- Analysts predicted that Ethereum could outperform Bitcoin due to key indicators.

- Ethereum spot ETF inflows and ascending price channels indicated potential price targets up to $10,000.

As a seasoned analyst with over two decades of experience in financial markets, I have witnessed numerous market cycles and observed patterns that often repeat themselves. While Bitcoin has undeniably been the star performer in the crypto space thus far, I share Ali’s optimism about Ethereum’s potential to outperform Bitcoin in the near future.

So far, Ethereum (ETH) hasn’t managed to match Bitcoin’s (BTC) persistent rise in value as consistently as it has.

In contrast, Bitcoin has hit record peak prices lately, but Ethereum is yet to recover by 36.2%, falling short of its 2021 peak price of $4,878.

As I type this, Ethereum (ETH) was priced at around $3,111, representing a decrease of 0.6% over the last day and approximately 1% in the past week. This uneven performance has sparked discussions about whether Ethereum could surpass Bitcoin.

As a market analyst, I may not share the same pessimism that some might have regarding Ethereum’s recent performance. Instead, I remain hopeful and confident about its future prospects.

Analyst Ali has recently shared an optimistic view on social media platforms, suggesting that Ethereum could potentially surpass Bitcoin in the near future.

Ali’s confidence stemmed from multiple indicators, including the “alt season indicator.”

As per his perspective, each market cycle in history has a point where Ethereum surpasses Bitcoin’s growth, but so far, this hasn’t happened in the ongoing cycle. Ali considered this as a possible chance for investment.

What’s supporting Ethereum’s upside?

Ali additionally emphasized the MVRV (Market Value to Realized Value) ratio as a crucial predictor of Ethereum’s potential future growth.

The MVRV metric measures the ratio between the market value and realized value of an asset, offering insights into whether an asset is overvalued or undervalued.

Ali pointed out that, traditionally, Ethereum tends to perform better when the MVRV Rhythm surpasses its 180-day moving average (average moving line).

Even though Ethereum’s price has climbed from $2,400 to $2,800, the anticipated cross hasn’t happened yet, implying there might be more room for growth.

Besides the MVRM (Maker’s Value Realized to Market) metric, Ali highlighted a rise in inflows towards Ethereum spot ETFs. He elaborated that investors are moving from distributing to accumulating, with Ethereum spot ETFs gathering approximately $147 million worth of Ethereum.

Additionally, it’s been said that large Ethereum investors, known as “whales,” have bought approximately $1.40 billion in ETH. This adds credence to Ali’s optimistic viewpoint on the cryptocurrency market.

As a crypto investor, I’m excited about the potential price movement of Ethereum. Analyst Ali suggests that Ethereum could challenge resistance levels at $4,000 and even push further up to $6,000. If Ethereum follows the same pattern as the S&P 500, we might be looking at a bullish scenario with a target of $10,000 or more.

Examining market position

Considering Ali’s assessment suggests an optimistic perspective on ETH, delving into crucial indicators might offer additional clarity as to whether Ethereum has the potential to surpass Bitcoin in practical terms.

