-

Crypto analyst suggests Lido (LDO) might rally to targets of $8.8, $16.6, and even $36.9.

Despite bearish trends, key metrics indicate a potential change in market direction for LDO.

As a seasoned researcher with over two decades of experience in financial markets, I have witnessed countless bull and bear cycles. The recent analysis on Lido [LDO] has piqued my interest, given its potential for a multi-month rally. However, as someone who’s been around the block a few times, I always take these predictions with a grain of salt.

Over the course of the past year, I’ve noticed a persistent downtrend for Lido [LDO], with a significant drop of approximately 35% in value year-to-date. This downward trend has persisted even on shorter time frames, as evidenced by the 3.3% decrease in LDO over the last 24 hours. The price has now dipped below the psychologically significant level of $1, adding to the bearish sentiment surrounding this cryptocurrency.

Now, LDO is being traded at $0.9919, representing a noticeable decrease from its peak of $1.03 within the last 24 hours. However, even with this persistent downward trend, certain analysts anticipate an upcoming bullish reversal.

Bullish turnaround ahead for Lido

Based on a recent examination by CryptoBullet regarding X, it appears that LDO could potentially experience a prolonged upward trend over several months. The analyst’s interpretation of LDO’s weekly chart reveals a striking “Leading Diagonal” structure, suggesting now might be an advantageous time to invest in the asset.

The analyst noted:

As a cryptocurrency investor, I find this chart quite appealing, with its striking Leading Diagonal pattern. In my opinion, this would be an ideal time to consider investing in LDO. I’m optimistic about a potential long-term rally that could last for several months.

CryptoBullet set forth three targets for the potential rally: $8.8, $16.6 (the main target), and $36.9 if the bullish momentum intensifies. While this outlook appears promising, it is worth delving into LDO’s fundamental metrics to assess the likelihood of such a rally.

Active addresses and open interest

Investigating the basic aspects of LDO gives us a clear understanding of the asset’s present condition. Among the crucial factors to consider, one stands out: the level of retail involvement, which can be gauged by the quantity of active wallets engaging with the network.

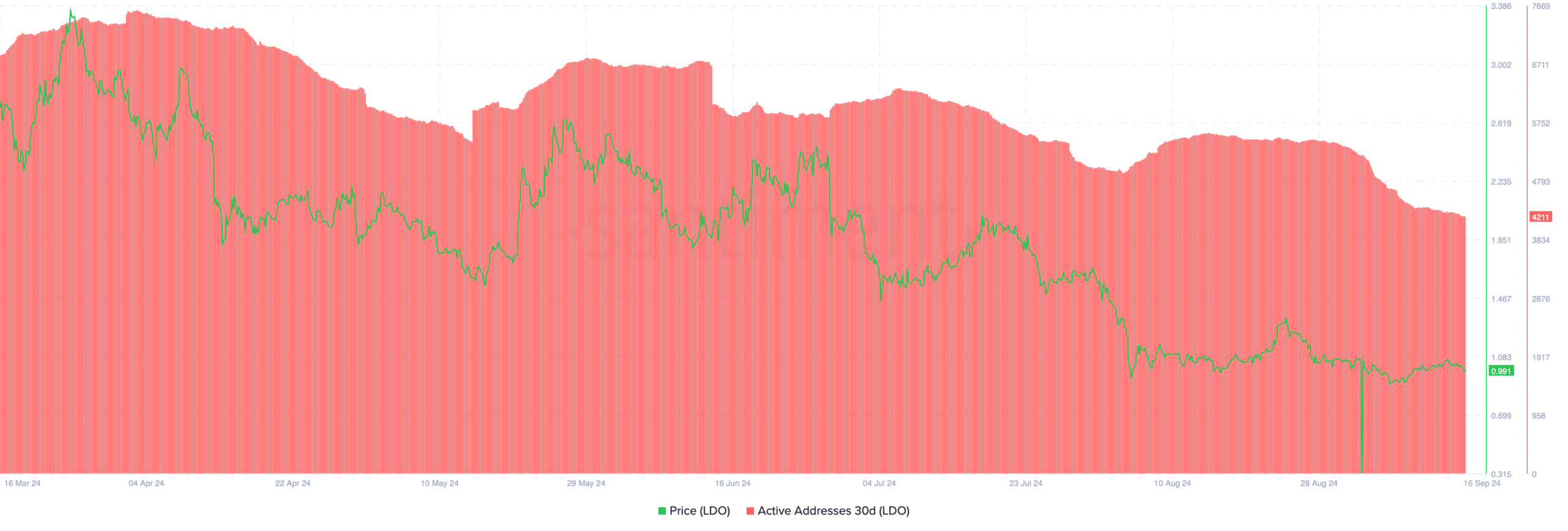

According to Santiment’s data, there has been a steady decrease in the number of active LDO addresses since hitting over 7,500 in April. The most recent statistics show that this figure now stands at approximately 4,211, which is almost a 5% decrease compared to the 5,000 active addresses reported last month.

