-

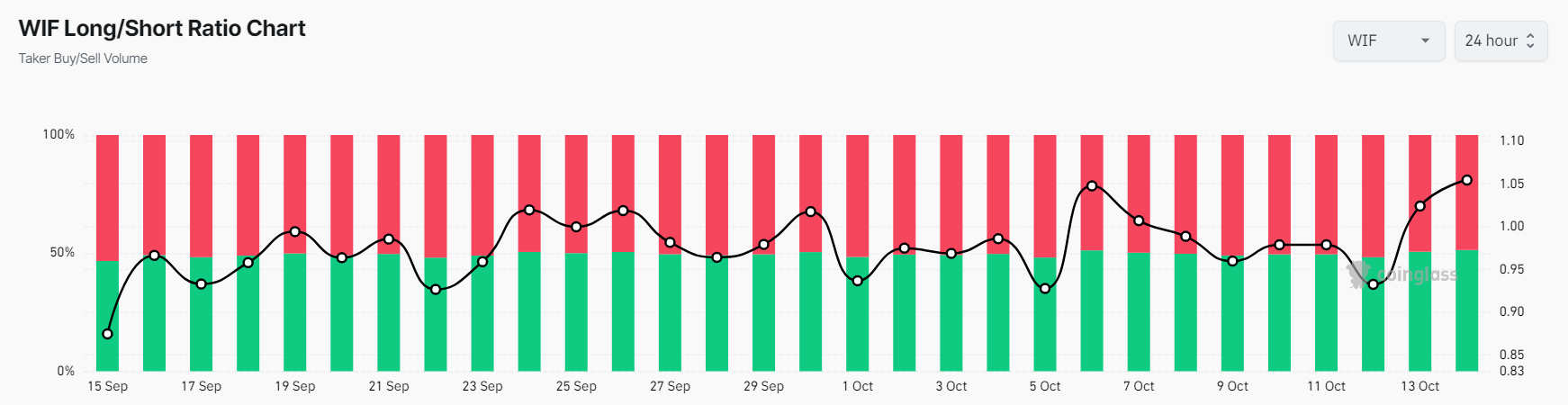

WIF’s Long/Short Ratio was at 1.07, indicating strong bullish market sentiment.

WIF’s Open Interest Funding Rate was at +0.0023%, indicating bullish sentiment toward the asset.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the current market sentiment surrounding dogwifhat [WIF]. The Long/Short Ratio at 1.07 and the Open Interest Funding Rate at +0.0023% suggest a bullish market sentiment that is hard to ignore.

The well-known meme cryptocurrency, Doge [WIF], was preparing for a significant price increase as it reached a critical breakout level.

The general feeling towards the market has moved from a decrease to an increase over the last day, as significant jumps in price have been observed for prominent cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH).

For those curious about the potential growth of WIF beyond its present state, that’s largely determined by its future price trends. It may lead to an impressive surge or a possible drop of 20%.

