- Litecoin has seen a 0.98% surge in the last 24 hours.

- Metrics point to rising whale activity and significant liquidation zones.

As a seasoned crypto investor with over a decade of experience in this volatile market, I’ve learned to read between the lines and interpret the subtlest of signals. Litecoin [LTC] has caught my attention today due to its modest surge of 0.67% over the last 24 hours. The chart is showing a stabilization near the critical support level at $61, which historically has been a strong foundation for this digital asset.

Over the past day, Litecoin (LTC) experienced a slight increase of 0.67%, igniting curiosity about the potential upcoming bullish trend change.

At the moment of reporting, the altcoin was rebounding from an important support point at $61, a crucial area that might influence its upcoming direction.

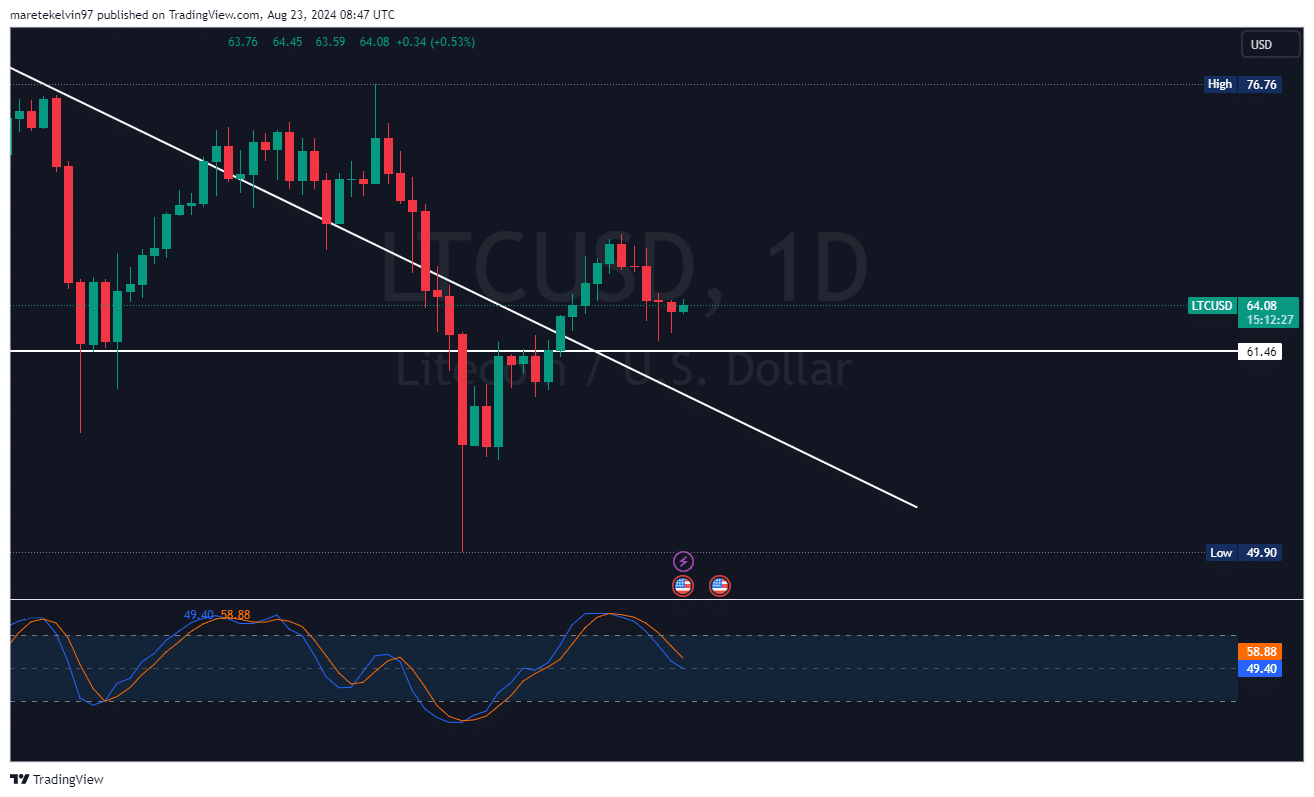

Over the past trading sessions, I’ve observed that Long Term Capital (LTC) seems to be experiencing downward pressure, with its price movement taking a shape resembling a descending triangle pattern on the charts. This suggests potential bearish trends ahead for LTC.

