- Bitcoin hunting down any long entries but it still may not be too late.

- Demand for crypto in US rising as MSTR makes a record BTC purchase.

As a seasoned analyst with over two decades of market experience under my belt, I find myself cautiously optimistic about Bitcoin’s current trajectory. The repeated hunting down of long positions suggests a volatile environment, but the balanced STH SOPR and rising demand indicate a potential for steady growth.

Positions taken by investors who have been holding onto Bitcoin (BTC) during its recent upward trend are finding themselves under pressure, causing them to quickly sell off their holdings as the price keeps climbing.

In this recurring trend, it’s clear that the market has been unstable, with long positions being swiftly closed out, especially following Bitcoin surpassing the $90K mark.

The repeated pattern of lengthy increases followed by quick declines indicates that investors trying to profit from the upward trend may be encountering considerable dangers.

This pattern of trading raises a query: Given the intense focus on buying Bitcoin’s long positions, is it now already too late, or still possible, to enter long positions in Bitcoin without encountering immediate obstacles?

Bitcoin SOPR for STH

Analyses of the Short-Term Holders’ SOPR (STH SOPR) suggested a balanced market sentiment.

At this point, right in the middle of excessive optimism (greed) and deep pessimism (fear), the SOPR suggests that there may be room for more price growth without an imminent threat of a significant downturn or correction.

According to the 30-day moving average, it appears that some investors were cashing out their gains, but this behavior does not suggest excessive enthusiasm or euphoria within the market.

Previously, when the SOPR (Spend Output Profit Ratio) reaches an ‘extreme greed’ level, it often signals a market correction or pullback because the market might be excessively heated.

Instead, it’s often in these ‘intense fear’ areas that major market bottoms take shape, providing excellent chances for purchasing.

As an analyst, I’ve observed a moderate trend that points toward gradual growth, accompanied by a measured optimism among traders. However, a sudden shift in behavior towards excessive greed might be a warning sign, suggesting the necessity of prudent profit-taking to anticipate any potential market downturn.

During that time, it provided a chance for shrewd investments, requiring a well-balanced methodology to handle the persistent fluctuations and take advantage of the upward trajectory.

Rising demand and MSTR’s record purchase

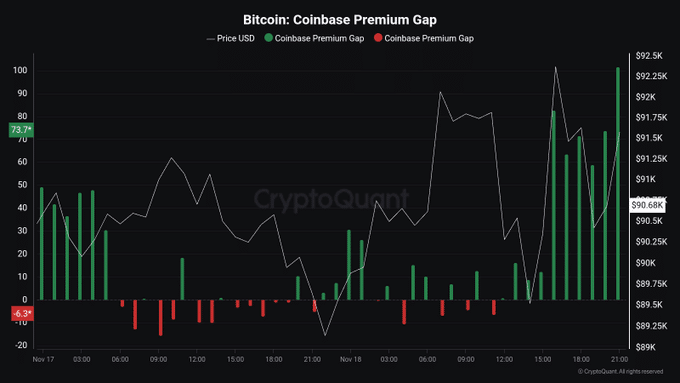

After the U.S. elections, there was an increase in the desire for Bitcoin, as suggested by the rising Coinbase Premium Index. This index signaled a strong buying enthusiasm among American traders, contributing to the ongoing bull market.

Yesterday’s data indicated substantial increases in the values, as the index reached its highest points simultaneously with Bitcoin approaching a value of around $92,000.

This pattern seems hopeful and might lead to more growth, implying that taking long positions right now could still be a good move.

Furthermore, it was also disclosed that institutions have been purchasing Bitcoin, with Michael Saylor revealing a potential $42 Billion allocation ahead of schedule for MicroStrategy’s three-year plan.

Read Bitcoin (BTC) Price Prediction 2024-25

MSTR has already bought 66% of next year’s $10 Billion target in just 10 days.

The growing interest in Bitcoin, along with MSTR’s ongoing purchases signaling another intention to acquire more Bitcoin, suggests there may still be opportunities for long-term investment in Bitcoin.

Read More

2024-11-19 14:31