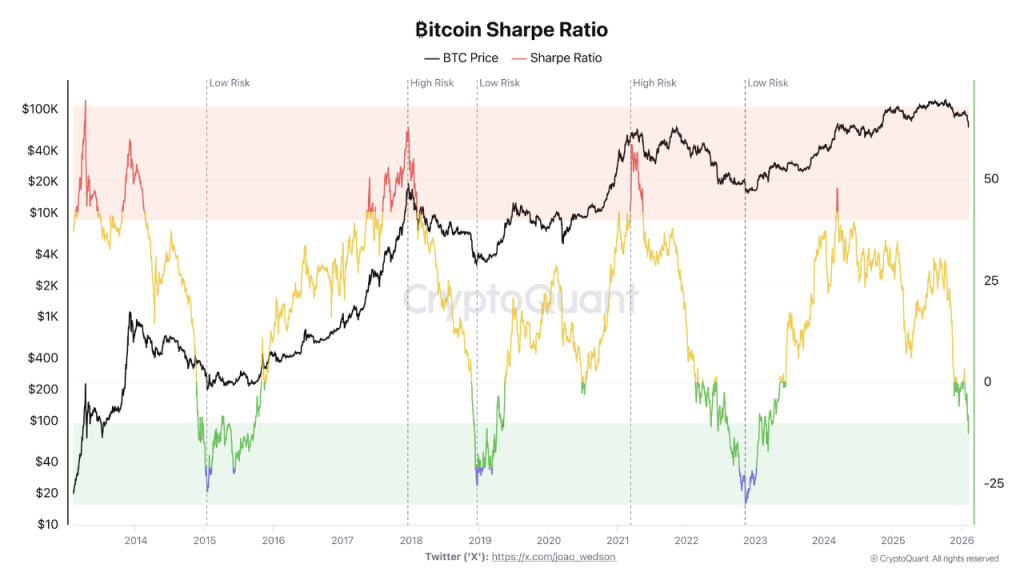

Well, well, well! Here we are, staring at the Bitcoin price, which today flops about like a fish out of water at around $68,890 after having a mini-vacation down to $60K. But don’t let that shiny number fool you; lurking in the background is our friend-the Sharpe Ratio-who seems decidedly less enthusiastic. It has decided to slip into what can only be described as a bear-market zone. Instead of rolling out the red carpet for an immediate price bottom, it’s more like waving a cautionary flag as rising risks take center stage, just before those long, winding market turning points that leave us all scratching our heads.

Sharpe Ratio signals growing stress, not capitulation

The Sharpe Ratio, which is basically like the adult in the room measuring risk-adjusted returns, has jumped into an area historically reserved for the later stages of Bitcoin bear markets. In layman’s terms, it’s saying, “Hey, investors, you’re taking on a lot of risk for not much reward here.” Shocking, isn’t it?

And if you thought that was the end of the story, think again! The ratio is continuing to spiral downward, making it abundantly clear that the recent BTC returns are not nearly enough to justify the wild ride we’ve been on. This kind of compression usually shows up when the market is settling down, not during those happy-go-lucky periods when everyone’s feeling optimistic.

Now, don’t go mistaking the Sharpe Ratio for a crystal ball. It’s more of a rearview mirror reflecting the consequences of price behaviors that have already transpired. As Bitcoin’s performance weakens on a risk-adjusted basis, more investors find themselves in deep waters. Stress levels rising? You bet!

Contrarian dynamics begin to surface

But fear not! History tells us that extreme readings from the Sharpe Ratio often coincide with those oh-so-tempting contrarian opportunity zones. Does this mean a reversal is just around the corner? Not quite. Instead, it hints at the possibility of the market slowly becoming a place where long-term positioning could finally make sense.

From a behavioral standpoint, when underperformance drags on like a bad sitcom, speculative excess tends to fade away, gradually shifting ownership towards folks who actually have the patience to hold onto their Bitcoin.

That said, let’s not rush things. This phase could drag on for months, and the BTC price may continue its downward dance before those risk metrics start looking decent again.

BTC price chart highlights key technical magnets

Now, from a technical angle, our expert friend proposes that the BTC price chart is like a weather vane pointing towards caution, reinforcing a rather gloomy outlook while showcasing the historical odds of dipping lower. After reaching a peak near $126,000, Bitcoin took a respectful pause at the 0.382 Fibonacci retracement around $78,000-a zone that acted more like a driftwood in turbulent waters. Once that level was lost, it was all downhill from there.

The next major retracement level is hanging around the 0.618 zone, which is chilling near $48,000, a level that might just become a gravitational pull if this corrective pressure keeps up. Who knew that numbers could be so clingy?

Risk management takes center stage

As a result, investors are now weighing two broad strategies like they’re picking toppings for their pizza. One approach wants to gradually build exposure as risk metrics creep toward historically lower-risk zones. The other is all about playing it safe and waiting for the Sharpe Ratio to show a solid improvement before adding to their stash. Either way, there’s no reason to hurry.

Still, the current setup is calling for a bit of discipline. The BTC price in USD remains as sensitive to liquidity conditions as a cat at a dog park, and the evolving structure suggests that time, rather than speed, is the name of the game. In this environment, how the BTC price behaves reflects positioning stress more than any strong directional conviction, a dynamic that continues to shape the endlessly evolving BTC price forecast.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 10 Movies That Were Secretly Sequels

- USD JPY PREDICTION

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Uncovering Hidden Order: AI Spots Phase Transitions in Complex Systems

2026-02-07 17:37