-

Analyst Master Kenobi labels ADA as a “cult coin,” arguing it enriches its founder without delivering value.

Comparison shows BNB outperforming ADA in market cap, development activity, and overall success.

As an analyst with years of experience in the volatile and fascinating world of cryptocurrencies, I find myself often intrigued by the passionate debates that arise within our community. In this particular case, the comparison between Cardano (ADA) and Binance Coin (BNB) has certainly stirred up some lively conversations.

Discussions about Cardano, a blockchain platform that uses proof-of-stake and is renowned for hosting decentralized apps (dApps) and executing smart contracts, are commonly heard among cryptocurrency enthusiasts.

Although Cardano’s native token, ADA, ranks high in terms of market value alongside other major cryptocurrencies, prominent crypto analyst Master Kenobi has given it the label of a “cult coin.” This implies that there is a strong and dedicated community around this digital currency.

Kenobi drew a comparison between ADA and Binance‘s native token, BNB, to reinforce his perspective, emphasizing the noticeable disparities in the strategies and results of these two projects.

ADA against BNB

Kenobi’s criticism centers on the perceived lack of progress by Cardano compared to Binance.

In a post on X, he stated, “Nothing VS Everything in 2330 Days,” pointing out that while Cardano has focused on what he considers “brainwashing sessions” through its long AMAs (Ask Me Anything sessions), Binance has emphasized utility, performance, and industry compatibility.

As per Kenobi’s perspective, BNB, through its approach that integrates advanced technology and marketing, has transformed into a tangible form of value storage. On the other hand, ADA is often viewed as a cryptocurrency that boasts more discussion than actual delivery.

The analyst particularly noted:

In my opinion, BNB stands out as the coin that truly embodies a store of value because of its practical uses. On the other hand, ADA might be perceived as more of a coin with a dedicated following or cult status.

A comparison of market performance and fundamentals

When comparing the market performance of ADA and BNB, there is a noticeable difference. BNB currently holds a market capitalization of $80.2 billion, whereas ADA’s market cap stands at $11.9 billion.

Regarding their price fluctuations over the last period, ADA took a dip of 5.1% within the last 24 hours and 2.1% during the last seven days. In contrast, BNB has shown lower volatility, decreasing by just 0.8% in the past day but rising by 8.1% over the previous week.

As an analyst, I’m noticing a striking disparity between how these two assets are being viewed by the market and their actual rates of adoption.

