- Ethereum has surged nearly 20% in two weeks, with significant accumulation by investors.

- Key metrics like active addresses and whale transactions indicate potential for price increases.

As a seasoned researcher with over two decades of experience in the crypto sphere, I have witnessed numerous bull runs and bear markets. However, the current surge in Ethereum [ETH] has piqued my interest more than any other recent event. The 20% price increase in just two weeks is reminiscent of the early days of Bitcoin’s rise, a time that I remember fondly as an exciting and lucrative period for those who dared to invest.

😱 EUR/USD Under Siege: Trump’s Tariffs to Ignite Chaos!

Prepare for unpredictable market swings triggered by new policies!

View Urgent ForecastEthereum (ETH) appears to be ready for a breakout from its recent phase of sluggishness, potentially leading to a substantial surge in price. Following several months where it lagged behind Bitcoin, Ethereum is presently valued at approximately $3,558.

After seeing a 20% rise in prices over the last fortnight, this suggests increased investor enthusiasm. Although ETH has dropped by 1.4% in the last 24 hours, it continues to stand above the vital $3,500 support threshold, indicating market robustness.

Amidst the current fluctuations in prices, market experts are highlighting significant patterns that underscore Ethereum’s capacity for prolonged expansion. One analyst from CryptoQuant, going by the name theKriptolik, has offered insights that illuminate Ethereum’s persistent attractiveness to large-scale investors.

The analyst emphasized that despite Ethereum’s lower price levels compared to previous highs, the ETH Exchange Supply Ratio has dropped to levels last seen in 2016. This decrease indicates that investors are transferring their holdings off exchanges, suggesting long-term accumulation.

Despite an increase in available supply, the decrease in Ethereum held by exchanges indicates that investors perceive Ethereum as a secure investment option, or a ‘safe haven’ asset.

Key metrics signal growing momentum for Ethereum

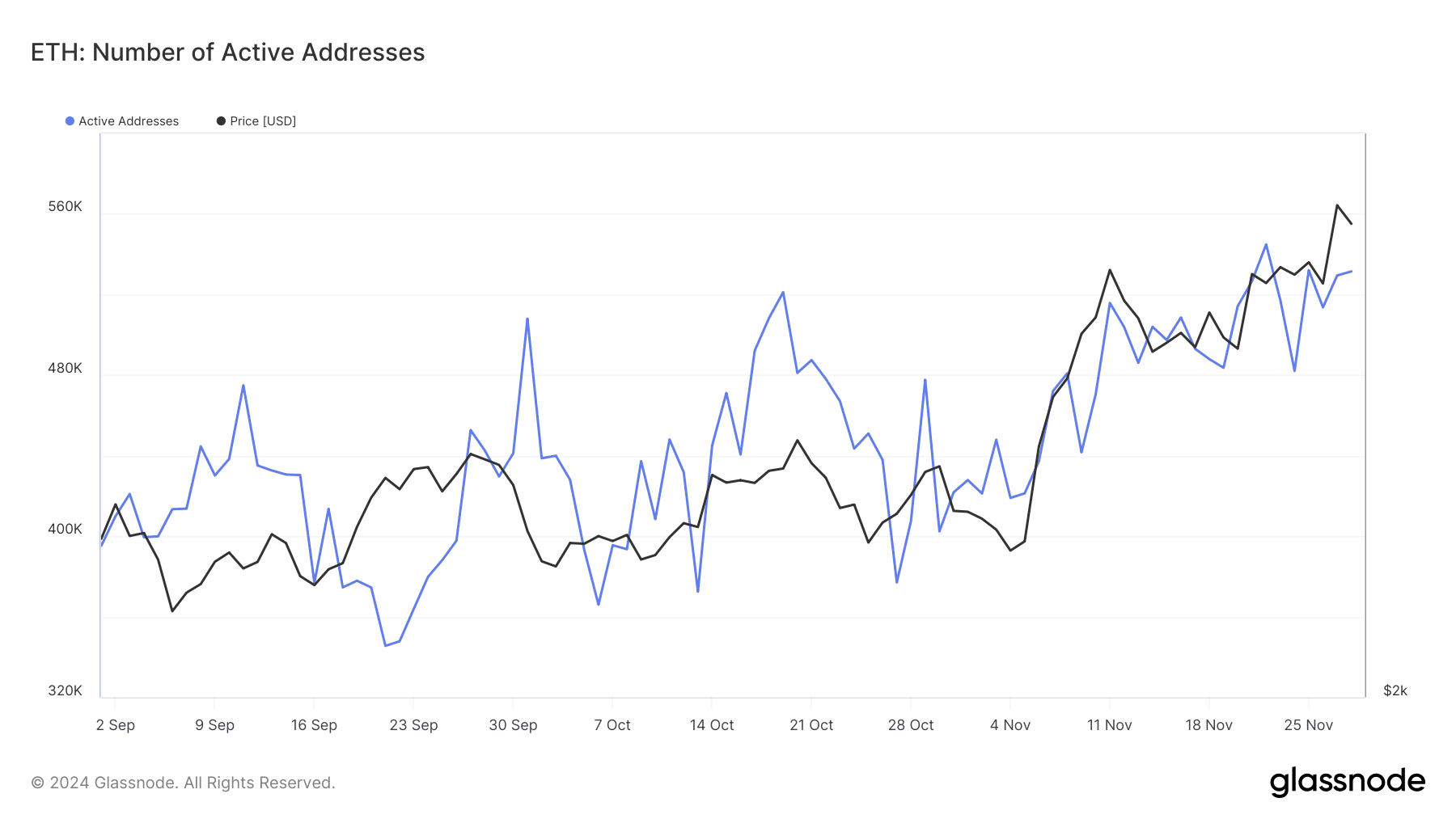

Examining the broader statistics of Ethereum provides extra understanding about its performance and how investors are behaving. A significant sign is the increase in active Ethereum addresses, which is frequently linked to retail investor activity.

