-

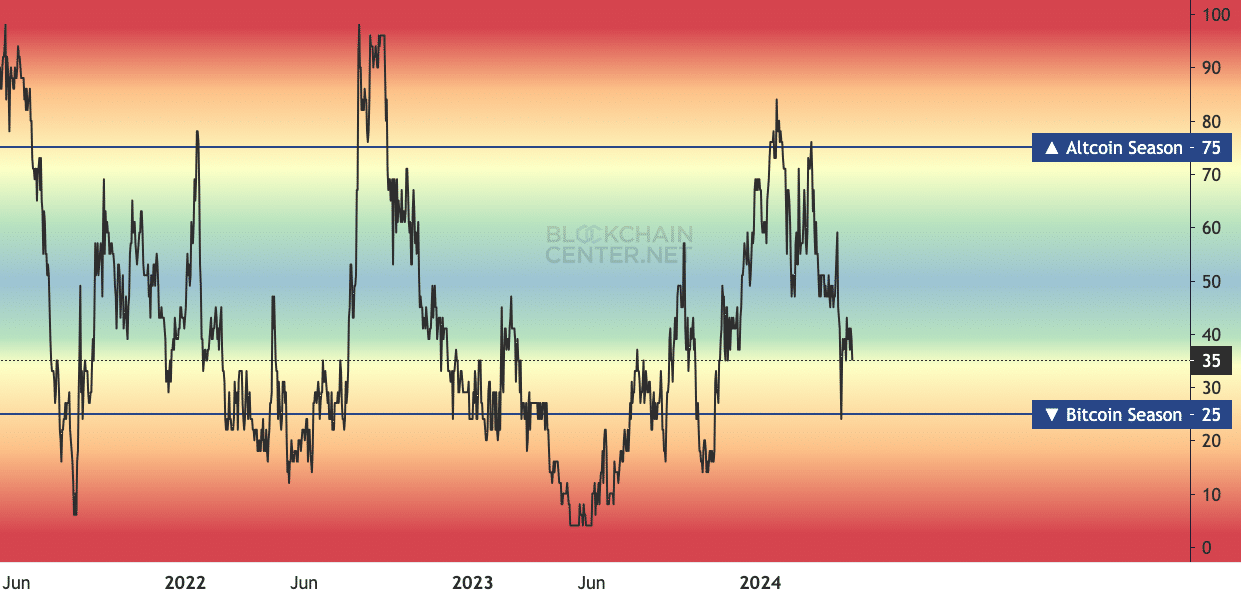

The Altcoin Season Index at 35 suggested that the many tokens were not out of depression.

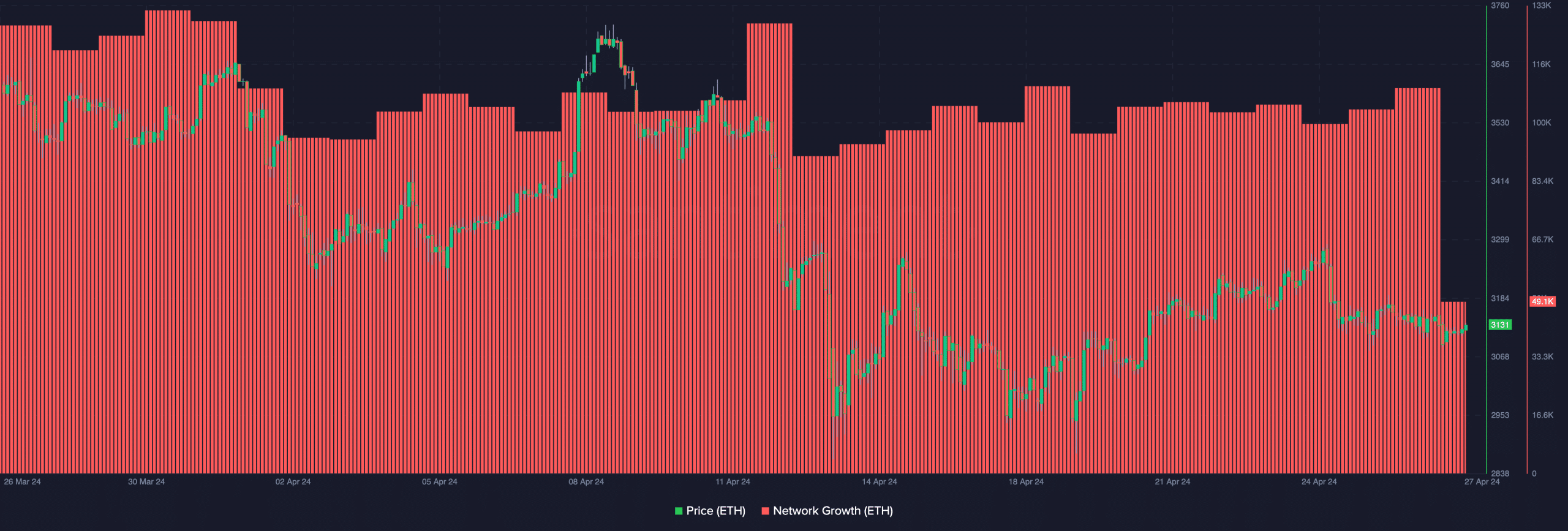

A decline in ETH’s network growth and volume might hinder the upswing.

One common phrase that has gained significant buzz in the financial markets for several months with seemingly minimal results is referred to as “altcoin season.” This term signifies a potential uptrend in the prices of alternative cryptocurrencies relative to Bitcoin.

