- Ethereum continued to trade in the $3,000 price zone.

- However, the ETH/BTC pair broke support for the first time since 2016.

As a seasoned analyst with years of experience navigating the cryptocurrency market, I find myself both intrigued and concerned by Ethereum’s current trajectory. The ETH/BTC pair’s recent break below support levels since 2016 is indeed a worrying sign, but it’s not uncharted territory for those of us who have lived through the rollercoaster ride that is crypto.

The battle between Ethereum’s [ETH] and Bitcoin‘s [BTC] market standing persists as a major topic, with the ETH/BTC ratio still showing signs of instability.

Latest findings indicate that the price of Ethereum’s main token, ETH, has been maintaining a position near key resistance points relative to Bitcoin. Meanwhile, the pattern of ETH staking suggests a steady increase in deposits.

Here’s what the charts tell us about Ethereum’s trajectory and market health.

Ethereum testing key resistance

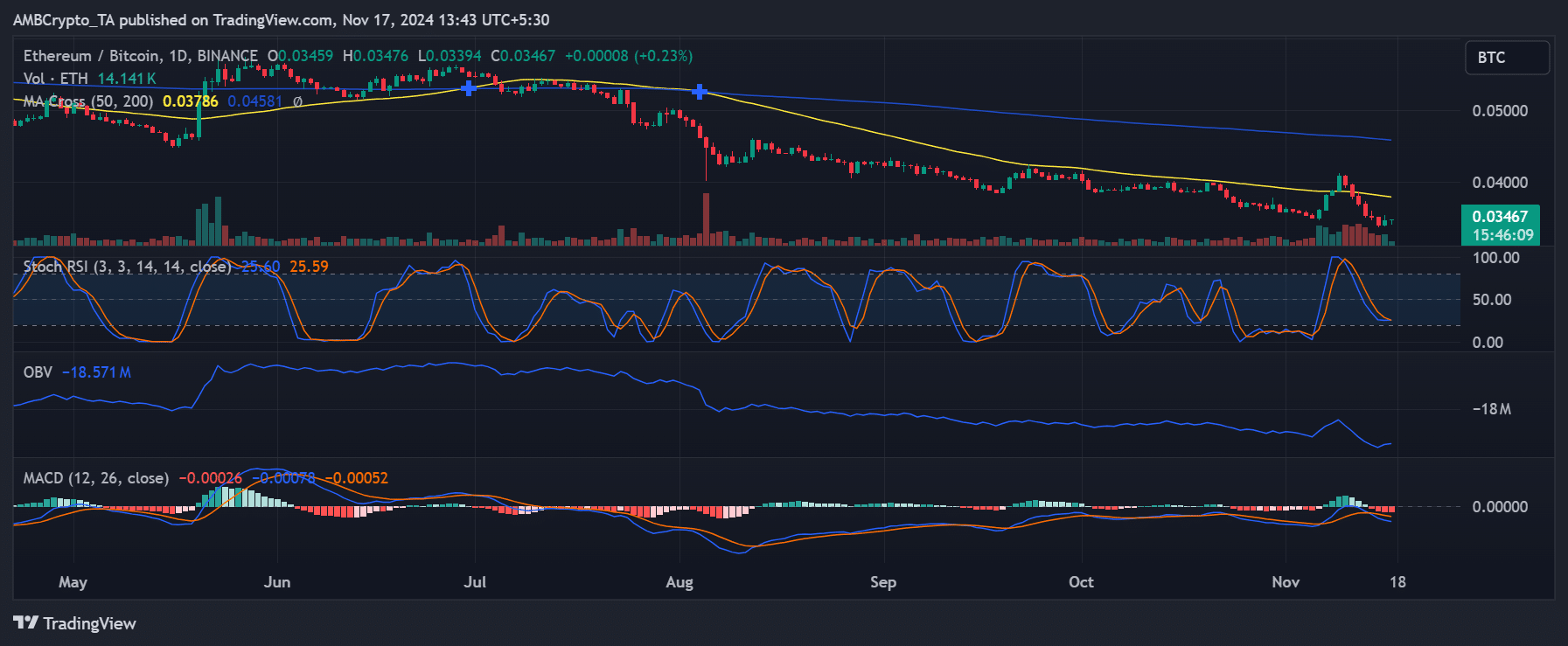

As a crypto investor, I’ve noticed that the Ethereum’s ETH/BTC pair has shown some signs of improvement following a recent downturn, currently exchanging for approximately 0.03469 Bitcoins at this moment.

After experiencing a substantial drop earlier this year, ETH fell below its 50-day and 200-day moving averages, which formed a bearish pattern.

The recent uptick, however, has brought it back above 0.034, but the 200-day MA, at 0.0459 BTC at press time, loomed as a formidable resistance level.

Signals like the MACD suggested a downward trend, with its signal line staying beneath zero, while the Stochastic RSI indicated oversold territory, implying possible recovery rallies might occur.

The On-Balance Volume (OBV) hints at a subdued trend, adding weight to the idea that Ethereum is encountering notable hurdles in attempting to regain its position relative to Bitcoin.

