- Ethereum’s funding rate signals a potential rebound for ETH.

- ETH has declined by 16.48% over the past 7 days.

As a seasoned analyst with over two decades of experience in the crypto market, I have witnessed numerous bull and bear cycles. The recent downturn in Ethereum [ETH] is not uncommon, but the current signs suggest a potential rebound.

Over the last week, following reaching $4109, Ethereum (ETH) has been under significant selling pressure, causing its value to drop as low as $3095, representing a decrease of approximately 16.48%.

Although Ethereum has seen a temporary setback, it appears poised for another climb to approximately $3,300. This optimism stems from the fact that Ethereum’s funding rate has decreased following its rejection at the $4,000 mark.

Ethereum’s Futures market cools after $4k rejection

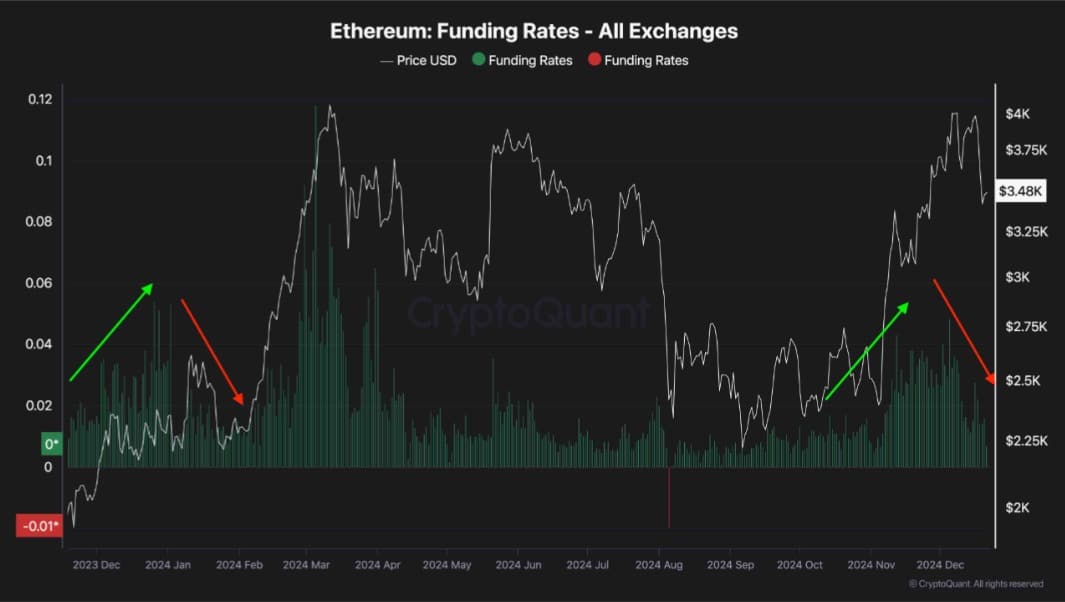

Based on information from Cryptoquant, Ethereum’s inability to surpass the $4,000 resistance level led to significant sell-offs and liquidations within the futures market.

As a crypto investor, I’ve witnessed a massive market plunge recently, with Ether (ETH) hitting record lows. Despite a significant surge in ETH’s funding rate last week, its inability to maintain a position above $4k has brought the funding rate back to a balanced state. These levels, in my view, are ideal for a bullish trend to resume.

Thus, the cooling trend observed might open up possibilities for a longer-term, eco-friendly surge in the upcoming period, from my analysis perspective.

In January 2024, a similar pattern emerged. The decrease in funding rates caused a stabilization in the futures market, which boosted ETH significantly, leading to a significant upward trend.

At this recent event, the price of Ethereum surged from $2169 to an impressive $4091. This significant increase in the past suggests that the current market adjustment might be signaling the start of a new period of upward momentum.

What ETH charts suggest

Over the last week, Ethereum has been under significant selling pressure; however, the current market situation seems to indicate a potential for rebound.

