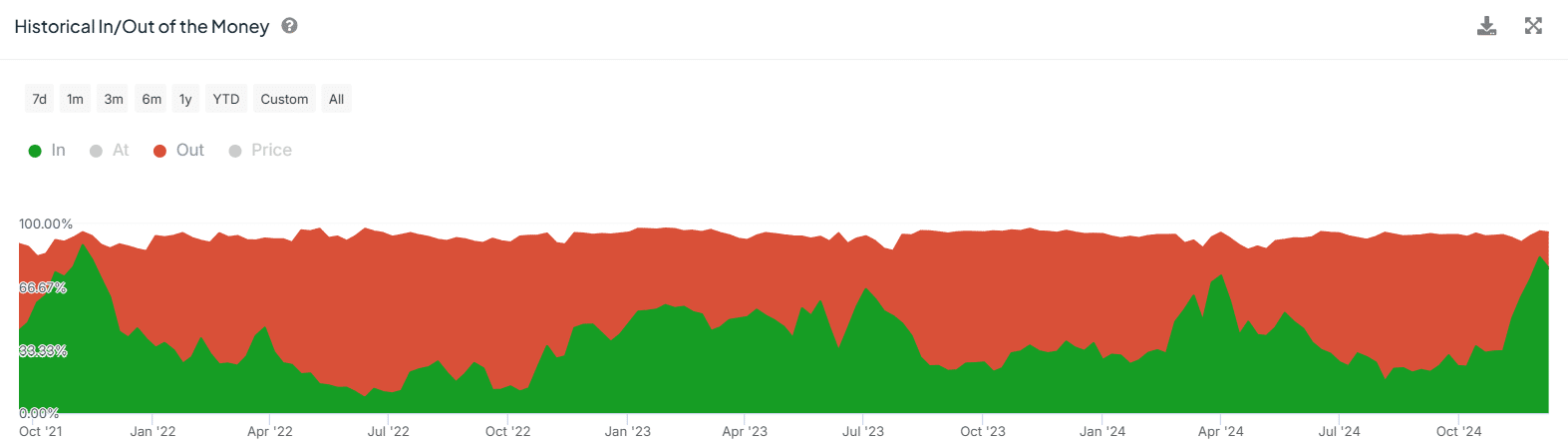

- Percentage of Litecoin wallets in profit has risen to its highest level since 2021 after recent gains

- A bearish reversal is likely after an inverse cup and handle pattern on the lower timeframe

As a seasoned crypto investor with a decade of experience under my belt, I’ve seen the market ebb and flow like the tide. The recent surge in Litecoin’s price has been intriguing, to say the least. On one hand, I see the percentage of Litecoin wallets in profit at its highest since 2021, a clear sign of market confidence. On the other, analysts like Ali Martinez are raising red flags about the coin’s lack of strong fundamentals and declining address count.

EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

Market chaos looms — top analysts release an urgent forecast you must see!

View Urgent ForecastOver the last month, Litecoin (LTC) has surged by more than half, following a general upward trend in the altcoin market. Yet, there are certain analysts who predict that Litecoin might not survive, despite this recent surge.

In a recent blog post, well-known analyst Ali Martinez pointed out that Litecoin’s current price is identical to what it was in the year 2017. Furthermore, he expressed the view that at present, there seem to be insufficient robust foundations to support any prolonged growth.

As he explains, although Long Term Capital (LTC) may see some temporary increases, it’s likely to remain trapped within a long-term price band or consolidation phase.

Litecoin wallet profitability hits 2021 highs

Regardless of the bearish sentiment, it’s worth noting that Litecoin has experienced significant gains recently, causing a spike in the number of wallets generating profits to levels not seen since 2021. In fact, as reported by IntoTheBlock, about 78% of Litecoin holders, or approximately 6.33 million wallet addresses, are now profiting from their investment.

Conversely, the wallets that are in losses have dropped from 46% to 16% in just one month.

An uptick in Litecoin’s wallet earnings might boost investor trust, potentially fostering an optimistic perspective toward Litecoin.

On the other hand, some traders who purchased initially and others who joined the surge may decide to sell their holdings, potentially leading to a decrease in the trend’s strength.

