- BTC has surged by 4.16% over the past 24 hours.

- Rising open interest and declining funding rate suggest a high demand for Bitcoin’s short trade.

As a seasoned analyst with over two decades of market experience under my belt, I find myself intrigued by the recent surge in Bitcoin’s [BTC] performance. Over the past 24 hours, we’ve witnessed a 4.16% increase, pushing BTC to a new high of $98,056. This Christmas-time rally has certainly stirred up some conversation among us market veterans.

💥 Trump Tariff Shockwave: EUR/USD in Crisis Mode?

Find out what experts predict for the euro-dollar pair this week!

View Urgent ForecastOver the past 24 hours, Bitcoin [BTC] experienced small gains as the markets enter the Christmas mood. As of this writing, Bitcoin was trading at $98,056. This marked a 4.16% increase over the last day.

On Christmas Eve, the price of Bitcoin climbed significantly, rising from a minimum of $93,461 to a maximum of $99,419. This recent increase has sparked discussions among analysts about Bitcoin’s behavior following the Christmas holiday.

According to an analysis by Cryptoquant’s Trader Oasis, Bitcoin (BTC) might maintain a horizontal trend during the Christmas week. As the need for short positions increases, there could be a subsequent movement towards distribution, following this period.

Bitcoin’s demand for short positions soars

Based on information from Trader Oasis, Bitcoin has seen a decrease in value over the last few weeks due to reduced institutional interest.

According to his interpretation, the Coinbase premium index didn’t follow the price increase, resulting in a drop. Yet, the analyst predicts that the market will persist in rising since the index is now below zero.

Based on his perspective, the ongoing increase appears to be sustained by funding rates and active participation, as indicated by open interest.

In other words, it’s good news for a rising market as the funding rate has dropped, whereas open interest has significantly increased in recent days.

If the funding rate decreases while open interest increases, this could mean that investors are entering into short positions. This implies that these investors anticipate a fall in prices.

On the other hand, a rise in interest for short positions might lead to a short squeeze due to growing buying pressure. This surge of interest lures in additional buyers, consequently fueling a self-perpetuating market rally.

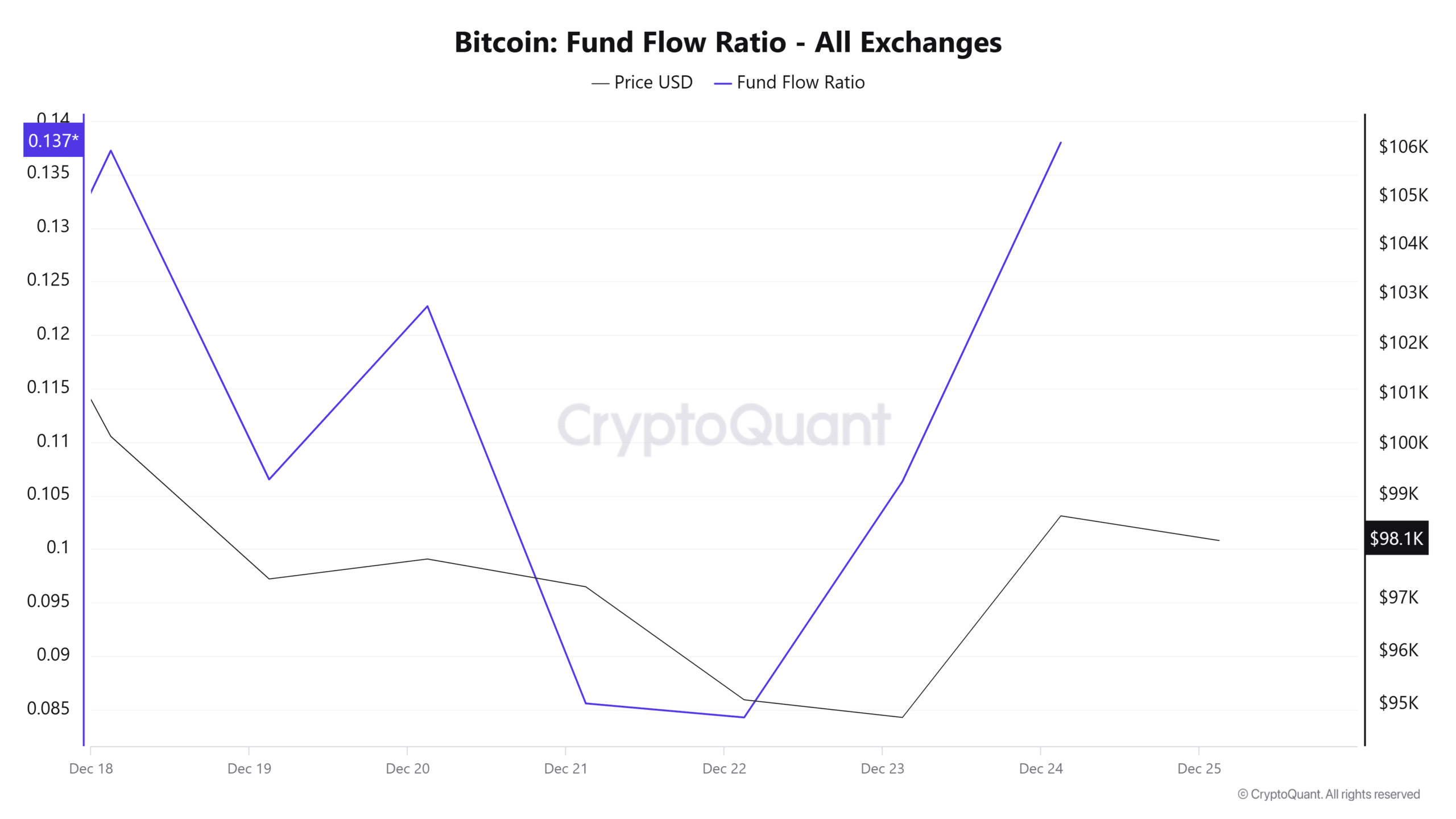

Over the last three days, I’ve noticed a significant surge in demand for Bitcoin. This is reflected in the BTC fund flow ratio, which has jumped from 0.084 to 0.137 during this period.

