- BNB has marked a key milestone this cycle by breaching the $600 resistance.

- However, it still appears undervalued – a condition bulls must seize to fuel further gains.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market cycles and trends. Watching BNB breach the $600 resistance this cycle has been an exciting development, but I believe it still appears undervalued – a condition bulls must seize to fuel further gains.

Over the last seven days, Bitcoin [BTC] investors have experienced a thrill ride, as excitement mounts as Bitcoin approaches the much-anticipated $100,000 mark.

Even though there was increasing anticipation, the weekend failed to bring the expected breakthrough, instead keeping the market tense with uncertainty.

In historical patterns, when Bitcoin approaches psychological thresholds that people find significant, altcoins often experience an uptick as a result.

Many individual investors regularly move their funds to reduce potential losses, a practice that Binance Coin (BNB) utilized effectively to reach its record peak of $717 in early June.

After that point, BNB has been consistently trying to surpass the resistance at $600, a barrier it managed to overcome following several unsuccessful attempts, during the period after the elections.

Currently priced at $660, the bullish MACD crossing suggests an increase in momentum. With Bitcoin yet to reach its significant milestone, could Binance Coin (BNB) achieve a new record high before this market cycle ends?

Broader market signals BNB may be undervalued

It’s worth noting that given the recent surge of more than 10% in just four trading days for BNB, there’s a possibility it could pull back to $600. This rapid increase may indicate an approaching adjustment or correction.

If bulls can’t hold onto this price point, a sense of worry might grow among investors, leading them to sell off to prevent any more potential losses.

In contrast, it seems rather improbable that Bitcoin will dominate the market’s growth, given the robust surge of altcoins, some even recording triple-digit increases. Traditionally, when Bitcoin is approaching its zenith, Binance Coin (BNB) has often reaped the benefits.

Furthermore, the coin’s daily graph indicated it might be underpriced, implying a possibility for more growth ahead.

Should this pattern continue, BNB might reach $700 initially, serving as a significant motivator for bullish investors to further propel the cryptocurrency toward an unprecedented peak.

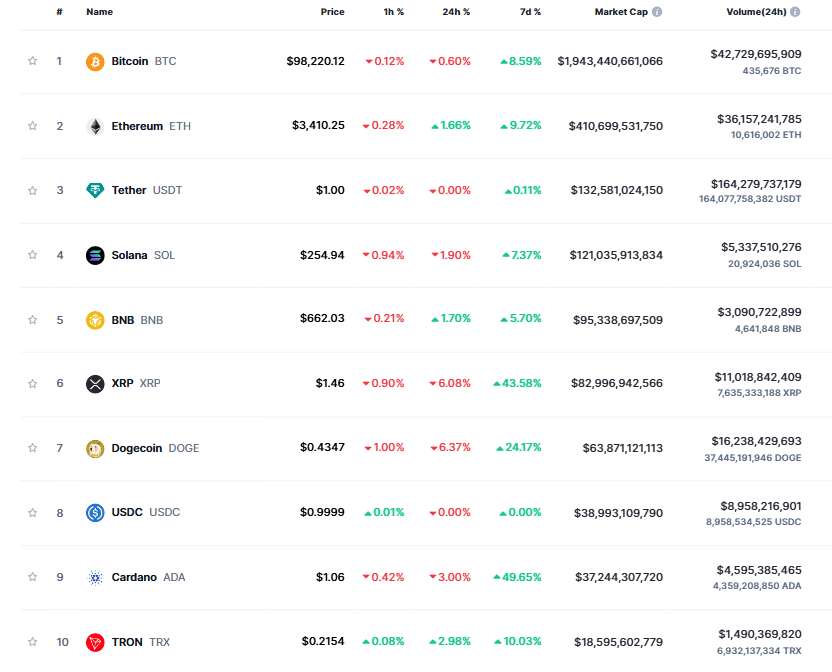

Source : CoinMarketCap

During this bull market, BNB has trailed behind compared to its peers like Cardano (ADA) and Ripple (XRP). Notably, ADA and XRP have managed to surpass the $1 mark again following a long period of price stabilization.

Despite BNB achieving a notable feat by surpassing the significant $600 barrier, the potential for being undervalued relative to its competitors could prove to be its most potent advantage.

Due to the significant gains that many cryptocurrencies have experienced during this market cycle, it’s highly likely that a sudden reversal could cause turbulence in their prices.

With substantial profits already made, investors might choose to depart and concentrate on Bitcoin again. This situation could offer a chance for BNB to match or even surpass them in value.

So, is $700 just around the corner?

Over the past four months, I’ve noticed that the daily price chart of BNB has been in a downtrend, repeatedly failing to surpass the $600 mark. Yet, lately, there seems to be a resurgence as it manages to climb out from this prolonged phase. Interestingly, the Relative Strength Index (RSI) remains within its neutral range at present.

In simpler terms, the current low valuation of BNB presents a great opportunity for buyers to start stockpiling, which could lead to BNB increasing towards $670 in the near future. This is supported by other positive signs as well.

Yet, a rally all the way to $700 might seem overly ambitious under the current market conditions, where the spotlight remains on other altcoins, signaling an underlying shift in investor interest.

As a researcher, I find it intriguing that while Bitcoin surged past its all-time high of $715 daily gains in excess of 9%, with consolidation occurring around the $70K mark, BNB’s recent daily growth hasn’t even managed to top 2%.

This muted momentum must shift dramatically for a parabolic run to take shape.

As speculators in the market consider the present price as a potential low point, it’s crucial for bullish investors to take a strong stance in order to break through the resistance at $700.

Therefore, the possibility of $670 remains tangible, supported by strong bullish indicators.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Reaching a fresh record high for BNB calls for a substantial increase in buying activity from bulls, enough to propel it above the crucial $700 barrier.

Reaching this particular point might serve as a mental catalyst, inspiring potential investors to jump into the market and long-term owners to keep their investments steady. This could generate the impetus required for a new all-time high.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-11-24 15:04