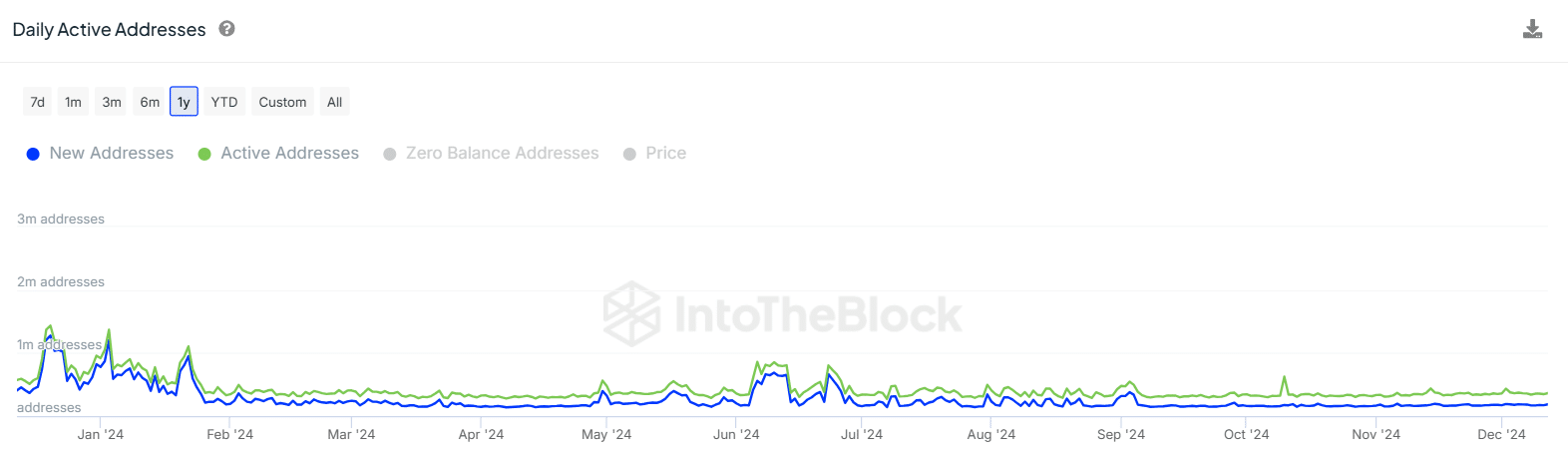

Is a high address count a positive indicator?

At the moment of reporting, there were approximately 364,000 active Litecoin addresses – a significantly larger number compared to many other altcoins. For example, Cardano (ADA), an altcoin with a market cap four times greater, has only about 41,000 active addresses.

Contrarily, an examination of the big picture shows that the number of Litecoin addresses has been decreasing steadily. In fact, as recently as the beginning of this year, there were over a million active addresses.

It seems as though the implication is that Litecoin’s usefulness decreased this year, potentially leading to a drop in its price.

