- Spot market demand leads Bitcoin’s upward momentum.

- BTC has declined by 2.46% over the past 24 hours.

As a seasoned crypto investor with over a decade of experience navigating the volatile world of digital currencies, I can confidently say that the current surge in spot market demand for Bitcoin is a bullish sign. The recent decline in price, while concerning to some, should not deter us from recognizing the underlying trend.

For approximately a month now, Bitcoin [BTC] has been climbing steadily, reaching a fresh all-time high of $108,268.

Due to this ongoing upward trend, significant players are actively discussing the reasons for its continuation. Notably, analysts from CryptoQuant attribute the rise in BTC’s price primarily to an increase in demand for the spot market.

Bitcoin’s spot market demand soars

According to Avocado’s examination, it’s unclear whether Bitcoin’s growth phase is primarily influenced by the Future markets or the direct trading markets.

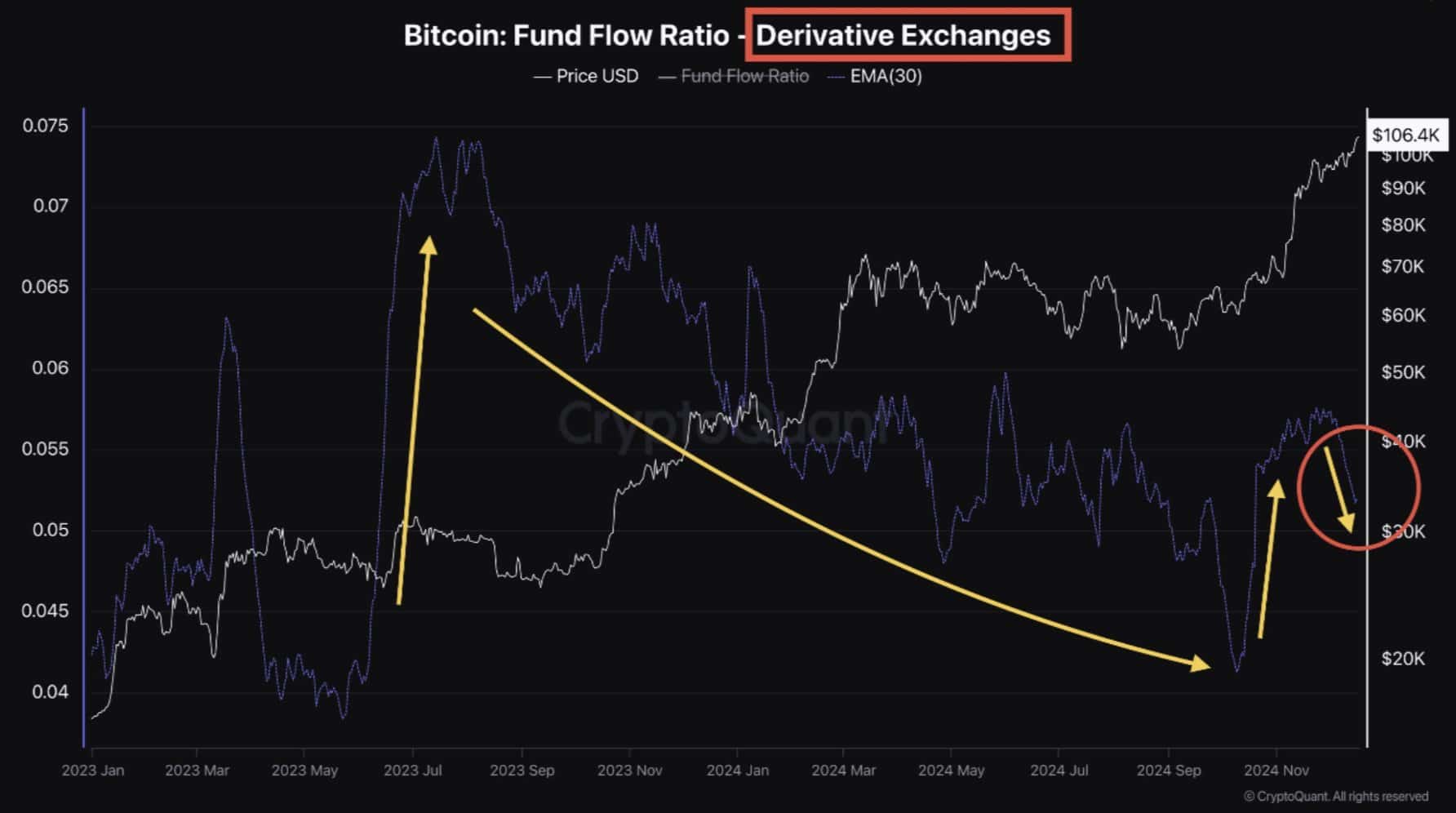

Consequently, the surge in the 2023 market (or bull run) was fueled primarily by the Futures market, which later sparked increased activity in the spot market. This dynamic push resulted in a rise in prices.

As a researcher studying cryptocurrency trends, I’ve observed an extended downturn in the Bitcoin spot and Futures market from March 2024 to September. However, October 2024 marked a significant shift as trading volumes for both markets surged, propelling prices to reach new All-Time Highs (ATH).

