-

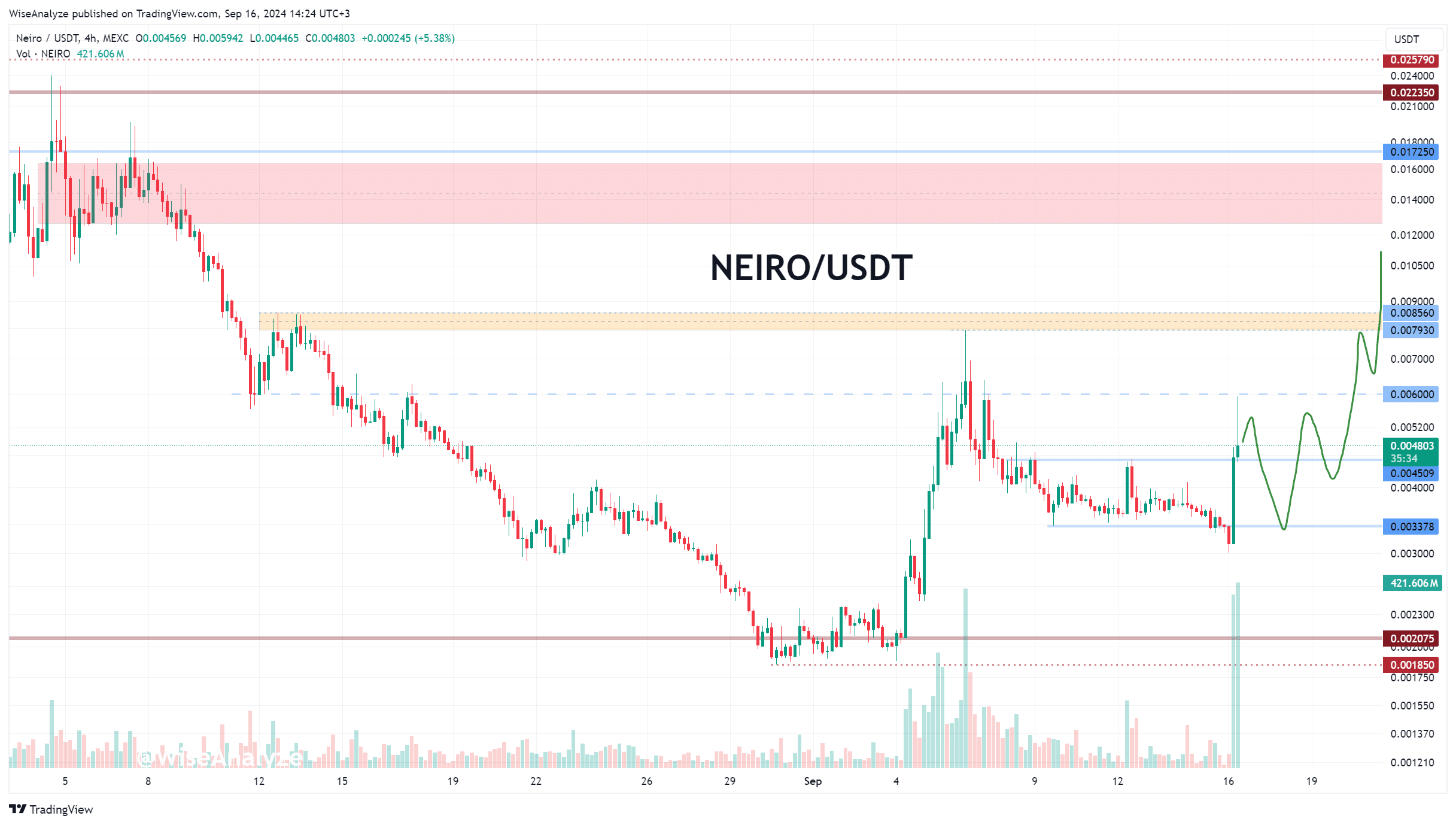

A break above $0.006 could trigger strong bullish momentum, targeting a surge towards $0.01.

