- XRP’s impressive rally clears short liquidations, but raises risks of a long squeeze

- Elevated risk metrics and thin liquidity below $2.50 hinted at heightened volatility ahead

Investors of XRP have recently experienced substantial profits due to the token’s strong surge. Yet, certain warning signs suggest that rough waters may lie ahead. With more than 90% of bearish liquidation points used up and risk levels reaching extreme highs, is this the opportune time to secure profits before the trend reverses?

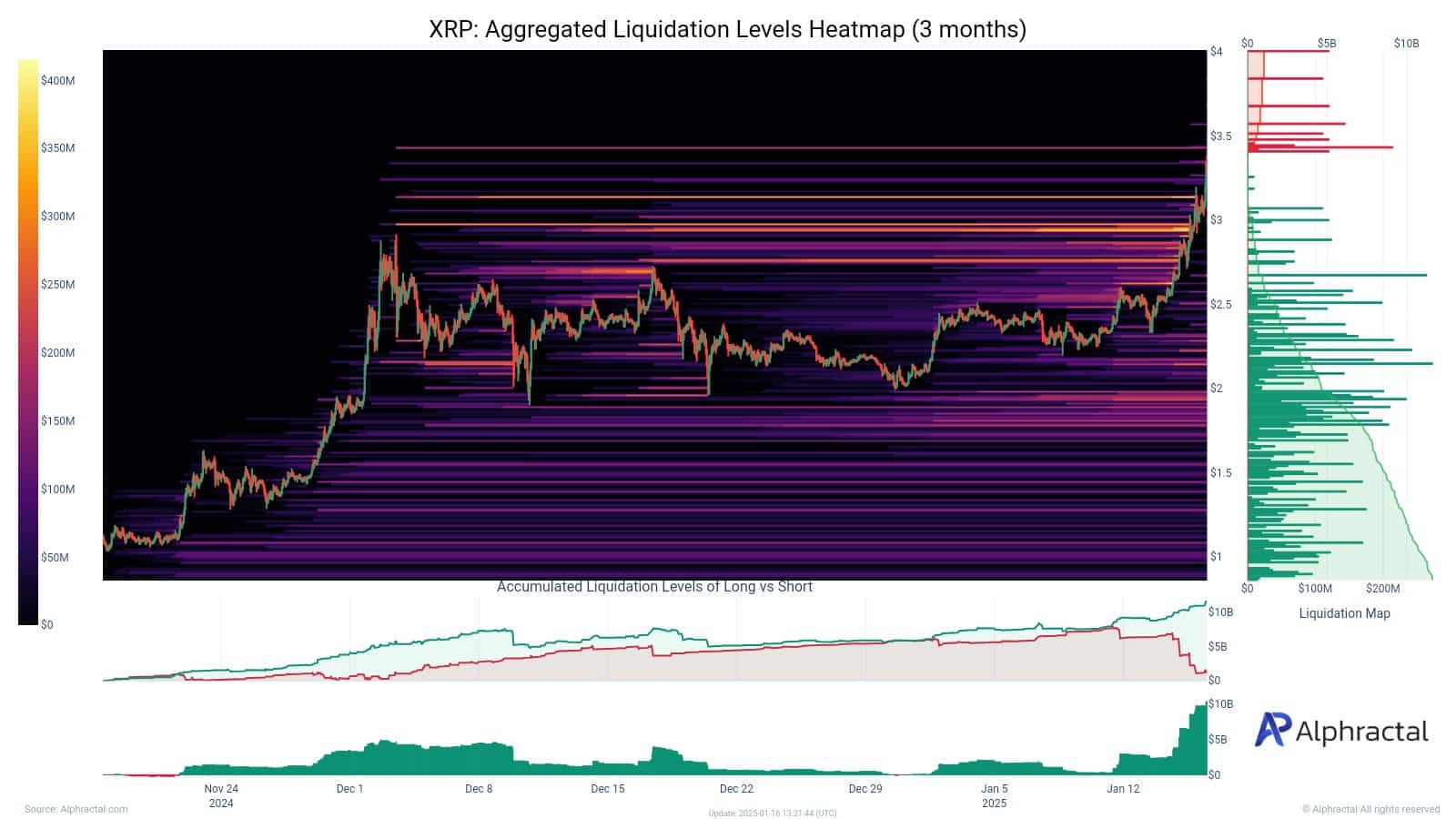

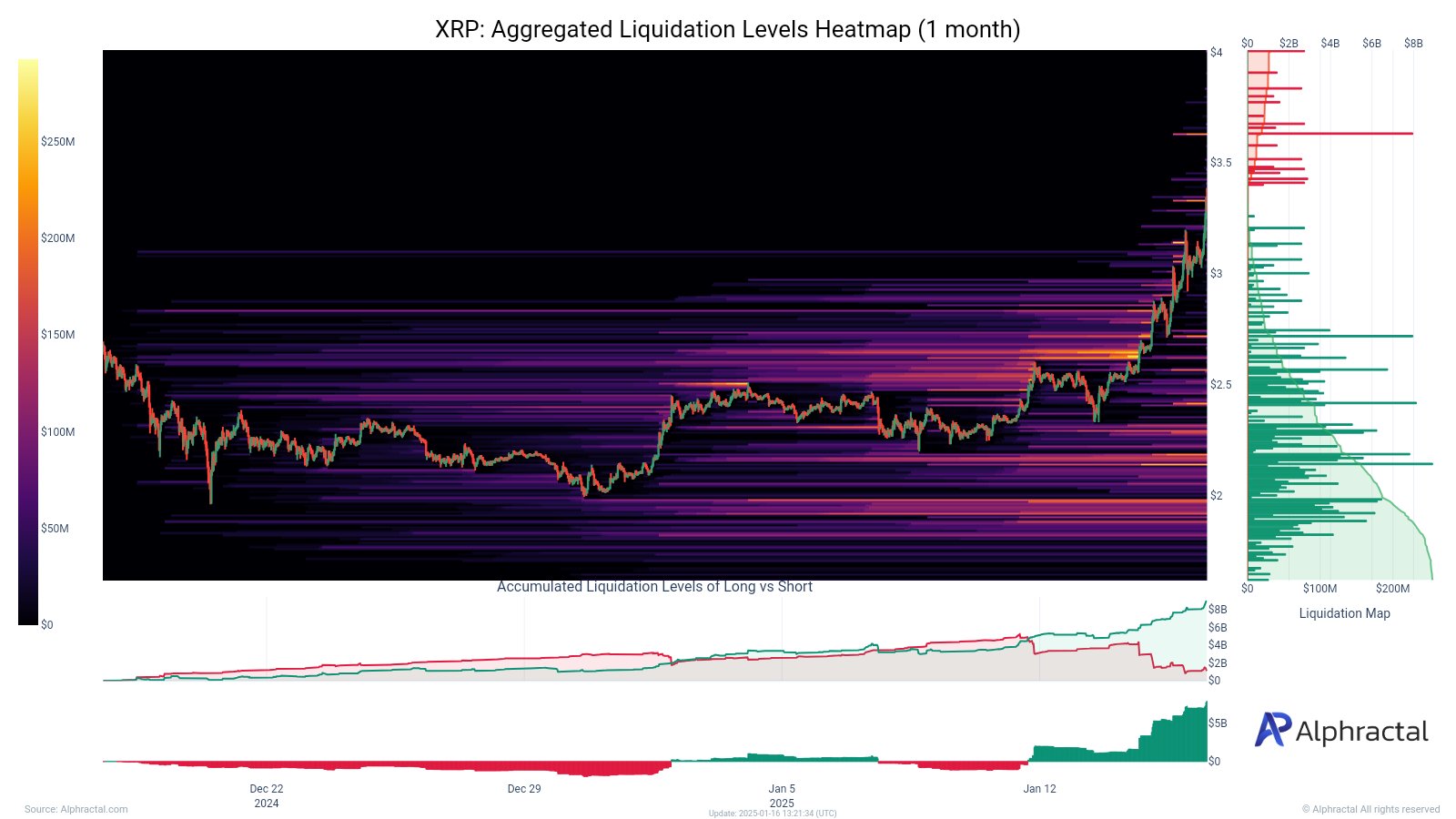

Liquidation heatmaps reveal XRP’s fragile market dynamics

Although XRP’s liquidation maps demonstrated its strong upward trend, they simultaneously pointed out potential weaknesses within the market. Over a three-month period, heavy concentrations of liquidation events were observed in the $3.00-$3.50 price range, where numerous short positions had been closed, contributing significantly to the rally.

Below $2.50, the market becomes less active, implying there may not be much resistance if the price falls, indicating potential weakness in the chart.

Over the course of a month, the heatmap supported this perspective, showing almost complete depletion of short selling opportunities (bearish liquidation levels) and an accumulation of long trades within the $3.25 to $3.50 price range.

If XRP’s momentum slows down, it could lead to a prolonged period of decreased value, possibly causing a sudden drop in price due to increased selling.

Furthermore, the trend of more short liquidations being matched by increasing long liquidations suggests a market that is becoming increasingly optimistic or bullish in its outlook.

As a crypto investor, I’ve noticed that XRP’s price surge has been fueled by short squeezes. However, the scarcity of bearish liquidity and the concentration of long positions suggest potential for increased volatility in the near future.

