- Short-term holder activity suggested Bitcoin might have formed a local top nearly three weeks ago.

- Long-term holder metrics from Santiment flashed warning signals.

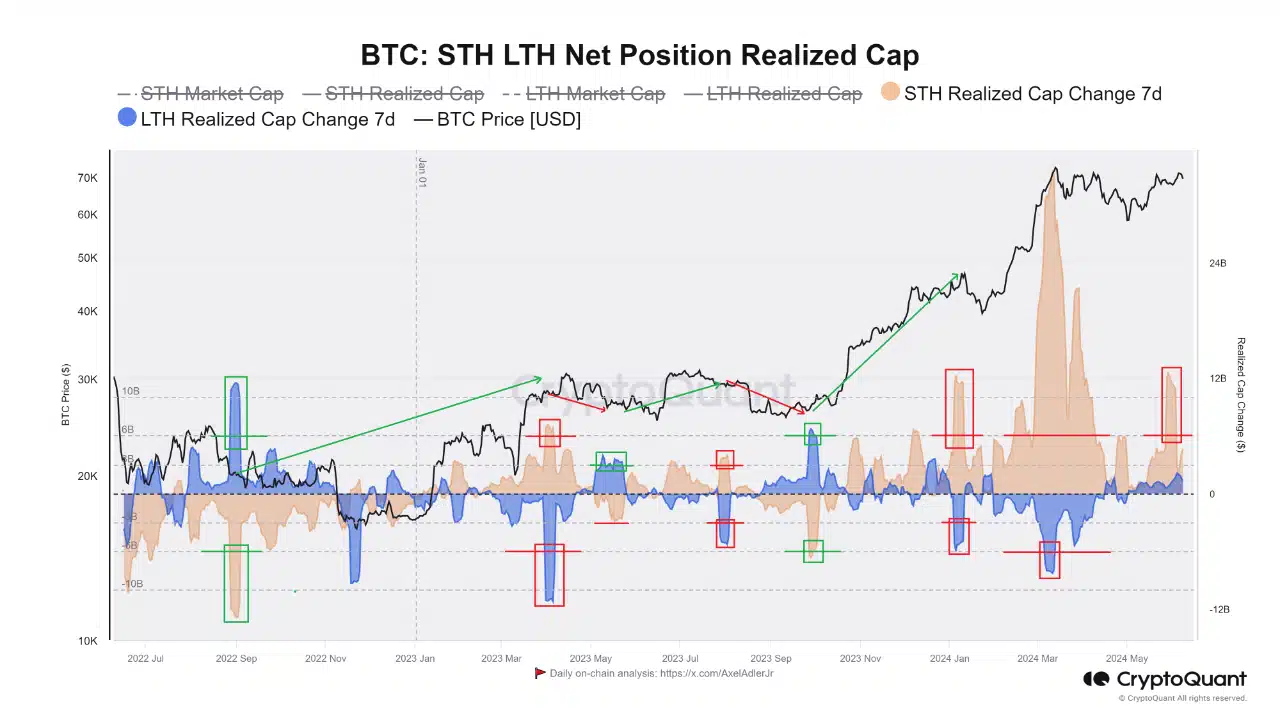

As an experienced analyst, I’ve closely monitored Bitcoin’s price action over the past few weeks, and based on recent developments, I believe we could be seeing a local top formation. The short-term holder (STH) activity suggests a potential peak, as evidenced by the rapid rise in STH realized cap. This metric has historically indicated profit-taking from holders and buyer entry during market tops.

Bitcoin [BTC] saw a rapid rise in the short-term holder (STH) realized cap metric.

Capitalization based on realized prices represents a form of market capitalization calculation, which takes into account the price at which a cryptocurrency was last transacted as opposed to its current market value.

The recent uptick in the realized cap could mean a local top was in.

Which scenario is more likely to unfold in the coming days – a pullback towards the $66k mark or reaching for the resistance level above with potential corrections following?

Bitcoin short-term holders take profits

Analyst Amr Taha pointed out in a CryptoQuant Insights post that the realized market capitalization of Shorted and Hodled (STH) coins experienced a significant surge, exceeding $10 billion.

He observed that significant capital gains of over $6 billion typically occur when investors make modest profits and new buyers join the market at peak times.

