-

Ethereum’s exchange data showed that ETH’s selling pressure was easing.

However, ETH failed to recover amid a decline in demand.

As a seasoned crypto investor with a knack for deciphering market trends and a penchant for Ethereum [ETH], I find myself intrigued by the recent developments. The selling pressure seems to be subsiding, as suggested by the data from derivative exchanges, which is a positive sign. However, the spot market remains bearish, with entities like the Ethereum Foundation and Metalpha continuing their selling spree.

This year, Ethereum (ETH) hasn’t matched the success of Bitcoin (BTC). The primary factor contributing to its poor performance is a decrease in demand, coupled with heightened selling actions.

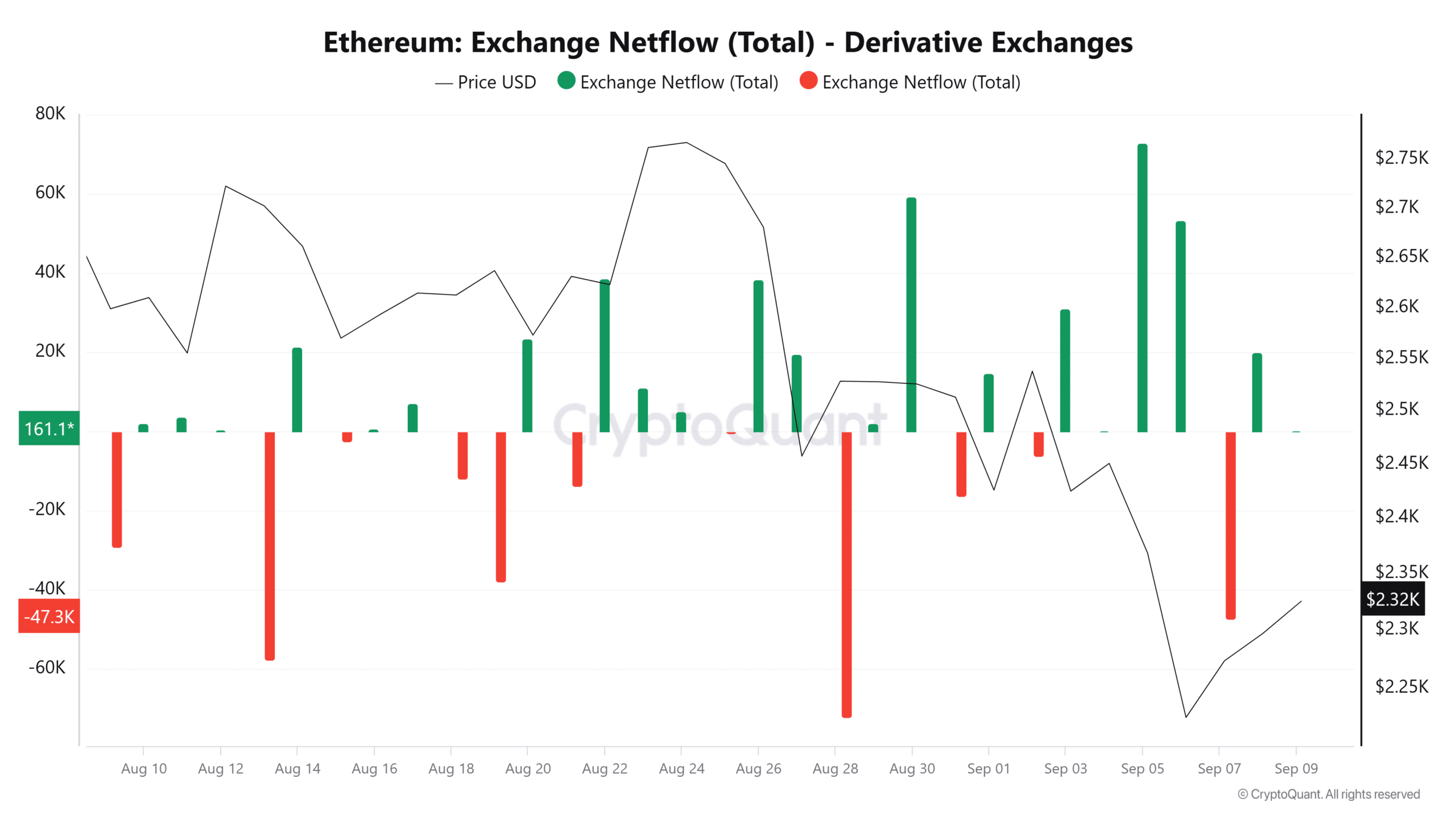

It appears that the demand for selling Ethereum (ETH) might soon run out, as suggested by data from CryptoQuant’s Quicktake post. On September 7th, the netflow of ETH on derivative exchanges exceeded 40,000 ETH.