To thrive in the upcoming timeframe, Ethereum (ETH) and other cryptocurrencies apart from Bitcoin (BTC) need to surpass Bitcoin’s performance.

However, the event you mentioned hasn’t occurred yet. Our investigation of AMBCrypto’s assessment of Blockchaincenter.net uncovered that the situation wasn’t imminent. The Altcoin Season Index, as reported by the platform, stood at 35.

Alts fails to sustain the preview

To indicate an altcoin bull market, or “altseason,” the relevant index must reach a value of 75. Notably, this level was attained during the final week of January and the opening week of March. Regrettably, these gains were short-lived, vanishing within just a few days.

As an analyst, I’ve examined the price trends of cryptocurrencies such as Ethereum (ETH), Cardano (ADA), and Ripple (XRP) over the past 90 days, and noticed a decrease in value for all three. However, if less than 75% of the top 50 cryptocurrencies outperform Bitcoin (BTC) during this period, we may not experience an “altcoins season.”

Given the current pressures on deadlines, it’s safe to assume that the timeframe under consideration wasn’t particularly tight. Aside from the index, Ethereum (ETH) could be a significant determining factor.

In 2021, Ethereum’s significant price rise was a leading factor that triggered the upward trend seen in many other cryptocurrencies.

Notably, less than 20 altcoins out of the top 50 have outperformed Bitcoin in the last 90 days.

EETH hasn’t been included in their ranks, and its performance during this market cycle hasn’t matched its past bull run achievements.

ETH dashes the hope

If the desire for Ethereum (ETH) increases significantly, the situation could shift, potentially driving up the token’s price to challenge its record peak. This scenario would be fueled by a large influx of new Ethereum accounts.

According to AMBCrypto’s analysis, Ethereum’s network expansion currently stands at 3131 new additions. This figure implies a relatively modest rate of cryptocurrency adoption for Ethereum.

Should the metric persist in its downward trend, Ethereum’s price could struggle to advance. Consequently, the delay of altcoin season may be prolonged.

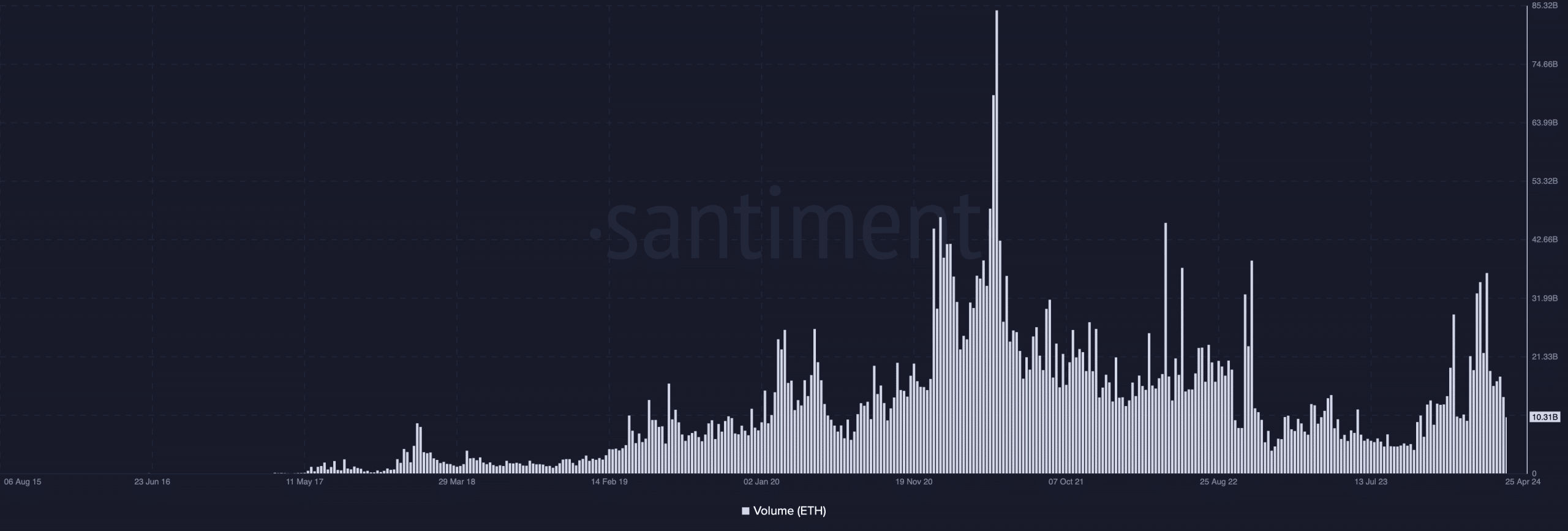

An increase in network expansion could lead to a cryptocurrency and leading token price rise. At present, the trading volume amounts to $10.31 billion.

Read Ethereum’s [ETH] Price Prediction 2024-2025

During ETH‘s early ascent to its record-breaking peak, trading volume surpassed $40 billion. A substantial volume signifies heightened investor attention towards a cryptocurrency. Maintaining this trend may potentially cause price increases.

At a quiet market level, it’s uncertain that there will be significant price hikes for altcoins within the upcoming weeks. Furthermore, altcoins may no longer depend on Ethereum to initiate prolonged surges in value.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Lucy Hale’s Sizzling Romance with Harry Jowsey: The Un serious, Fun-Filled Love Story!

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-04-28 10:15