- In a twist of fate, Litecoin has danced ahead of Bitcoin, propelled by liquidations, yet lurking risks remain in the shadows of market volatility.

- Analysts, those wise sages, implore caution as LTC grapples with formidable support challenges and the capricious nature of price fluctuations.

Ah, Litecoin [LTC], that mischievous little sibling of Bitcoin [BTC], has recently managed to outshine its elder in a fleeting moment of glory. Liquidations of bearish positions have sprinkled a bit of optimism among traders, but lo! The wise analysts, with their furrowed brows, are waving caution flags like a race car driver in a storm.

Despite this jubilant rally, the market remains a tempestuous sea, where risk management is not just a suggestion, but a lifeline!

LTC’s short-term performance – Liquidations fuel the rally, but caution is required

In the last 24 hours, Litecoin has taken a 5.54% tumble, trading at $119.74 after a brief flirtation with $127.30. Yet, in this chaotic ballet, LTC has still managed to outpace Bitcoin in the short term. The liquidation of those bearish positions likely gave LTC a temporary boost, akin to a sugar rush before the inevitable crash.

Data, that fickle friend, suggests that while LTC enjoyed a robust rally in mid-February, a rejection at key resistance levels hinted at profit-taking and a cloud of uncertainty hanging over the market like a bad smell.

Meanwhile, Bitcoin, in a dramatic twist, saw a 20.51% decline before staging a recovery, reflecting the broader malaise of the market. Analysts, ever the cautious guardians, have stressed the importance of stop-loss levels, as volatility reigns supreme with key LTC support at $114 and $110.

Litecoin market analysis

Recent analysis has unveiled a dynamic market landscape, akin to a circus where the performers are both thrilling and terrifying.