Over the past month, there’s been a drop in the desire for Futures markets, but the demand for immediate transactions (Spot market) keeps climbing up.

The increase in immediate market needs indicates that speculation may be decreasing in the Futures market, meanwhile, the urge to buy in the present market appears to be growing stronger.

Consequently, futures markets are likely to persist in a pattern of liquidations followed by heating up, leading to an increase in Bitcoin’s price. This trend, in turn, is expected to attract more investment capital towards the spot market.

Often, a surge in spot market demand pushes an asset’s price up through a higher buying pressure.

Impact on BTC

Normally, when there’s more demand to buy (buying pressure), prices tend to go up. But contrary to this pattern, Bitcoin has seen a decrease in price recently due to a market adjustment (or correction) within the last day.

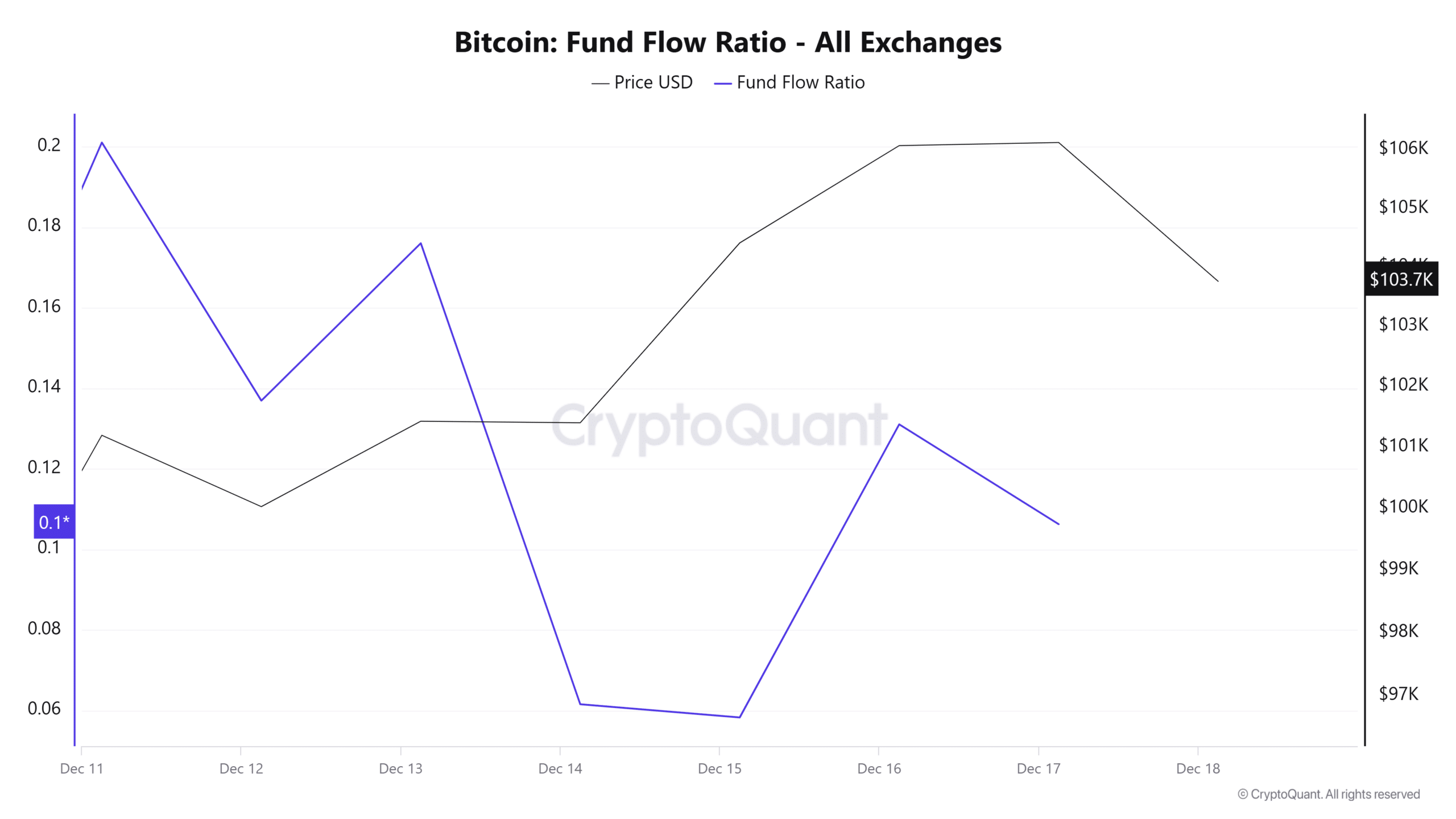

Currently, at the moment I’m writing, the price of Bitcoin stands at approximately $103,825, showing a 2.46% drop over the past day. Interestingly, despite this decrease, there has been an ongoing increase in demand across the market, particularly noticeable in the spot market.

