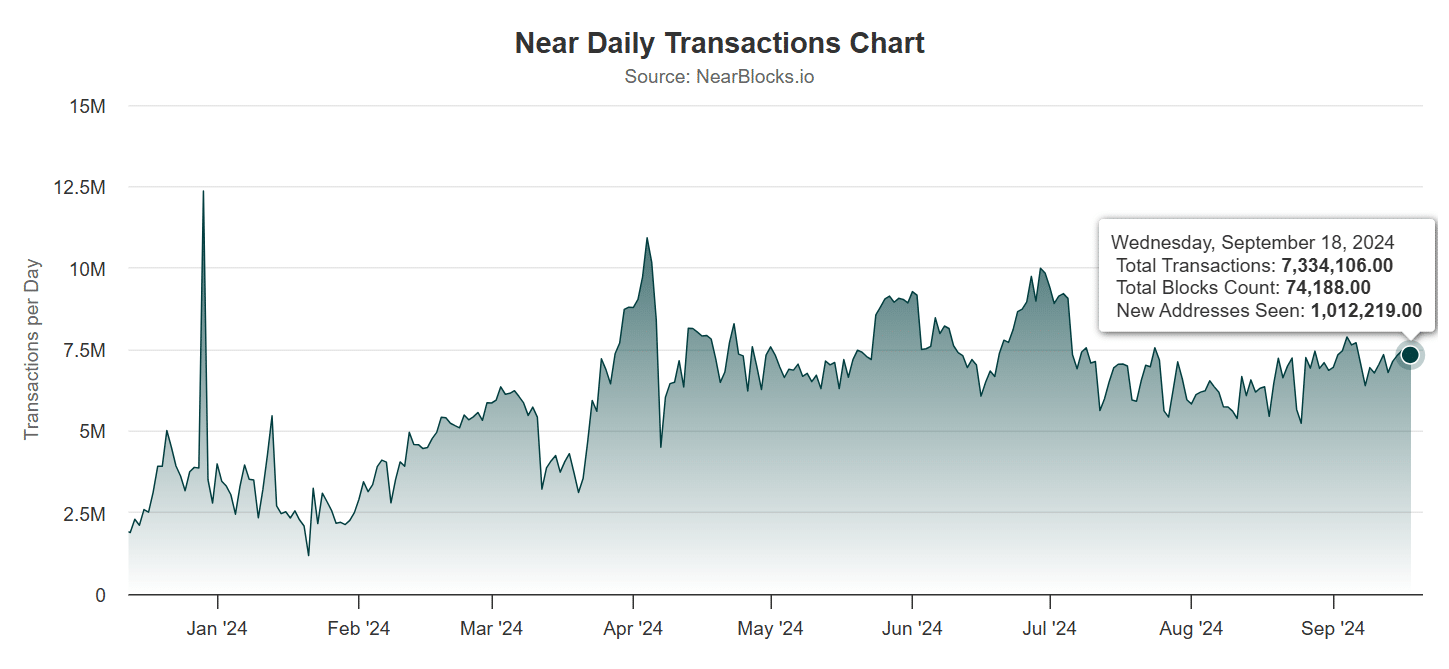

- Near Protocol has seen a massive surge in daily transactions, suggesting high network usage.

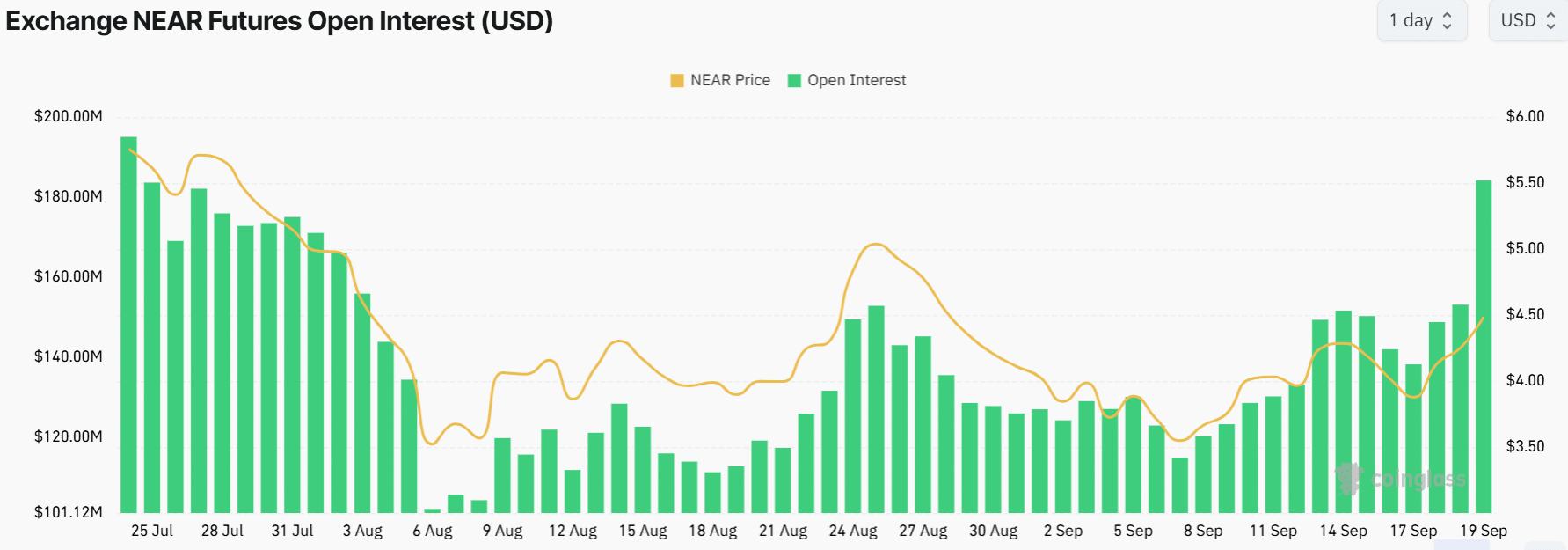

- The network growth and high Open Interest suggested long-term bullish outlook.

