-

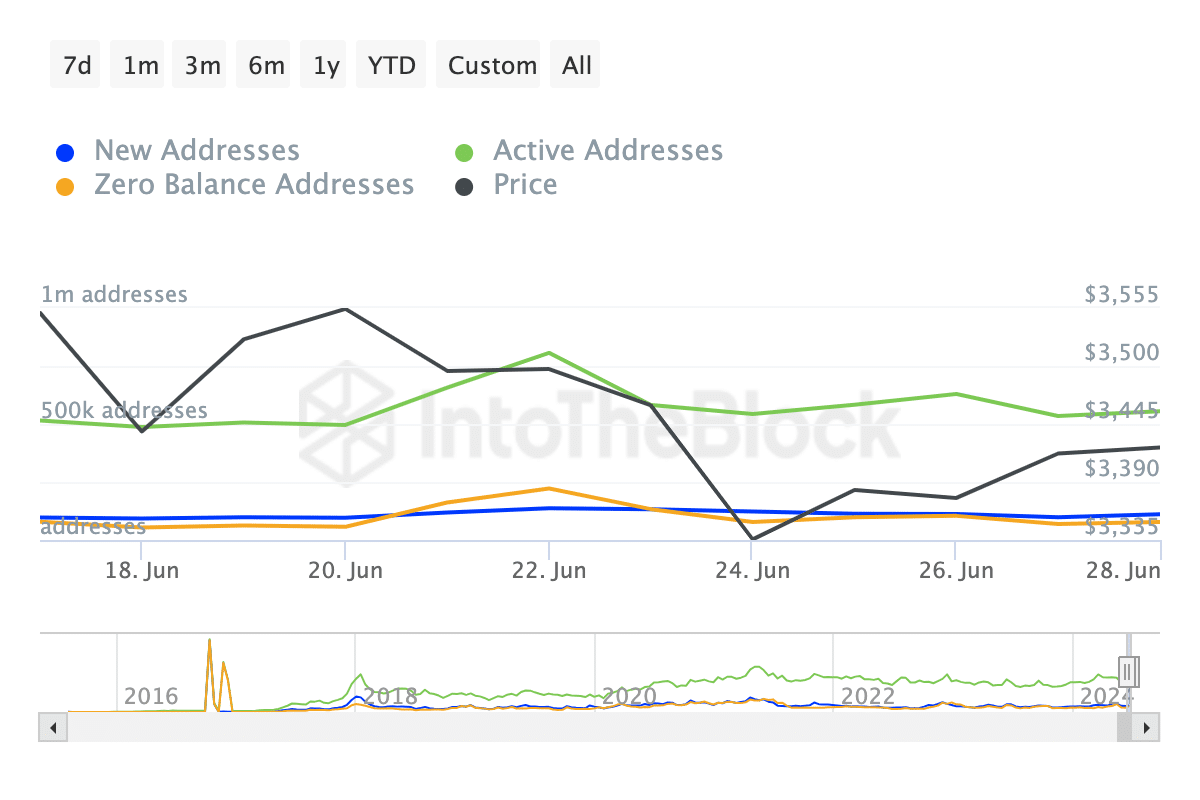

The number of addresses on the network has been falling for the last seven days

ETH supply on exchanges fell, reducing the potential of a sell-off

As a researcher with experience in analyzing cryptocurrency markets, I find the recent trend in Ethereum’s [ETH] network activity quite concerning. The declining number of active and new addresses on the network is a red flag, as these metrics typically reflect user engagement and adoption levels.

As an analyst, I’ve noticed a disappointing trend in network activity on the Ethereum [ETH] blockchain despite the upcoming launch of Spot ETFs. After conducting a thorough evaluation, I came across this disheartening discovery with AMBCrypto.

At the moment of publication, it was noted that the number of Ethereum addresses with recent activity, those making a transaction for the first time, and those holding no balance had decreased. New addresses signify distinct users who have successfully completed a transaction within the network for the very first time.

Activity falls, but there is a catch

This measurement indicators the degree of usage or popularity. In contrast, the count of active addresses signifies the number of individuals partaking in transactions. An uptick in this figure reflects heightened user interaction and expansion.

As I analyze the data at present, I observe a decrease of 15.45% in the number of active addresses over the past week. Unfortunately, new addresses have also experienced a decline, amounting to 6.50%.

As a crypto investor, I was taken aback by this recent development given how imminent the projected ETF launch seemed. If this downward trend continues, it could potentially impact Ethereum’s price. This is because decreased activity on Ethereum’s network might translate to reduced demand for the cryptocurrency.

Based on data from CoinMarketCap, the Ethereum price stood at $3,379 as of this moment. Over the past week, this figure marked a decrease of approximately 3.35%.