A rise in Ethereum (ETH) withdrawals from derivative trading platforms indicates a decrease in selling pressure, suggesting that traders are less inclined to take on short selling positions by borrowing ETH.

Spot market selling spree continues

While data from the derivatives market showed that Ethereum traders were becoming less pessimistic, the same has not been seen in the spot market.

The Ethereum Foundation has been offloading Ether (ETH) and recently exchanged 450 ETH for a total of $1 Million in DAI through SpotOnChain. Over just the past four days, they have disposed of approximately $1.28 Million worth of ETH tokens.

In the past three days, as reported by Lookonchain, Metalpha – a cryptocurrency wealth management company based in Hong Kong – has transferred over 54 million dollars’ worth of Ethereum to Binance.

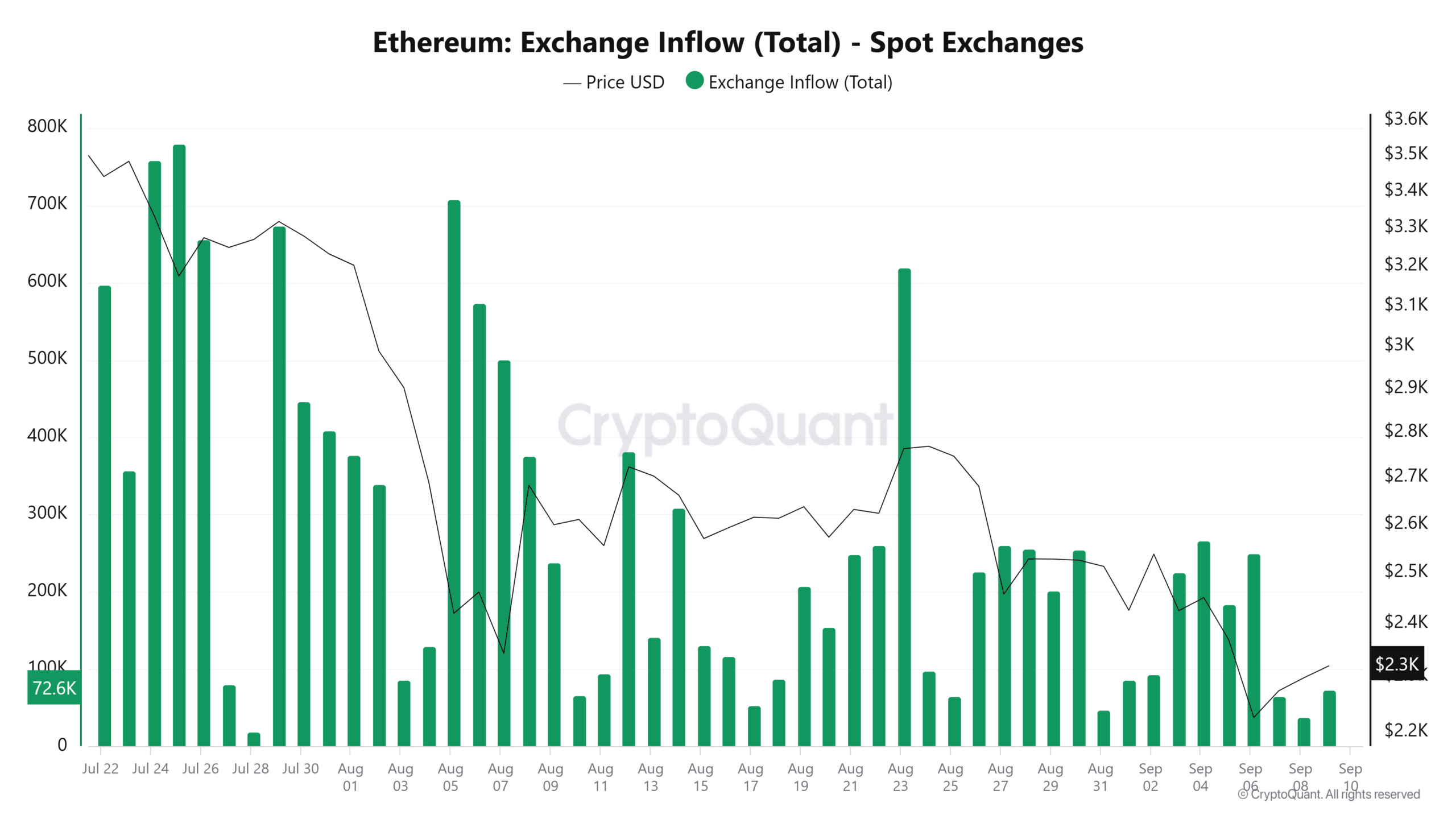

As an analyst, I’ve observed a noteworthy trend: While there has been a surge in selling activities related to Ethereum (ETH), the quantity of ETH being deposited onto spot exchanges appears to be decreasing. On September 8th, the exchange inflows for ETH dipped to 37,415 ETH, which is the lowest level since late July.

Thus, while sellers remain active, selling momentum may be weakening.

