- The latest price decline didn’t reset the local top risk signal, according to Bitcoin’s NVT Golden Cross.

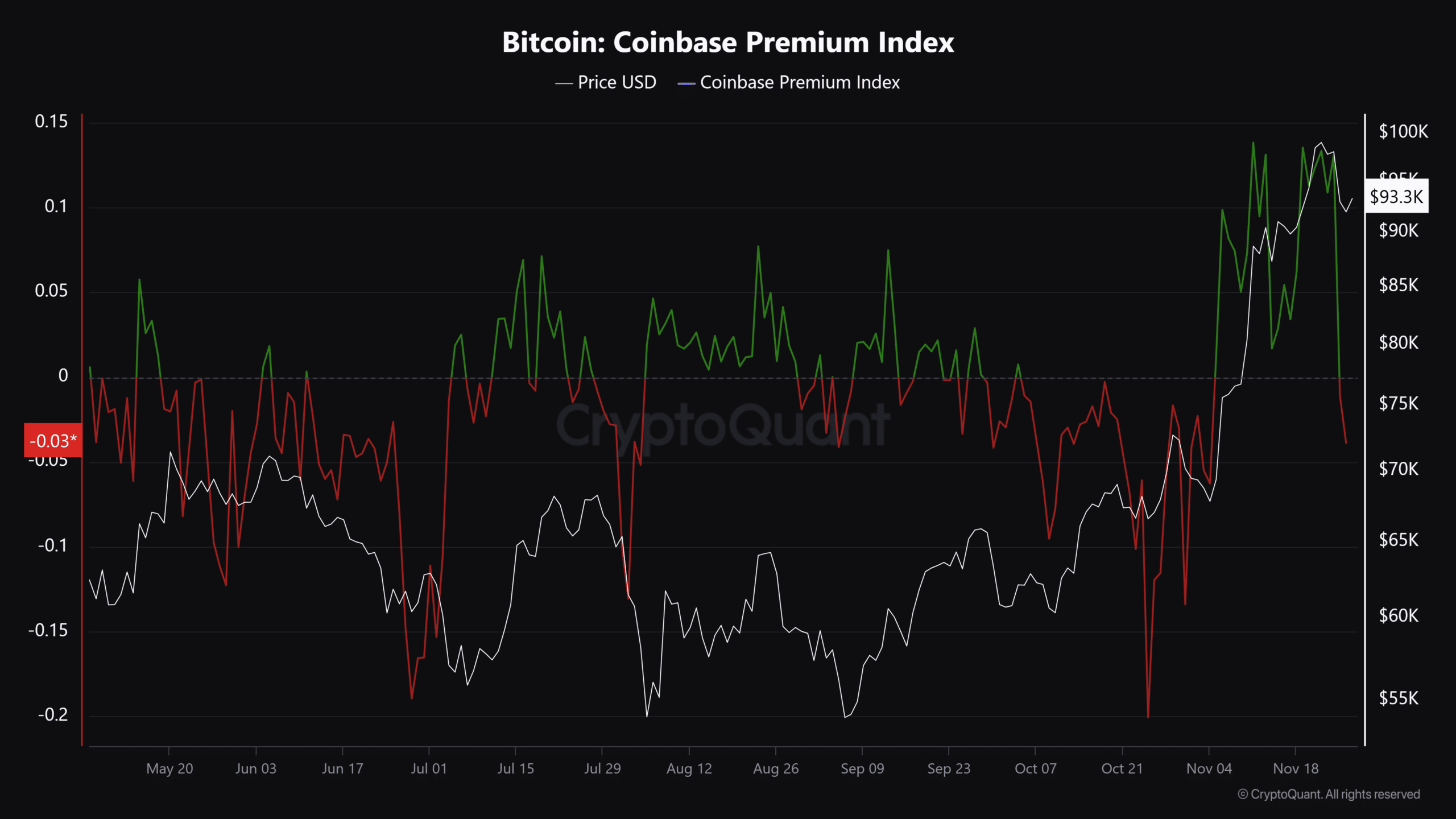

- U.S. investor demand turned negative for the first time since the elections.

