-

BNB may retest support below $500.

Its futures open interest has fallen by over 20% in the past two weeks.

As a seasoned analyst with extensive experience in the crypto markets, I believe that Binance Coin (BNB) may face a significant price decline below the $500 mark. The coin’s price has been attempting to fall beneath its moving averages, which could signal a shift in momentum from bullish to bearish if this trend continues.

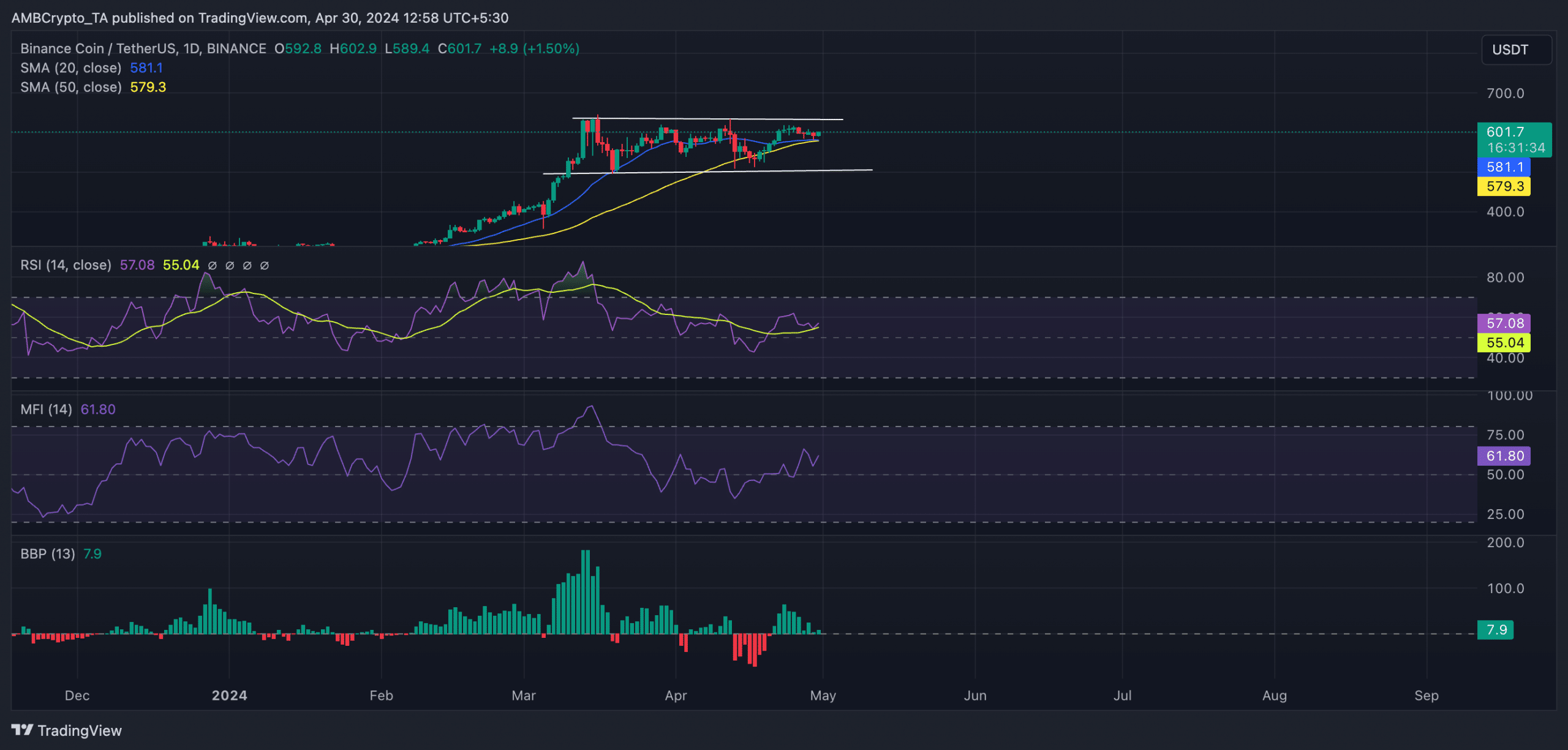

The price of Binance Coin (BNB) could potentially drop below the $500 threshold as it struggles to move beneath its moving averages, according to AMBCrypto’s analysis of its 1-day price chart. The coin is approaching its 20-day and 50-day moving averages.

What to expect?

Short-term averages like the 20-day and 50-day moving averages are frequently employed to spot trends. If an asset’s price dips below these averages, it suggests a change from bullish to bearish sentiment. In conjunction with decreased buying pressure, this indicates that the market is experiencing a downward trend.

Should bears take over with increased pessimism, causing BNB to drop beneath these moving averages, the cryptocurrency’s value might reach the robust support area priced around $495.

If the buying volume of BNB decreases, it’s more likely that this trend will continue. Nevertheless, a review of its crucial momentum indicators suggests that this might not necessarily be the case for the BNB coin.

The readings from the Relative Strength Indicator (RSI) and Money Flow Index (MFI) indicated that BNB‘s values were above their respective thresholds for positivity. At present, the RSI stood at 57.05, whereas the MFI was at 61.78.

Market participants engaged in a somewhat higher volume of coin purchases compared to sell-offs, as indicated by the data.

Despite a stable price for BNB over the past week, its Elder-Ray Index still showed positive results.

As a researcher studying the altcoin market, I would describe an indicator that quantifies the balance of buying and selling pressures. A positive reading for this indicator implies that buyers hold more influence over price movements, indicating a predominantly bullish market scenario.

Currently, the Elder-Ray Index for Binance Coin (BNB) stands at 0.29 upon pressing this text. Since the 21st of April, this indicator has exclusively provided positive readings.

Realistic or not, here’s BNB’s market cap in SOL’s terms

BNB in the derivatives market

The BNB futures market underwent an evaluation, which showed a decrease in its open interest starting from 11th April. Currently, the open interest for BNB futures stands at approximately $592 million. This represents a 23% drop based on data from Coinglass.

Theopen interest for a financial asset’s futures contracts represents the current tally of contracts that haven’t been settled or liquidated. A decrease in open interest signifies more traders are closing their positions without establishing new ones, indicating a possible reduction in market activity.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- PI PREDICTION. PI cryptocurrency

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

2024-05-01 02:47