- The SEC has approved the first leveraged MicroStrategy ETF

- Market indicators suggested an upward move for Bitcoin

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and regulatory approvals. The recent SEC approval of the leveraged MicroStrategy ETF by Defiance is an intriguing development, especially considering the high-risk nature of this product. It’s akin to adding rocket fuel to Bitcoin’s price movements, potentially catapulting it to new heights if market indicators play out as expected.

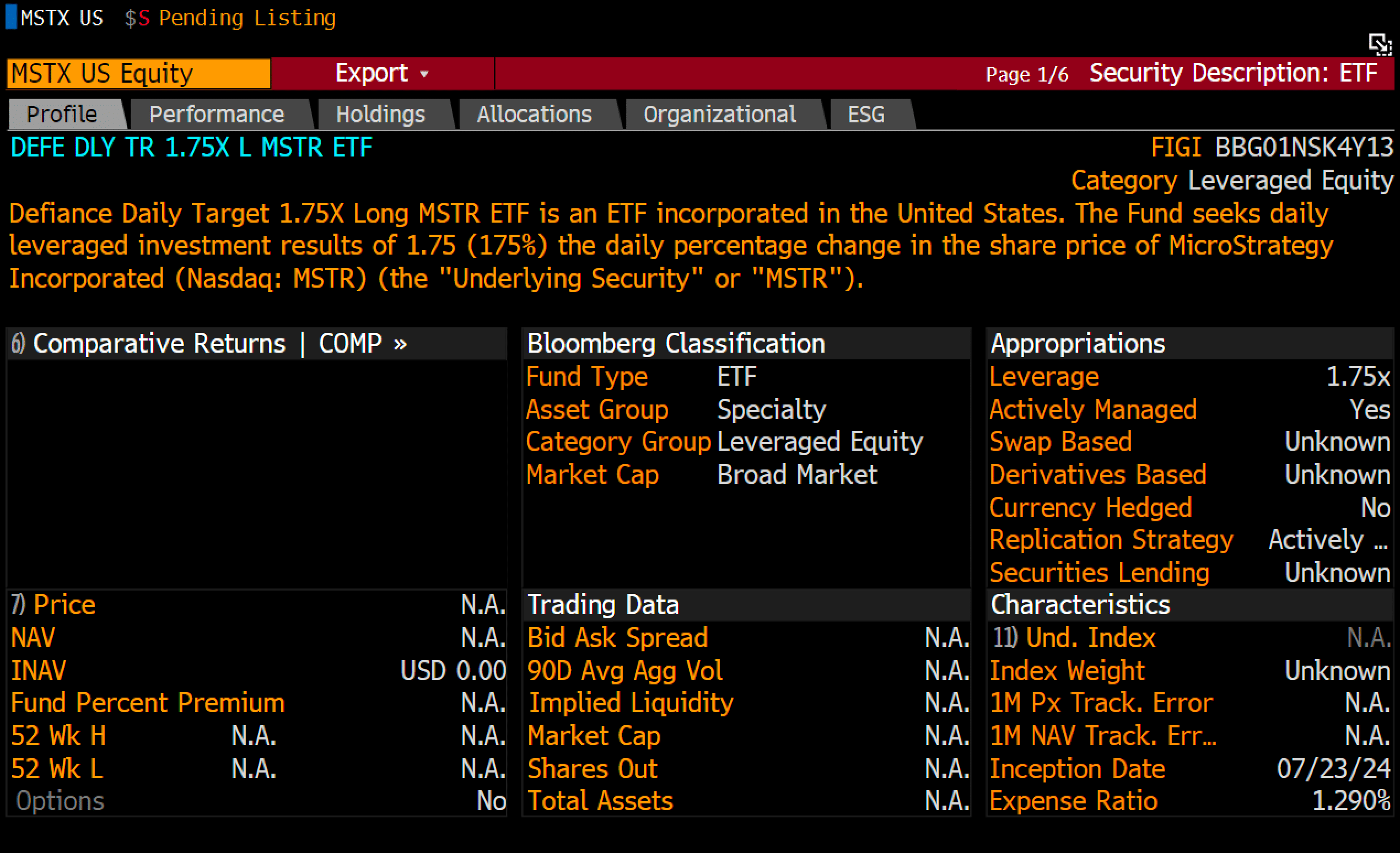

As a researcher, I’m excited to share that today, the Securities and Exchange Commission (SEC) has made headlines for approving the first leveraged MicroStrategy ETF, which goes by the ticker symbol $MSTX. This innovative fund is brought to us by Defiance. Notably, this update was initially reported by Eric Balchunas, Bloomberg’s ETF Analyst, on [specific date or platform].