It’s clear that there’s an increase in demand for the spot market, as indicated by the decrease in the flow of funds into exchange accounts. What’s more, it seems that many users are choosing to store their funds in personal wallets instead of keeping them on exchanges.

This indicates a positive trend suggesting less trading on exchanges, often linked to prolonged trust in the market’s future.

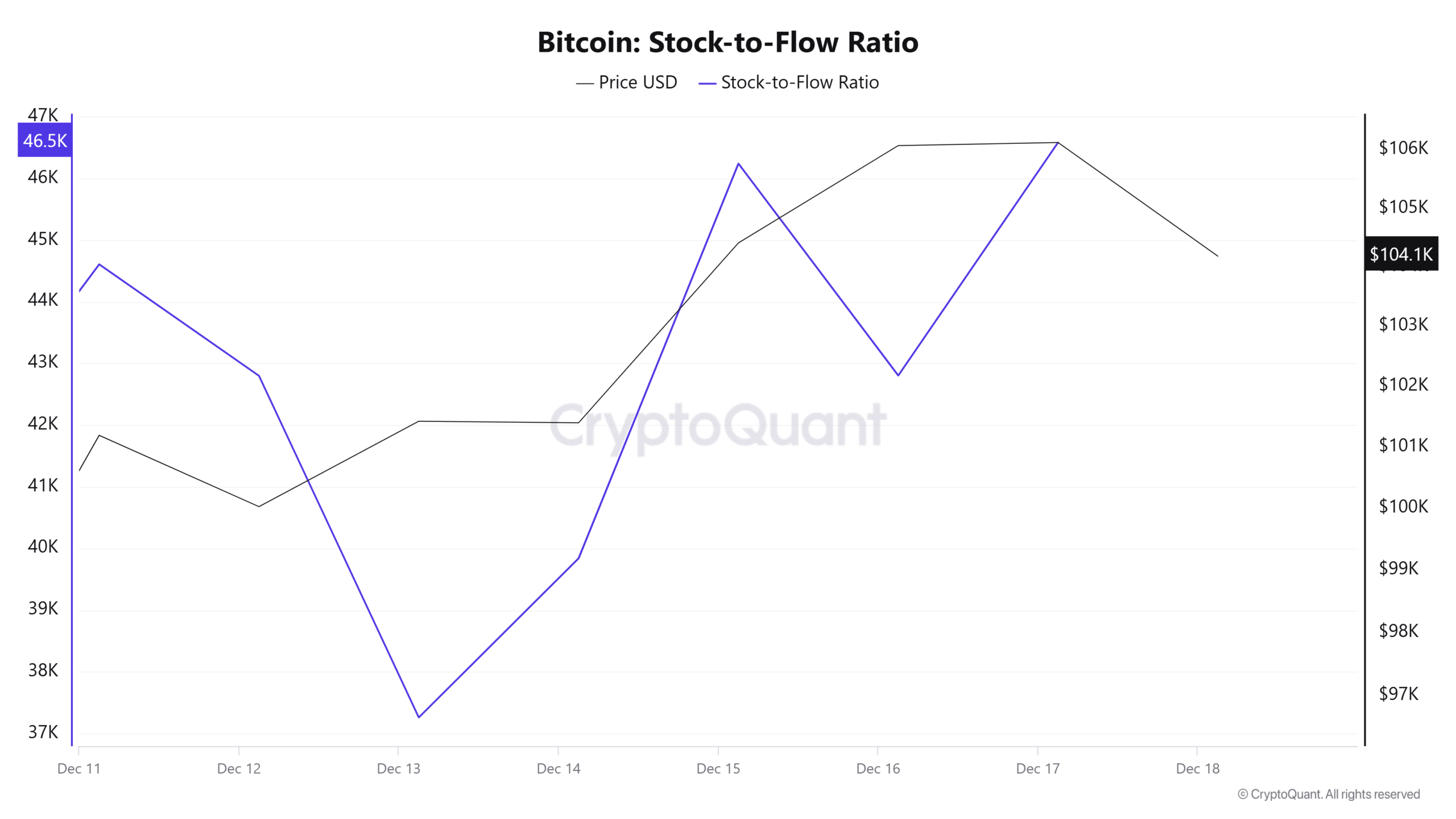

Furthermore, the Stock-to-Flow Ratio (SFR) of Bitcoin has increased to an impressive 46.5 thousand following a dip to 37 thousand. An uptick in the SFR generally indicates a rise in the scarcity of Bitcoin.

This indicates that the availability of these assets is decreasing as interest grows, while the desire for them remains high. When desirability escalates in the face of dwindling resources, it results in a compression of supply, which in turn pushes prices higher.

Read Bitcoin Price Prediction 2024–2025

Essentially, an increase in the demand for Bitcoin’s active market is setting the stage for further price increases due to heightened buying activity. If this trend persists, we can expect the prices to keep climbing upwards.

As a researcher, I am speculating that should conditions remain favorable, Bitcoin could regain its position above $106,000 and potentially reach new highs. Conversely, if the current correction continues in the coming days, Bitcoin might dip to around $102,630 before resuming its upward trend.

Read More

2024-12-18 15:03