- Whale activity and a 79% volume surge suggested potential bullish momentum for Ethereum.

- On-chain metrics remained mixed, but bulls held a slight edge in the Long/Short Ratio.

As a seasoned researcher who has navigated through multiple bull and bear markets, I find the recent developments surrounding Ethereum quite intriguing. The whale activity, with a significant deposit of 3,510 ETH into Kraken after two years of inactivity, is a clear sign of growing confidence in Ethereum’s future. This large-scale transaction could potentially spark a bullish momentum, much like a lighthouse guiding ships through the crypto seas.

An Ethereum [ETH] ICO participant, who initially gained 150,000 ETH (now valued at $389.7 million), made a significant move by depositing 3,510 ETH ($9.12 million) into Kraken after remaining inactive for over two years.

The substantial trade indicates increasing optimism about Ethereum’s upcoming development. Currently priced at $2,656.39 and rising by 3.02%, investors are eager to see if this significant transaction by a ‘whale’ (large investor) will ignite a bullish trend.

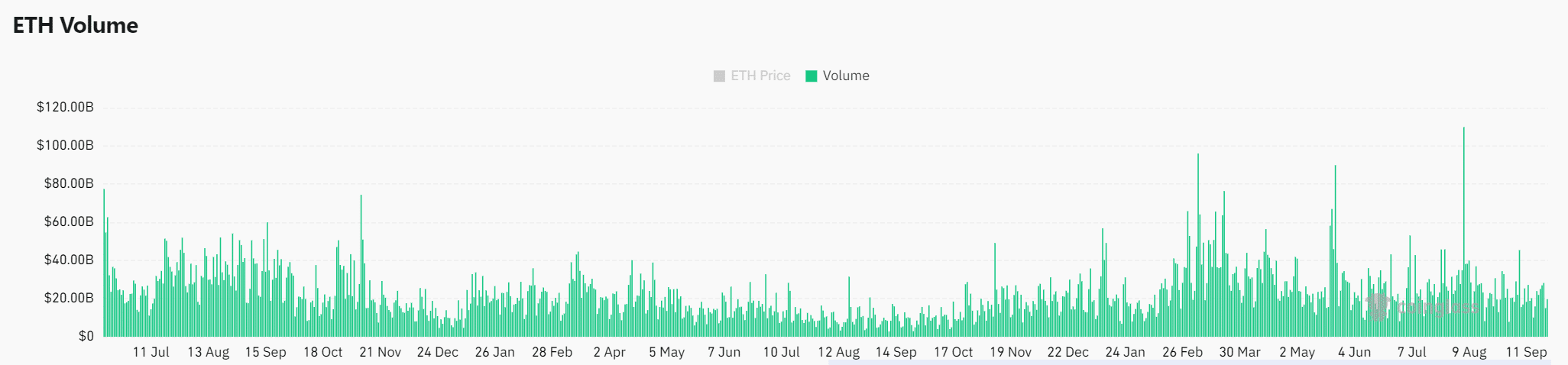

Ethereum’s volume surge: A bullish signal?

In the past day, there’s been a significant jump in the trading volume of Ethereum, reaching an impressive $28.21 billion as we speak, marking a 79.30% rise from its previous level.

This surge typically signals a growing appetite among traders, which often leads to higher price volatility.

Consequently, an increase in trading volume may push the market upwards as long as buyers remain in control. But if the volume decreases without further buying support, this could indicate uncertainty and possibly trigger a drop in prices.

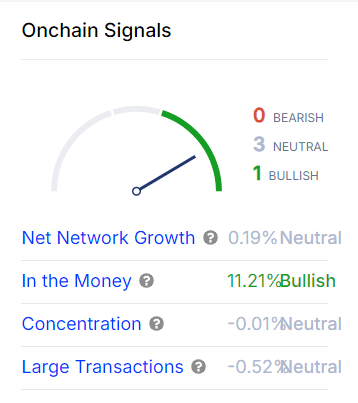

On-chain metrics: Mixed signals for Ethereum

Looking at the on-chain metrics, AMBCrypto found a mix of signals.

As a crypto investor, I’m observing that the network growth of Ethereum is holding steady at a rate of 0.19%. This suggests there’s not a substantial increase in new users joining the platform right now.

On the other hand, the “In the Money” metric, which demonstrates the percentage of investors who are currently profiting, stands at a bullish 11.21%.

Implies that many Ethereum owners are still in a profitable situation, meaning they might be less likely to sell, thus potentially lowering selling pressure and contributing to price consistency.

In contrast, indicators such as Concentration and Large Transactions appear to be holding steady, showing no substantial increases or decreases in the accumulation of ‘whales’ (large investors).

Consequently, even though the whale’s transaction to Kraken suggests increased market movement, it hasn’t triggered significant changes in Ethereum’s on-chain behavior as of now.

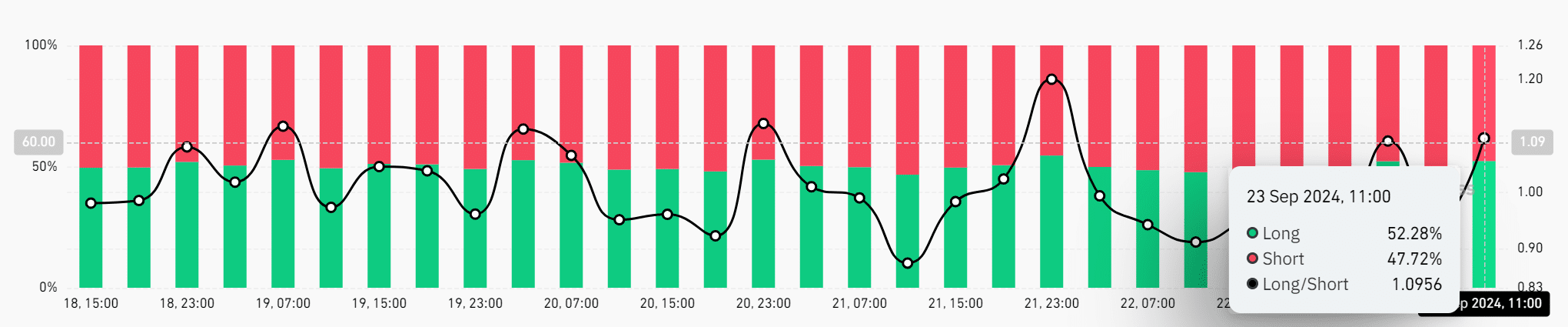

Bulls hold an edge

On September 23rd, there was a slightly greater number of traders choosing to go long (52.28%) compared to those who were shorting the market (47.72%), indicating a slight bias towards bullish sentiment in the Long/Short Ratio.

A small advantage suggests that traders are generally opting for Ethereum’s price to continue rising. If this trend persists in favor of the bulls, Ethereum might sustain its upward trend.

Read Ethereum’s [ETH] Price Prediction 2024-25

The increased whale transactions on Ethereum and the surge in trading volume hint at a potentially bullish trend. Yet, conflicting data from the blockchain indicate that the market is still exercising caution.

The Long/Short Ratio gives bulls a slight edge, but broader market dynamics will ultimately dictate the direction.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-24 03:03