- ARB could rally by 125% – 200% amid key bullish catalysts

- ETH’s price could further aid the token’s prospects from January 2025

As a seasoned crypto investor with over a decade of experience in this ever-evolving digital landscape, I can confidently say that the potential growth of Arbitrum (ARB) is nothing short of intriguing. The analysts’ predictions of a 125% to 200% rally if ARB reaches its 2024 highs are indeed tantalizing.

Based on expert analysis, Arbitrum (ARB) might be currently underpriced compared to its potential value. If it reaches its predicted peak by 2024, analysts estimate a possible additional return of approximately 125%.

In a recent post, Andrew Kang of crypto VC Mechanism Capital noted that ARB has been ‘fundamentally’ undervalued against other altcoins.

$ARB has experienced a significant price surge, yet it remains underestimated in terms of its fundamental value. Compared to cryptocurrencies like Sui, AVAX, and Tron, it trades at a minimal fraction, but outperforms them significantly in terms of trading volume and Total Value Locked (TVL), multiple times over.

ARB’s key catalysts

Kang noted that the altcoin is experiencing significant institutional attention and is focusing on Ethereum‘s compatibility studies. He believes these factors have positively influenced the coin’s price movement.

As a crypto investor, I firmly believe that Arbitrum’s latest innovation, Timeboost, serves as a significant catalyst for the platform. According to Blockworks Research, this new priority transaction ordering system will fuel increased activity on Arbitrum. They argue that the market has been underestimating ARB’s potential, and Timeboost could be the game-changer that corrects this mispricing.

So, how far can ARB’s price go from here?