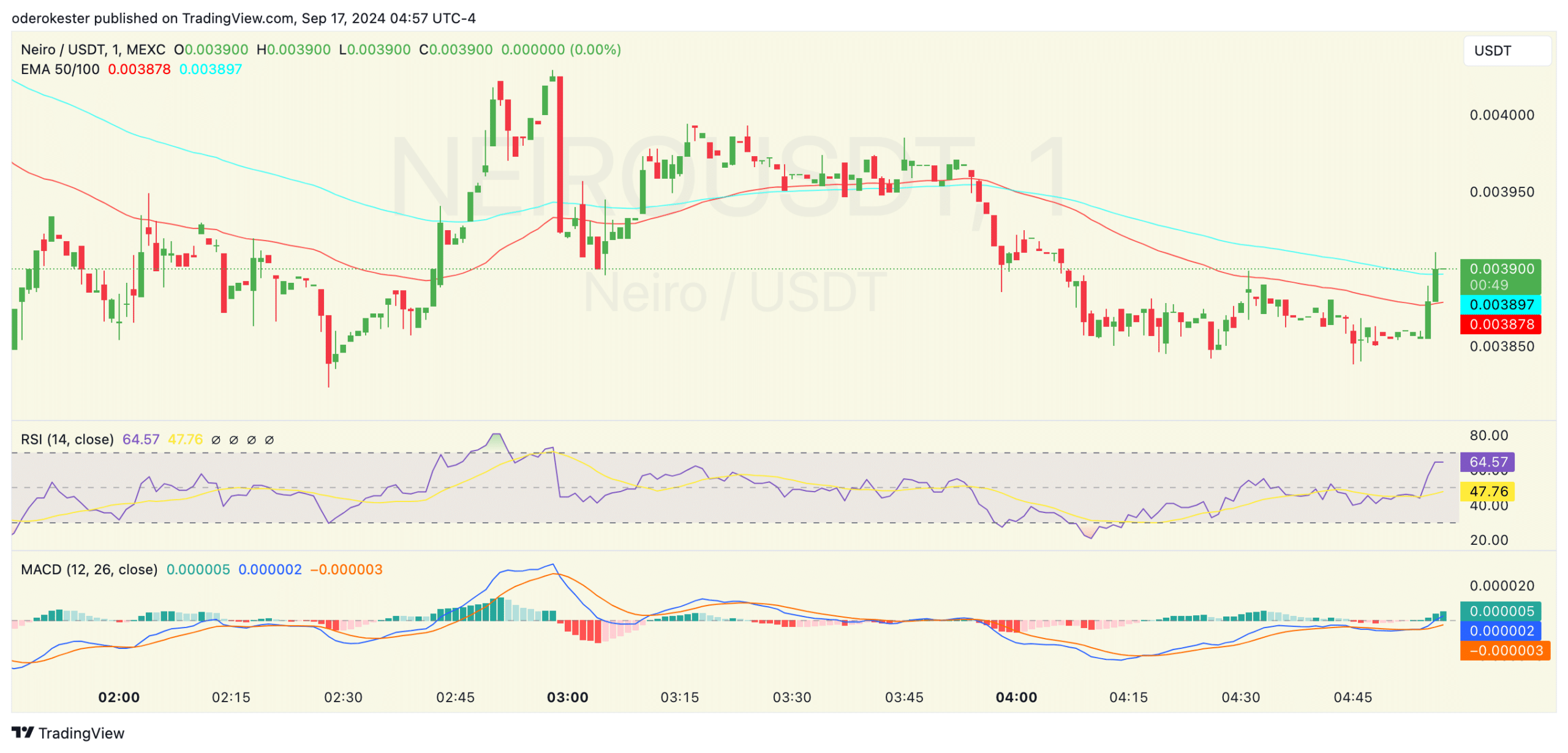

Recent volume spike suggests growing interest, but $NEIRO faces resistance from the 50 and 100 EMAs.

As a seasoned crypto investor who has witnessed the rise and fall of countless digital assets, I find myself intrigued by NEIRO‘s current market position. The recent surge in volume is a promising sign, indicating growing interest from the community. However, the resistance from the 50 and 100 EMAs serves as a formidable obstacle that needs to be addressed before we can talk about significant upward momentum.

It seems like NEIRO cryptocurrency might be setting up for an uptrend following a phase where it was consolidating and facing bearish forces.

Experts predict that the price might stay within a range of $0.0034 and $0.0045 for some time, before showing any substantial increase.

Crypto analyst Zen stated,

“$NEIRO starting a bullish reversal imho.”

He noted that the price could stay within this range for a while before potentially surpassing the $0.006 barrier, which currently acts as a resistance level.

If we manage to break past the current resistance, it’s likely that our price could reach around $0.00793 next. A strong push towards $0.01 might ensue after that.

Key resistance levels and price path

Based on Zen analysis, the $0.006 level is significant as the initial strong resistance to keep an eye on. If NEIRO manages to surpass this threshold, it might signal the commencement of more robust bullish movement.

If the price hits approximately $0.00793, it could act as a catalyst for additional growth, potentially pushing the price up towards a psychologically significant level of $0.01.

As a crypto investor, based on the current price trajectory analysis, it seems we might be headed for a potential revisit to around $0.006. If all goes as projected, there could be a subsequent surge aiming at $0.00793.

During this consolidation period, we might be laying the groundwork for a more substantial advance, which could propel the value of NEIRO upward in the long run. If we surpass the $0.01 mark, it would represent a crucial achievement for investors aiming for substantial profits.

Neiro crypto market sentiment

A significant jump in trading activity, totaling more than 421 million units, indicates growing curiosity towards NEIRO. Such a sharp increase in trades could potentially signal an upcoming bullish trend.

As the action increases, it might indicate a resurgence of energy, particularly if purchasers manage to drive the cost above important resistance thresholds.

Despite the recent volume surge, the price of NEIRO has seen mixed performance in the short term.

Currently, NEIRO cryptocurrency is worth approximately 0.003882 USD, marking a drop of 27.71% in the last day. However, it’s important to note that there has been a slight growth of 2.66% over the past week.

The press time market cap was $3.88 million, based on a circulating supply of 1 billion tokens.

Technical indicators show mixed signals

From a technical perspective, at the moment, both the 50 Exponential Moving Average (EMA) at $0.003889 and the 100 EMA at $0.003909 are higher than the current price. This suggests that there is short-term resistance to the price increase.

It seemed like the price was having trouble moving beyond those points, hinting at a potential period of stabilization or consolidation.

In simpler terms, the Relative Strength Index (RSI) stands at about 46.25, which suggests a slightly pessimistic trend as it shows weak momentum and some selling pressure. Yet, it’s important to note that the RSI hasn’t reached the oversold zone just yet. This implies that any potential future drops might be more moderate or limited.

Read Neiro’s [NEIRO] Price Prediction 2024–2025

In simpler terms, the MACD lines barely moved, staying close to the point where they cross, suggesting that there isn’t much strong momentum pushing the price up or down.

This reinforced the likelihood of continued sideways movement until a breakout occurs.

Read More

2024-09-17 21:44