Based on my years of trading experience, I’ve noticed that when a pattern consistently indicates a downtrend and the price seems to be holding steady near a historically significant support level like $61, it can signal a potential reversal or at least a temporary pause in the downward trend. This is particularly true if this level has held strong in the past. As always, thorough analysis and careful monitoring are essential when making trading decisions.

Market watchers are currently keeping a keen eye on this particular level, hoping to spot indications of an impending rebound. This anticipation is backed up by the technical analysis using the Stochastic Relative Strength Index (RSI), which was almost ready for a bullish crossover in oversold territory at the moment of reporting.

If this merge occurs, it might imply that the selling pressure has weakened, possibly leading to an increase in prices.

LTC whales on the move

As per the latest data from Santiment, we’ve noticed a significant rise in major cryptocurrency transactions by ‘whale’ investors in recent times. Currently, approximately 55% of these whales are reportedly holding over $5 million in digital assets.

The increase in development indicates that large Litecoin (LTC) holders might be adopting a long-term investment strategy. Potentially, this could cause substantial fluctuations in the Litecoin price.

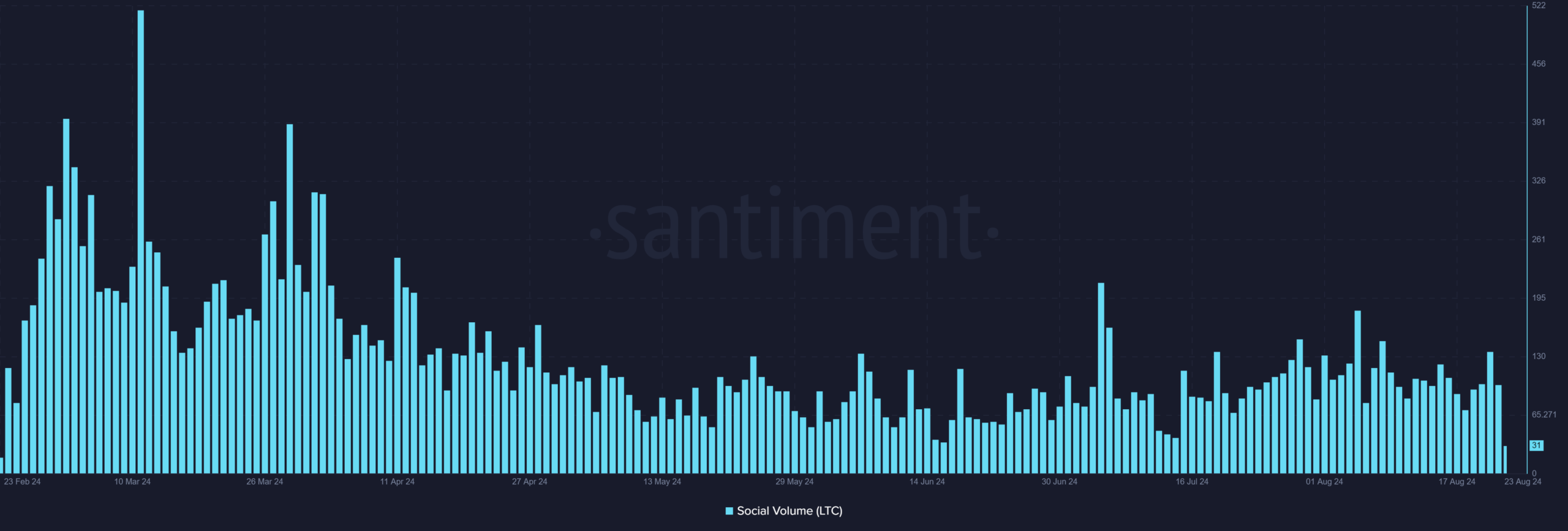

Additionally, there was an uptick in Litecoin’s Community Activity, reflecting a strong user interaction on the platform. Normally, when the conversation about Litecoin (LTC) is lively and widespread, curiosity tends to grow, leading to enhanced trading activity and potentially boosting its value.

Can LTC sidestep a major market shakeout?

