If you thought gold was just a fancy decoration for dragon hoards and old bankers’ desks, think again. On April 21, gold decided to have a growth spurt and zoomed past $3,390—because what better way to say “economic uncertainty” than by making something shiny even shinier? Investors, like moths to a flame or unpaid interns to free pizza, swarmed to safe-haven assets. Meanwhile, Bitcoin looked at the commotion and probably thought, “Hey, am I next?”

According to some fine scribbles and numbers from Trading Economics—the kind of folks who make graphs that look like roller coasters—gold has hit a new all-time high while the world simultaneously figures out if it’s on fire or just having a bad hair day. On April 21, gold jumped 2%, breezed past $3,390, and flirted with $3,395 around 7:30 UTC, as if saying, “Look at me, I’m shiny AND punctual!” Experts (who are suspiciously fond of explanations involving trade tensions and currency dramas) suggest this all boils down to a tense global ballroom dance, where the US dollar is awkwardly stepping on everyone’s toes while growing weaker by the minute.

Just a week ago, President Donald Trump decided it was a smashing idea to poke the trade bear with new tariff investigations on critical mineral imports. This ratcheted up the world’s biggest trade squabble, especially between the US and China—because if there’s anything the world needs, it’s more cliffhangers and plot twists with tariffs. Meanwhile, investors started eyeing traditional fiat currencies the same way you eye suspicious leftovers in the fridge—warily—as the US dollar nosedived to a three-year low.

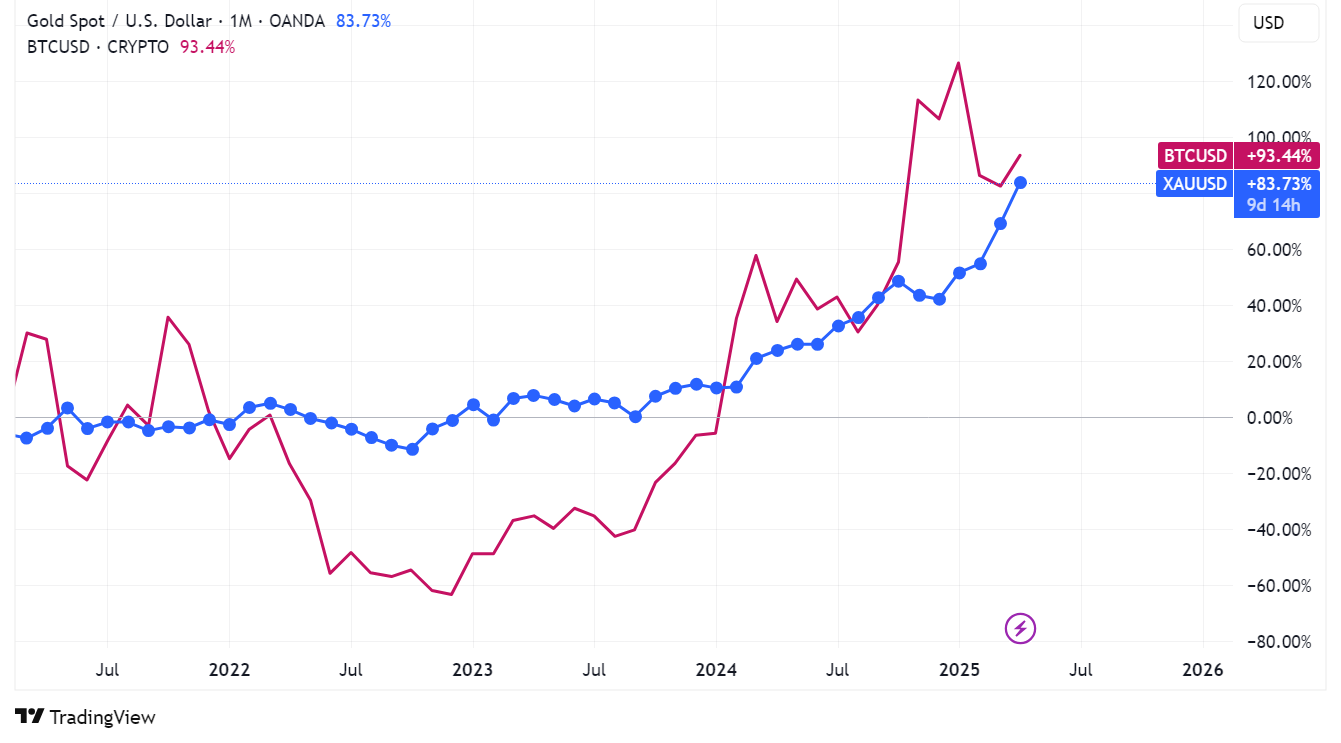

Now, if gold were a fussy cat, Bitcoin would be the cheeky kitten following it around, hoping for some scraps. The skyrocketing gold price might just be a cryptic signal for crypto junkies: buckle up for a Bitcoin bull run. Why? Because these two “safe-haven” assets often do a little synchronized swimming, holding hands in the stormy sea of financial chaos.

On that very same day, Bitcoin decided to remind everyone it’s no slouch by hitting a monthly high of $87,570. At press time, our digital gold behemoth ticked up over 3.2% in just 24 hours, leisurely trading around $87,538—not exactly pocket change for your average pawnshop. The last time BTC dared to cross the $87,400 line was March 28, before it went for a brief existential crisis in early April.

Gold and Crypto: A History of Glittering Partnerships and Occasional Drama

Bitcoin often gets called “digital gold,” which is possibly market-speak for “looks shiny, costs lots, and people pretend to understand it.” Jerome Powell, the Federal Reserve’s head honcho, once said Bitcoin was competing with gold because both serve as value vaults—less “buy your lunch” and more “stash in your invisible safe.”

Cathie Wood, the fortune teller-in-chief from ARK Investment Management, reckons Bitcoin could zoom past gold’s $15 trillion empire one day, despite gold’s rather slow-and-steady 2,700-year head start. Bitcoin achieved a $2 trillion market cap in just 15 years—roughly the time it takes gold to grow moss in a cave.

“At $2,700, gold is a $15 trillion monster, compared to Bitcoin’s $2 trillion baby steps. Even if Bitcoin moonshots past $100,000, it’s still got its training wheels on,” Wood quips.

Historically, gold’s party invites tend to spill over to Bitcoin’s dance floor soon after. Both are the financial world’s equivalent of “safety blankets,” protecting owners from the tantrums of fiat currency. Plus, both share a love of mining—though one prefers pickaxes and dirt, and the other prefers… well, mysterious lines of code and probably wizardry.

Still, a Bloomberg report points out that gold is the calmer sibling, with annual volatility cruising between 10% and 20%. Bitcoin, on the other hand, would put even the wildest rollercoaster to shame with swings over 50%. Yet, analysts have noticed that Bitcoin often moons over gold’s past moves with a delay, like an eager understudy waiting for their cue.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-04-21 12:43