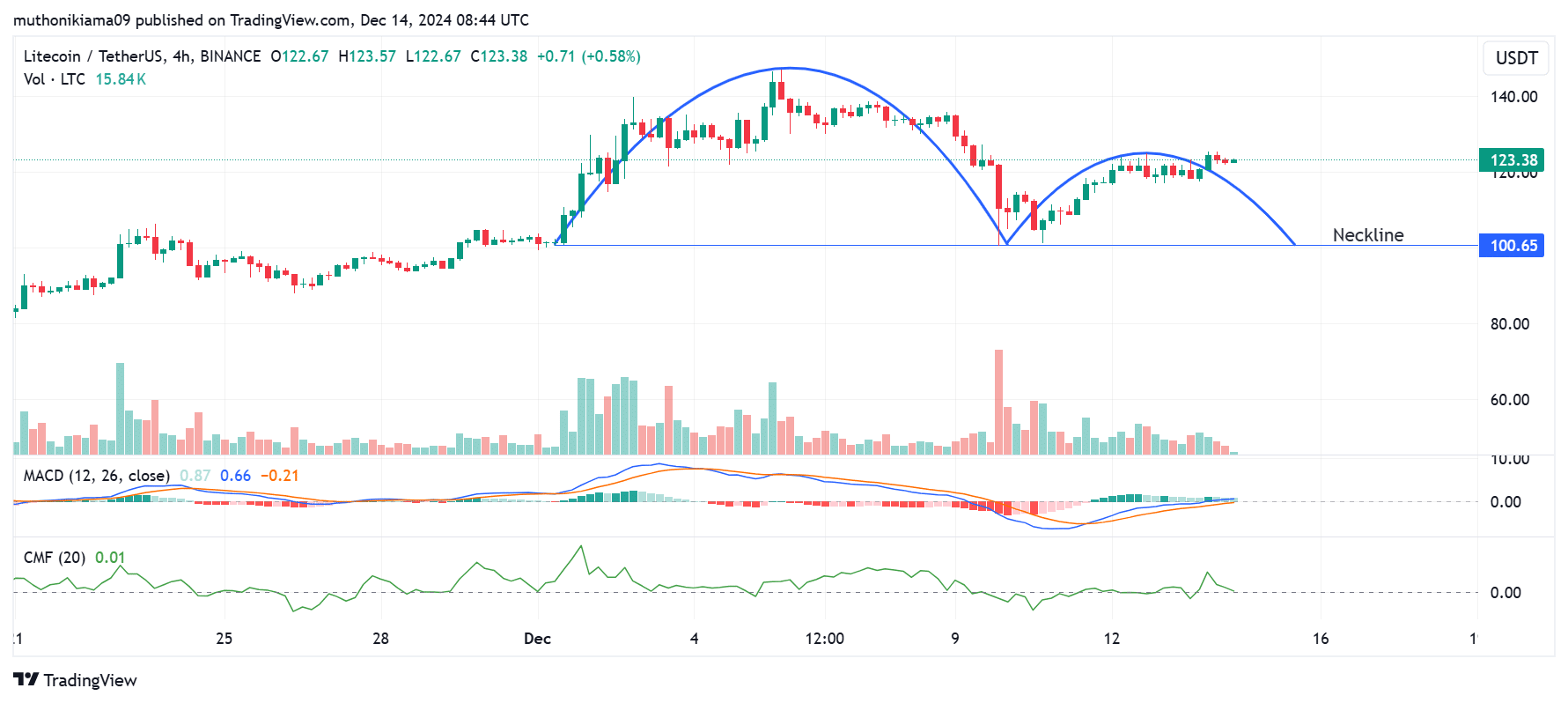

Litecoin price analysis as THESE bearish signs emerge

Currently, Litecoin is being exchanged for approximately $123, representing a 1.57% increase over the past day. However, this cryptocurrency might be approaching a downward trend following the appearance of an inverse cup and handle pattern in its four-hour analysis chart.

If Litecoin experiences a bearish trend and its price starts to fall, investors should keep an eye on the neckline of this pattern around $100.65. This is crucial because if it drops below this point, it might lead to further decreases in price.

Based on the Chaikin Money Flow (CMF), there’s been a noticeable decrease in buying pressure as it’s fallen close to or even touched the zero line. Should it turn negative, this might suggest an increase in selling activity, potentially foreshadowing a shift towards bearish market trends.

Simultaneously, the Moving Average Convergence Divergence’s (MACD) bars in the histogram suggested a low demand for purchasing. Yet, the MACD line on the smaller timeframe indicated a slight bullish trend persisted, as it was positive.

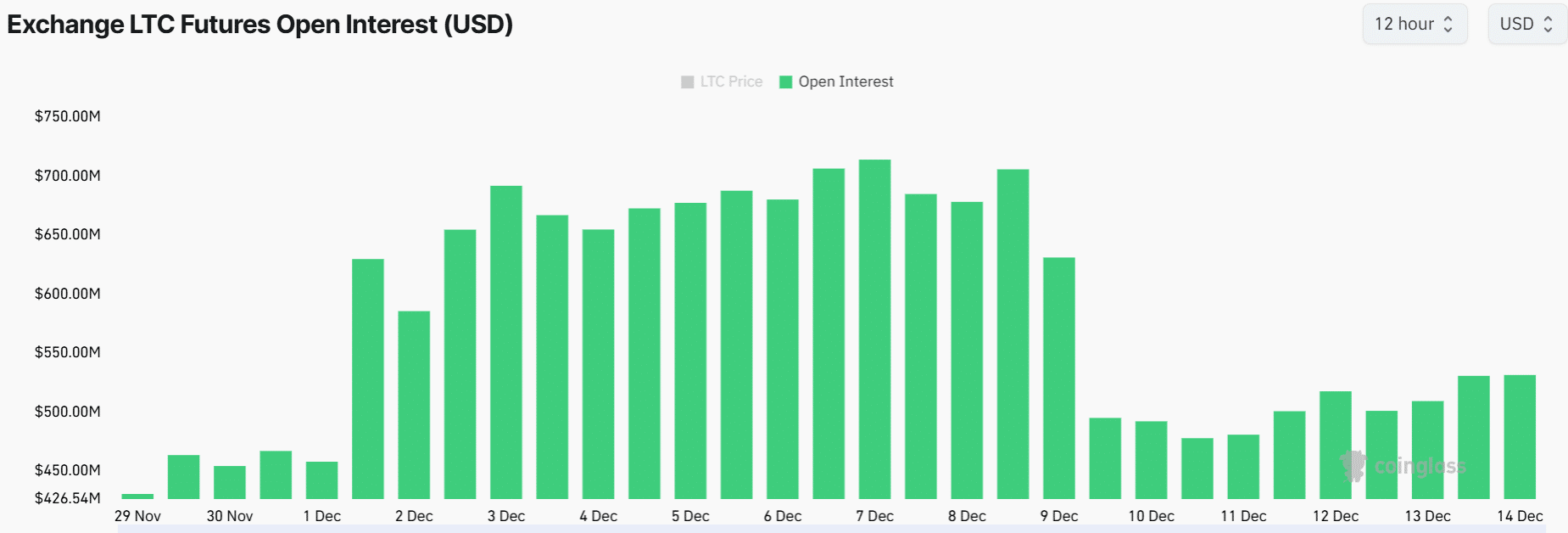

Litecoin’s Open Interest drops

Ultimately, data from Coinglass showed that the level of speculative interest in Litecoin decreased following its multi-month high earlier this month, as the Open Interest (OI) peaked at $706 million.

As reported at the current moment, the Open Interest for Litecoin stood at approximately $531 million – Indicating that certain traders may have liquidated their positions.

A decrease in Open Interest (OI) might suggest a bearish attitude among traders, as they seem more cautious and uncertain, leading to less active participation in the market.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-12-15 05:12