- The token’s value increased, and so did ETH.

RNDR’s popularity grew among traders, suggesting a significant price hike in the long term.

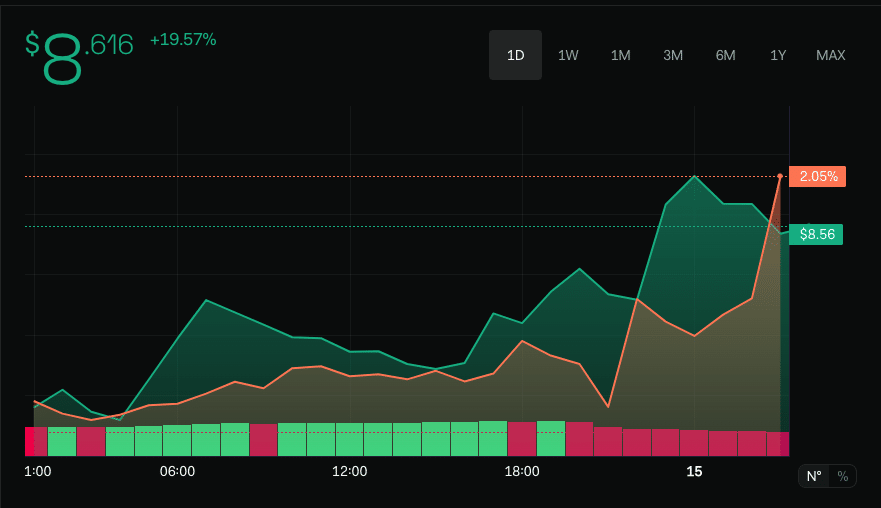

In the past 24 hours, the value of RNDR, the native token for the Ethereum-based decentralized GPU rendering platform, increased remarkably by a total of 18.85%.

After a market downturn, RNDR distinguished itself among top assets by exhibiting an impressive recovery rate. Notably, this uptick coincided with ETH regaining the $3,000 mark and surpassing it once again.

Yet, besides this, other factors caused the rise in RNDR‘s price. Initially, we observed an uptick in social influence.

Did ETH “Render” help?

Based on the data from LunarCrush, we found that Render’s social influence grew significantly by 116% during the same period when its value experienced a sharp rise.

Due to an uptick in social influence, the appeal of the RNDR project amongst traders significantly grew based on our research. Traders were drawn to RNDR primarily due to its strong foundation.

Knowledgeable market observers have noticed a trend: Many people active in the market are optimistic about projects centered around Decentralized Physical Infrastructure Networks (DePIN).

In the cryptocurrency world, initiatives such as Render encourage token ownership by rewarding users who engage with the platform’s protocol using their tokens as incentives.

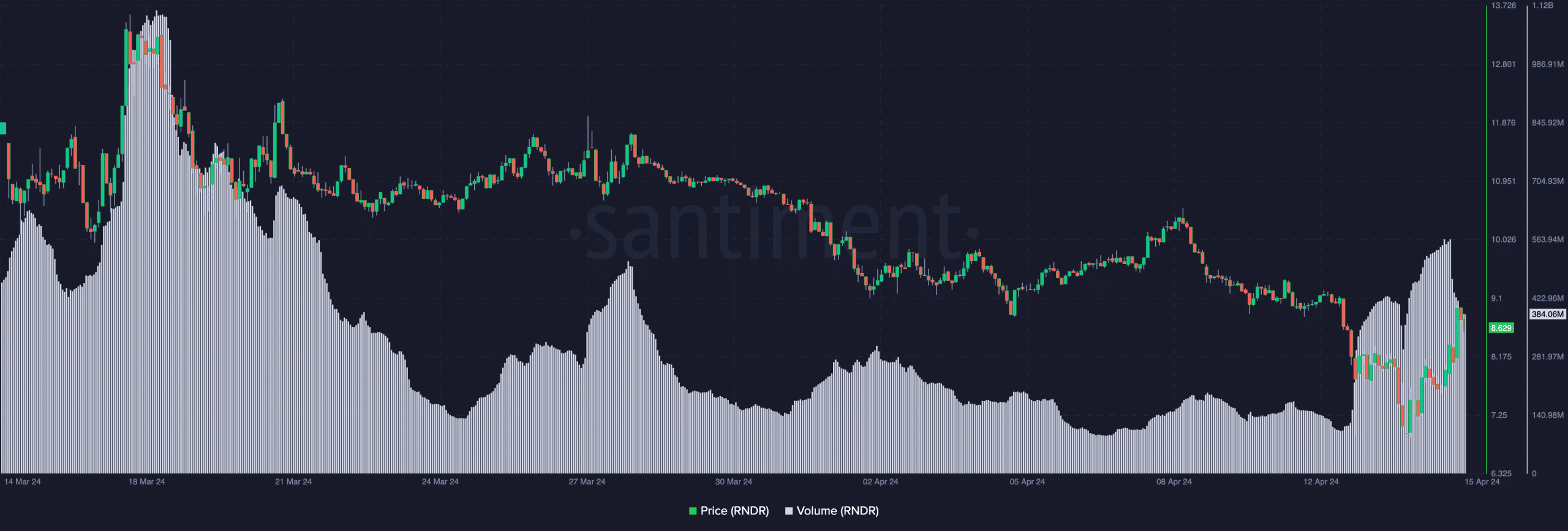

Additionally, AMBCrypto noted heightened intrigue towards RNDR based on trading activity. Specifically, according to Santiment, Render’s trading volume reached a peak of $556.65 million on the 14th of April.

