- Notcoin’s price dropped 3.02% in the past 24 hours, trading at $0.005802.

- An analyst highlighted a falling wedge pattern for a potential rally.

As a seasoned analyst with over two decades of market experience under my belt, I’ve witnessed countless bull and bear runs, and learned to decipher the intricate language of charts and indicators. The current state of Notcoin (NOT) presents an interesting conundrum.

Over the last 24 hours, Notcoin’s price dropped by 3.02%, currently valued at $0.005802 per token. Interestingly, despite this decrease in price, its market capitalization increased to an impressive $594.42 million compared to the previous day.

In the face of recent price dips, I’ve noticed an impressive level of resilience within the market. However, it seems that trading activity has slightly slowed down, with a decrease of approximately 9.08% in volume, leaving us at around $86.19 million for the day.

This trading activity suggested moderate market interest, with a volume-to-market cap ratio of 14.49%. The fully diluted valuation (FDV) of NOT remained at $594.38 million, indicating confidence in the coin’s long-term potential.

Having a total of 102.46 billion tokens, NOT presents opportunities for possible shifts, always keeping a watchful eye on market trends.

Notcoin primed for potential breakout amid low volatility

At the moment of reporting, Notcoin’s price appears to be stabilizing near $0.005807, suggesting a potential surge could be imminent. Experts have observed that the Bollinger Bands are becoming narrower, with the upper and lower limits set at $0.0071 and $0.0054 respectively, indicating a tightening range which often precedes a significant price movement.

Using this contraction frequently points towards low market turbulence, possibly signaling an upcoming major price adjustment, hinting at a possible market breakthrough.

Currently, the Moving Average Convergence Divergence (MACD) indicator shows a pessimistic outlook. Specifically, the MACD line is situated beneath the signal line, and the chart’s histogram continues to decline, indicating persistent falling trends.

For a potential bullish reversal, the Moving Average Convergence Divergence (MACD) line should move over the signal line, accompanied by an upward movement of the histogram towards the $0.0071 resistance level.

In simpler terms, the Chaikin Money Flow (CMF) was at -0.06, suggesting that there’s a slight dominance of sellers over buyers in the market, as the CMF value being less than zero implies increased seller influence.

If the Cumulative Moving Average (CMF) surpasses zero, it’s indicative of growing buying pressure, potentially propelling prices towards the resistance level.

Selling pressure high as holders lose profits

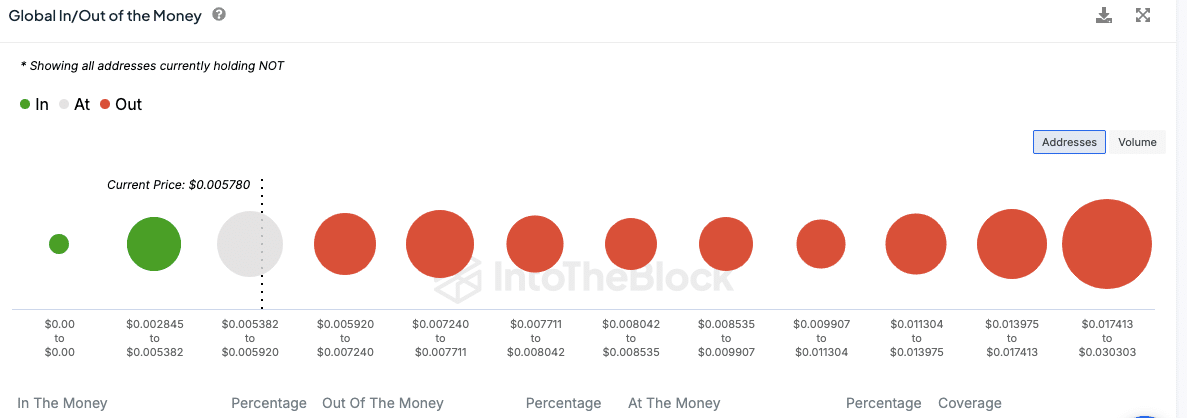

The worldwide “In/Out of the Money” graph indicated that a majority of NOT holders currently have their tokens at prices considered “Out of the Money.” These holders generally possess NOT coins in higher price brackets, specifically ranging from approximately $0.005920 to $0.017413. This trend suggests that numerous owners could be experiencing paper losses on their investments.

Mostly, it was only a few addresses that had profits, with the majority being those who bought when the price ranged from approximately 0.002845 to 0.005382 dollars. This suggests that the potential for earning profits is currently rather limited.

The chart of long/short ratios indicated a fluctuating pattern of buying and selling activity, with noticeable surges in selling transactions exceeding 50%. This pattern demonstrated that at times, sellers outnumbered buyers, creating a shifting balance within the market. This situation hints at a general sentiment equilibrium, where sellers occasionally hold sway but fail to maintain consistent strength.

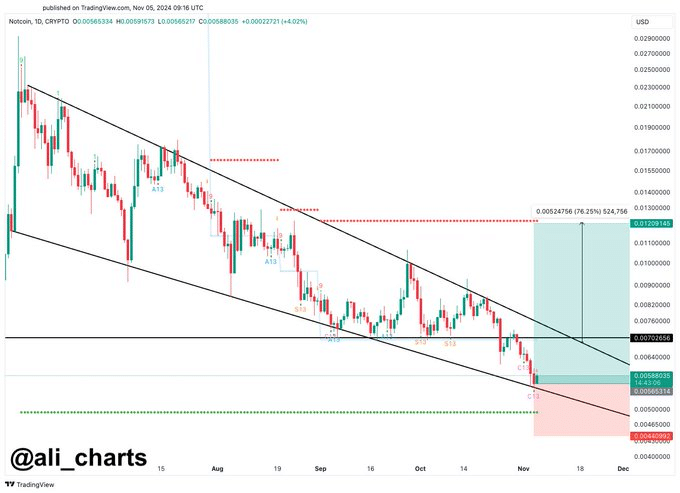

Falling wedge pattern signals rally for Bitcoin

According to crypto expert Ali Martinez, there’s a potentially optimistic ‘falling wedge’ pattern emerging on the chart for NOT. If this pattern holds true, it could result in a surge towards approximately $0.012, but it’s important to note that confirmation is still needed.

Keep a close eye on technical indicators, since growing purchasing momentum might trigger a substantial price surge among traders and investors.

Read Notcoin’s [NOT] Price Prediction 2024–2025

As a researcher, I find myself analyzing the market dynamics. Should the buying momentum strengthen and my technical markers signal a bullish trend, I anticipate the token could challenge its upper resistance thresholds. Conversely, if selling forces persist, it’s plausible that the token might retrace to revisit its support at $0.0054.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-11-06 05:12