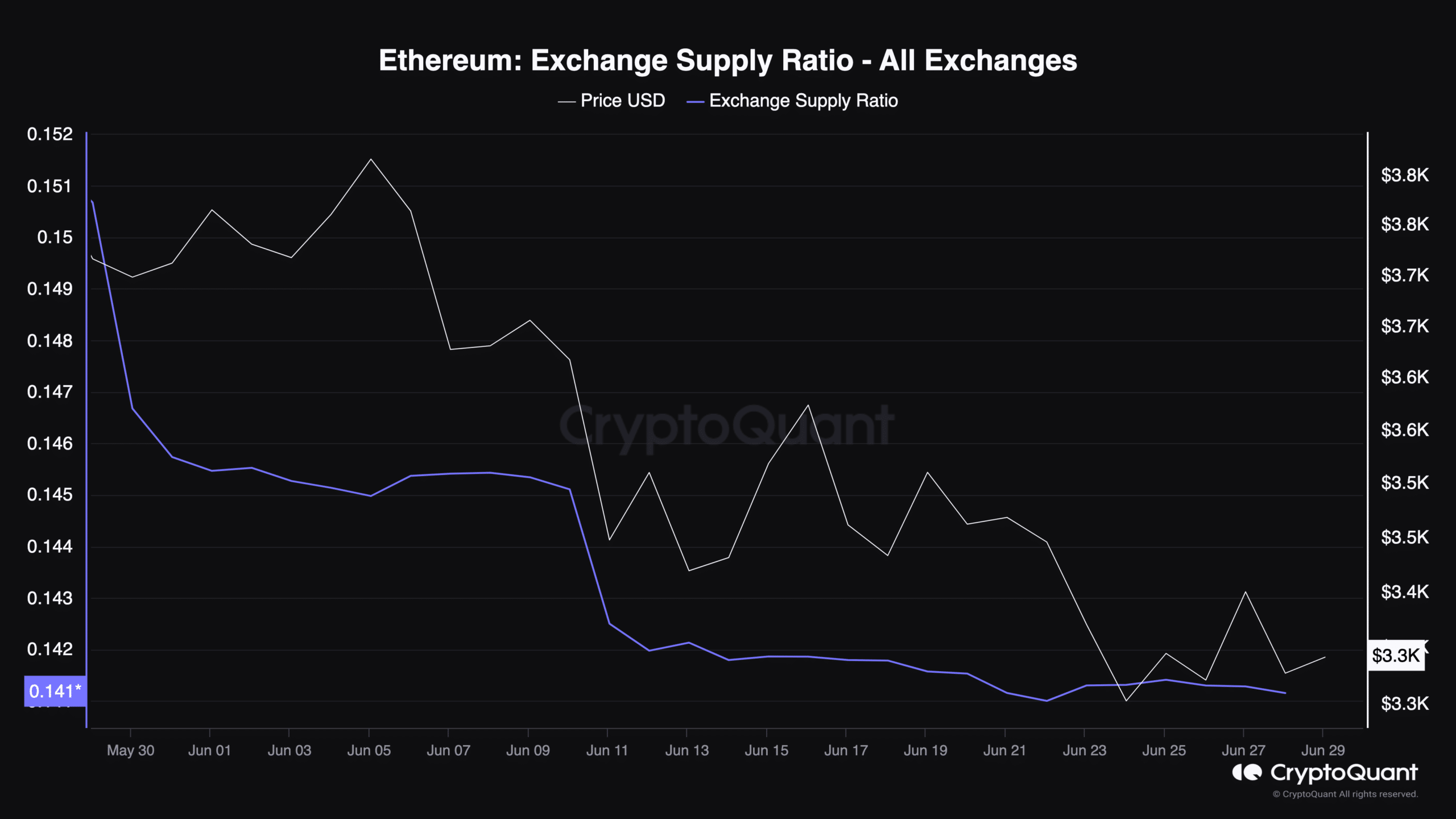

As a financial analyst, I would like to highlight another important metric that AMBCrypto considered during their analysis – the Exchange Supply Ratio of Ethereum. To explain it simply, this figure represents the proportion of Ethereum coins held in exchanges compared to the entire Ethereum supply available in circulation.

When the quantity of coins traded on exchanges increases, it signifies an uptrend. This situation might result in heightened selling pressure, potentially causing a downward price trend in the future.

At the moment of publication, the asset ratio was showing a decrease based on CryptoQuant’s data. This downward trend reduces the likelihood of a massive sell-off since holders appear content with securing their assets in cold storage.

ETH traders are not confident

With fewer funds remaining on cryptocurrency exchanges, the likelihood of a strong market uptrend, or bull run, increases. Yet, for Ethereum (ETH) to benefit from this trend, there must be a surge in demand for purchasing it.

Based on current market trends, I estimate that ETH‘s price may reach around $3,600 during the initial days of July. Conversely, should the market take a turn for the worse, we could see ETH trading between the ranges of $3,200 and $3,400 instead.

