- At the time of writing, Mantle appeared to be doing a rather splendid impression of a bearish swing structure on the weekly timeframe, much like a sad puppy left out in the rain.

- Its drop below $1.03 was akin to a dramatic exit from a party, revealing a bearish structure break on the daily chart.

On the fateful Friday of February 21, Mantle [MNT] decided to take a nosedive, plummeting a staggering 13%. Now, one might say the trading volume has been as robust as a butler on a caffeine high in recent weeks, suggesting that a quick recovery for our dear altcoin is as likely as a cat attending a dog show.

Mantle’s price action showed multiple bearish signals

The key swing levels on the weekly timeframe were at $1.51 and $0.56 (white), respectively, for April and January 2024. Since then, MNT has made a (marginally) lower low at $0.549 and a lower high at $1.39 (yellow). It’s like watching a game of limbo, and the bar keeps getting lower!

This delightful display confirmed that the weekly swing structure was indeed bearish. The daily market structure has also joined the gloomy party. The recent drop below $1.03 was the cherry on top of this bearish cake.

Moreover, the price took a tumble to the 75% level of the former range formation (purple) at $0.83, testing it as support. Over the coming days, the $0.915-$0.956 zone is expected to serve as a supply zone, much like a buffet that’s just a tad too rich for the average swing trader’s taste.

The technical indicators were in agreement, like two old chums at a pub. The CMF was at -0.1, highlighting significant capital outflows, while the DMI was waving a big red flag, indicating a strong bearish trend on the daily charts, with both the ADX and -DI above 20. This was in perfect harmony with the bearish market structure previously mentioned.

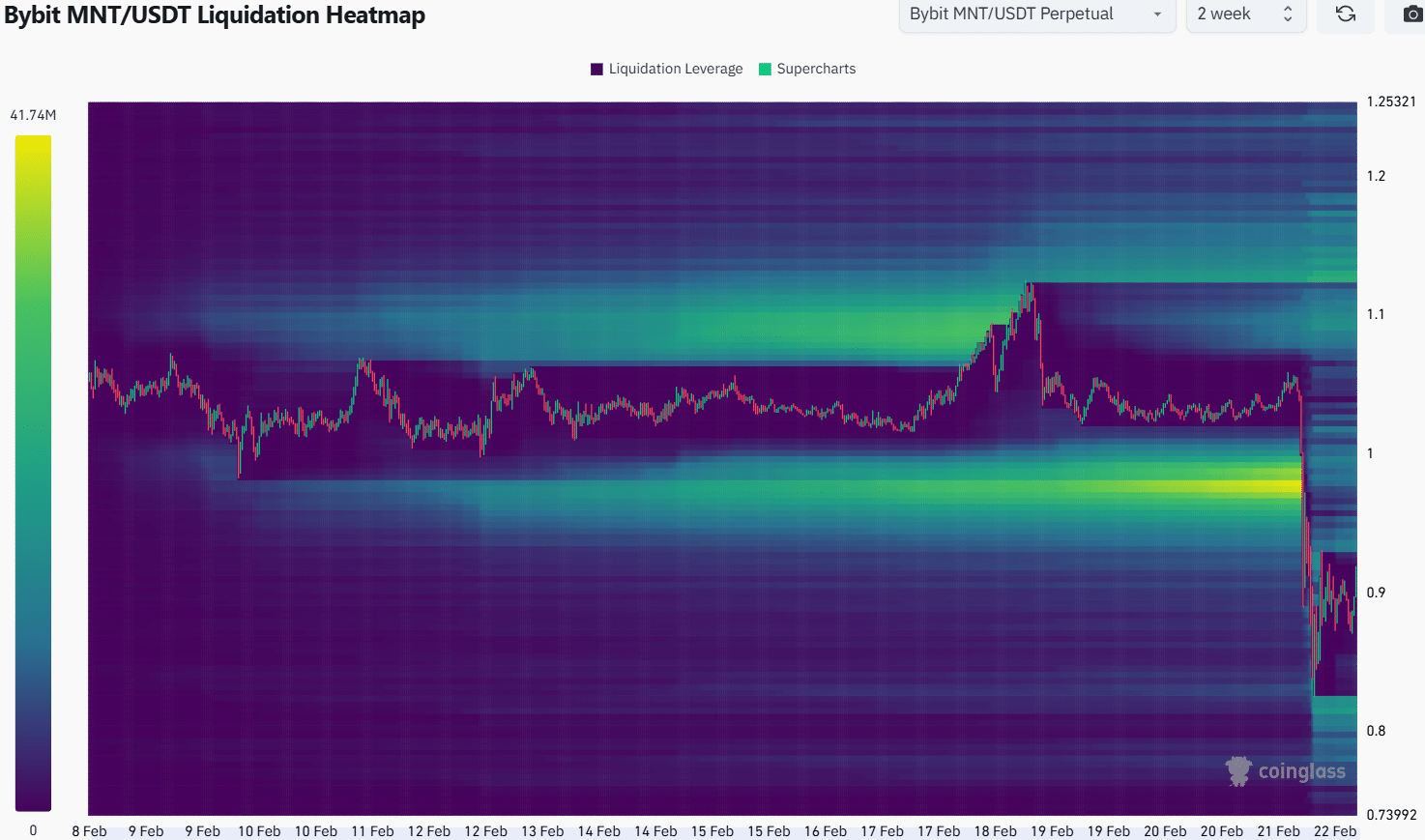

The liquidation heatmap revealed that a cluster of liquidity around $1 was obliterated during the altcoin’s recent losses, much like a soufflé in a thunderstorm. This cascade of long liquidations likely contributed to the recent price move to $0.83.

After such a vigorous move, the price would likely settle around the $0.9-mark, giving time for liquidation levels above and below to build, like a well-prepared tea party. The price can then visit both pockets before its next impulse move, which is as unpredictable as a cat on a hot tin roof.

It remains a mystery which one would be tested first, but swing traders can bide their time for a move towards $0.95-$1.03 before entering. A move beyond $1.1 would invalidate the bearish setup, hence, it can be used to set stop-loss orders, much like a safety net for a tightrope walker.

Read More

2025-02-22 16:10