- BTC flashed bearish signals ahead FOMC meeting.

- Despite short-term caution, analysts remained bullish in the mid-term.

As a seasoned researcher with over a decade of experience in financial markets, I’ve seen my fair share of bull and bear runs. With Bitcoin [BTC] leading the crypto market ahead of the Fed rate decision, I find myself cautiously optimistic about its short-term prospects but maintain a long-term bullish outlook.

In simpler terms, Bitcoin (BTC) took the lead in the cryptocurrency market as investors reduced risk before the Federal Reserve’s interest rate decision. Analysts were anticipating a ‘cautious reduction’ or ‘hawkish cut,’ indicating that the Fed might make a more conservative adjustment to interest rates.

The cryptocurrency declined from an all-time high of $108K to $103K just hours before the FOMC meeting. Markets had priced in another 25bps interest rate cut.

Analysts anticipated a more aggressive or ‘hawkish’ stance because of persistent high U.S. inflation, which might influence the Federal Reserve’s interest rate trajectory as far as 2025.

A similar outlook was shared by crypto trading firm QCP Capital. The firm noted,

The approach might lean towards being somewhat aggressive, given that inflation is steadily over 2%, and a robust job market makes the Federal Reserve exercise caution.

What’s next for BTC?

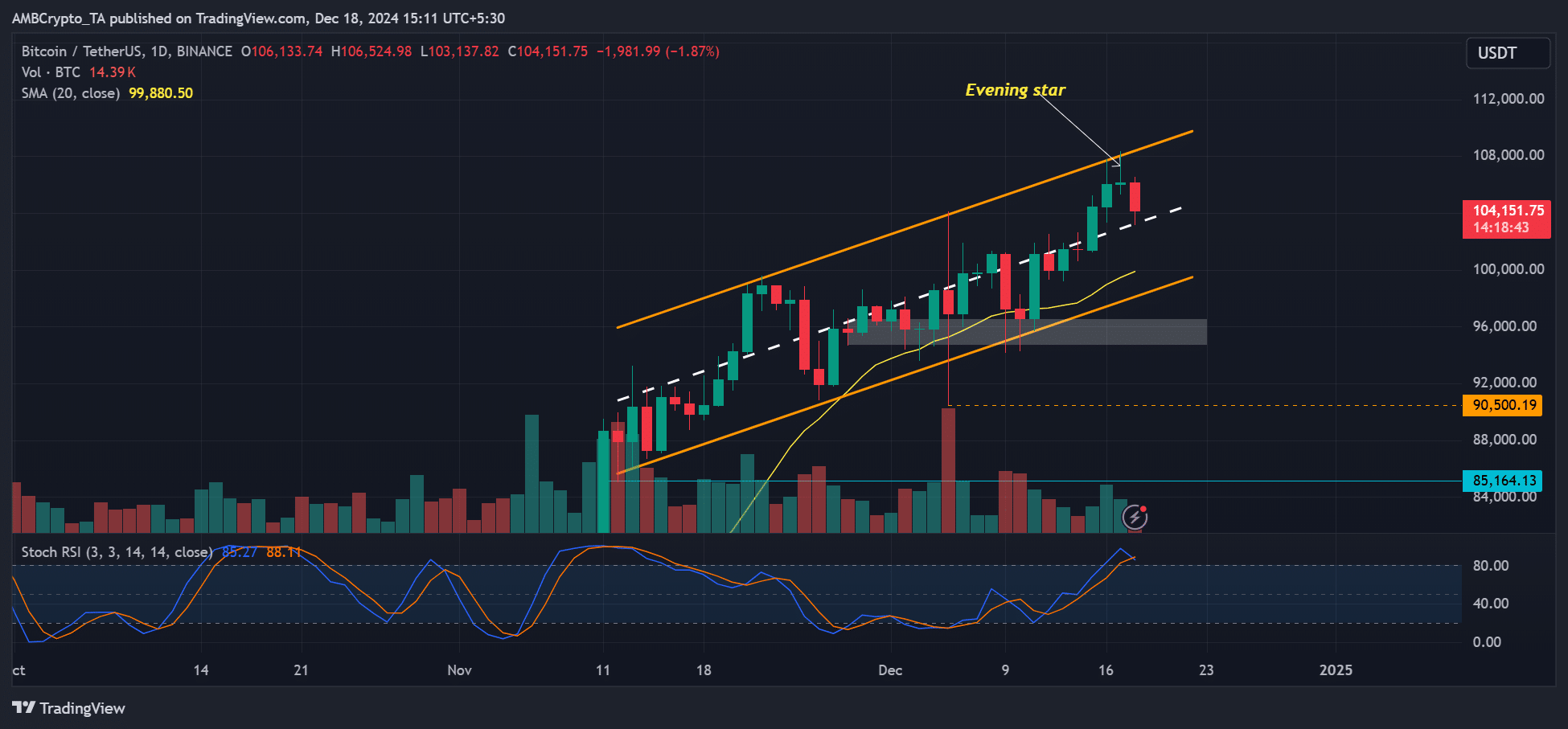

The firm added that the BTC chart flashed bearish signs, including an evening star, a signal of potential trend reversal.

As a researcher, I find myself cautiously evaluating the technical outlook for Bitcoin. Yesterday’s candle formation resembles an ‘evening star,’ a bearish pattern on the daily timeframe. Additionally, there seems to be a bearish divergence, suggesting potential downward price action.

For those not familiar, the evening star is a bearish candlestick pattern consisting of three candles: first, a large bullish candle, then a smaller candle (which could be either bullish or bearish), and lastly, a large bearish candle. This pattern often indicates a potential trend reversal from bullish to bearish.

This suggested that a BTC crash could be likely in the short term.

It’s worth noting that options traders have shown a more conservative approach lately. Instead of focusing on potential price increases like they did previously, they’ve been more inclined to secure protection against possible price drops by purchasing put options over the past week.

As a crypto investor, I’ve noticed that the latest record highs of Bitcoin at around $107K and $108K have sparked some short-term bearishness among options traders, indicating they expect a possible downturn in the near future.

As we speak, Deribit’s 25-delta risk reversal (25RR) stands as a negative value for options due to expire on December 20th. This indicates a predominant bearish outlook and the premium placed on purchasing put options, suggesting they are considered more valuable at this time.

On January 3, 2025, put options were slightly more expensive than call options, indicating a bullish sentiment. For the entire first quarter of 2025 (from January to March), the prices of other expiry dates varied between 1 and 3 volatility points.

Over the past few weeks, the volatility levels soared to 4-5, with options traders capitalizing on market rallies. However, the situation now is starkly different. The outcome of the FOMC meeting will determine if this trend continues or not.

Regardless, QCP Capital remained optimistic about the long-term prospects up until 2025, even though there was some cautiousness in the options market over the short term.

A different analyst, Stockmoney Lizards, shared similar optimistic long-term expectations for Bitcoin, suggesting further potential expansion due to the recent RSI readings in a monthly timeframe.

Read More

2024-12-18 20:07