The drop in actively used addresses may indicate decreasing retail enthusiasm towards LDO, a situation that might affect its market dynamics. Generally speaking, when the number of active addresses goes down, it often means less activity on the network, possibly suggesting a decrease in user engagement or trust among individual investors.

In simple terms, this fall could add more weight to Lower Downtown’s (LDO) price in the immediate future, making it tough for the asset to escape its present negative trend and rise again.

Should the anticipated surge take place and the general market mood improves, I might observe a rise in active wallets, hinting at heightened investor enthusiasm.

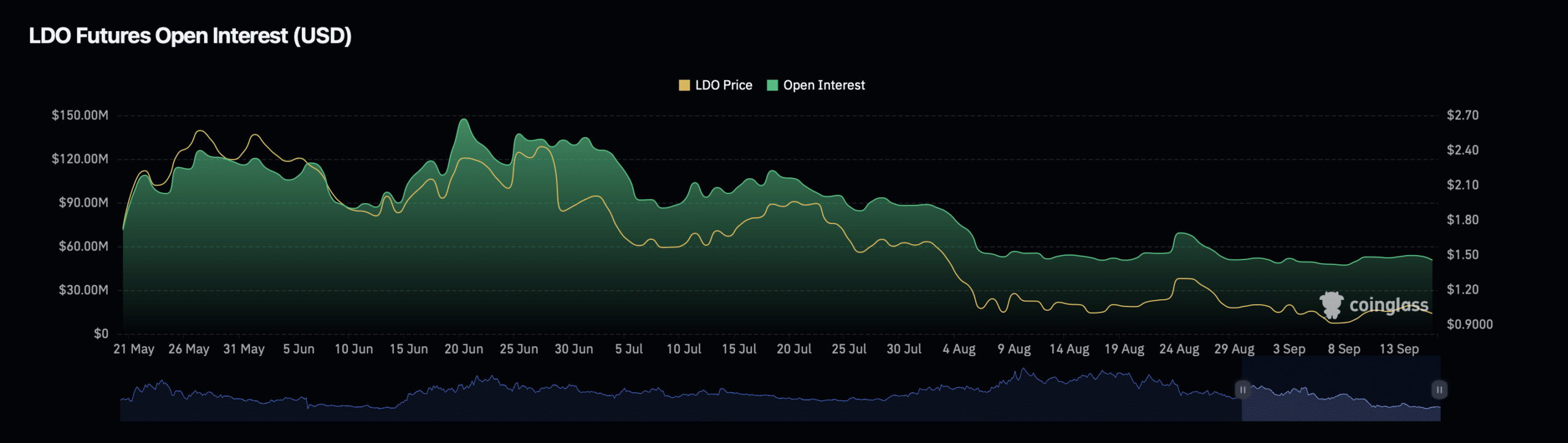

Beyond just observing retail transactions, looking at the open interest gives a more comprehensive perspective on the positions held by various market players regarding LDO.

According to Coinglass data, LDO‘s open interest value dropped by about 3.95%, now standing at approximately $49.95 million. However, the volume of open interest transactions for this asset increased substantially, going up by around 68.91% to reach $63.21 million.

What about prices?

This divergence in open interest metrics suggests that while the total value of active contracts has decreased, the number of contracts being traded has surged.

Based on my years of trading experience, this situation might signal heightened speculative activity as traders seem to be aggressively positioning themselves in anticipation of a possible price shift. I have seen similar patterns before, and when this happens, it can potentially lead to significant market movements. It is important for me to stay vigilant and adapt my strategies accordingly, given the increased volatility that often follows such activity.

Realistic or not, here’s LDO’s market cap in BTC’s terms

Increased trade activity, even though the total value of these trades is decreasing, could suggest that traders are preparing for a potential change in market direction.

Should CryptoBullet’s optimistic prediction come true, the heightened trading actions might generate enough thrust for LDO to break free from its present declining trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-16 13:12