-

ETH has surged by 9.03% over the last seven days.

An analyst eyes further gains if $2200 support level holds.

As a seasoned researcher with over two decades of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the recent surge in Ethereum’s [ETH] price. Over the past week, ETH has shown a remarkable recovery, climbing 9.03%, and currently trading at $2553. This is a testament to the resilience of this digital asset and its community.

currently seeing a robust rebound, the value of Ethereum [ETH] is being traded at approximately $2553 as we speak.

Over the last 24 hours, I’ve witnessed a 5.25% rise in my crypto holdings. This daily growth culminated a robust week-long uptrend. Consequently, if I were to examine the weekly chart, it would show an impressive surge of 9.03% for this altcoin.

Prior to these gains, Ethereum had been on a downtrend, reaching a low of $2251 last week.

Even though Ethereum’s value has seen an increase recently, it’s important to note that it is currently significantly lower than its peak in March at $4070. Similarly, it continues to be 47.9% below its all-time high of $4878.

Given the present market circumstances, I’m left pondering the durability of our ongoing recovery. Following the analysis of renowned cryptocurrency expert Ali Martinez, it seems that a potential resurgence could be on the horizon, provided the crucial support level at $2200 remains intact.

What market sentiment says

As reported by Martinez, the TD Sequential was indicating a “buy” signal for Ethereum’s weekly chart as of the current reporting period.

As an analyst, I find it compelling that the current market trends hint at a robust recovery potential, provided Ethereum’s price maintains its position above the crucial $2200 support level.

In this particular context, the TD Sequential tool assists in identifying moments when a trend may be nearing its end and could potentially reverse. So, if the TD Sequential emits a buy signal, it’s hinting that the downward trend might be weakening, suggesting a possible shift towards an uptrend.

Therefore, based on weekly charts, ETH may see a sustained rally rather than a short-term bounce.

ETH looks favorable

Based on AMBCrypto’s assessment, Ethereum (ETH) showed a robust increase in price trend over its weekly graphs. This surge was likely due to advantageous market circumstances that seemed to set the stage for additional growth in the altcoin.

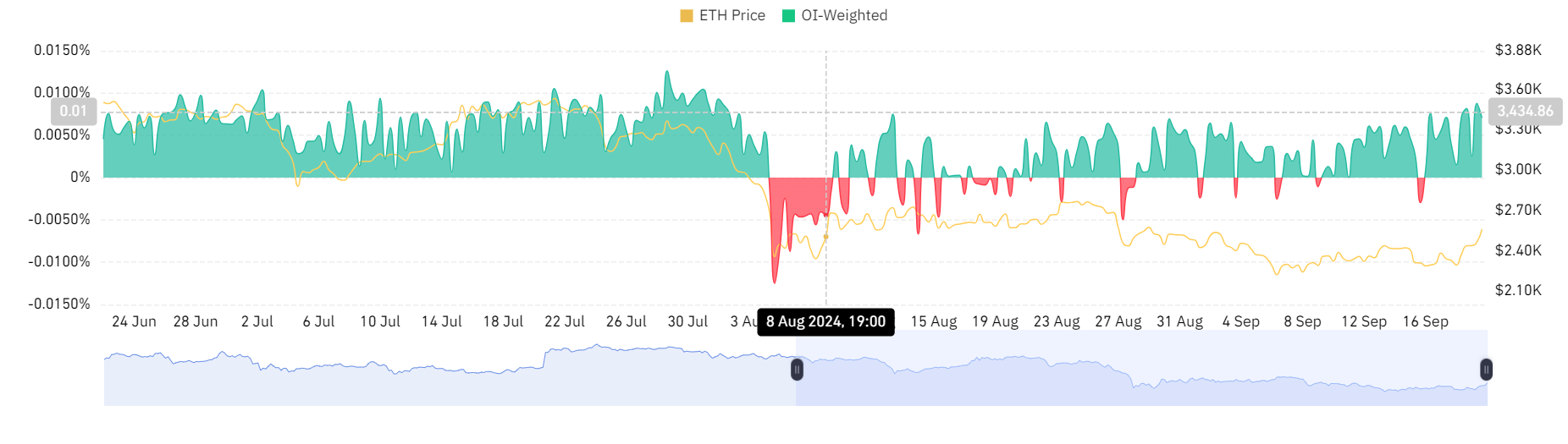

For starters, Ethereum’s OI-Weighted Funding Rate has remained for the past 4 days.