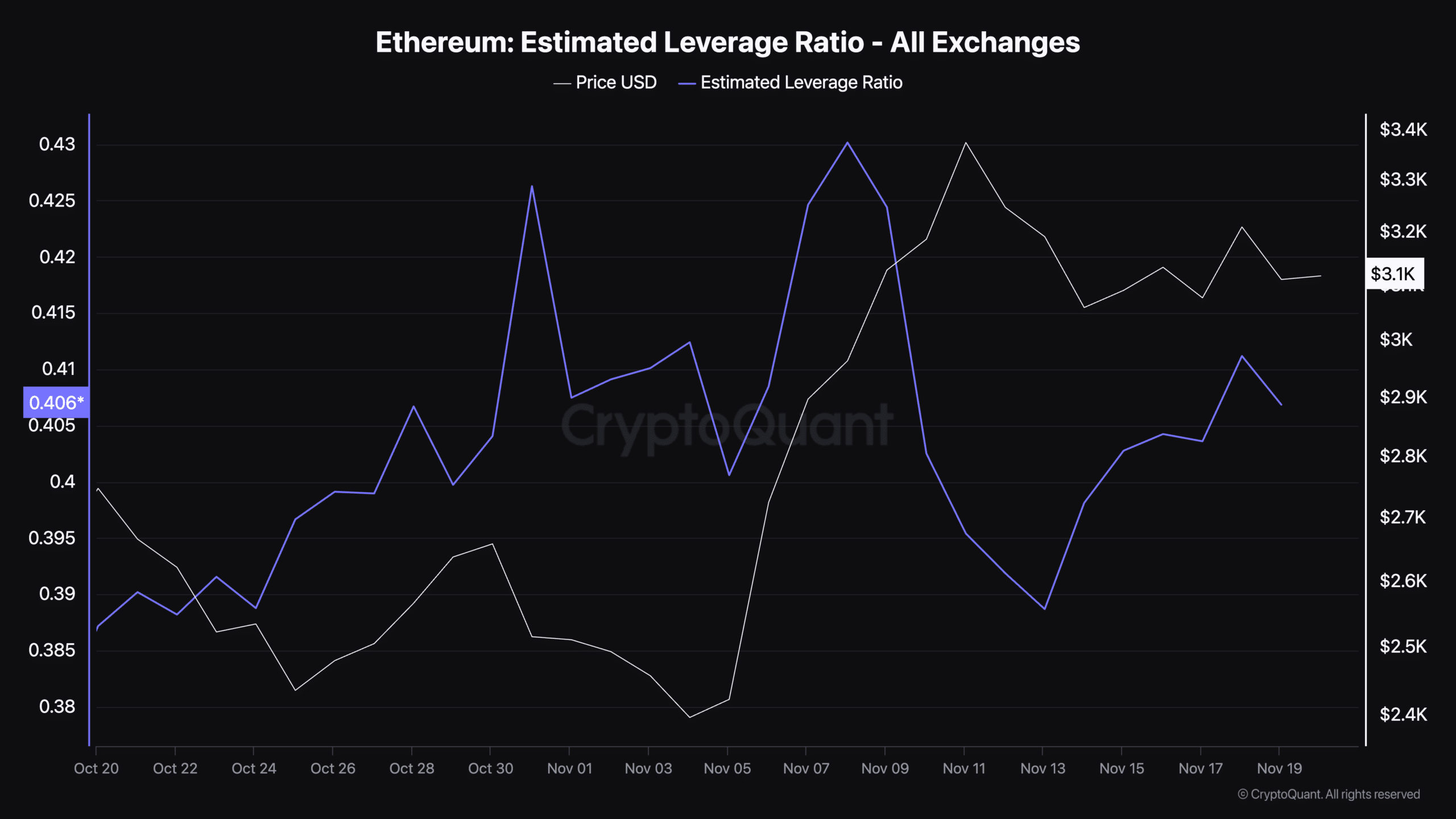

One such metric is the Estimated Leverage Ratio, which reflects the level of leverage used by traders in the derivatives market.

A high leverage ratio generally signals an elevated risk level and possible price fluctuations, whereas a decrease might imply less active speculation.

As a researcher, I’ve been tracking the leverage ratio of Ethereum, and I noticed an interesting development. On the 19th of November, the estimated leverage ratio dropped to 0.40, marking a decrease from its peak of 0.430 earlier in the month. This suggests a shift in market dynamics that could potentially impact the short-term behavior of Ethereum.

As I analyze this trend, it seems to suggest a decrease in speculative actions, which might open up possibilities for steadier development down the line.

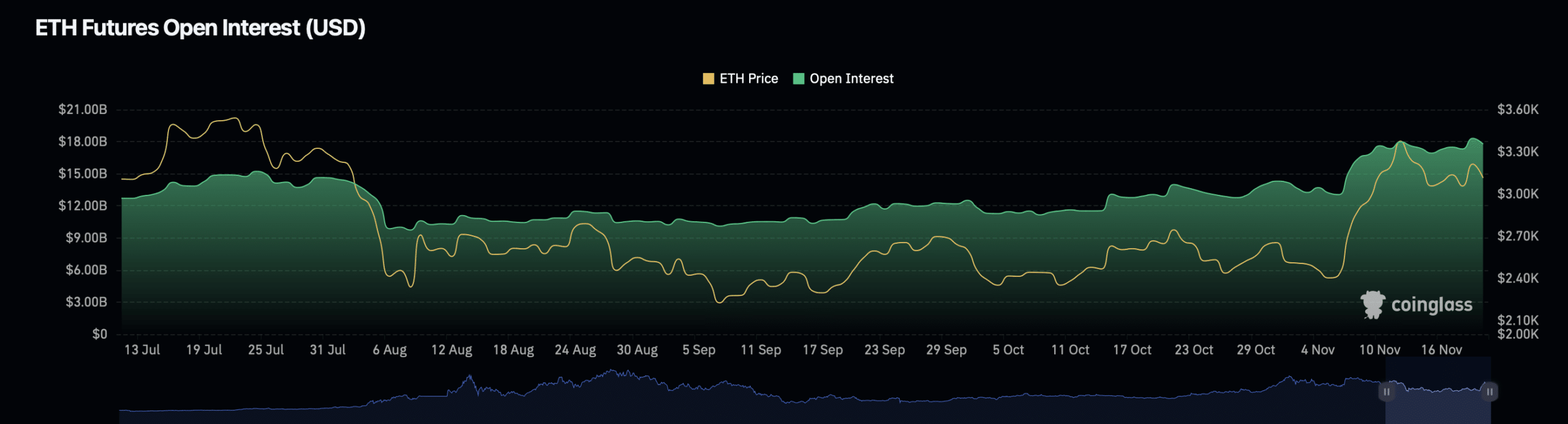

According to the data from Coinglass, Ethereum’s Open Interest fell by 0.09%, resulting in a current market value of approximately $17.88 billion.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Furthermore, the Open Interest volume for Ethereum has dropped by about 30% and currently hovers around $31.10 billion.

Such patterns might signal a phase of stabilization and decreased trading volume for Ethereum, providing potential hurdles and prospects for future expansion.

Read More

2024-11-21 09:12