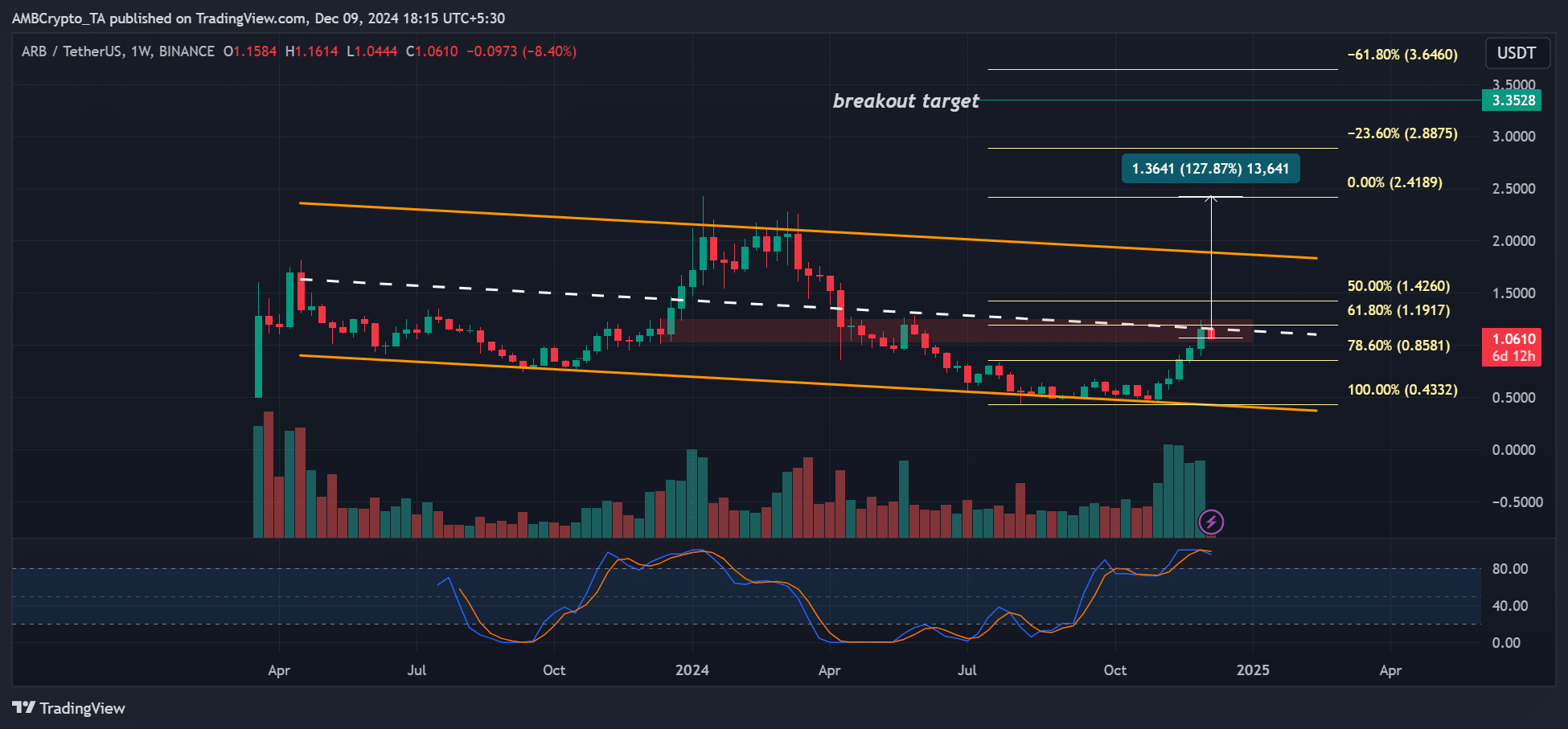

Over a seven-day period, the projected intermediate goal lies at the top end of the channel (approximately $1.9). If this level is reached, there’s an opportunity for an 80% increase in value. Additionally, surpassing its 2024 peak of $2.4 could extend the potential surge to 127%.

Based on traditional patterns, if the price breaks out from its downward trend line as expected, it could reach approximately $3.35. This represents a significant increase of around 213%, or nearly triple, from its current value of $1.

Currently, ARB finds itself at a crucial juncture near the midpoint of its trading channel. If it manages to surpass the $1.2 mark, this could significantly increase the likelihood of reaching the upper boundary and potentially causing a breakout.

It’s possible that the long-term influence could stem from the trajectory of Ethereum’s price and any shifts in regulatory policy. The Ethereum L2 segment has been slower due to ambiguous DeFi regulations. However, this situation may improve under the Trump 2.0 administration.