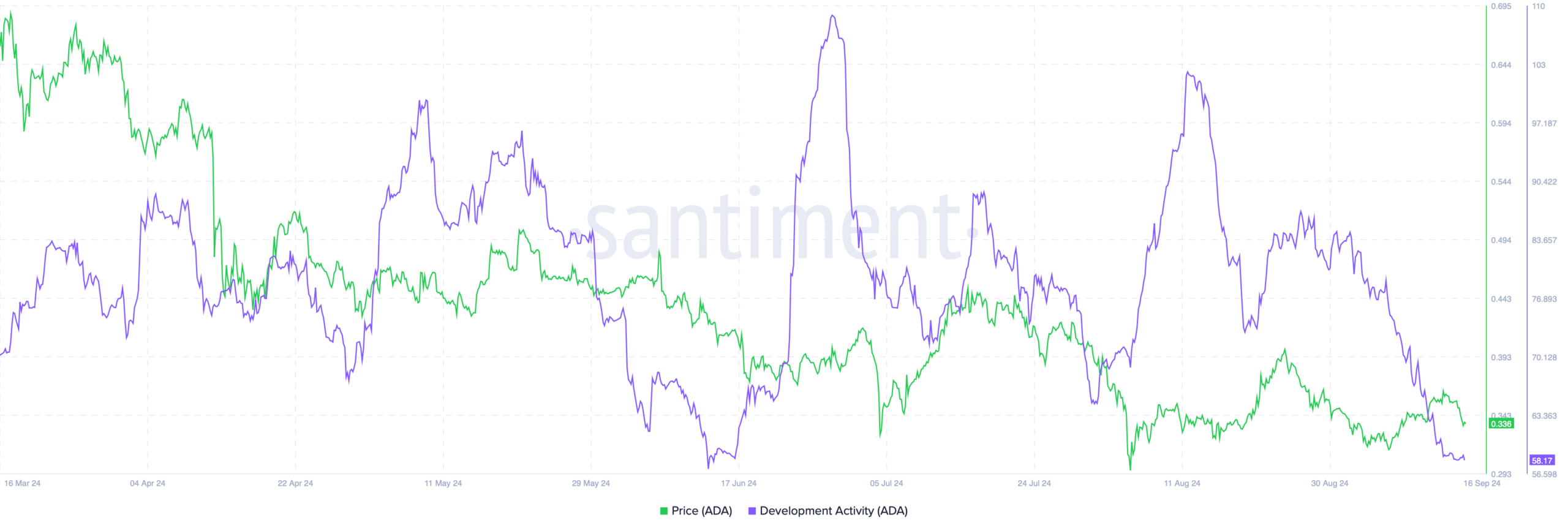

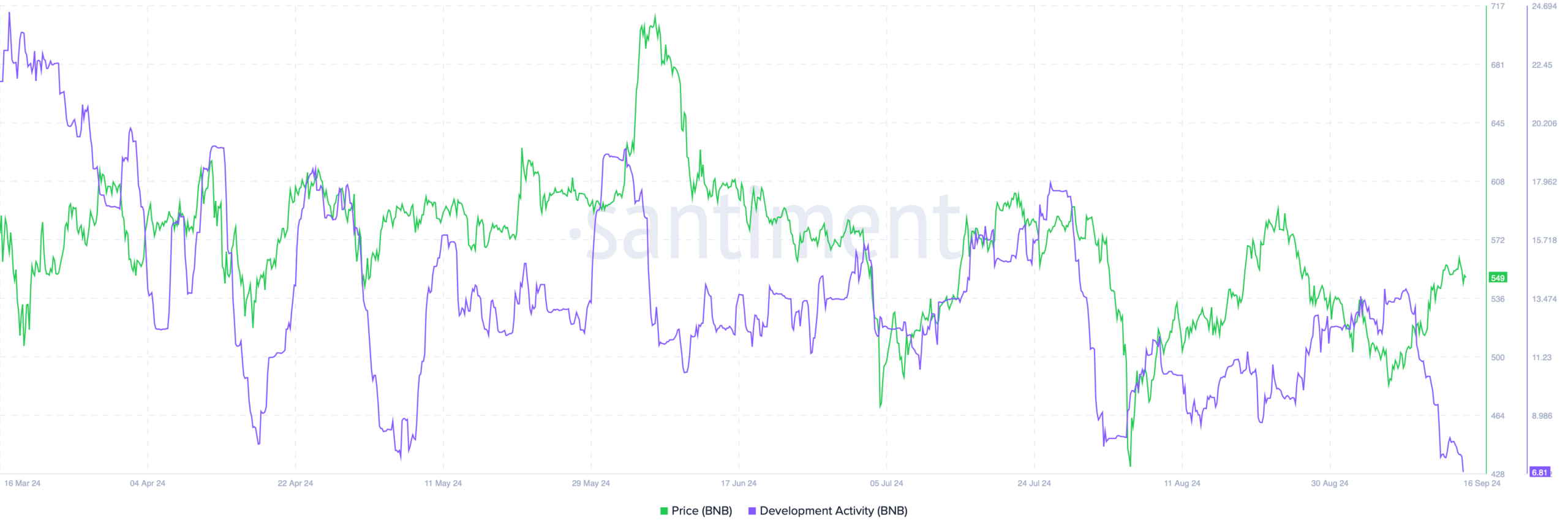

To delve deeper into the reasons behind this gap, let’s scrutinize the core characteristics of both ADA and BNB. As we analyze developmental trends, Santiment’s data indicates a consistent decrease in activity for both ADA and BNB.

On the other hand, the development activity for ADA stands at 58.17, significantly higher than Binance’s (BNB) 6.81. This discrepancy indicates that, in spite of the criticism, Cardano might boast a more active development community compared to Binance.

