- Dogecoin has shown signs of recovery after a recent dip, with analysts pointing to bullish reversal patterns.

- A potential MACD crossover and RSI suggested a possible surge in Dogecoin’s price.

As a seasoned researcher with years of experience analyzing cryptocurrency markets, I have to say that the recent developments in Dogecoin [DOGE] have piqued my interest. The asset’s recovery from a 5% dip and the formation of bullish reversal patterns such as the Diamond Reversal Pattern and potential MACD crossover are intriguing indicators, pointing towards a possible surge in Dogecoin’s price.

Over the past week, there’s been a significant dip in the value of Dogecoin (DOGE), often referred to as the well-known meme-inspired digital currency. This drop amounts to about 5% in its overall price.

Nevertheless, the asset exhibited indications of improvement, having risen by 1% within the last day. This uptick placed its trading value at $0.1008 as of the current moment. This substantial bounce back was noticeable when compared to the previous low of $0.096 reached earlier in the week.

Technical outlook on Dogecoin

In the midst of these fluctuations, various cryptocurrency experts have offered their opinions about the possible trends in Dogecoin’s pricing.

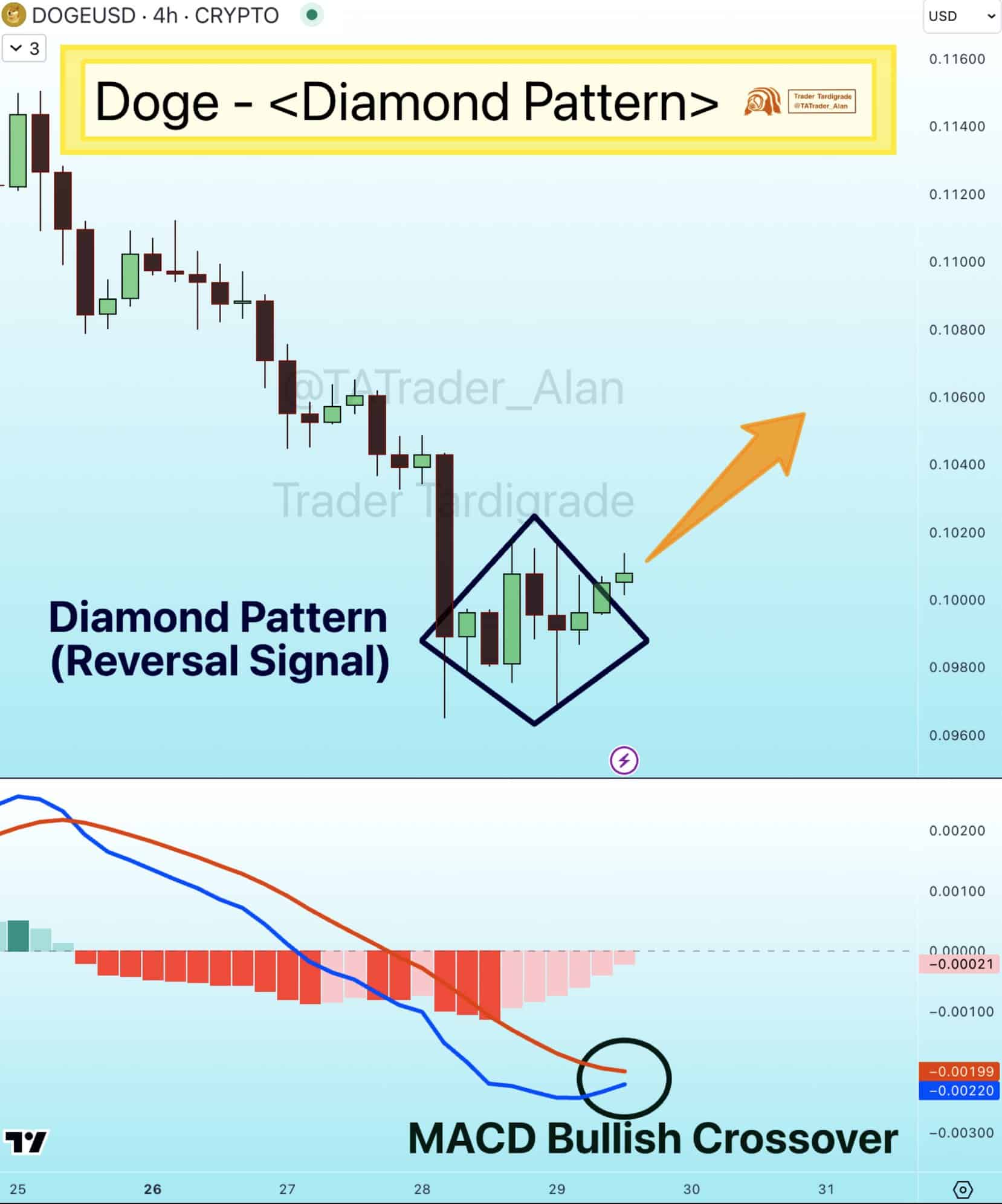

One of them is the renowned cryptocurrency analyst known as Trader Tardigrade, who shared a positive perspective about X (previously tweeted on Twitter) in a recent post.