Though initially intended as a 2x ETF, the SEC’s restrictions limit its leverage. This ETF will be highly volatile, similar to a 13x SPY ETF, surpassing even the $MSOX (2x weed ETF) in risk.

Despite Defiance being the first to launch this particular product in the market, Tuttle is also working on a 2x MicroStrategy ETF.

The demand for Exchange-Traded Funds (ETFs) that experience significant price fluctuations is robust, as illustrated by the $5 billion approval of the Nvidia 2x ETF. This endorsement could indicate increased purchasing interest and optimistic expectations towards Bitcoin.

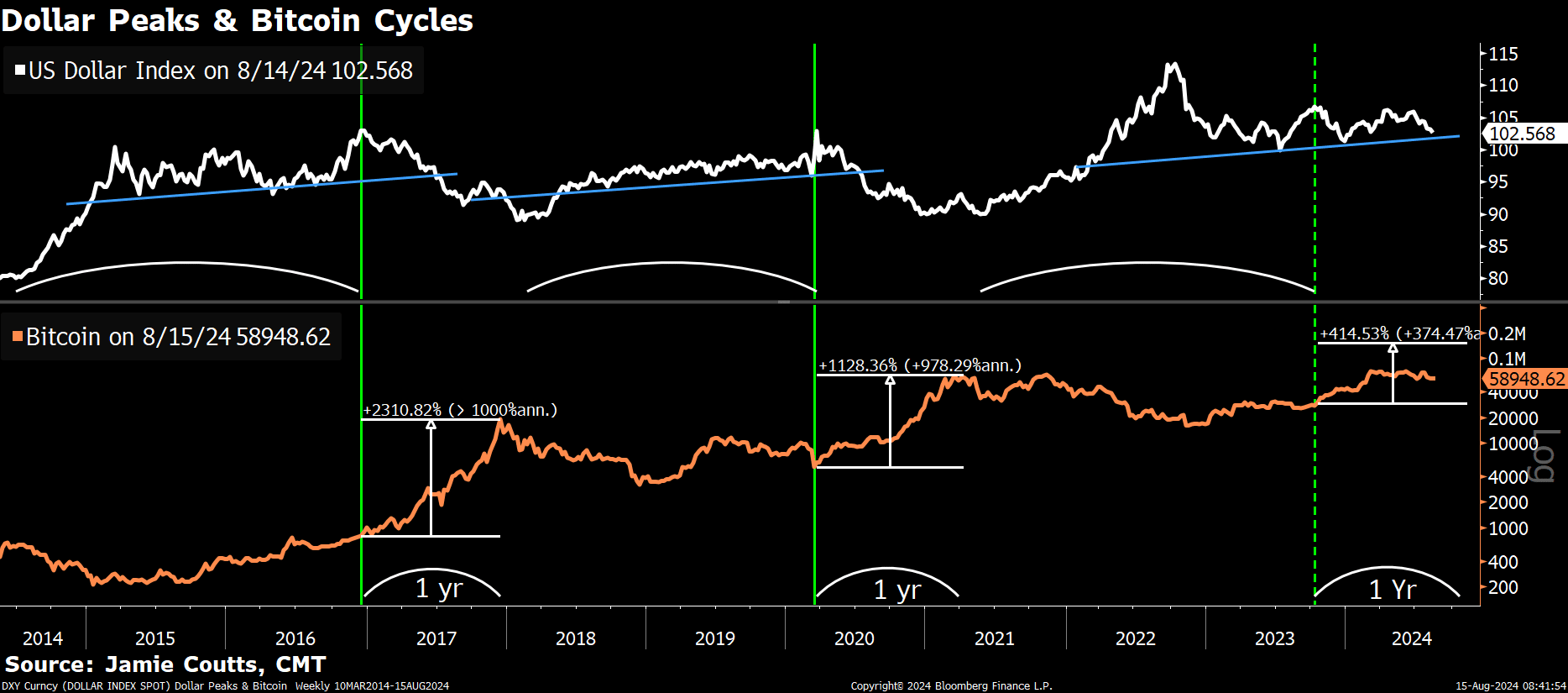

USD cycles, treasury, & BTC bull markets

When the value of the U.S. dollar decreases (as a result of the Federal Reserve’s actions or increased global liquidity), Bitcoin [BTC] often experiences significant growth.