Based on information from Glassnode, we see that the number of active Ethereum accounts has been consistently growing. As of November 28th, it stands at approximately 531,000, which is an increase from around 500,000 in October.

As someone who has been investing for over a decade, I have learned that an upward trend in network activity often indicates heightened demand, which can lead to increased prices. Based on my personal experience, when I see this pattern, it sets off alarm bells in my mind because it’s a sign that the market is picking up and there may be potential for significant returns. However, it’s important to remember that past performance is not always indicative of future results, so always do your own research and make informed decisions.

An increase in operational Ethereum addresses suggests more individuals are becoming involved in the Ethereum system, either through transactions, using decentralized apps, or staking. This growing participation helps solidify the network’s underlying structures.

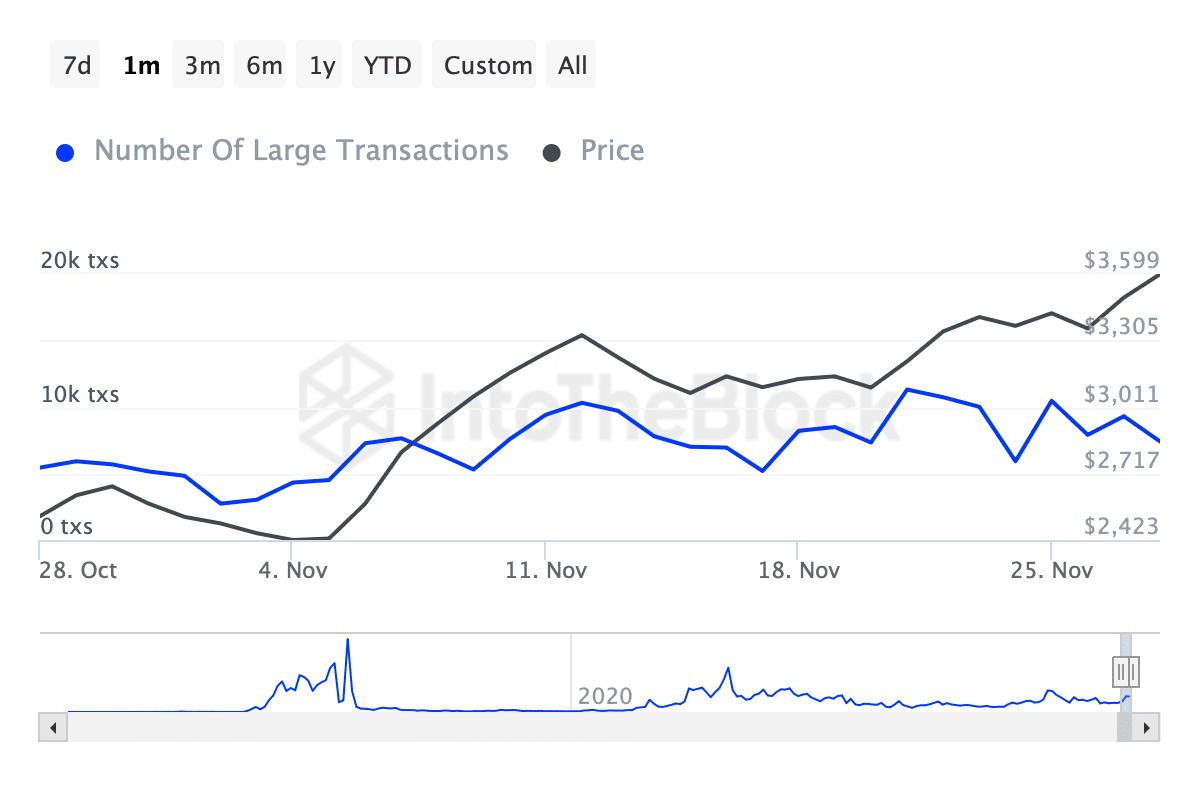

A key indicator to watch is the level of activity among large Ethereum investors, or ‘whales’, who execute transactions worth more than $100,000. As per IntoTheBlock’s data, we noticed a spike in such transactions reaching 11,210 earlier this month, suggesting increased institutional involvement.

On the other hand, there’s been a drop in this figure lately, with Ethereum reporting approximately 7,410 whale transactions by November 28th.

Read Ethereum [ETH] Price Prediction 2024-2025

Although a minor drop might suggest temporary selling for profits, the persistent involvement of major investors implies a lasting fascination and faith in Ethereum’s long-term worth.

Generally speaking, increased whale behavior often results in heightened price fluctuations, while a decrease might indicate consolidation or readiness for the next market action.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

2024-11-30 00:07