He pointed out a potential bullish reversal for Dogecoin, highlighting a “Diamond Reversal Pattern” on the DOGE H4 chart.

As per Tardigrade’s analysis, this pattern suggests that Dogecoin might have hit its lowest point in the present market downturn.

It seems that a bullish crossing in the Moving Average Convergence Divergence (MACD) is approaching, potentially indicating a robust increase in the asset’s value.

A Diamond Reversal Pattern, in simple terms, is a graphical indication spotted during technical analysis. It suggests that the direction of a financial asset’s price movement might be about to change or reverse.

Usually, this pattern emerges following a sustained market trend, be it bullish or bearish, and it has a diamond-like appearance on the graph. It starts with a broadening price fluctuation that subsequently converges, creating a diamond shape.

Deviating from the usual sequence, often moving counter to the previous trend’s flow, could signal a possible change or reversal.

For Dogecoin, the emergence of this pattern implies that the downward trend might be about to conclude, potentially leading to an upturn in the near future, hinting at a bullish shift.

Another crypto analyst known as dogegod on X has also provided a positive outlook on Dogecoin’s price action.

He noted that recent price movements have established a bottom for Dogecoin, and historically, bull runs for DOGE have commenced when the green and red lines on the chart intersect, leading to a price surge in the following weeks.

Based on dogegod’s analysis, we might see a recurrence of this pattern during the ongoing cycle, possibly starting as soon as the initial week of September.

It’s expected that the upcoming weeks might mainly show a rise in Dogecoin prices, similar to how it behaved following significant turning points in its past cycles.

Fundamentals and market indicators

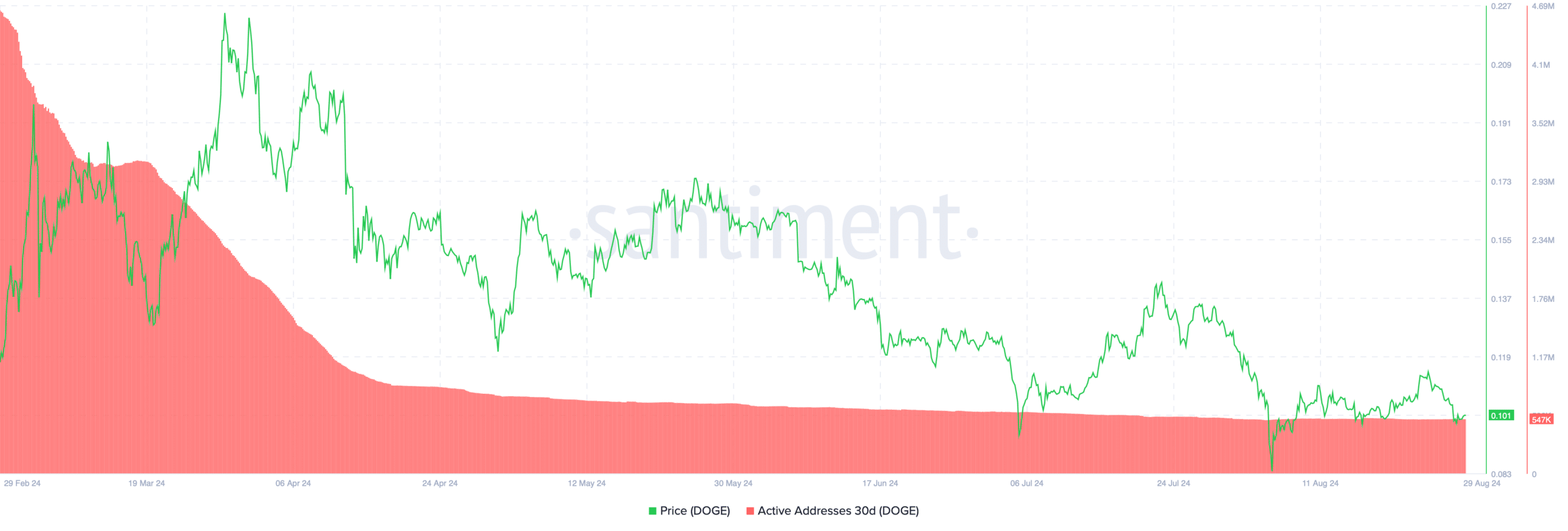

Beyond the technical aspects, there have been significant developments in Dogecoin’s underlying factors over the past few months as well.

Based on information from Santiment, it appears that the number of active Dogecoin accounts has noticeably decreased. In March, there were approximately 4.5 million active Dogecoin accounts, but as we speak, this figure has dropped below 600,000.