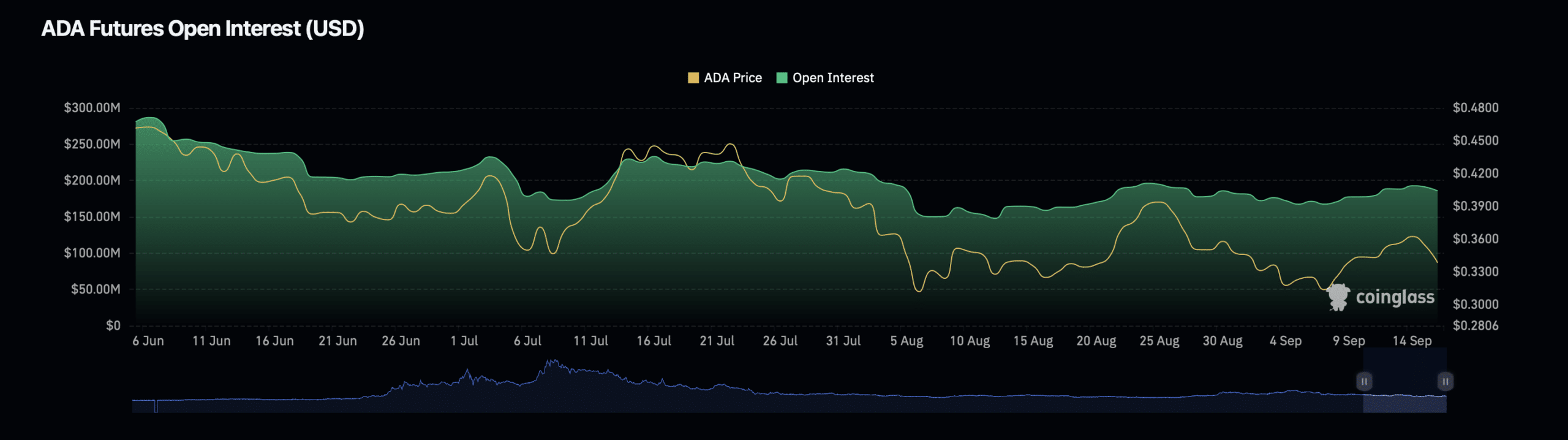

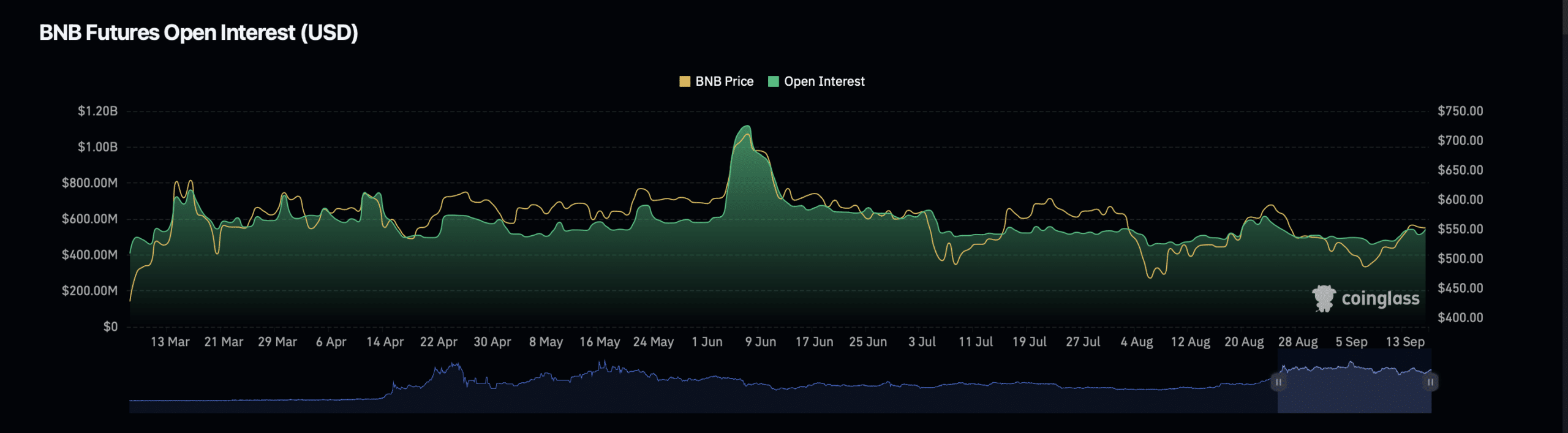

A significant factor to keep in mind is the open interest, representing the total number of active derivative agreements, like future and option contracts that are yet to be settled.

According to Coinglass data analysis, the open interest for ADA decreased by approximately 2.79%, landing at $185.99 million, whereas its open interest volume experienced a notable increase of around 75.51%, reaching $291.46 million.

Is your portfolio green? Check the Cardano Profit Calculator

An increase in the number of open contracts for ADA might signal higher levels of trading action or anticipation among traders regarding this cryptocurrency.

Conversely, the open interest for BNB has expanded by 4.15%, reaching approximately $532.67 million. This surge is accompanied by a significant jump in open interest volume by around 201%, amounting to $735.12 million. This growth suggests lively market activity and heightened investor curiosity.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Lucy Hale’s Sizzling Romance with Harry Jowsey: The Un serious, Fun-Filled Love Story!

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-09-16 15:20