Typically, a high OI-Weighted Funding Rate suggests that there’s a substantial amount of open interest linked to investors choosing to hold long positions.

A significant Open Interest alongside a favorable Funding Rate indicates that investors are increasing their bets on price rises by employing leverage, which suggests they have faith in an impending price increase trend.

This is a bullish sentiment, with long position holders paying short position holders.

Furthermore, the Averaged Funding Rate on Ethereum exchanges has been favorable over the past three days. This trend aligns with AMBCrypto’s earlier observations suggesting that there is more interest in taking long positions compared to short ones.

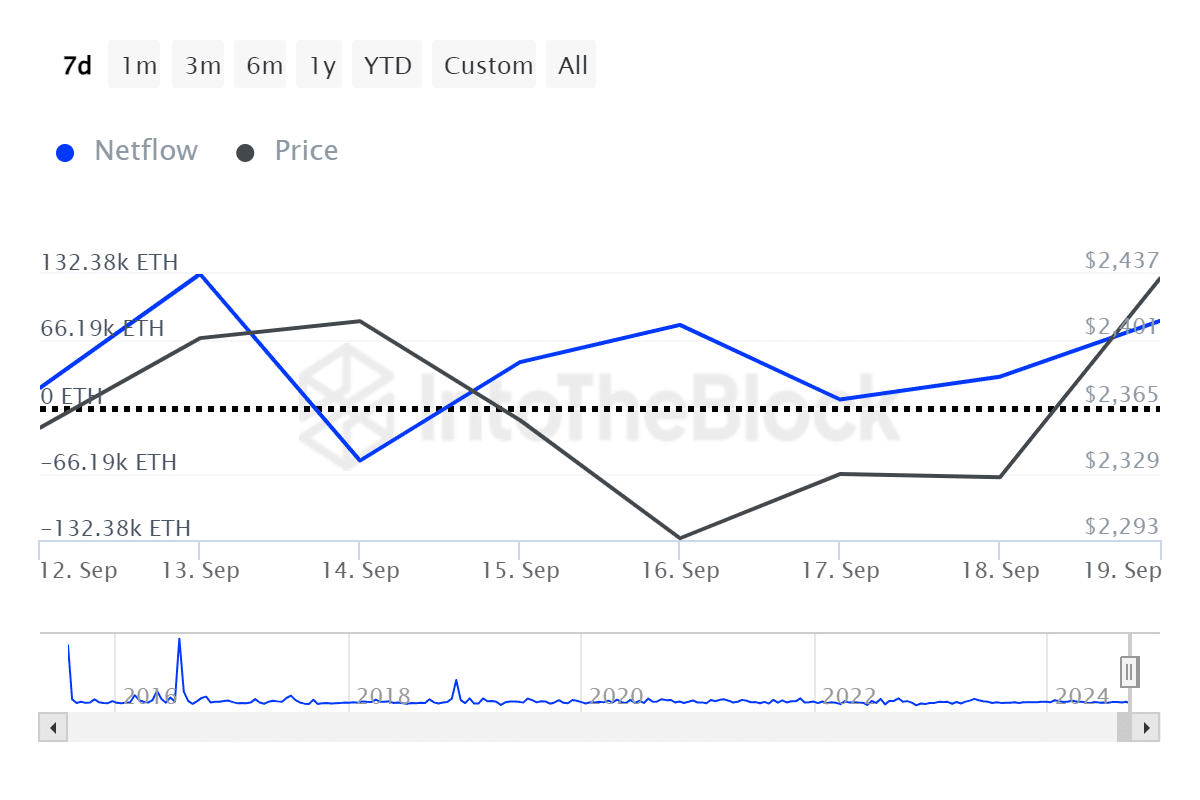

In summary, throughout most of the past week, there’s been a trend of Ethereum being transferred from smaller holders to larger ones (positive netflow). However, on the 14th of September, we saw a brief reversal with larger holders transferring less Ethereum than they were receiving (negative netflow).

Read Ethereum’s [ETH] Price Prediction 2024–2025

For the past six days, there’s been a trend of more ETH being bought by large investors rather than sold. This suggests that these significant investors are stockpiling Ether, which implies they have faith in the asset’s potential worth in the future.

As a crypto investor, I can confidently say that Ethereum’s current market mood is quite favorable. If this positive trend persists, Ether (ETH) might attempt to break through the upcoming resistance at roughly $2810 – a level it has historically found difficult to surpass.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-20 18:16