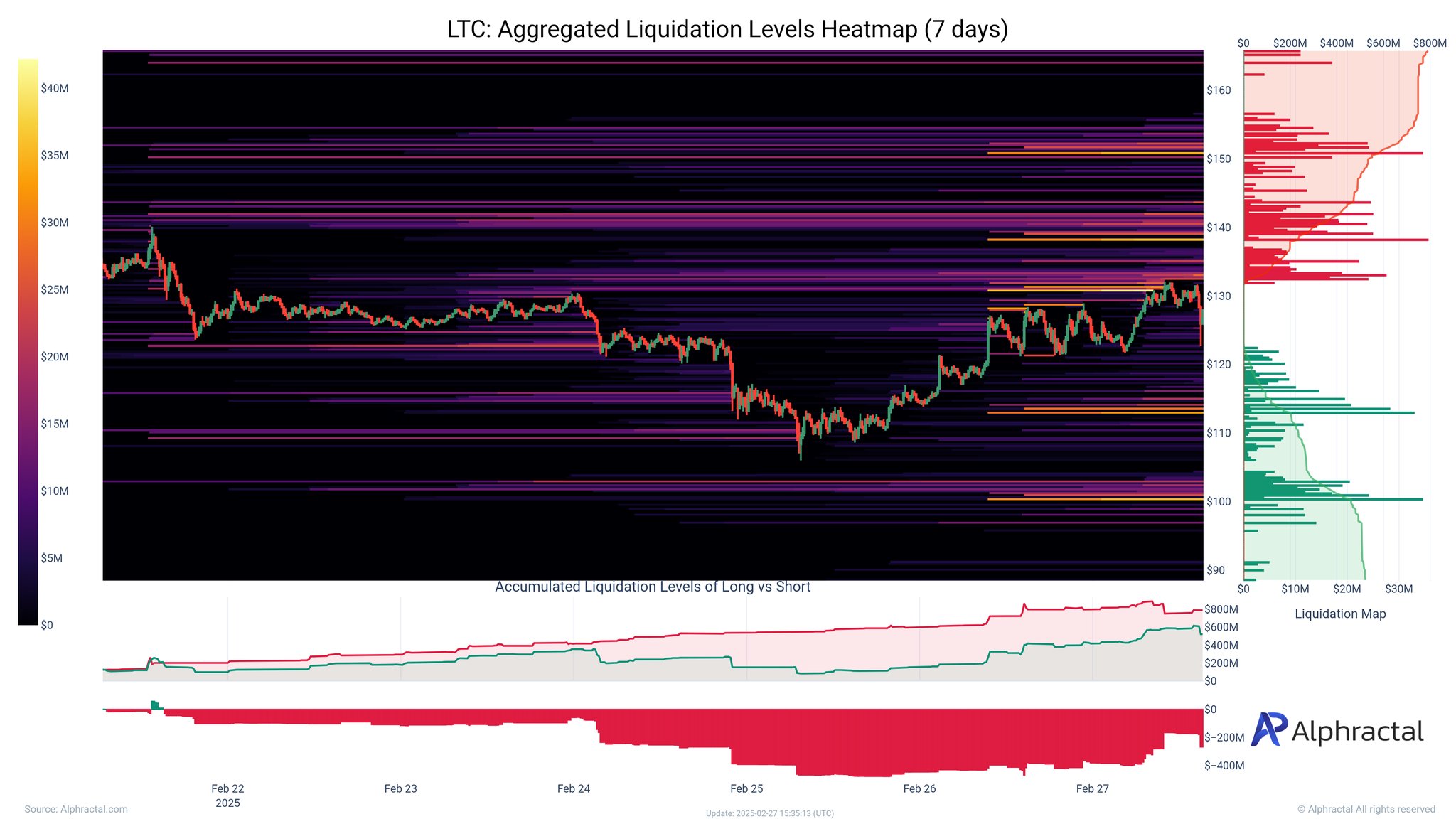

A seven-day liquidation heatmap revealed a flurry of activity at key levels – strong short liquidations near the $130 resistance and long liquidations near the $110 support. The cluster of short liquidations above $130 suggested that bearish positions were squeezed like a lemon in a cocktail as LTC attempted to rally.

This rally, dear reader, was largely driven by short liquidations, a spectacle to behold!

However, as LTC approaches the $110-level, long liquidations will become more pronounced, signaling potential downside risk if selling pressure increases. The overall trend also highlighted more short liquidations than longs – reinforcing that bears were unceremoniously booted out during the upward move.

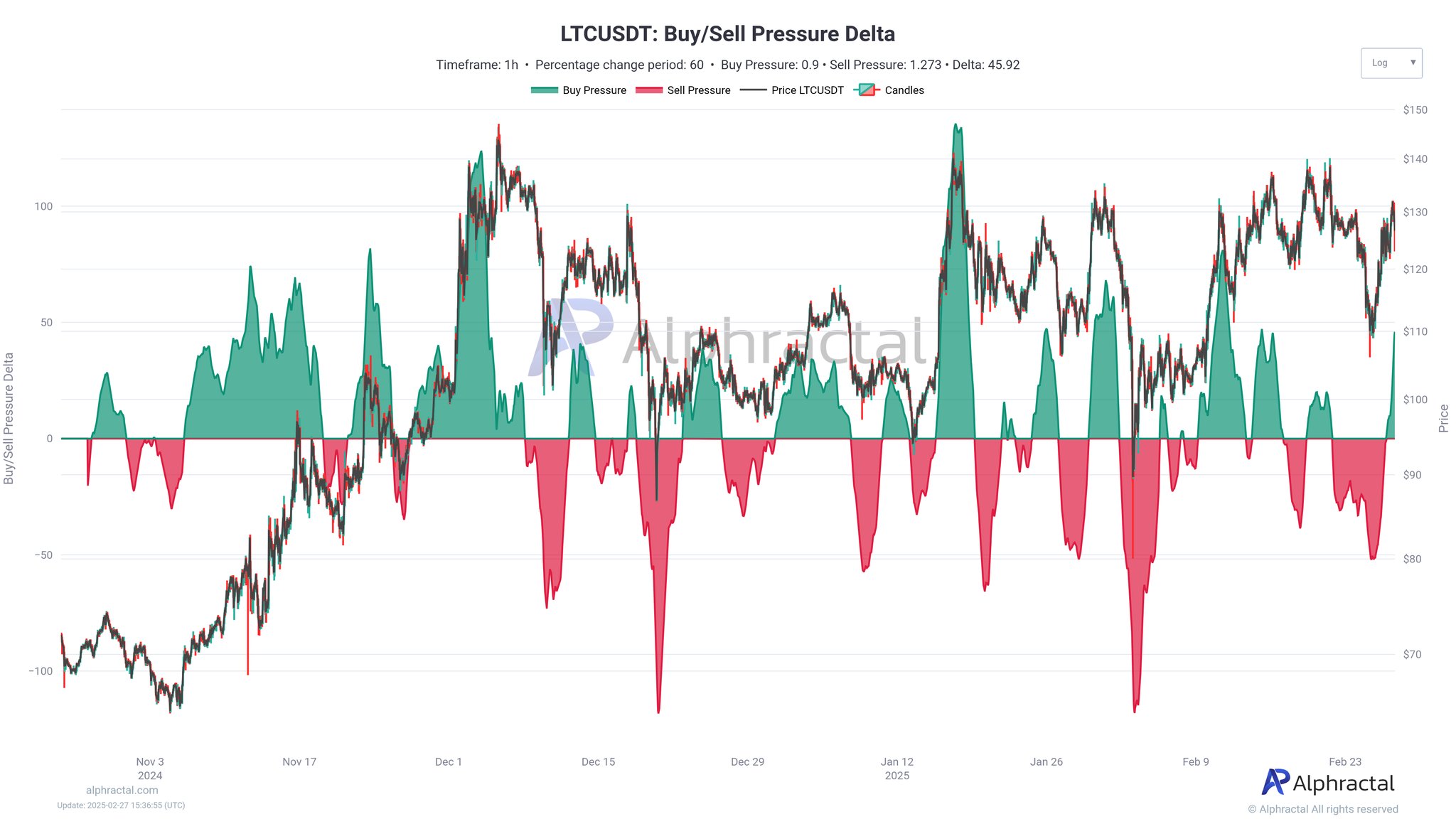

The buy and sell pressure chart underlined key moments of accumulation and distribution, like a soap opera with unexpected plot twists.