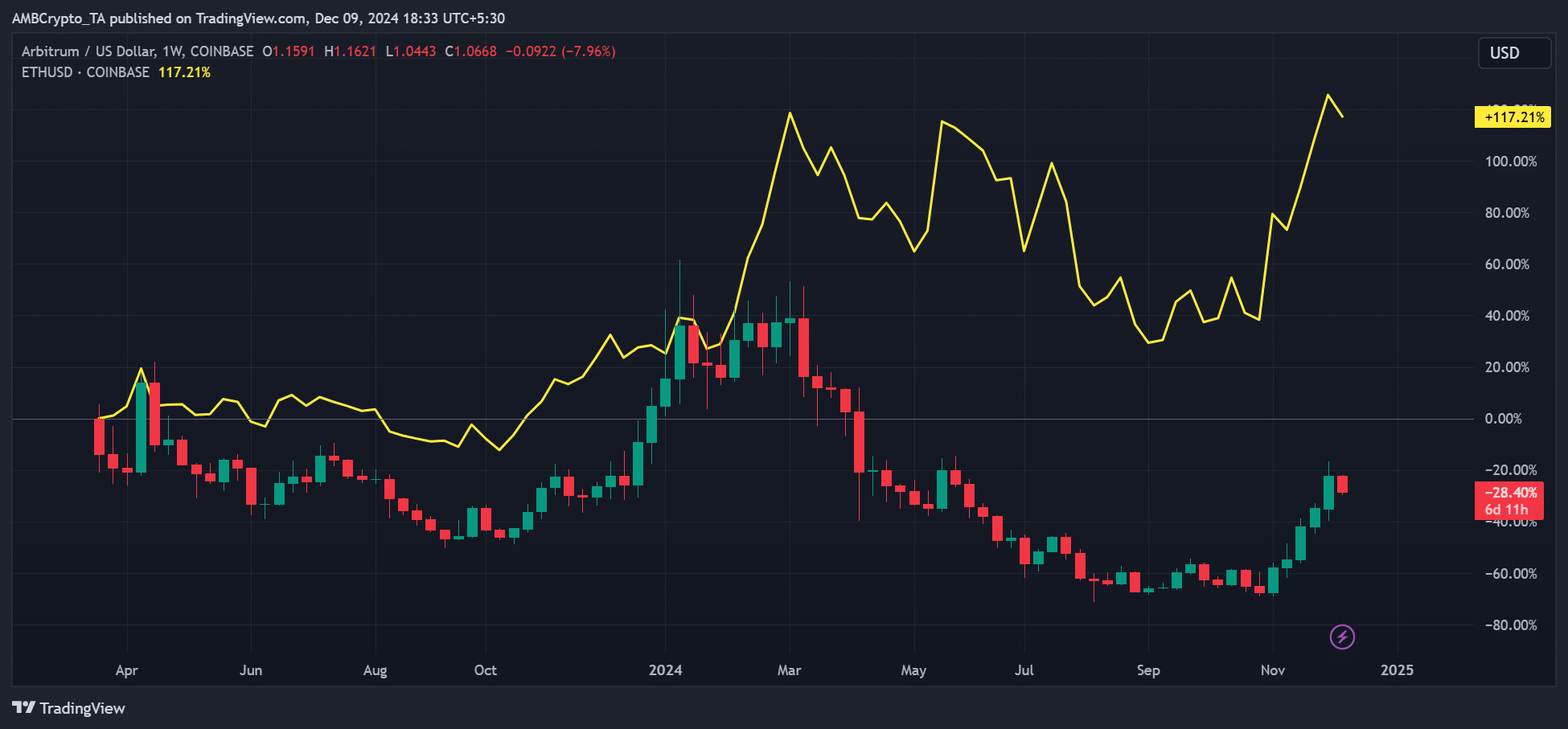

The recent appointment of pro-cryptocurrency candidate Paul Atkins as SEC Chairman last week sparked expectations for Ethereum (ETH) to reach $4k. Additionally, this news caused the price of Arbitrum (ARB) to increase, suggesting a strong connection between ETH and ARB, as well as the wider Layer 2 (L2) segment.

Could the potential increase in ETH’s price by January 2025, as predicted by many analysts, potentially benefit ARB? Notably, QCP Capital mentioned in their recent market analysis that they anticipate ETH may reach a new record high.

Historically, ETH has often reached a new record high by January following the halving event. This trend is mirrored in the options market, as the demand for ETH call options (which give the buyer the right to buy ETH at a specific price) increases significantly starting from January onwards.

In short, strong ETH momentum from January 2025 could lift ARB even higher.

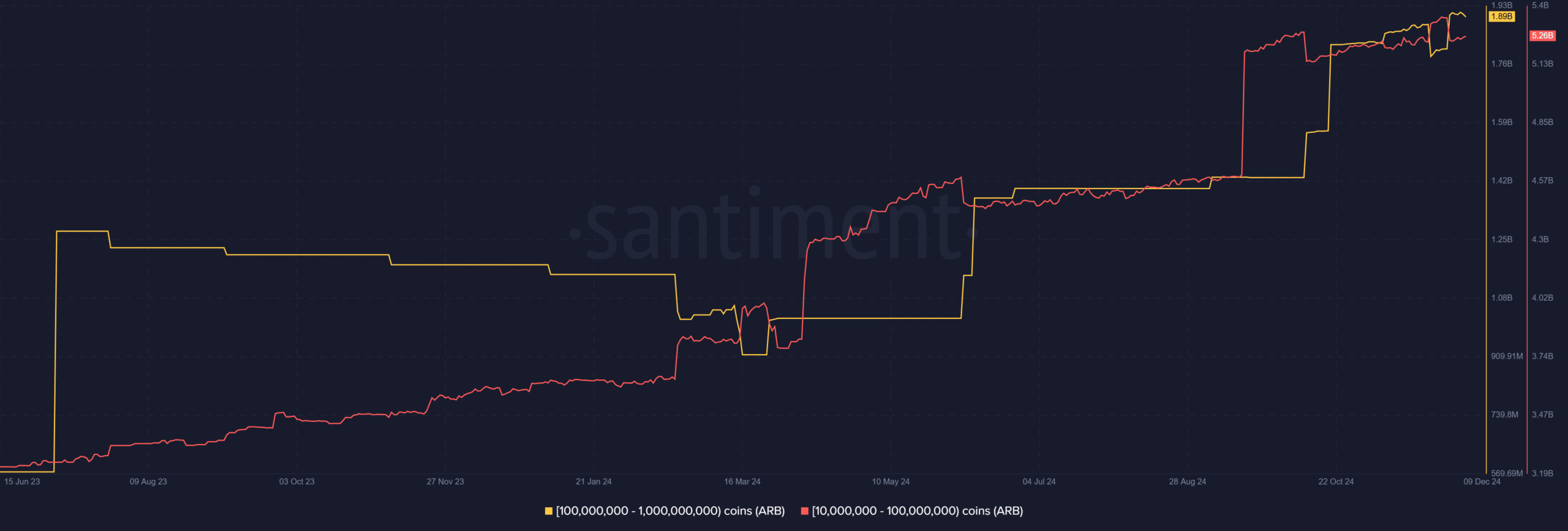

It’s worth noting that a surge in ARB holdings by leading whale investors could potentially trigger another bullish trend for ARB. Over the past few months, these top investors have amassed more than 7.15 billion tokens of ARB, which currently amounts to around $7.15 billion.

Based on the earlier findings, it seems we’re looking at a positive trend for ARB, potentially yielding up to a 200% increase in value by January 2025.

In a nutshell, the performance of Ethereum (ETH) might dictate the trend for other altcoins like Aave (ARB). Therefore, a bearish outlook on ETH may impact ARB’s optimistic predictions.

Read More

2024-12-10 08:40