- The sweet nectar of stablecoin liquidity, once plentiful, now strangely scant—reminiscent of a spring bloom extinguished too soon.

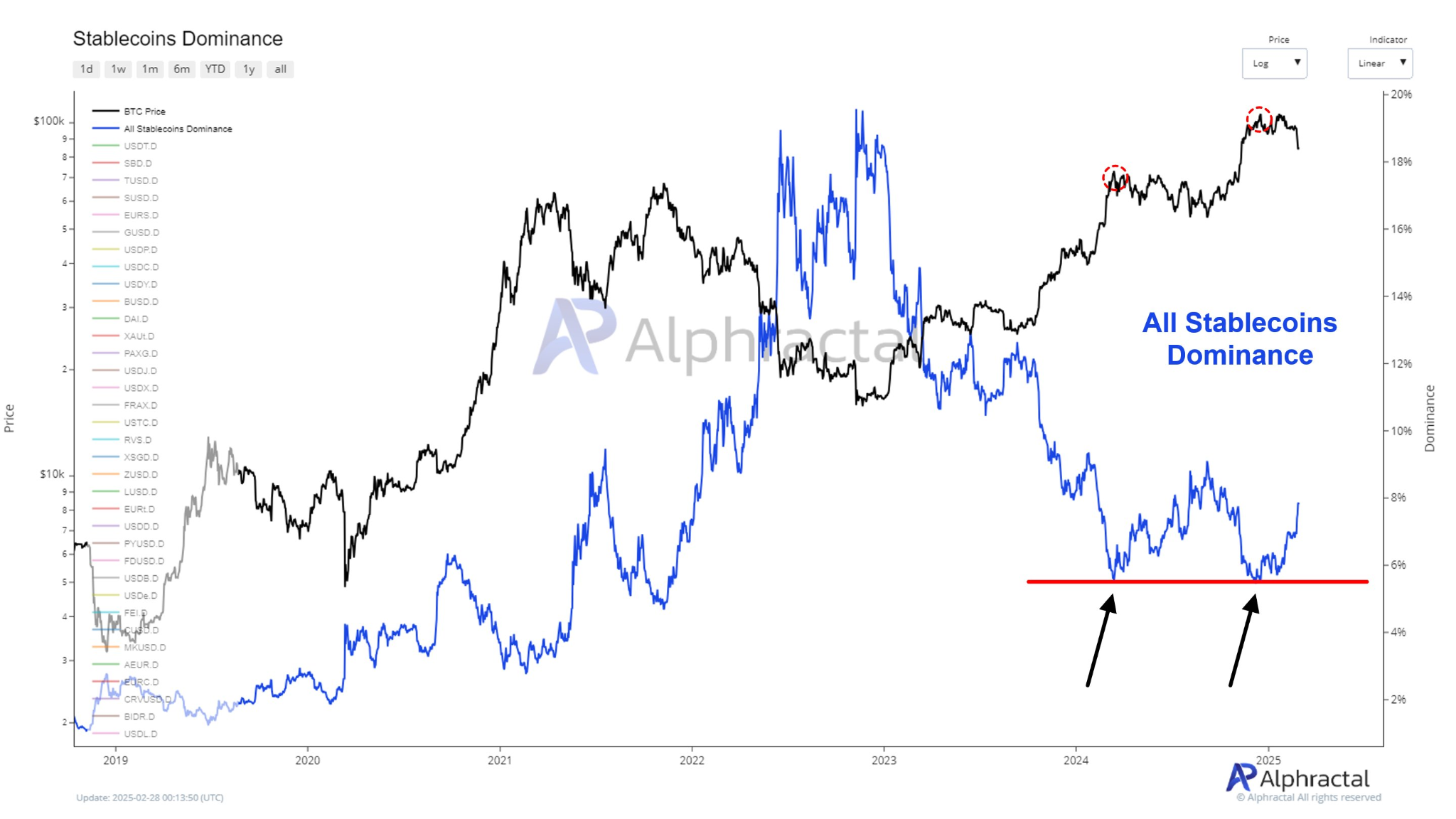

- Like the trilling of sparrows foretelling rain, stablecoin dominance heralds the murmurs of Bitcoin’s price corrections.

Ah, how the tides of liquidity wane! The stablecoin abundance we once knew has shriveled like a forgotten fig in the corner of a dusty pantry. Just recently, our once-mighty Bitcoin plummeted from its majestic perch in the golden quarter of 2024, tumbling indifferently below the fabled $80,000 mark, as if it had forgotten to hold onto its silk parachute.

Yet, lo and behold, Bitcoin has regained its footing, frolicking proudly above the $85,000 threshold, almost like a cat that has knocked over a glass but still expects a treat. But what of the Stablecoin Supply Ratio (SSR) Oscillator? This curious instrument observes the whispers of liquidity and market behavior, considering itself the oracle of our soggy present.