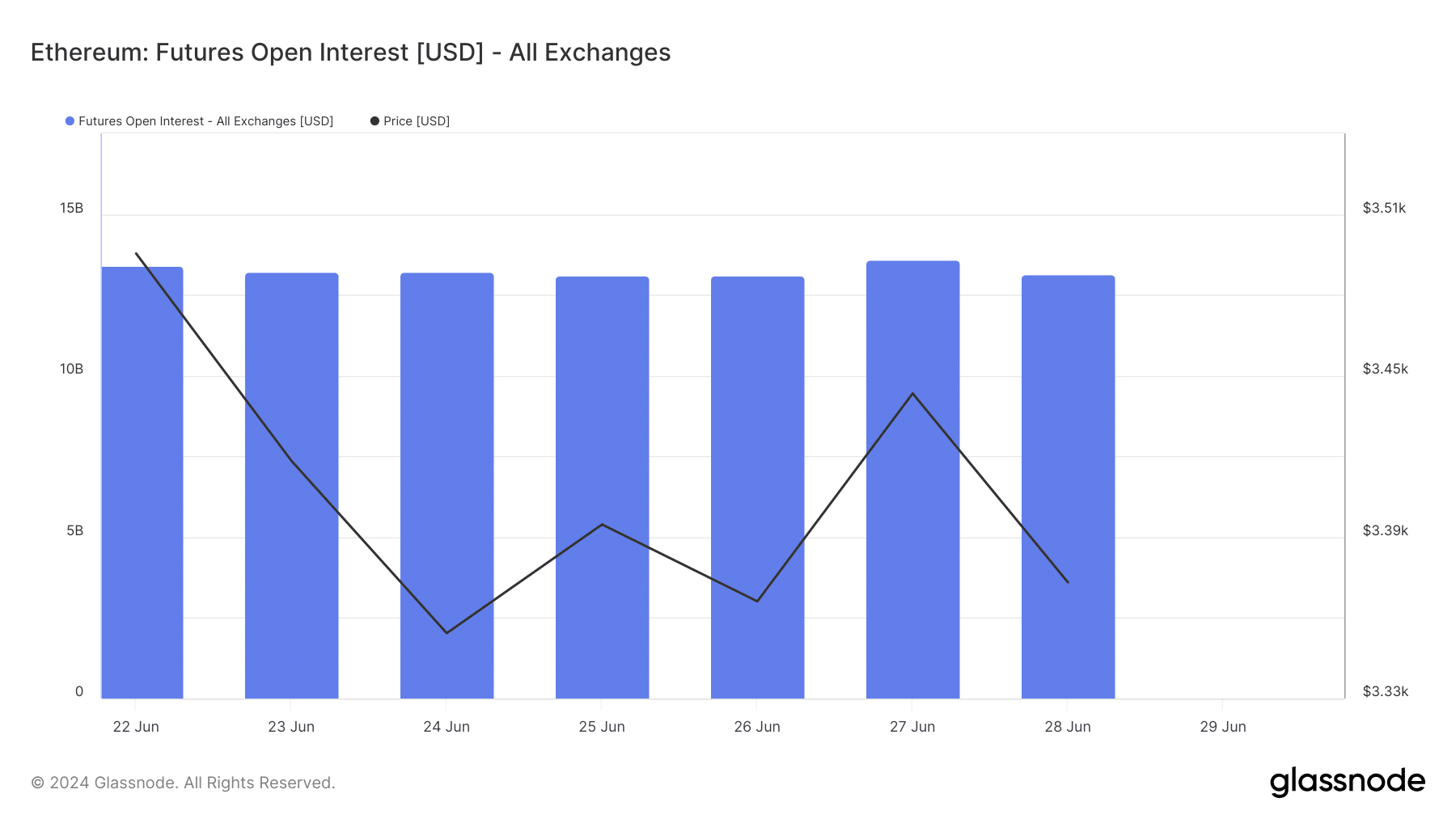

Furthermore, Ethereum’s Open Position value in the derivatives market decreased since 27th of June. Open Position (OI) signifies the current value of ongoing contracts in this market.

When this metric rises, it indicates that traders are heavily engaged in speculation. Conversely, a decrease suggests traders are closing their positions and withdrawing funds from the market.

As an analyst, I’d interpret the Open Interest (OI) of $13.14 billion for Ethereum as a strong indication of active participation among market players. This substantial figure suggests that traders are eagerly engaging in the market, preparing to capitalize on potential price fluctuations.

Read Ethereum’s [ETH] Price Prediction 2024-2025

If ETH‘s value keeps declining, it’s likely that its price will do the same. But this projection could change if open contracts rise and the demand for buying Ethereum in the spot market strengthens.

If this is the case, ETH could begin a hike towards $4,000.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-30 01:11