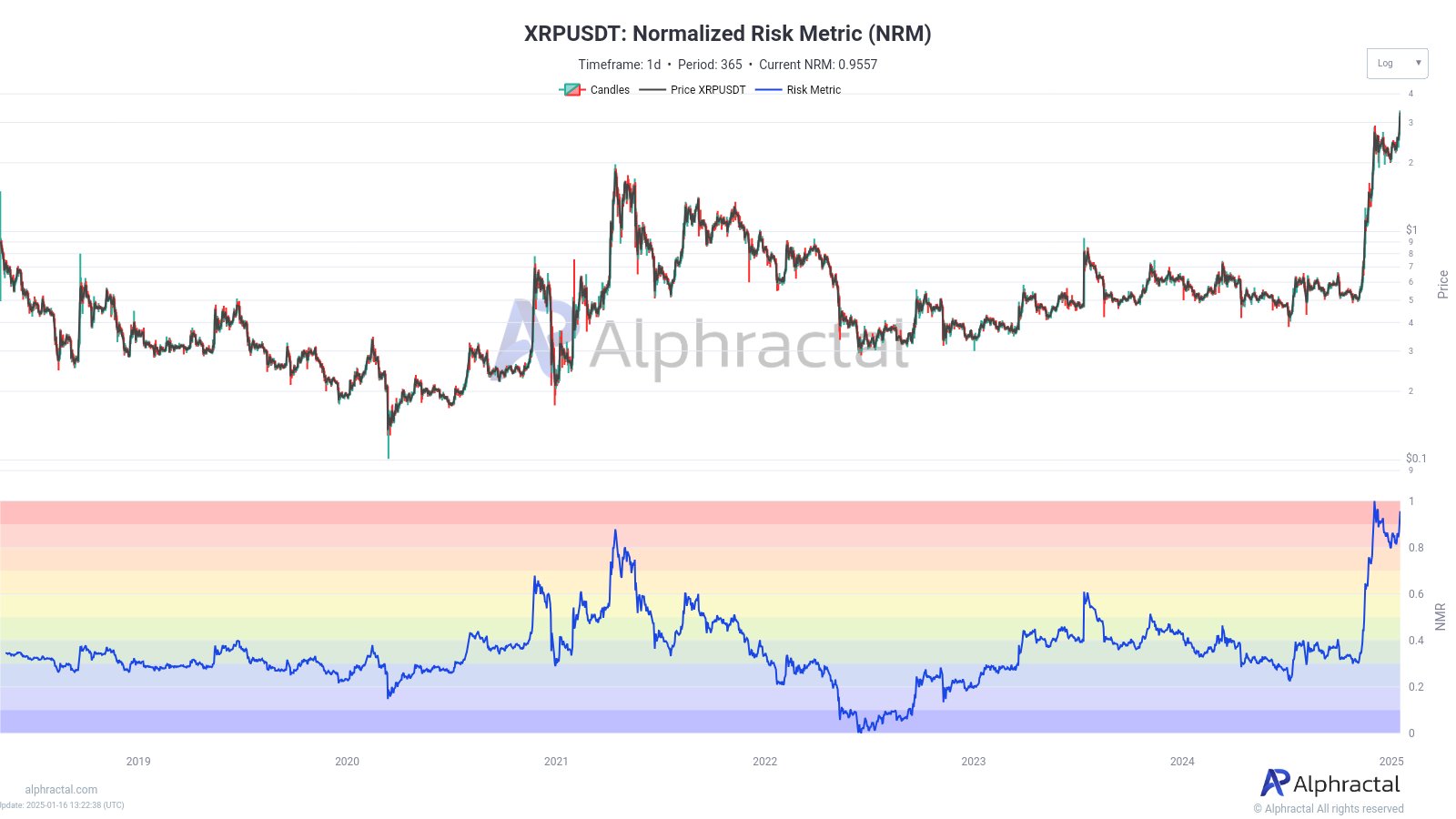

XRP’s elevated risk metrics

The recent surge in XRP’s price has come with some worrying indications of increased risk, as the Normalized Risk Score and Sharpe Ratio have almost reached unprecedented highs.

At the moment, the NRM’s current reading of 0.9557 appears to be approaching historical peaks that have typically been followed by significant market corrections – suggesting potential overheating. Given XRP’s current position within the red zone on the risk chart, it seems likely that a price drop may occur.

In a similar manner, the Sharpe Ratio, which gauges risk-adjusted performance, appears to be exceeding safe thresholds as well – Resembling trends observed prior to past market adjustments.

This means that XRP’s risk-reward balance is skewed, making the current market dynamics precarious.

Blending these risk indicators with an excessively hot market increases the likelihood of increased price fluctuations and possibly a dip as seen on the graphs.

Realistic or not, here’s XRP market cap in BTC’s terms

What are the possibilities?

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-01-18 01:11