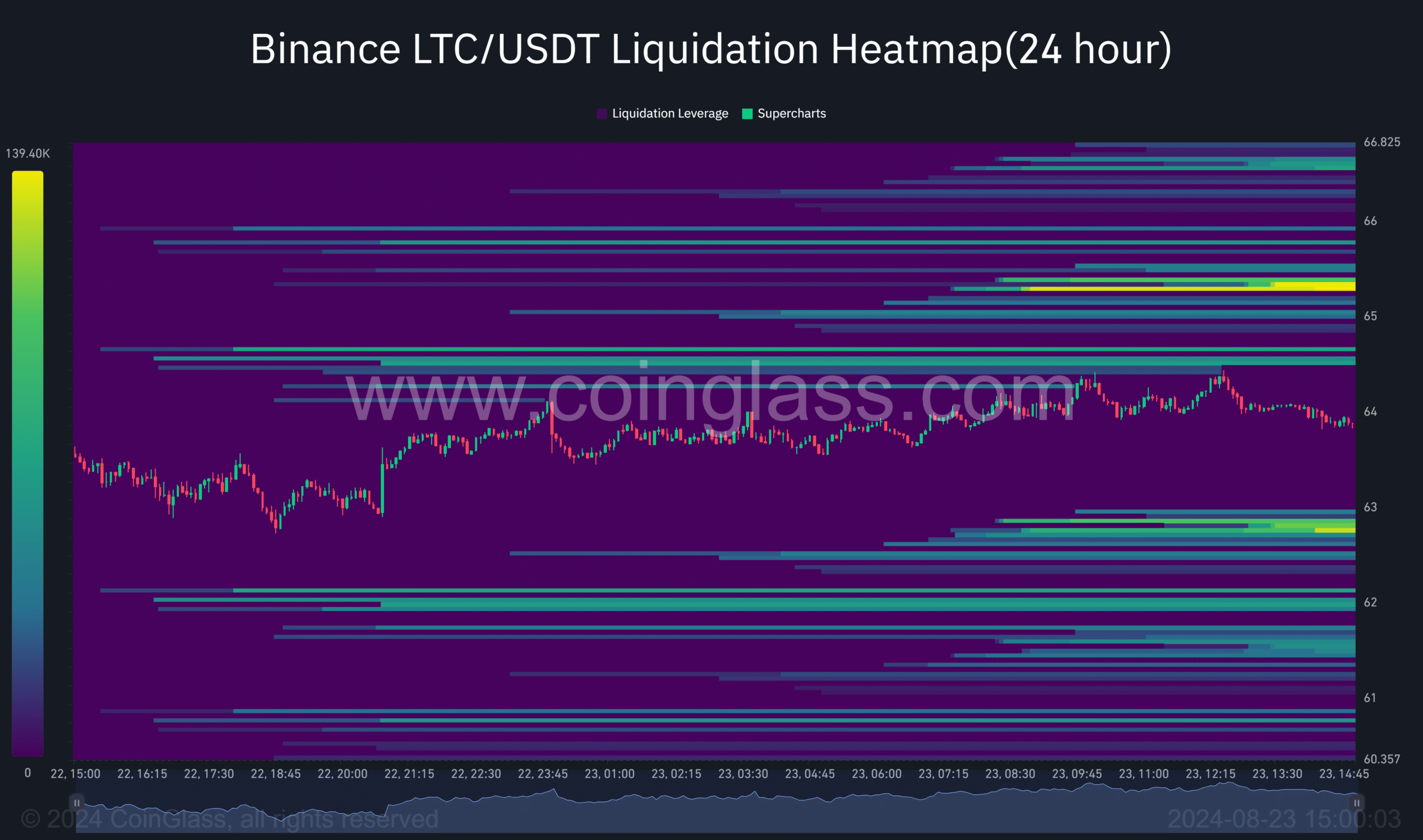

Based on AMBCrypto’s analysis of Coinglass’ heatmap data, there were groups of liquidations concentrated near the $65 support area. These liquidation concentrations could potentially attract LTC prices upward, acting like a magnetic force.

Read Litecoin’s [LTC] Price Prediction 2024–2025

Currently, Litecoin finds itself at a pivotal moment. Despite the steep price drops we’ve witnessed, a decline in bearish feelings combined with some specific on-chain information suggests that new record-breaking prices could be on the horizon.

As Long Term Capital (LTC) demonstrates increasing signs of optimism following its test at the $61 support, it could potentially continue in a positive trend as long as the favorable sentiment persists.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-08-24 05:11