-

Ethereum’s large transaction surge by 13%, hinting at a looming price action.

Over 547,600 ETH worth $1.26 billion hit exchanges, stirring market excitement.

As a seasoned analyst with over two decades of experience in the financial markets, I find these recent Ethereum [ETH] developments quite intriguing. The surge in large transactions by 13% and the subsequent $1.26 billion worth of ETH moving onto exchanges is reminiscent of the dot-com era when Yahoo! stocks were traded in millions.

Over the last three weeks, an amount equivalent to approximately 547,600 Ethereums, worth over $1.26 billion, has been moved to cryptocurrency trading platforms, as per a tweet from a well-known analyst.

This significant transfer indicates heightened Ethereum market liquidity and trading activity.

Historically, when a large quantity of any cryptocurrency gets transferred to exchanges, its owners might choose to sell or rebalance their portfolio, potentially leading to market fluctuations.

Ethereum transactions soar by 13%

Based on figures from IntoTheBlock, there’s been a 13% surge in significant Ethereum transactions within the past day. This rise has propelled the total number of large-volume Ethereum transactions from 3,070 to 3,370.

As the number of significant transactions grows, it suggests that institutional investors or major token holders are developing a keen interest in the token, leading to the rise in trading activities on exchanges.

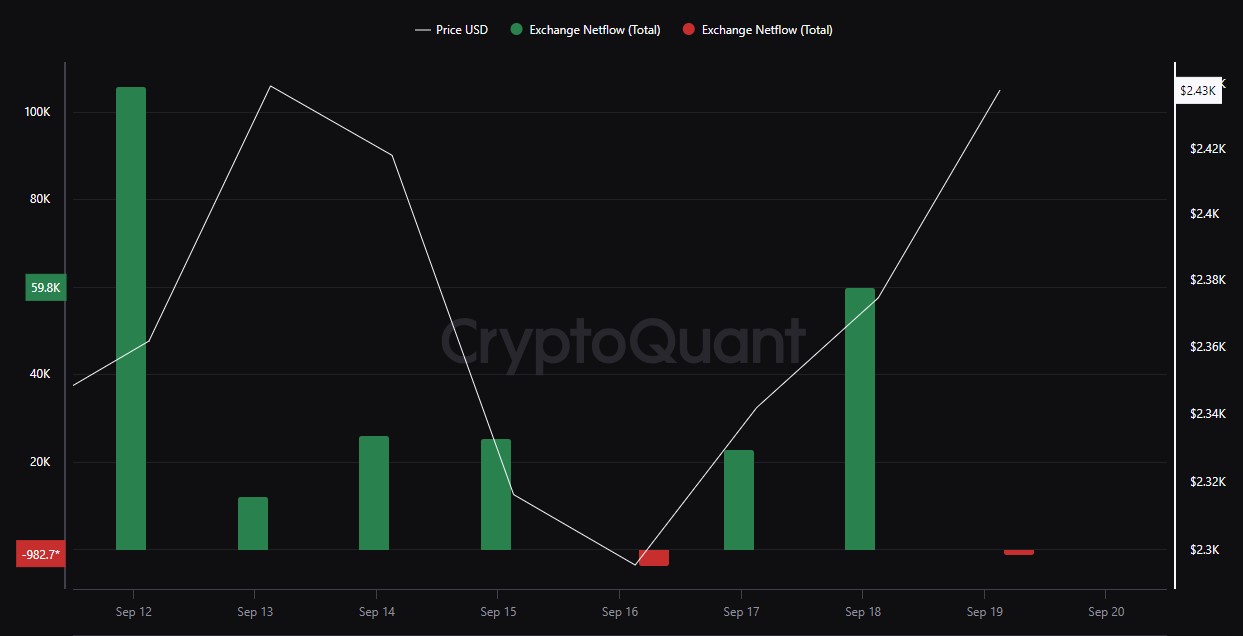

Ethereum netflows skyrocket

The data from CryptoQuant shows us that there’s been a significant boost in the amount of Ethereum moving into exchanges over the past day.

Typically, a higher rate of net flow (outflow or inflow) of Ethereum suggests that the market’s volatility might be increasing. This is because it could mean more traders are either taking profits by selling their Ethereum or engaging in speculative activities based on anticipated price fluctuations.

This adds to the existing sentiment that the market could be gearing up for significant shifts.

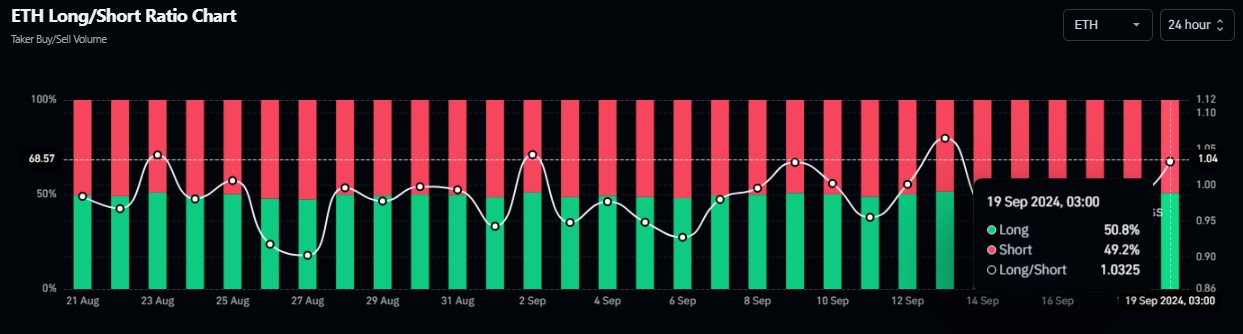

Bulls are in control

At the given moment, as reported by Coinglass, about 50.8% of investors were maintaining long positions. This suggests a predominant sentiment among market players that they are hopeful and ready to wager on an increase in the value of Ethereum over the short term.

Read Ethereum’s [ETH] Price Prediction 2024–2025

On the other hand, given the large volume of Ethereum moving towards exchanges, a significant increase in sellers could potentially undermine the optimistic outlook for the market.

Given the latest reduction in interest rates by the Federal Reserve after four years and positive market trends, it’s possible that the price of Ethereum could increase in the upcoming period.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-09-20 02:15