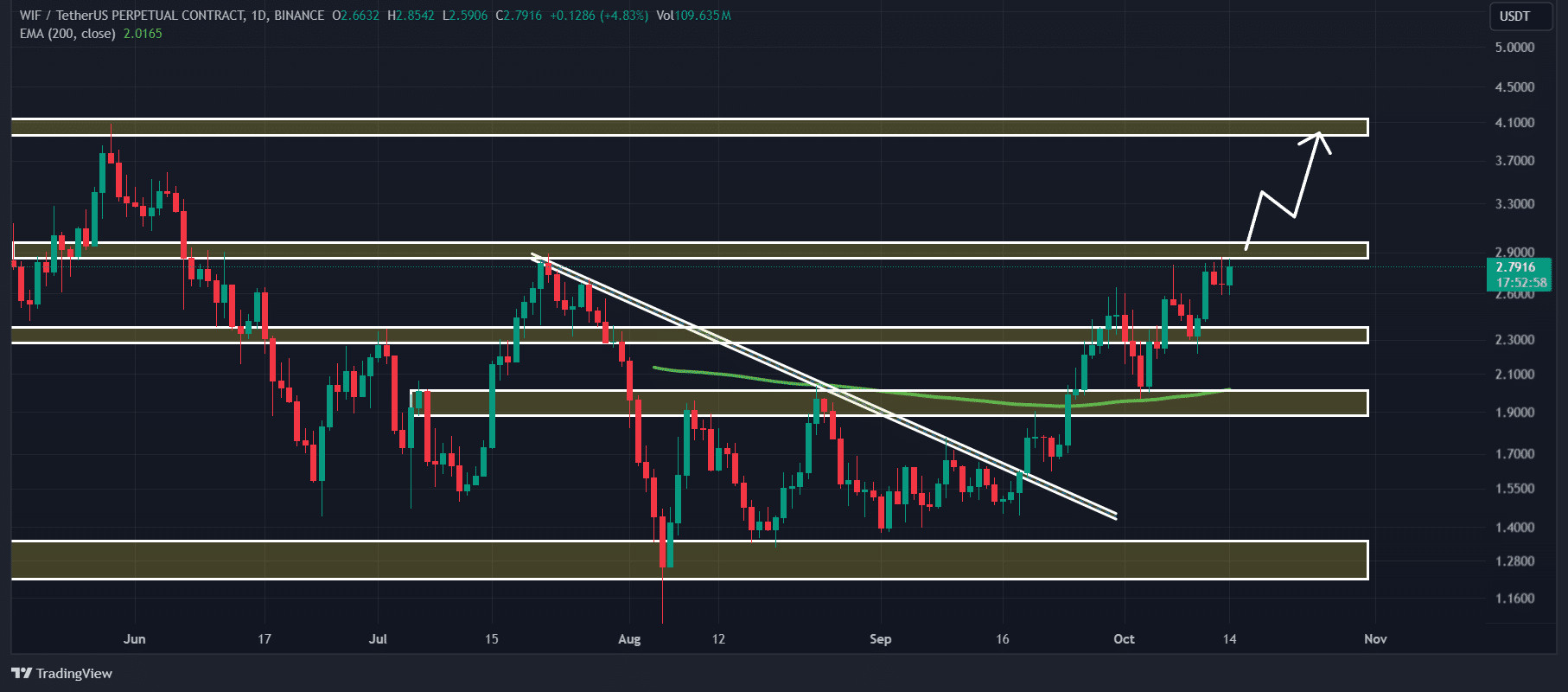

dogwifhat technical analysis and key levels

According to the technical assessment by AMBCrypto, WIF seemed optimistic when last checked, encountering robust resistance near the $2.88 price point.

If the memecoin continues its current trajectory and finishes the day’s trade at more than $2.96, it might surge by approximately 30% to hit around $4 within the near future.

If WIF, together with significant digital currencies, doesn’t manage to maintain the prevailing market optimism, there might be a potential drop of up to 20% in its value within the near future.

Right now, the memecoin is experiencing an upward trend because its value is higher than the 200-day Exponential Moving Average (EMA), viewed over a daily chart.

Bullish on-chain metrics

The favorable perspective was also reinforced by certain online statistics, as reported by the on-chain analysis company Coinglass. Specifically, the Long/Short Ratio for asset WIF stood at 1.07, suggesting a robust optimism among traders towards a bullish market trend.

Furthermore, there’s been a 10.68% surge in Futures Open Interest within the last 24 hours, and this trend appears to be continuing. This increase could indicate heightened trader activity, with some possibly taking on long positions.

Meanwhile, WIF’s Open Interest Funding Rate was +0.0023%, indicating bullish sentiment toward the asset.