As a seasoned crypto investor with a knack for keeping my finger on the pulse of market trends, I’ve learned to read between the lines and interpret signals that many overlook. The latest price decline didn’t reset the local top risk signal according to Bitcoin’s NVT Golden Cross, which is a red flag that I can’t ignore. The U.S. investor demand turning negative for the first time since the elections is another troubling sign.

The drop in Bitcoin’s [BTC] price from approximately $100K to $90K was not unexpected, considering that AMBCrypto previously highlighted crucial signs of an overheated market prior to the sudden price plunge.

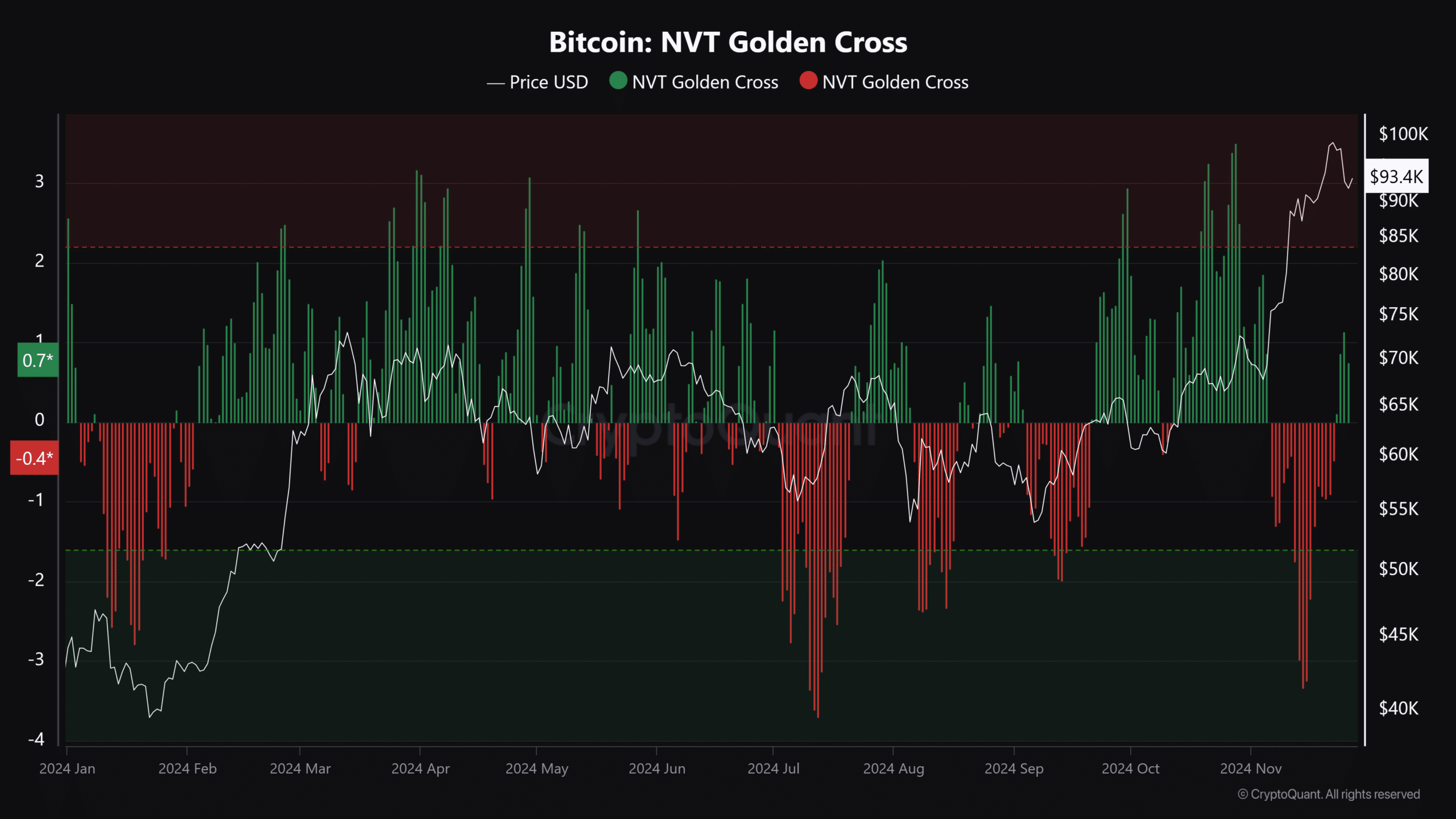

The recent shakeout was expected to normalize market conditions for a solid recovery. But a key local top/bottom metric signal, Bitcoin NVT Golden Cross, remained sticky and elevated.

