- Oh darling, 77.7% of Litecoin holders are long-term investors, outshining Bitcoin and Ethereum!

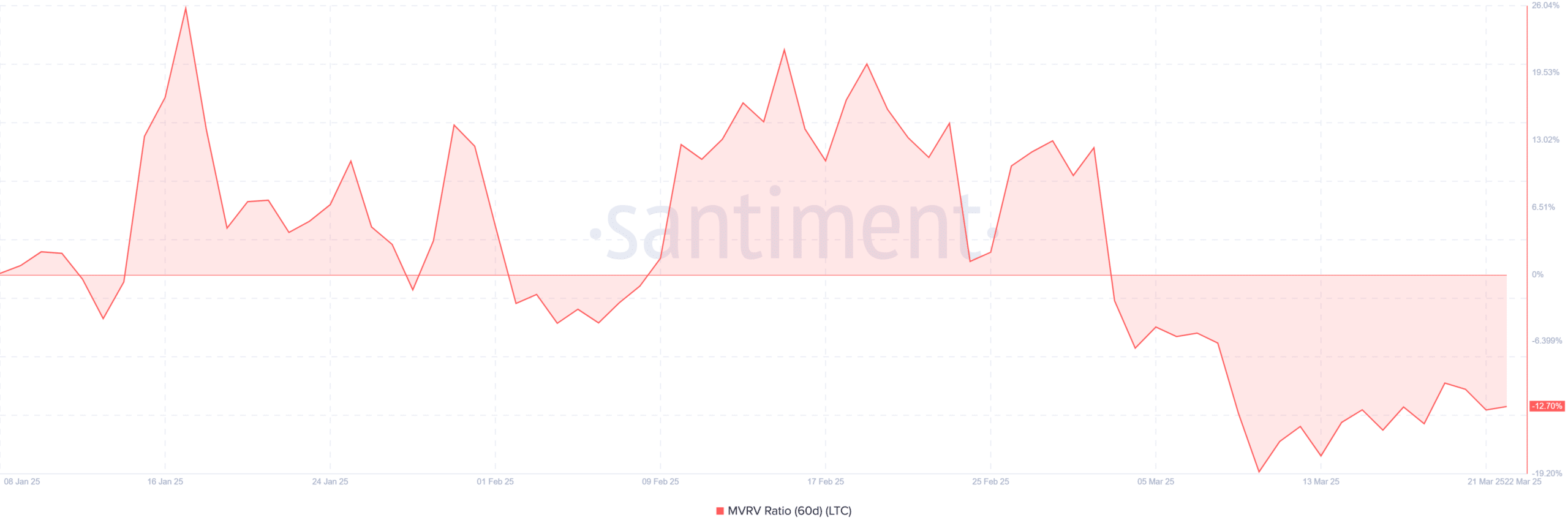

- But alas, despite their steadfast HODLing, LTC’s 60-day MVRV is a dismal -12.7% – a sign of short-term misery!

Ah, Litecoin [LTC], the darling of the crypto soirée, boasts a loyal investor base. Yet, its short-term profitability is as gloomy as a rainy day in London. According to the ever-reliable IntoTheBlock, a staggering 77.7% of all LTC holders are long-term holders [LTH]. It seems they have more faith than a cat in a room full of rocking chairs!

While this shows a delightful conviction in the altcoin’s long-term value, one must point out that recent metrics suggest these holders are not exactly rolling in riches just yet. Quite the conundrum, wouldn’t you say?

Most of LTC’s supply is gathering dust

With over three-quarters of its holders keeping their assets as idle as a forgotten umbrella, Litecoin leads the pack in HODLer loyalty. Chainlink [LINK] and SHIB are trailing behind, like wallflowers at a dance, with 77.5% and 75.8%, respectively.

This loyalty is charming, but it also implies a rather low active turnover. A bit like a party where no one wants to dance, this can suppress short-term demand and limit any bullish momentum on the charts. Oh, the drama!

MVRV reveals Litecoin’s lackluster momentum

This long holding pattern becomes even more relevant when we consider the Market Value to Realized Value [MVRV] ratio.

Now, consider this – the 60-day MVRV for LTC is a rather sad -12.7% at press time. This indicates that most holders who acquired Litecoin in the last two months are, on average, feeling the pinch. A bit of a pickle, wouldn’t you agree?

Negative MVRV values often hint at undervaluation, but they can also indicate a broader market hesitance to buy into ongoing weakness. Quite the pickle, indeed!

