- Ah, the illustrious WIF, a creature of the market, showing signs of a potential bounce, as if it were a cat trying to land on its feet after a tumble!

- Charts, those fickle friends, displayed a cacophony of mixed signals, with derivative and spot traders squabbling like children over a toy.

In the past 24 hours, our dear dogwifhat [WIF] took a nosedive, plummeting by a staggering 18.98%. This dramatic descent was, of course, spurred by the broader market’s tantrum.

Yet, as the dust settled, selling pressure began to wane, and WIF, like a phoenix, started to rise. However, some market cohorts, ever the pessimists, clung to their bearish outlook, slowing the momentum of this potential rally. Oh, the drama!

On the path to a bounce back

According to one analyst—who surely must have a crystal ball—WIF seemed poised for a rebound, trading within a parallel channel, as if it were a well-behaved dog on a leash.

A parallel channel, dear reader, is where the price frolics between defined zones of support and resistance, much like a child playing hopscotch. At the time of writing, WIF had responded to the support level and was trending higher, much to the delight of its fans.

However, the chart pattern hinted at a prolonged consolidation, as if WIF were taking a leisurely stroll near the lower support level before making a grand leap upward.

If WIF can break free from this phase, its next target would be a lofty $5, a level it last reached in the distant past of November 2024. Ah, nostalgia!

For now, market sentiment resembles a mixed salad, with some participants favoring an upward move while others anticipate a potential downtrend. What a delightful mess!

Buyers keeping WIF steady

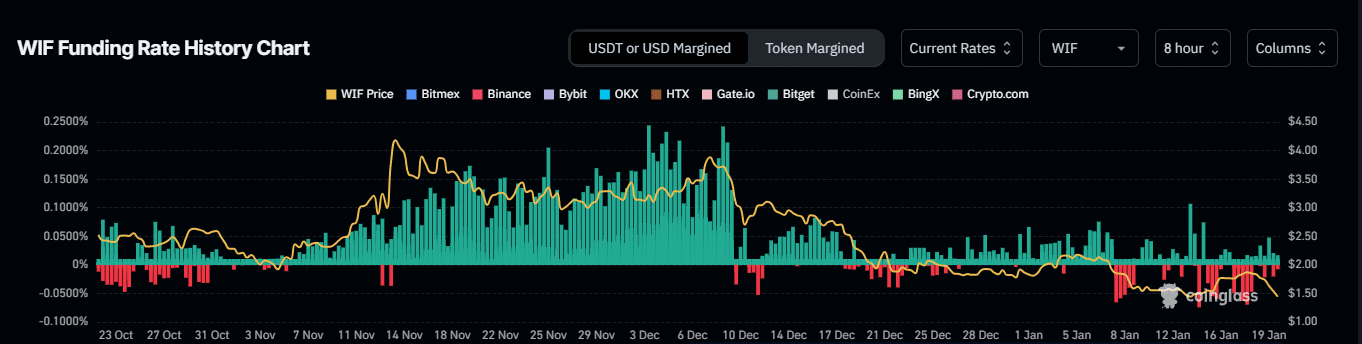

WIF has seen a gradual increase in its Funding Rate over the past eight hours, standing at a modest 0.0044% at press time. A positive Funding Rate, you see, indicates that the market is favoring long-position traders, who are paying a premium to maintain their positions—like a dog owner buying treats for their beloved pet.

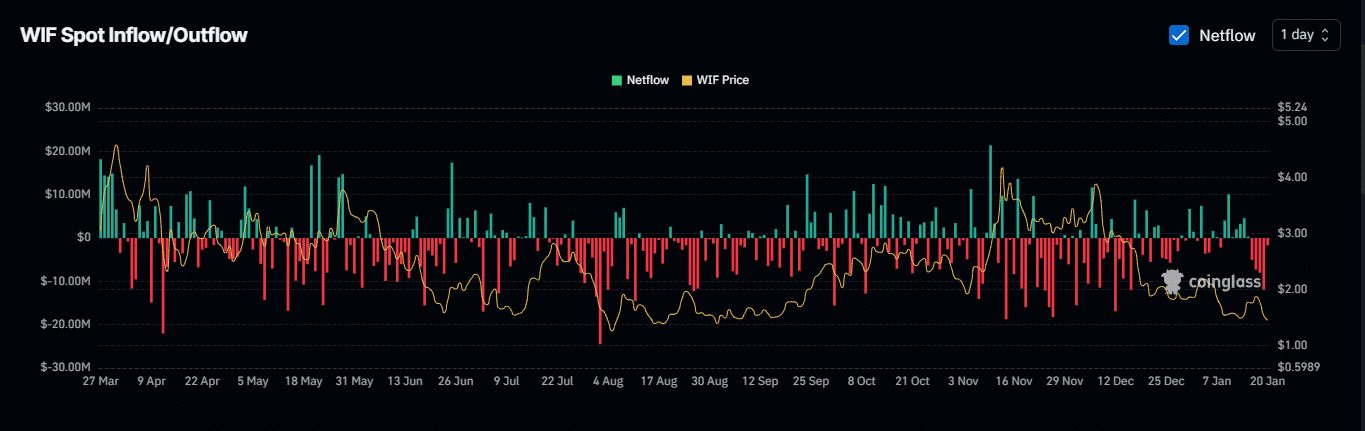

Among spot traders, a significant outflow of funds has been observed. In the past 24 hours alone, a staggering $1.67 million worth of WIF has exited the market, increasing the likelihood of a price move higher. It seems the dogs are barking!

This marks the fourth consecutive day of withdrawals, with the most substantial outflow—$11.88 million—recorded the previous day. Oh, the drama of it all!

Significant withdrawals from the market often suggest that participants are moving tokens off exchanges, perhaps to sell, or maybe just to hide them under their pillows for safekeeping.

Sellers could push WIF lower

But lo and behold! Sellers remain active in the market, applying downward pressure on WIF. One key indicator, Open Interest, has turned negative, declining by 10.01% to $403.15 million. A drop in Open Interest suggests that derivative traders are closing their contracts, much like a child giving up on a game of hide and seek.

Additionally, $8.51 million in liquidations occurred over the past day, with the majority impacting long traders. Long positions accounted for $8.05 million in losses, compared to a mere $459,950 for shorts. Oh, the irony!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-01-21 05:12