A decrease in the number of active wallets could imply less user involvement and interaction, potentially leading to a downward pressure on Dogecoin’s price, if this pattern persists.

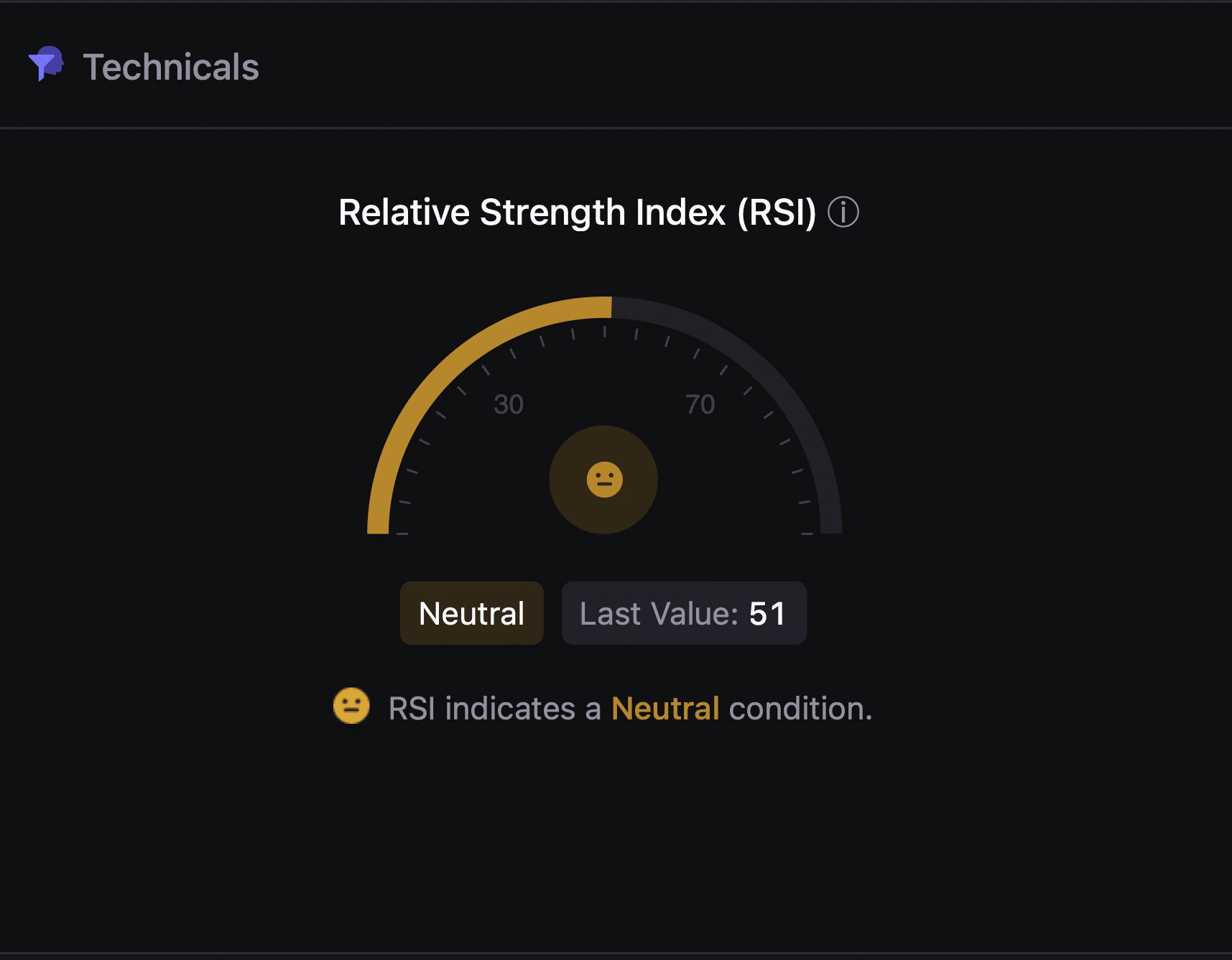

Additionally, the data from CryptoQuant showed that at the moment of reporting, the Relative Strength Index (RSI) for Dogecoin stood at a neutral level, specifically 50.

In simpler terms, the Relative Strength Index (RSI) is a tool employed during technical analysis that helps gauge how quickly and intensely a financial asset’s price is rising or falling.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Having an RSI (Relative Strength Index) of 50 implies that the Dogecoin asset is neither showing signs of being overbought nor oversold, indicating a well-balanced market sentiment toward Dogecoin.

In simpler terms, the current RSI (Relative Strength Index) reading for Dogecoin implies it might be going through a pause or stabilization period, where neither buyers nor sellers seem to have an upper hand. This could mean that the coin’s price may move sideways for a while before we see a clear trend upwards or downwards develop.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-08-30 09:12