- Despite high unrealized losses, a whale was seen accumulating ETH

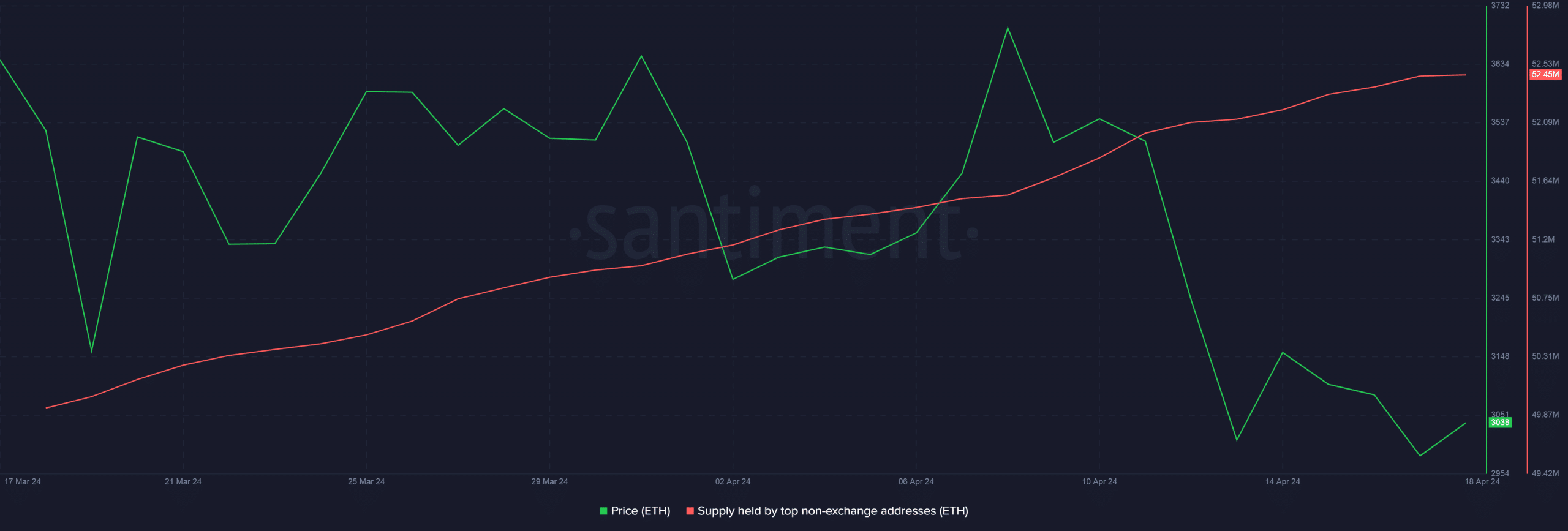

ETH supply held by addresses that don’t belong to exchanges increased in recent weeks

On Friday morning in Asia, Ethereum‘s [ETH] price took a significant drop due to growing conflicts between Israel and Iran. However, it bounced back during the day and was worth over $3,000 at the time of reporting. Despite this recovery, Ethereum has mainly experienced declines over the last week. As per CoinMarketCap, its value dropped by more than 12%.