When the proportion of funds flowing into Bitcoin increases, it signifies an influx of investment in Bitcoin. This upward trend suggests that investors are becoming more confident and are ready to commit more resources to Bitcoin, which drives up its price due to heightened demand and purchasing activity.

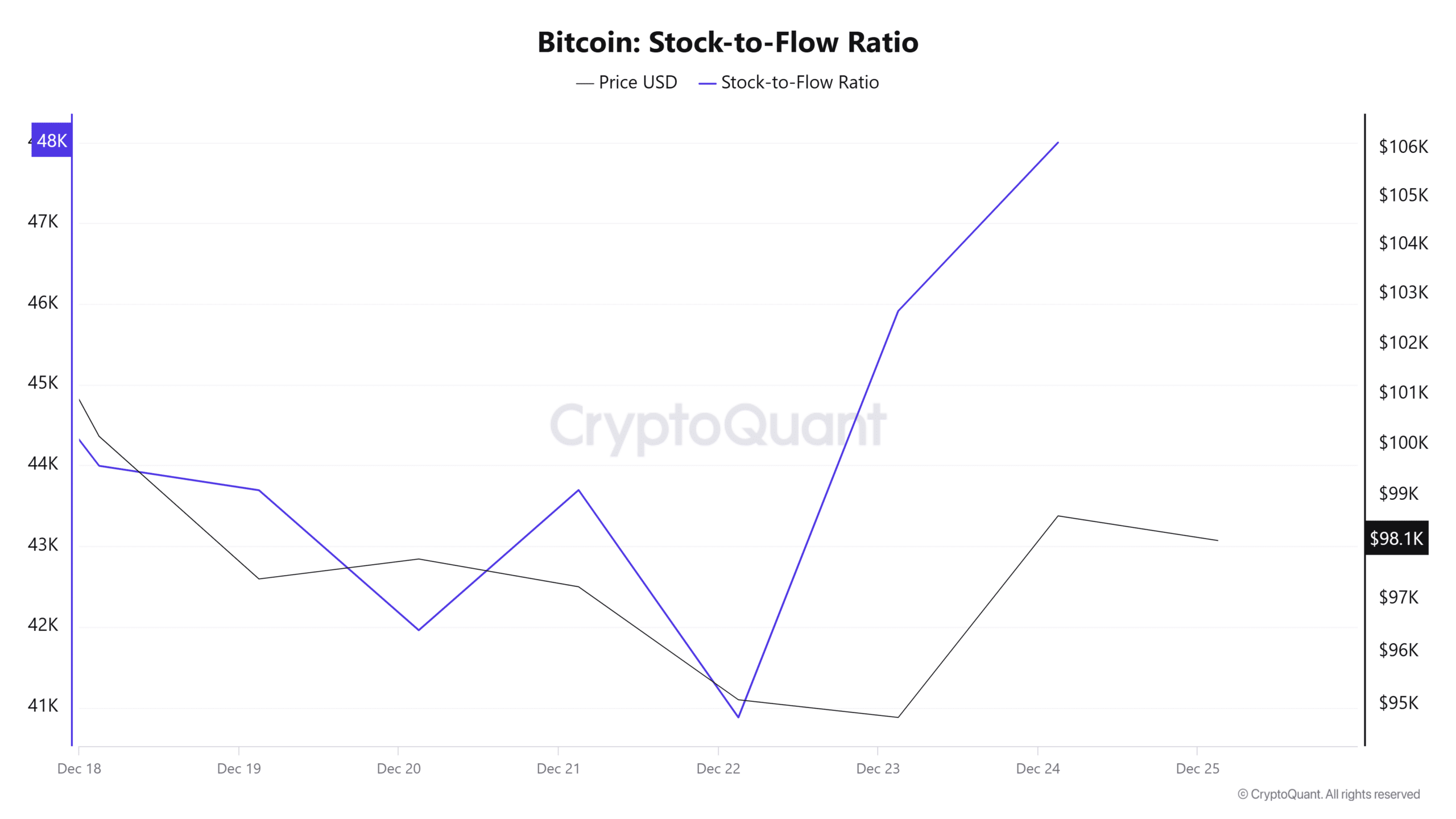

Furthermore, the surge in incoming Bitcoin (BTC) implies that more of these digital coins are being withdrawn from exchanges, leading to increased scarcity. As an increasing number of traders opt for purchasing this cryptocurrency, it is becoming increasingly scarce, as indicated by the growing stock-to-flow ratio.

As the supply of Bitcoin decreases, increased demand due to scarcity drives up its cost because high demand coupled with low availability tends to increase prices.

Read Bitcoin’s [BTC] Price Prediction 2024-25

What’s next for BTC?

As more investors express interest in short trades, there’s an increased risk that they might experience a ‘squeeze.’ This happens when the increased demand to sell (short) leads to an unexpected rise in the market price instead.

Given that the demand stays steady and the supply keeps decreasing, as seen currently, there’s a possibility that Bitcoin may surpass the $100k resistance level after Christmas. On the other hand, if the cryptocurrency trades within a narrow range, it might dip to around $96,600.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2024-12-26 03:03