Ethereum price action

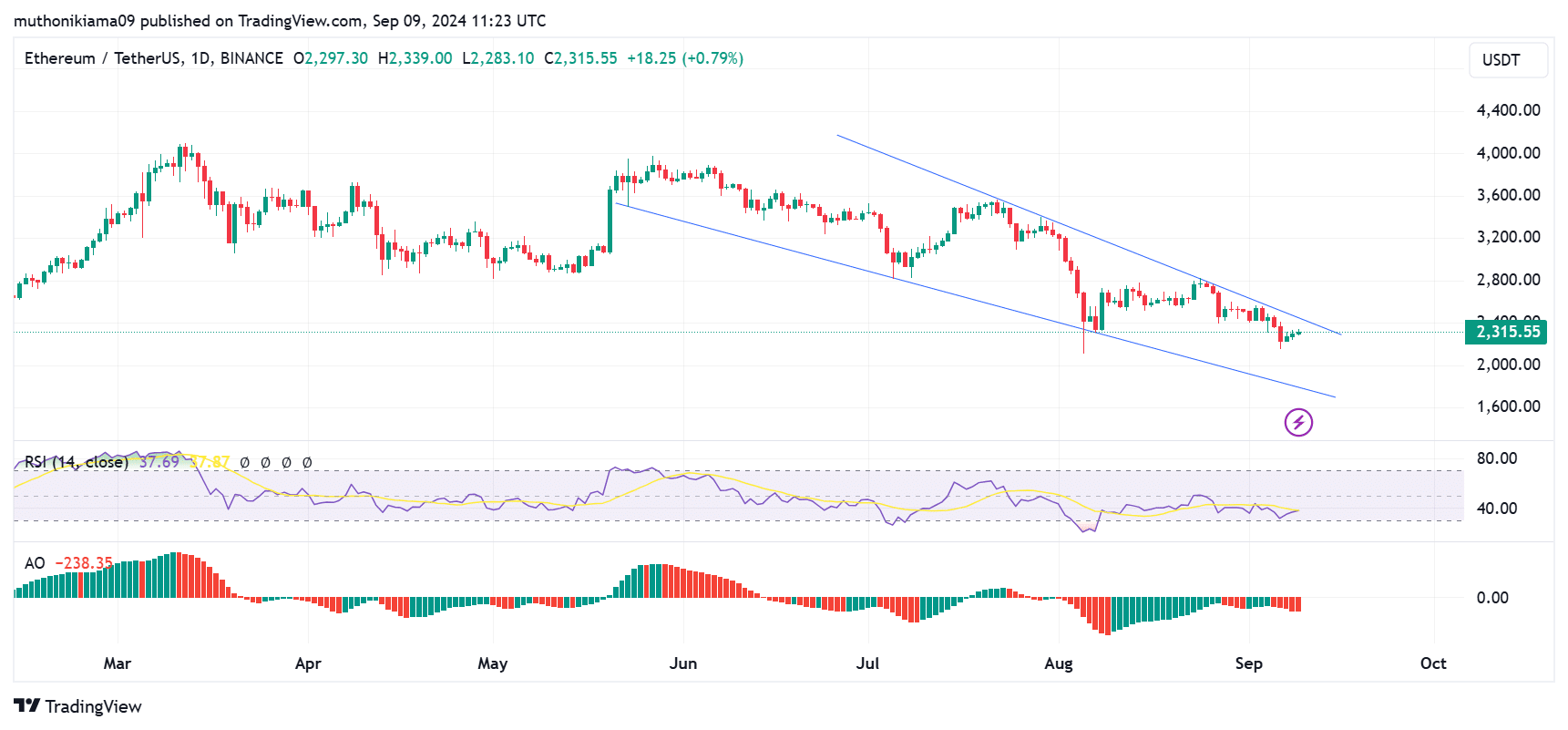

ETH was trading at $2,319 at the time of writing after a slight 0.6% gain in 24 hours.

On the daily chart, the altcoin’s price was moving inside a falling trendline (descending channel), suggesting bearish market dominance. Meanwhile, the Awesome Oscillator displayed a negative reading, indicating that the bears were maintaining their grip on the market.

Ethereum (ETH) has been trying to push upward following three successive green candles. A successful breakout might suggest a change in trend direction and potentially mark the start of an upswing.