Starting from March 2023, when the Stratum-Theta Hub (STH) cap reached over $6 billion, a correction process began and lasted for several weeks, even though an immediate decrease wasn’t guaranteed.

The metric tracks the realized cap change for both long-term holders (LTH) and STH. In March 2024, the LTH 7-day realized cap metric fell below $6 billion.

This generally indicates profit-taking activity from LTH and could mark local tops.

Bitcoin had not surpassed its previous record of $73,700 set in March. The heightened selling pressure from large investors could potentially hinder the bulls’ advancement.

Warning signs of network stagnancy

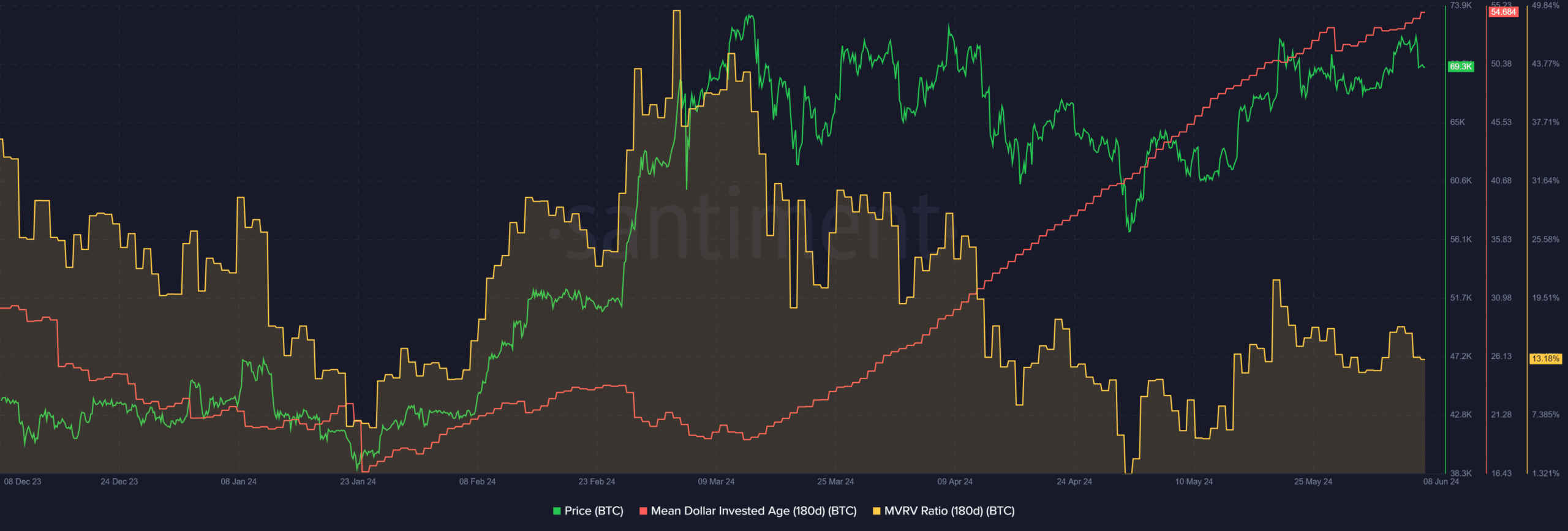

The average age of dollars invested in the network, represented by the Mean Dollar Invested Age (MDIA), has been gradually increasing since mid-March. This measurement takes into account the age of tokens on the network while considering their original purchase prices. A rising trend for MDIA is a bullish indicator.

If it remains at a high level for an extended duration, this could indicate network congestion caused by decreased activity in terms of transactions. Additionally, the presence of idle tokens may serve as an early warning signal for a dwindling number of new investors entering the market.

As a crypto investor, I’ve noticed that the MVRV (Moving Average Value) ratio signaled that my holdings were bringing in healthy profits. However, it’s essential to remember that this metric doesn’t necessarily mean imminent profit-taking is around the corner. It’s just one indicator among many, and market sentiment, news events, and other factors can significantly influence price movements. So, while keeping an eye on the MVRV ratio is prudent, it’s essential not to let fear of profit-taking cloud my investment decisions.