The DXY has now hit equal highs, indicating a potential reversal. As the DXY drops, Bitcoin is expected to climb higher, potentially surpassing its all-time high on the charts.

Treasury market volatility is a crucial yet often overlooked factor in shaping risk asset strategies. It’s a major concern for Federal Reserve Chair Jerome Powell and his team.

In an effort to stabilize the market, they’re focusing on dampening the Treasury’s price fluctuations. Consequently, this reduced volatility might instead be channeled into Bitcoin, possibly escalating its value.

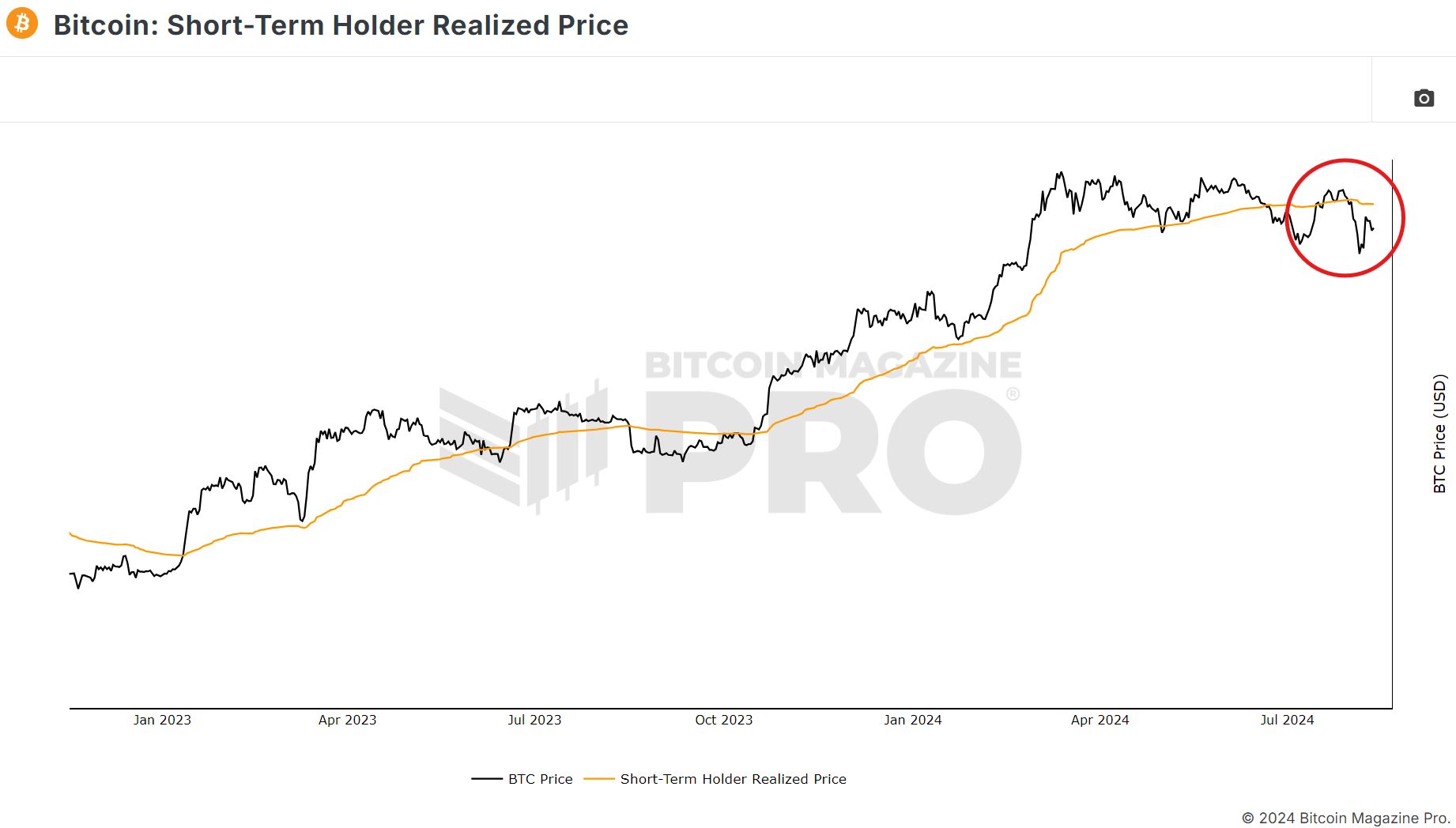

Bitcoin is showing robust energy, surpassing the estimated average purchase price for short-term holders, which is around $65,000.