In contrast, it appears that a shift, or “breakout”, could transpire if demand from buyers exceeds supply from sellers. Presently, the Relative Strength Index (RSI) stands at 37, suggesting that Ethereum is currently experiencing a downtrend.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As a crypto investor, I’ve noticed that the Relative Strength Index (RSI) line is showing signs of seller exhaustion, trying to cross above its signal line. If this crossover happens, it could indicate a potential buy signal for me.

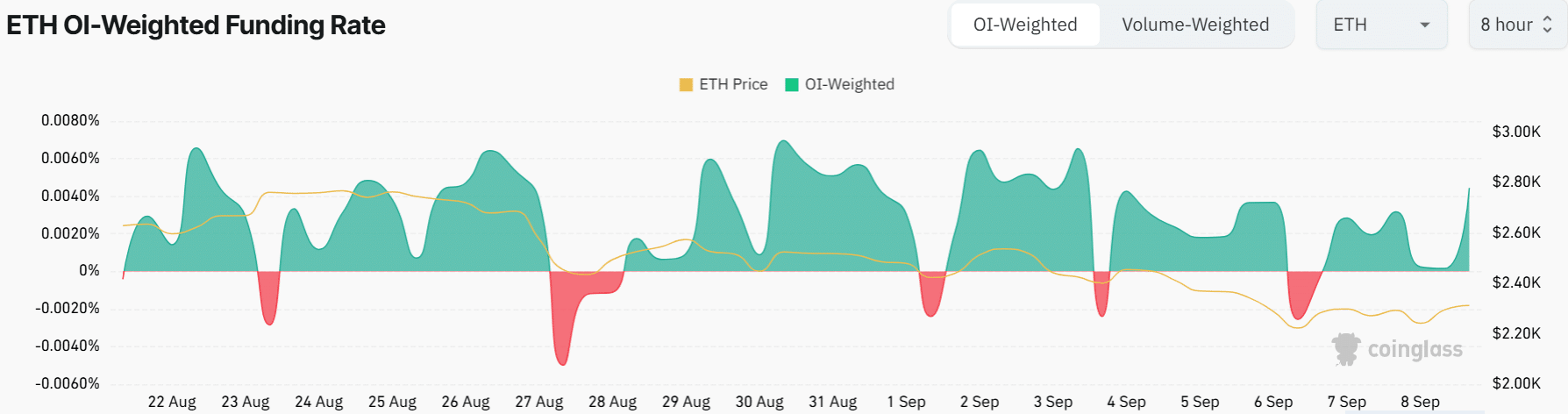

Even though there’s a general pessimistic outlook regarding Ethereum, the Futures Trading community is expressing optimism, as the Funding Rates have recently turned positive.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-10 08:07