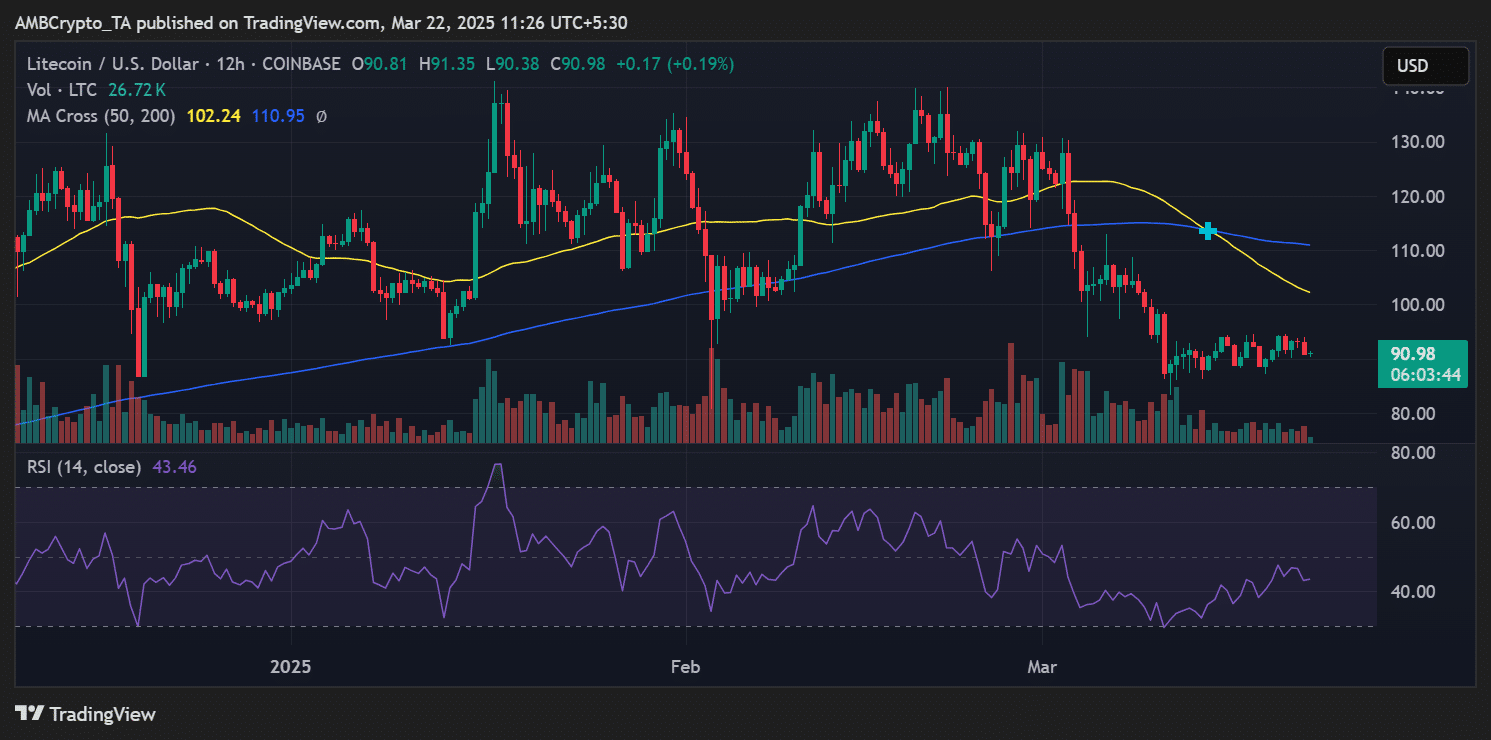

Price action reveals a struggle for recovery

On the price charts, Litecoin was valued at a rather pedestrian $90.98 at the time of writing.

The altcoin appears to be attempting to reclaim ground lost over the last few weeks, like a dancer trying to find their rhythm. However, despite its latest uptick, it still lags behind its 50-day [$102.24] and 200-day [$110.95] moving averages. Oh, the suspense!

With an RSI of 43.46, reflecting weakened momentum and no immediate signs of bullish divergence, LTC may remain trapped in a consolidation phase. It’s like waiting for the curtain to rise on a rather dull play without a decisive break above the $102-resistance.

In summary, while LTC’s high LTH percentage reflects a commitment from its holders, poor profitability and muted price action can be interpreted as signs of caution. A bit of a damp squib, if you will.

If accumulation continues, but the price remains below key moving averages, Litecoin could see extended sideways movement. Unless, of course, broader market sentiment improves or a catalyst sparks demand. So, my dear, the next few weeks will be quite the spectacle to behold!

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2025-03-23 01:14