ETH/USD trend: Bullish momentum

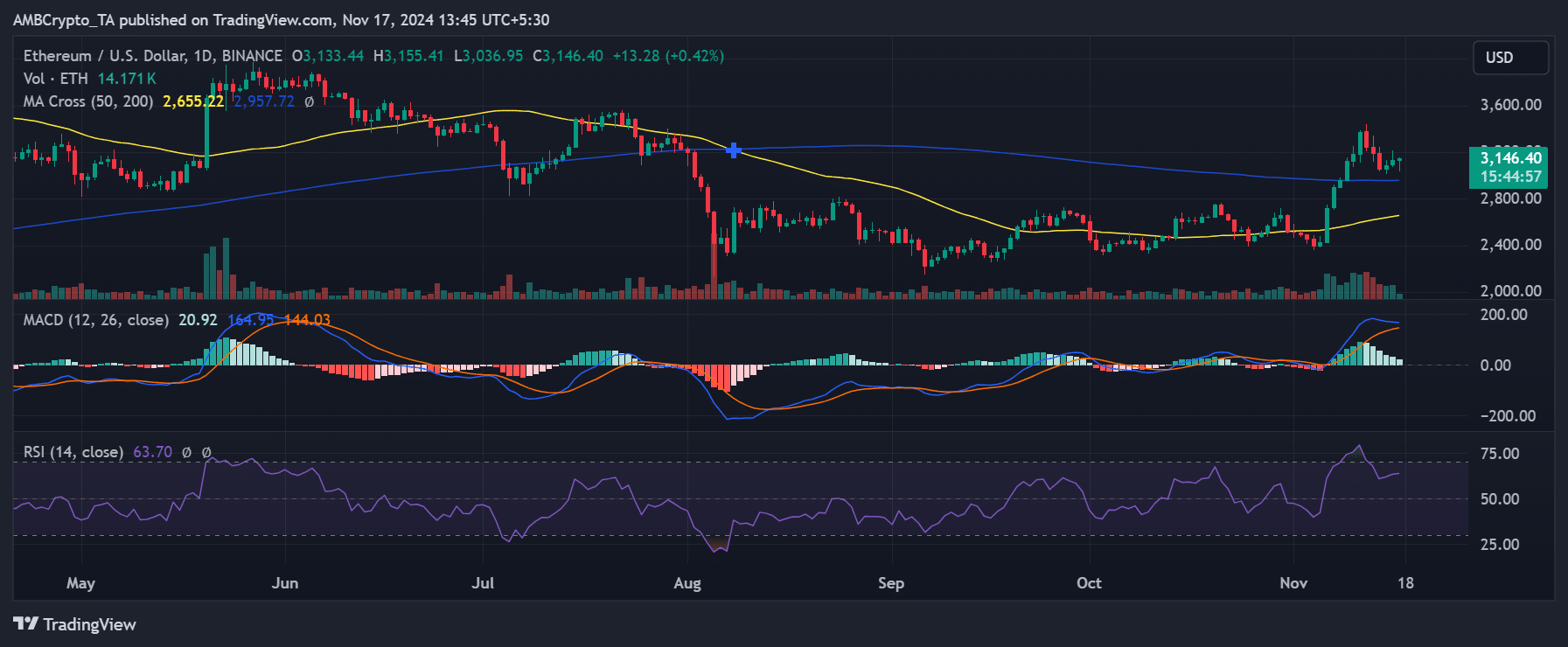

Instead of battling like Bitcoin, Ethereum (ETH) presented a brighter outlook in comparison. At the moment of reporting, Ethereum was being traded at approximately $3,147, and it had successfully regained its 200-day moving average which stood at $2,955.

As a researcher observing market trends, I’ve noticed an interesting development – the latest bullish intersection of the 50-day and 200-day moving averages could indicate a possible change in momentum. Specifically, I’m keeping a close eye on the $3,200 price range as it seems to be a significant barrier for further upward movement.

In simpler terms, the Relative Strength Index (RSI) was close to 71, signaling a slight oversold market, but the Moving Average Convergence Divergence (MACD) continued to show positive momentum, implying potential for more price increases ahead.

Maintaining Ethereum’s value above $3,000 will play a significant role in continuing its rise during the upcoming weeks.