If we see a recovery at this price point in the Bitcoin market, it might provide a solid base for further advancement toward $70,000 and potentially even higher prices. Such a move would underscore Bitcoin’s status as a preferred option for cryptocurrency investments, reaffirming its dominance in the field.

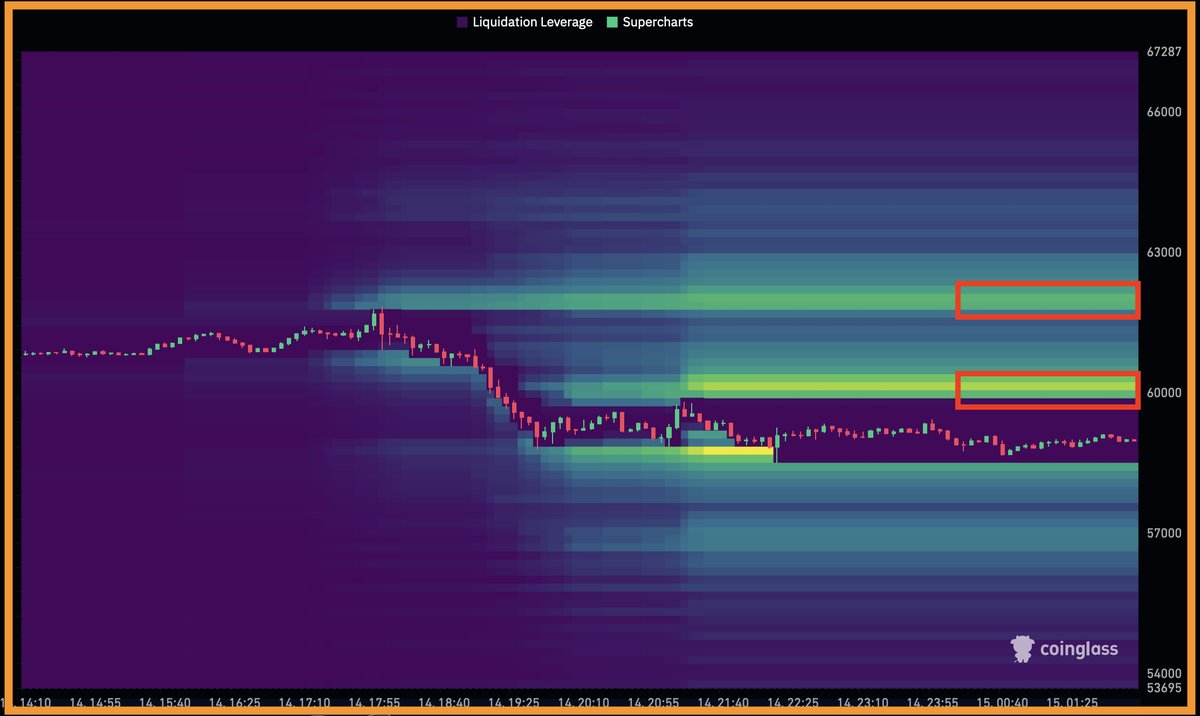

Leverage liquidations and RSI signal bullish sentiment

Leverage liquidation hunting is a key factor causing price movements across high timeframes.

If Bitcoin surpasses and maintains its value above $60,000, it might lead to liquidations worth approximately $93 million at that level. Additionally, around $75 million more could be triggered if the price rises between $61,800 and $62,200.

The rise in Bitcoin’s value might push it beyond its old record of $74,000, possibly resulting in even greater price increases.

As a crypto investor, I’ve noticed that Bitcoin’s Stochastic RSI has indicated we’re approaching a “Rebound Zone” over the next few months. This seems like a strategic moment for both traders and long-term investors to consider buying more Bitcoin, potentially positioning ourselves for a price increase down the line.

Based on my years of experience in the cryptocurrency market and observing the trends, I firmly believe that this indicator points towards a strong possibility of Bitcoin reaching new highs. Given my history of investing in Bitcoin, I think now is an opportune moment to consider adding Bitcoin to one’s investment portfolio, as it could potentially yield significant returns.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-08-16 02:52