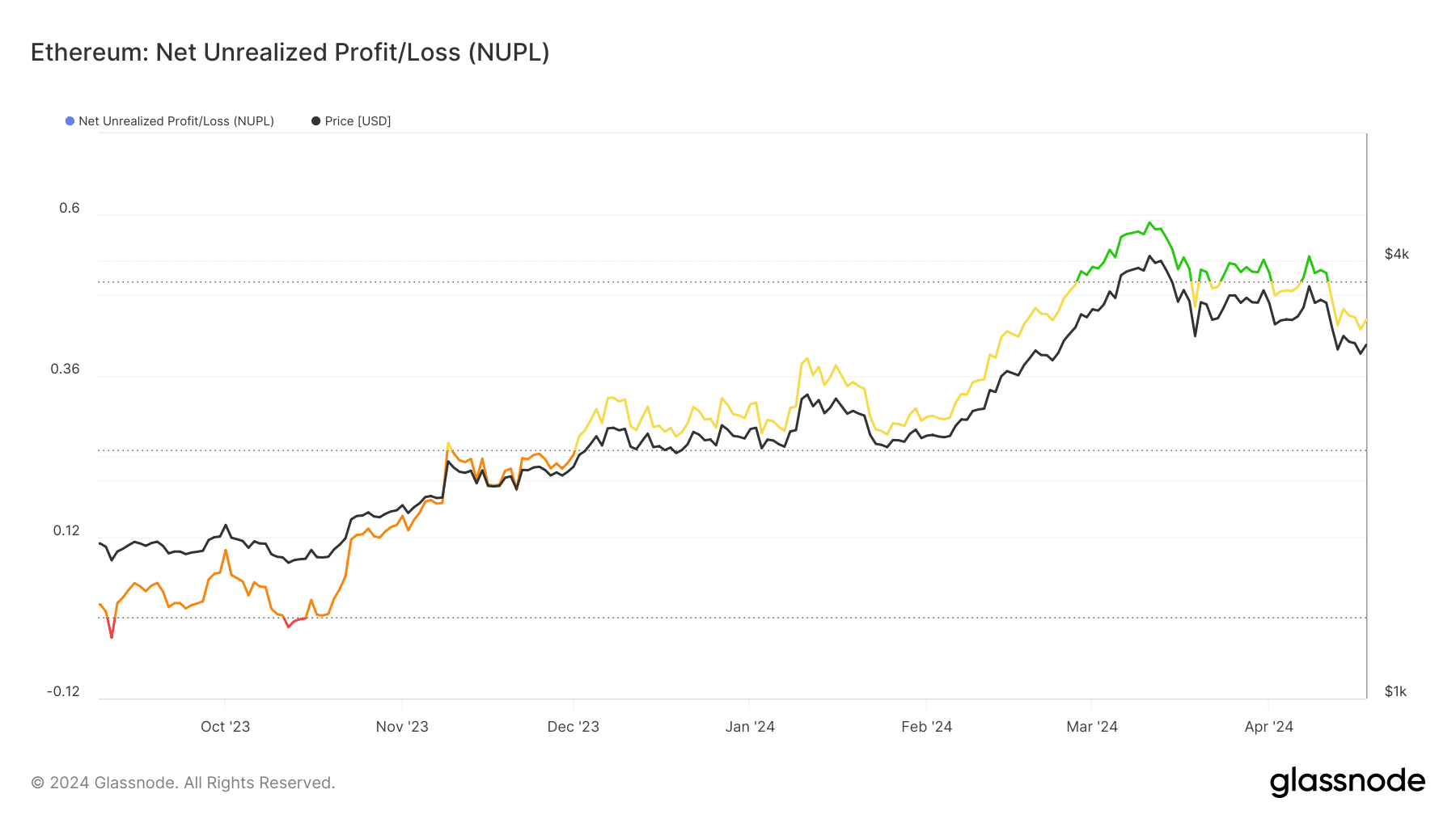

ETH’s profitability drops

The downturn caused a significant decrease in the number of Ethereum holders experiencing profits, as evidenced by data from Glassnode, which was analyzed by AMBCrypto.

Many investors give in to their fears and sell off their assets rapidly when faced with potential losses. But the behavior of a prominent “whale” investor caught the market’s attention.

Unfazed whale goes on buying spree

Using simpler language: A large Ethereum investor, as identified by Spot On Chain’s on-chain tracking, has purchased 41,358 ETH within the last five days, equating to approximately $128 million at current market values, despite holding these ETH at a loss.

In total, the whale currently holds approximately 117,268 Ethereum tokens. If these tokens were to be cashed out, the loss would amount to around $20 million.

The accumulation pattern, however, was not limited to the aforementioned whale. AMBCrypto dug further using Santiment data and noticed a steady rise in ETH supply held by addresses that don’t belong to exchanges.

The strong holding patterns in these Ethereum addresses reflect their faith in Ethereum’s future value and anticipation of a robust market recovery.

What to expect next?

Currently, based on the most recent data from the Ethereum Fear and Greed Index, the Ethereum market is showing an even balance between fear and greed, indicating that there’s no clear trend for investors to either buy or sell.

The upcoming Bitcoin halving may cause waves throughout the cryptocurrency market, affecting Ethereum as well. After the previous halving in 2020, Ethereum’s trend closely followed Bitcoin’s, resulting in record-breaking highs for both major digital currencies in the year that followed.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- THETA PREDICTION. THETA cryptocurrency

- How Potential Biden Replacements Feel About Crypto Regulation

2024-04-19 21:11