During LTC’s rally, buy-side dominance pushed the price higher. As momentum slowed, sell pressure increased, suggesting profit-taking or a shift in sentiment. Despite this, demand has remained strong near support, hinting at a potential rebound if LTC stabilizes, much like a cat landing on its feet.

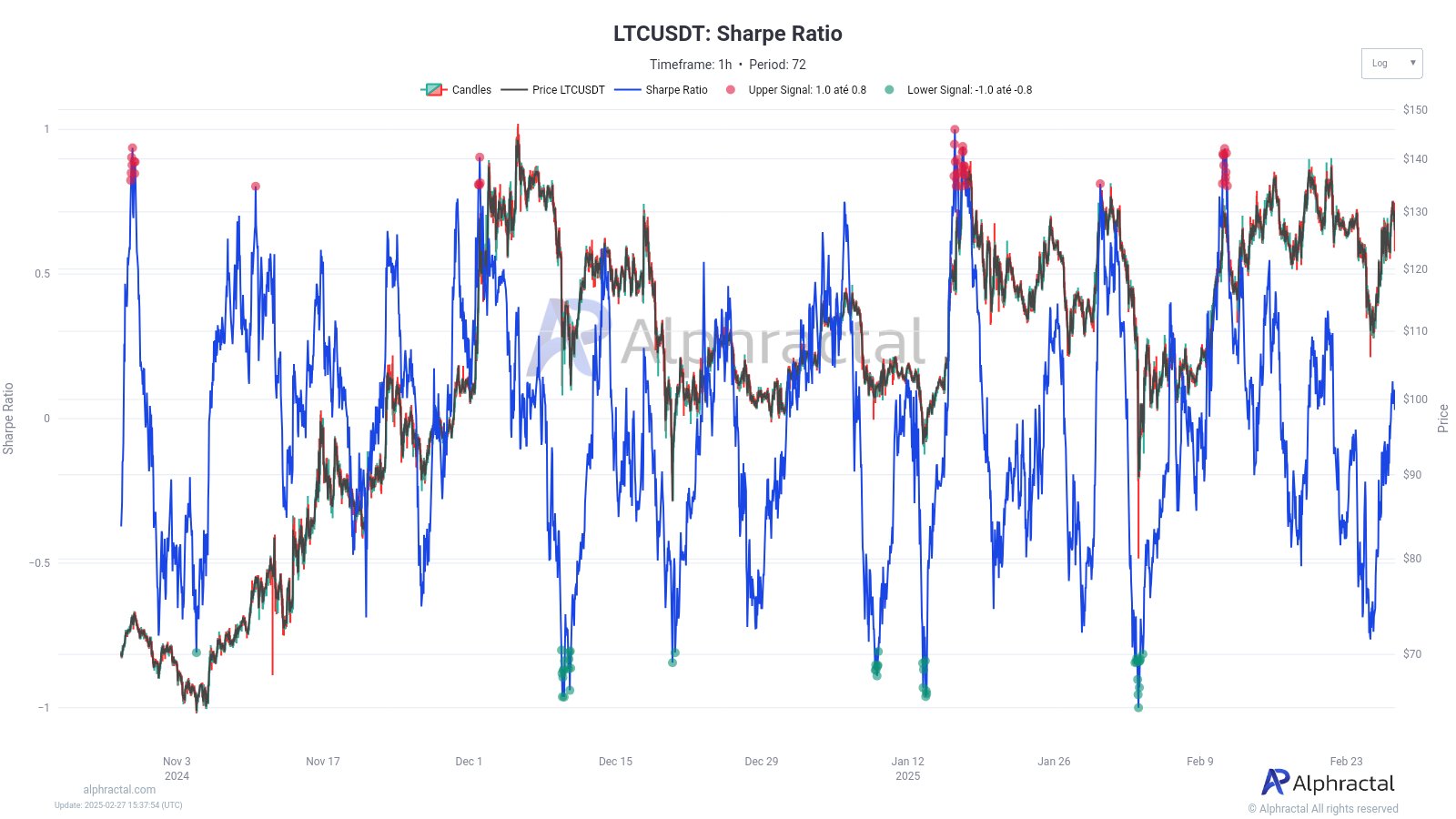

Finally, the Sharpe Ratio, with spikes above 0.8, signals overbought conditions where returns outpace risk, often leading to corrections. Conversely, dips below -0.8 indicate undervaluation, where risk outweighs potential returns, like a bad investment in a failing circus.

At the time of writing, LTC’s Sharpe Ratio seemed to be rebounding from a recent low – a sign that while volatility persists, risk-adjusted returns may improve in the near future, much to the delight of the hopeful traders.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-03-01 09:14