Bitcoin’s NVT Golden Cross warning

In this scenario, the indicator under discussion is an adjusted form of the evaluation measure called Network Value to Transactions (NVT).

This tool accurately identified previous highs and lows in the local Bitcoin market when it displayed positive or negative values. A value exceeding 2.2 might indicate an approaching peak, while a value as low as -1.6 could signal a potential upcoming trough.

A CryptoQuant analyst named DarkFost had pointed out a few days back when it became positive, indicating a possible peak if it continued to stay high. At present, this specific indicator is still relatively high although it’s below the potentially dangerous threshold of 2.2, despite Bitcoin experiencing a 9% drop.

As an analyst, I’m observing a persistent trend. The BTC NVT Golden Cross reading at this moment stands at 1.73, indicated by the green bars on my chart. This pattern, if it persists, may signal that Bitcoin could potentially experience another correction before resuming its upward trajectory.

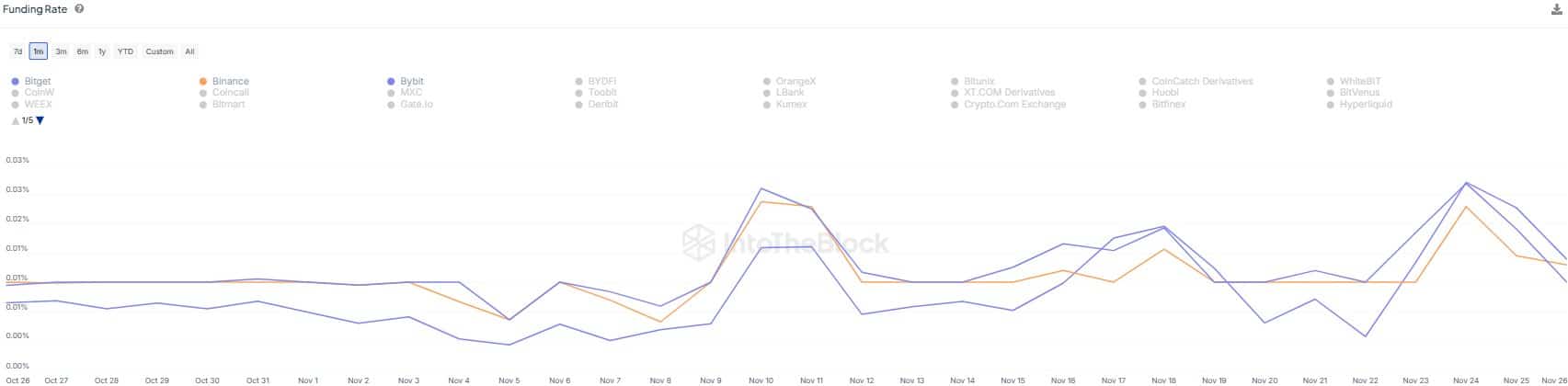

After the drop to $90K, it seems that abnormal market signals such as funding rates have returned to normal levels.

Based on IntoTheBlock’s analysis, the recent event appears to be a process of eliminating high-leverage positions, often referred to as a “leverage squeeze”. This phase might have concluded when it cleared out these highly leveraged positions and stabilized funding rates.

In summary, the recent decline in Bitcoin’s value caused concern among American investors, marking the first instance of decreased demand since the U.S. elections. This trend was evident through the Coinbase Premium Index, a measure that reflects the interest of U.S. investors in Bitcoin, often referred to as the “king coin.

Read Bitcoin [BTC] Price Prediction 2024-2025

Is it expected that the current pattern will shift, given that many financial experts predict a potential reversal starting post-U.S. Thanksgiving, with hopes of economic recovery?

Read More

2024-11-27 19:03