An Inquiry into the Peculiar SSR – The Dance of Market Liquidity & Those Wily Bollinger Bands

This SSR, a rather charming measure of Bitcoin’s standing in the cosmos of coins, reveals the interplay between humble stablecoins and their lofty Bitcoin cousin. A low SSR, you see, means stablecoins hold dearer riches, ready to tumble into Bitcoin’s laps like an unbidden compliment. As of February, the SSR Oscillator has surged, sitting rather smugly at around 14.

Ah, but behold the ominous Bollinger Bands—those fickle things—providing insight into potential market reversals. When the SSR wades towards the upper band, the liquidity of stablecoins dwindles, much like a fountain running dry amidst a scorching summer.

The Tug-of-War: Stablecoin Dominance vs Bitcoin – A Tale of Historical Tension

Upon looking back at the grave annals of SSR’s past, it is undeniable: a rising SSR oft precedes Bitcoin’s corrections like a Sherlock Holmes mystery unraveling. Late 2024 serves as our case study, where Bitcoin’s exuberant peak met low stablecoin dominance, embarking on a trend reversal like a ship turning to face the storm.

Contrary to twisted fate, when the SSR droops towards the lower Bollinger band, we behold abundant stablecoin liquidity, sending Bitcoin soaring, a phoenix from the ashes, ready to bask in bullish glory. Ah, just as Alphractal whimsically notes on X (formerly Twitter), this ancient relationship might just waltz its way back into our current dance of market volatility.

Deciphering the Market’s Cryptic Dance and Trends

These past weeks, my crypto comrades, volatility has gripped the market like a bear upon a picnic basket, especially as BTC nosedived beneath the crucial $80,000 threshold. External ruckuses—bybit hacks and Trump’s taxing escapades—cast a pall of uncertainty that swayed the global economy and stirred the cauldron of market volatility.

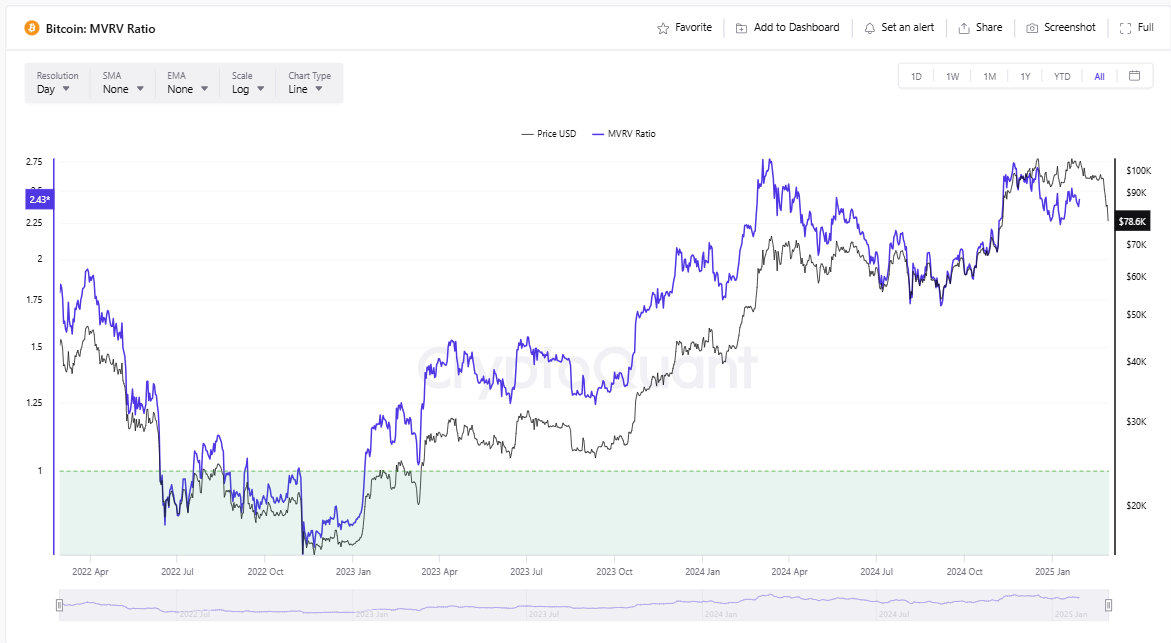

As the SSR precariously ricochets off its support, Bitcoin’s upcoming prance remains an enigma. At this very juncture, BTC’s MVRV ratio stands at a rather mediating 2.43—neither triumphantly overvalued nor woefully underappreciated, much like that friend who never brings snacks to the party.

Bitcoin at a Fork in the Road – What Lies Ahead?

Should the SSR continue its duplicitous upward trajectory despite the tumult, Bitcoin may find itself floundering further still. Yet, should stablecoin liquidity surge forth, reducing the SSR and rekindling the flame of bullish momentum, Bitcoin’s rebirth could grace the pages of our next chapter.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-03-01 10:20