As a seasoned cryptocurrency investor with over a decade of experience under my belt, I must say that the recent surge in Near Protocol (NEAR) has caught my attention. The massive increase in daily transactions and the network growth suggest high network usage, which is always a good sign. The fact that the daily transaction count is approaching a two-week high of 7.33M and new addresses joining the network at the rate of 900,000 per day since September 5th, is nothing short of impressive.

Near Protocol [NEAR] traded at $4.47 at press time after a 12% gain in price.

The surge was fueled by optimistic backing from the wider market, with many coins increasing in value after the Federal Reserve announced a reduction in interest rates.

NEAR’s trading volumes were up by more than 90% at the time of writing per CoinMarketCap.

Such a parabolic rise in volumes suggested that the recent gains stemmed from buying activity, triggering concerns about the rally’s sustainability.

However, on-chain data suggested that NEAR’s long-term outlook was positive.

Daily transaction count surges

As an analyst, I observed a substantial surge in the daily transaction data from NearBlocks, with the figure now nearing a two-week peak of approximately 7.33 million.

Over the past seven days, I’ve noticed a steady increase in daily transactions on the protocol, with the figure reaching 6.7 million just a week ago. This suggests that network activity has been quite high recently, which in turn could be driving up demand for NEAR.

Concurrently, we’ve seen a substantial increase in the number of daily addresses on the blockchain this month. Initially, it was around 687,000 at the beginning of the month.

Since the 5th of September, approximately 900,000 new addresses are added to the network each day.

As a researcher delving into blockchain data, I discovered through DappRadar that the substantial number of transactions wasn’t solely attributed to trading actions, but also stemmed from active usage within Decentralized Applications (DApps).

Weekly transfers of decentralized applications (dApps) on the network have risen by approximately 14%, exceeding $182 million per month. On the other hand, the monthly dApp volumes have decreased by a substantial 54%. This drop may be connected to fluctuations in NEAR‘s value.

Open Interest reaches eight-week high

Derivative traders are finding NEAR increasingly intriguing, as the Open Interest (OI) has soared to a peak of $184 million at the moment of reporting, marking the highest level seen since the 25th of July.

Since the beginning of August, NEAR‘s Open Interest (OI) has been steadily increasing, according to Coinglass. This trend indicates that traders have been creating new positions, as they anticipate potential price increases in the future.

Concurrently, NEAR‘s Funding Rates stood at a favorable 0.0112%, marking their highest level since June. This implies a growing interest in maintaining long positions.

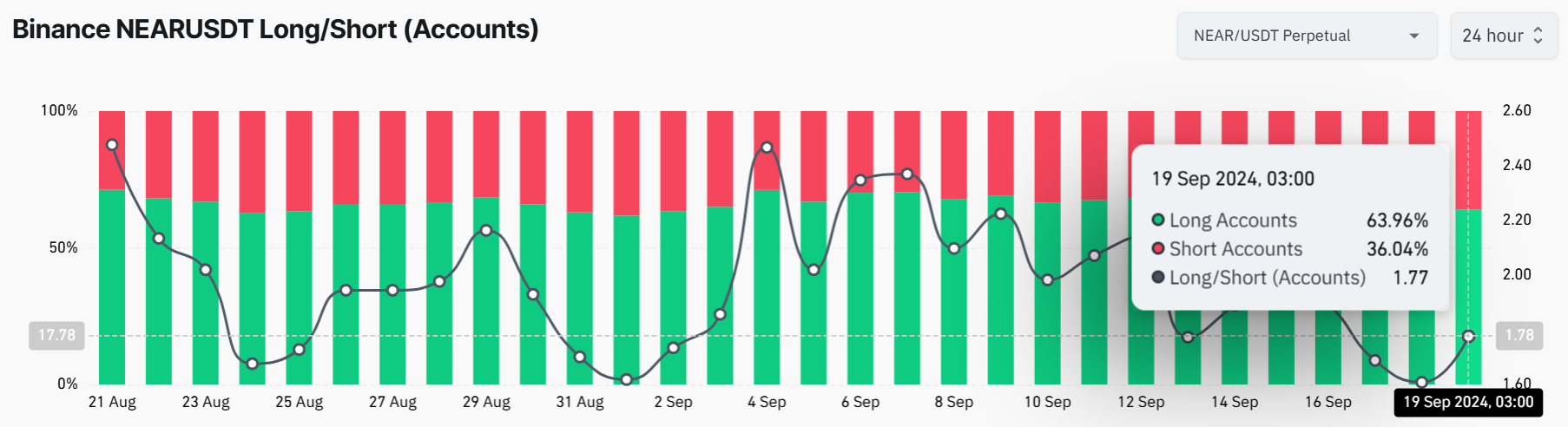

According to Coinglass’ analysis, traders on Binance have primarily held a long position on NEAR since August, suggesting they are optimistic about the altcoin and expect its price to rise.

A potential factor fueling optimism could be the increasing popularity of cryptocurrencies related to Big Data and Artificial Intelligence.

Read Near Protocol’s [NEAR] Price Prediction 2024–2025

Over the past month, I’ve observed a significant surge in the total market capitalization of these digital coins. From a value of approximately $22 billion as previously recorded, it currently stands at around $32 billion according to CoinMarketCap at this moment.

NEAR is the largest AI crypto currently, dominating more than 15% of this market cap.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-20 08:08