The growth amounted to a 37.72% surge compared to the figure on the 13th. Yet, the trading volume was relatively lower at the moment of reporting, potentially signaling that RNDR may lack sufficient support for further advancement.

Sentiment stays the same

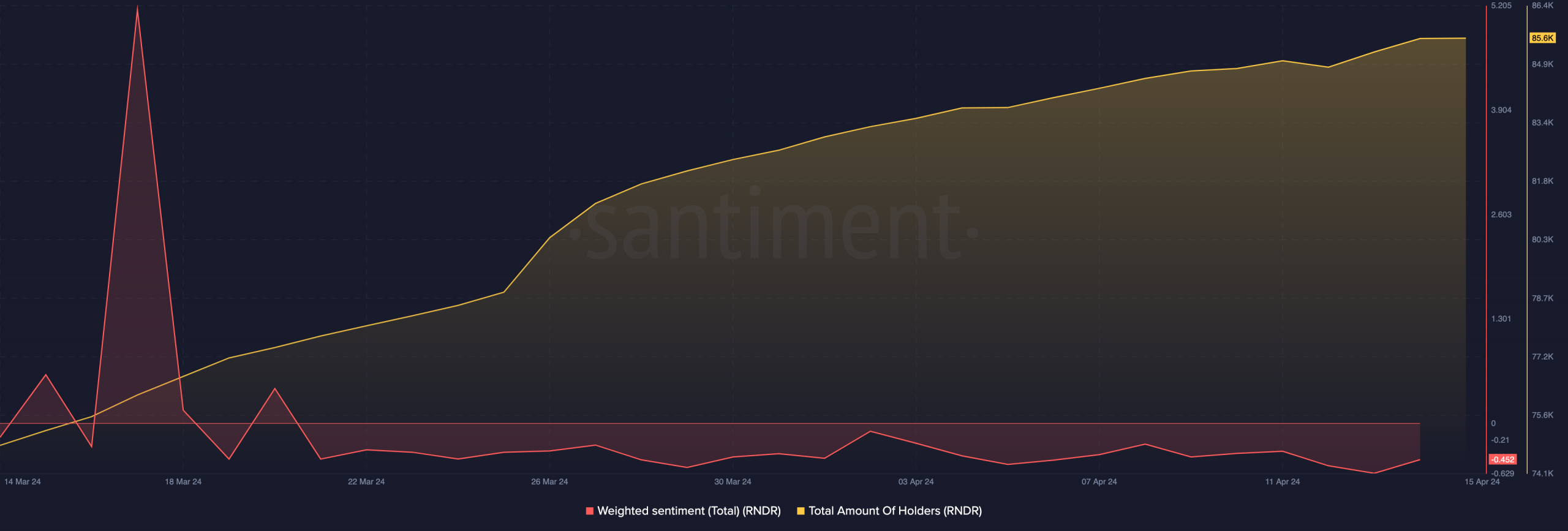

Although RNDR showed promise, traders appeared hesitant about its near-term results based on on-chain sentiment analysis.

This metric measures the typical sentiment towards a project by calculating the average of positive or negative comments. A favorable score indicates that many market observers hold optimistic views, while an unfavorable one implies a pessimistic outlook.

Currently, the sentiment score for Render’s Weighted Sentiment is at -0.45. Consequently, there could be a decreased interest in RNDR tokens in the near future. If this trend continues, the token price may dip below its current value of $9.

Despite that finding, it doesn’t dampen the lasting hopefulness about the project based on AMBCrypto’s assessment of the number of holders.

On March 25th, there were fewer than 80,000 individuals holding RNDR. But by the time of this publication, the number had grown to 85,600.

Realistic or not, here’s RNDR’s market cap in ETH terms

A growing number of token holders indicates that the network is gaining momentum and that the token is being adopted more widely. This trend could potentially lead to increased prices for RNDR.

Despite possible adjustments along the way, the significance of the DePIN story in the market keeps the token on track for potential price growth.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- How Potential Biden Replacements Feel About Crypto Regulation

- Why Shiba Inu’s 482% burn rate surge wasn’t enough for SHIB’s price

2024-04-15 22:15