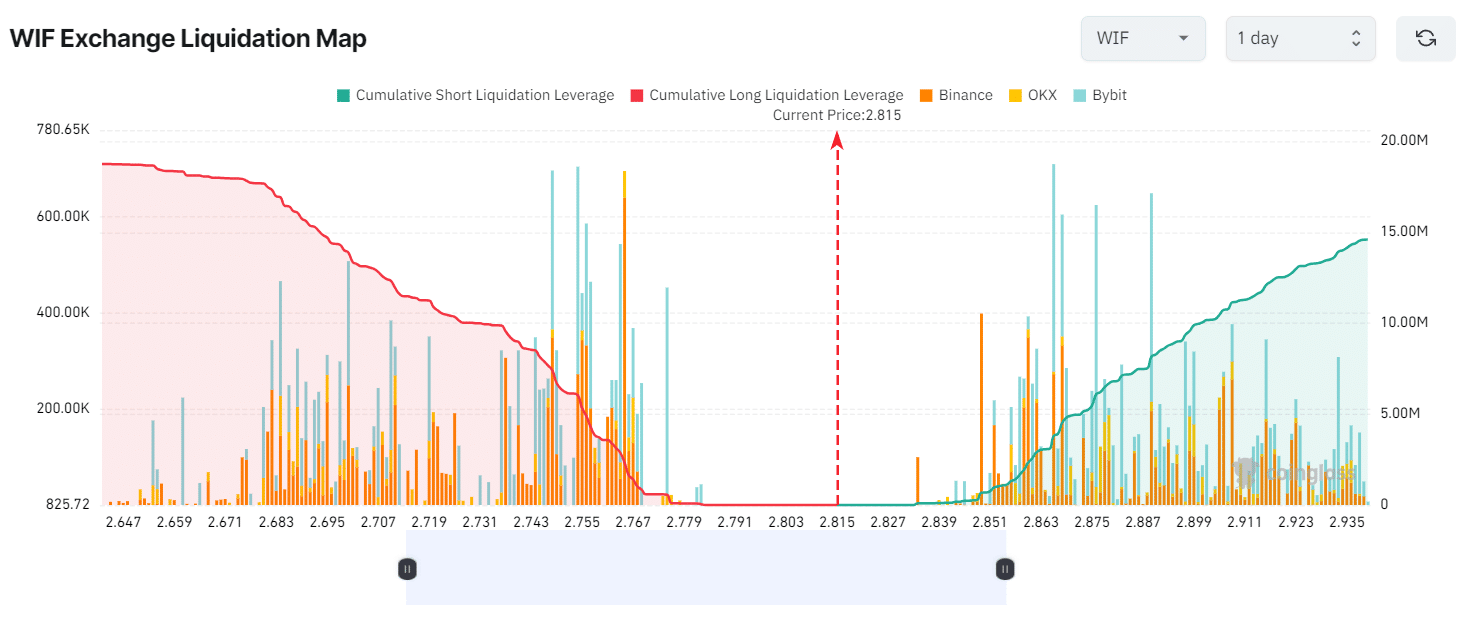

Major liquidation levels

Currently, based on data from Coinglass, my personal investment in crypto sits between two key levels: a lower boundary at around $2.748 and an upper limit at roughly $2.866. At these price points, traders seem to be heavily leveraged, which could potentially lead to significant market movements if these levels are breached.

Should the market’s outlook stay consistent and the price surpasses $2.866, it would lead to around $3.80 million being wiped out from short positions.

Should the market sentiment reverse and the price drop to the $2.748 mark, it would lead to a liquidation of around $7.40 million in long positions, as held by me in this research study.

This data suggests that bulls’ long bets are currently higher than bears’ short bets.

By blending these blockchain statistics with WIF‘s technical assessment, it appears that buyers are currently in control of the asset, potentially enabling them to surmount the impending resistance barrier.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

Current price momentum

Currently, World Internet Firms (WIF) is hovering around $2.80 per share, marking a slight drop of 1.15% over the last day.

In that time frame, the trading volume experienced a 25% increase, suggesting increased involvement from both traders and investors due to an optimistic market outlook.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-10-14 18:16