Ethereum’s TVL remains bright

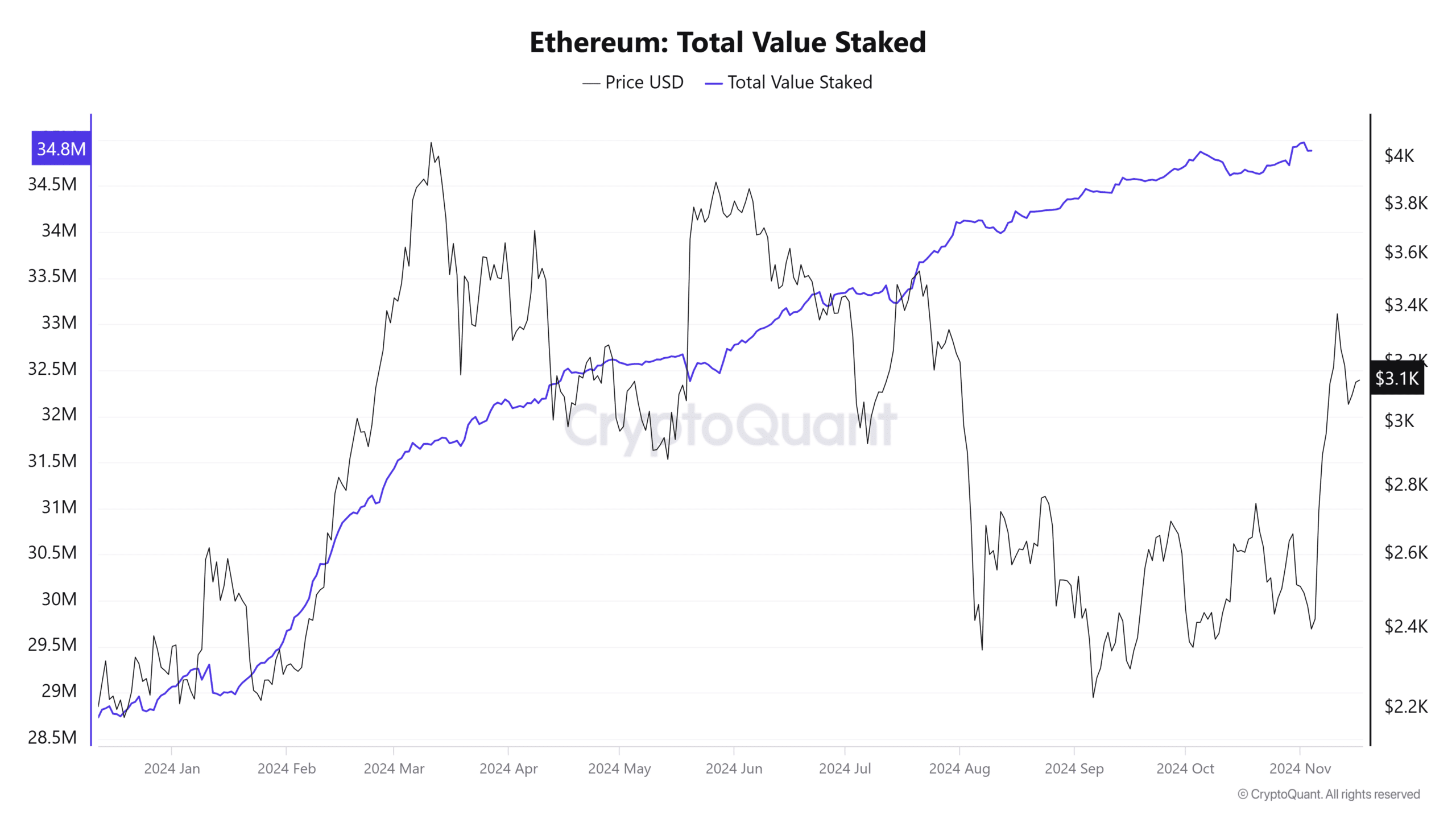

Regarding Ethereum deposits, its underlying strength continues to shine. The amount of Ethereum locked within the network has reached a record peak of 34.8 million Ether, demonstrating high levels of trust from investors.

With Ethereum’s current price at around $3,100, this indicator underscores a consistent growth in staking involvement, even though its performance versus Bitcoin has been relatively modest.

The chart from CryptoQuant revealed that staked ETH has grown consistently over the past year, even as Ethereum’s price endured volatility.

Displaying such resilience may indicate a long-term positive outlook, or bullishness, towards the network, despite a potential short-term decline in the ETH/BTC exchange rate.

What’s next for Ethereum?

In simpler terms, the general opinion about Ethereum among investors is divided. Although the increasing amount being locked up (staked) suggests faith from investors, the failure to maintain crucial levels when compared to Bitcoin creates some uncertainty.

The future progression of Ethereum largely hinges on its capacity to recover its influence compared to Bitcoin, especially since the dominance of Bitcoin is steadily increasing.

To reestablish strength, it’s crucial for Ethereum to surpass the 0.045 Bitcoin resistance level. On the other hand, should there be additional drops, keeping an eye on the 0.033 BTC support becomes vital.

Read Ethereum’s [ETH] Price Prediction 2024-25

The current perspective on Ethereum is somewhat uncertain due to its ongoing competition with Bitcoin, yet its staking statistics and overall network foundations continue to be robust.

From a crypto investor’s perspective, as the market contemplates a possible flip in the ETH/BTC ratio, I find comfort in Ethereum’s robust staking participation and its impressive USD performance. These factors could act as beacons of resilience, ensuring Ethereum’s long-term sustainability amidst the short-term turbulence that characterizes our dynamic crypto market.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-17 17:12