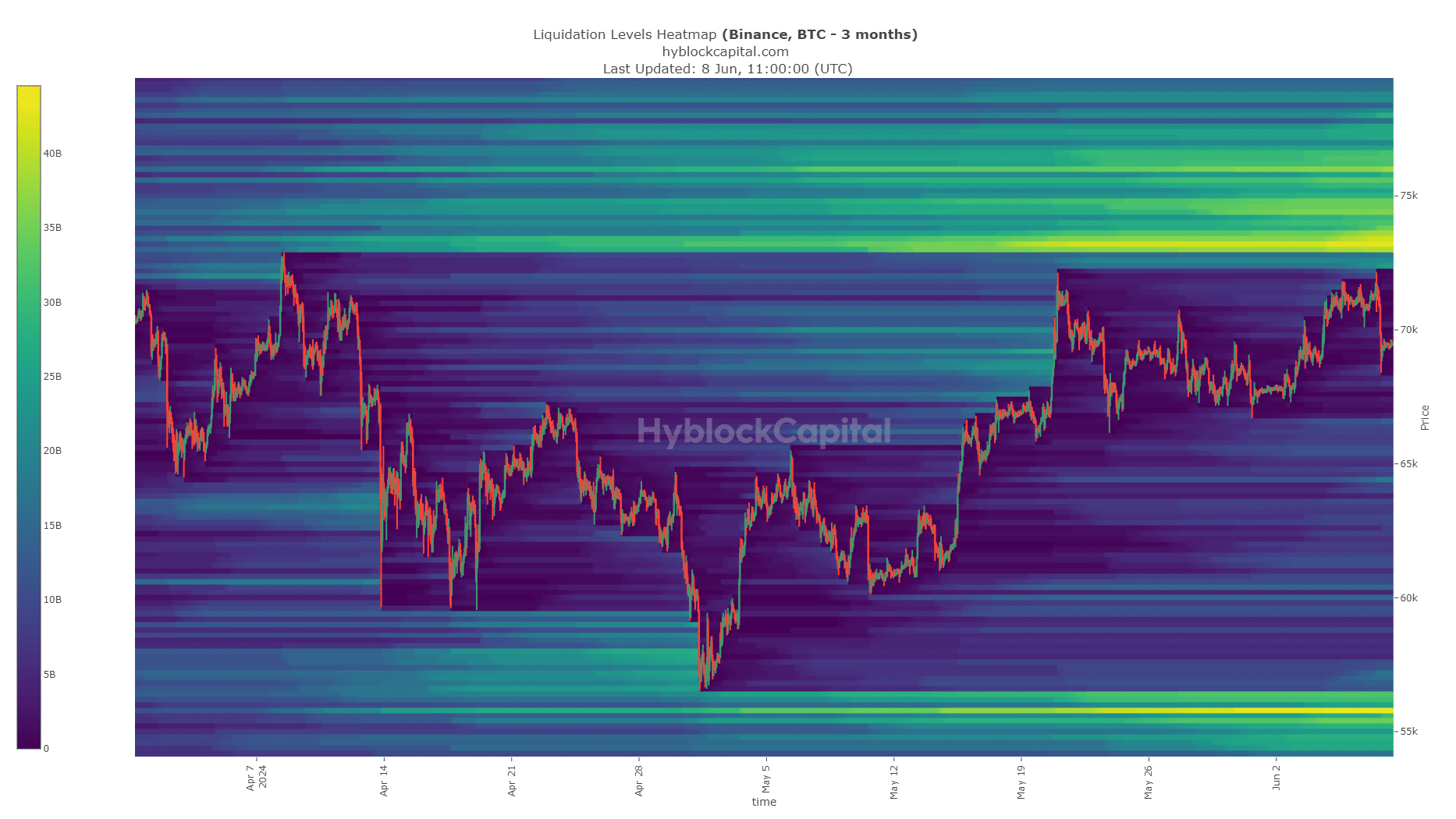

As a researcher examining the data, I observed that the density of liquidation points in the heatmap was scarce beneath the present market prices compared to the congested area between $73k and $75k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This pool of liquidity might be swept before the next downward move.

As an analyst, I’ve observed that it’s been around two months since Bitcoin underwent its halving event, yet its trend remains uncertain. Historically, the third quarter has not been kind to Bitcoin in terms of performance. Consequently, investors should brace themselves for a potentially lengthy and arduous struggle.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-06-09 12:07