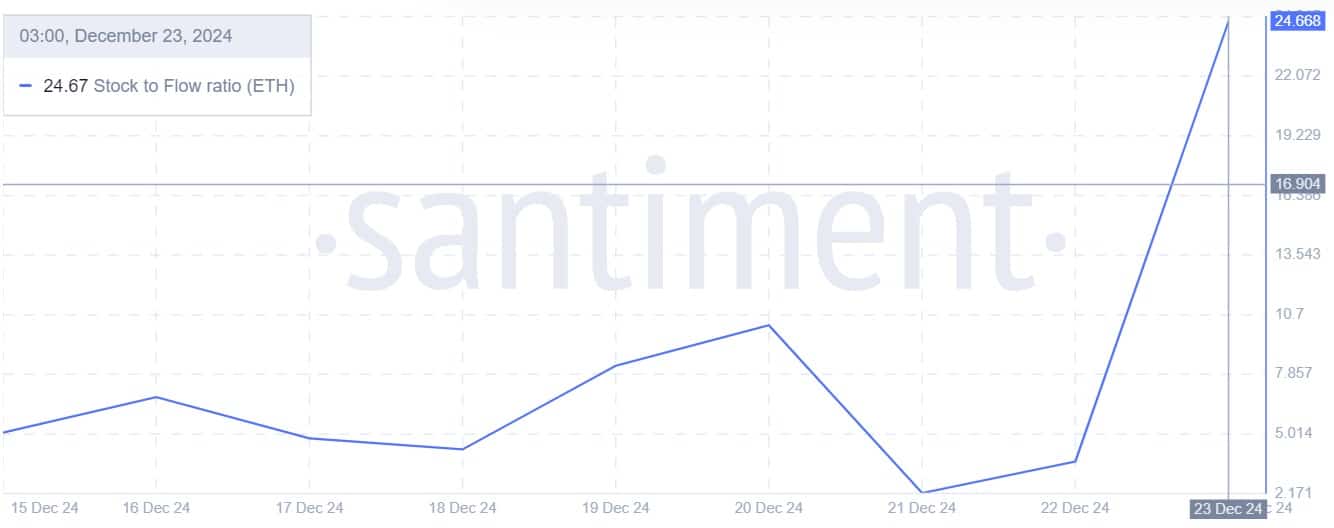

Initially, the Stock-to-Flow Ratio (SFR) of Ethereum has significantly increased over the past week, moving from 2.19 to 24.67. An increase in the SFR suggests that Ethereum is becoming more scarce as it is being accumulated by large holders at a higher rate.

Consequently, the scarcity of this altcoin is increasing. With growing interest from buyers, this trend drives up prices due to a reduction in supply availability.

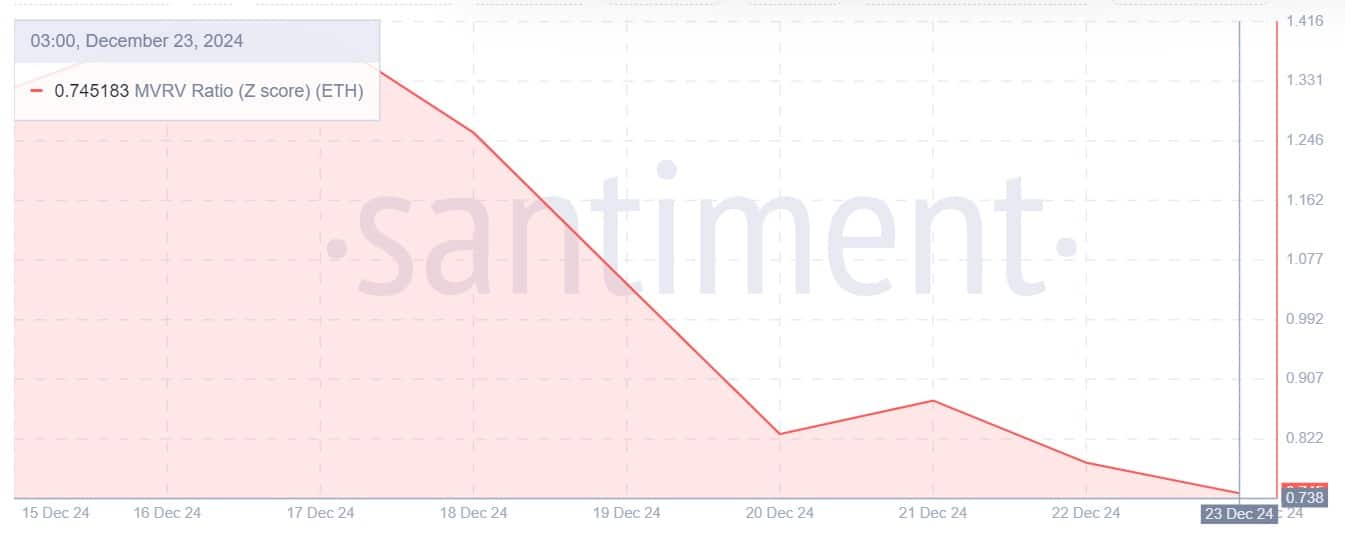

Furthermore, the Ethereum MVRV Z-score ratio has dropped to 0.745 in the last week. When the MVRV score dips this low, it suggests that ETH is presently underpriced, offering a favorable sign for accumulation by long-term investors.

Over the last seven days, it appears that whales have been purchasing during market dips. This increased buying typically leads to an uptick in demand, which in turn creates a strong push for prices to rise due to high demand.

Over the recent span of days, I’ve observed a significant uptick in Ethereum’s Bitmex basis ratio, shifting from -0.22 to 0.07. When this ratio moves above zero, it signifies growing confidence within the futures market as traders foresee price increases following a downturn, indicating a bullish sentiment.

Is a comeback likely?

From the information presented, it appears that the futures market is showing a positive outlook, predicting an increase in the price of Ethereum. Additionally, the current demand for Ethereum in the spot market remains strong, which sets up favorable circumstances for potential price rises.

Read Ethereum’s [ETH] Price Prediction 2024-25

Given the positive sentiment surrounding the market, Ethereum (ETH) might bounce back from its drop at around $3300 and regain a stronger resistance level. Should this trend persist, Ethereum could successfully surpass the resistance of $3700.

Moving forward might bolster Ethereum’s position to potentially reach around $3900. But, given that bears are still dominant, if bulls don’t manage to regain control of the market, Ethereum could slide down to approximately $3160.

Read More

2024-12-23 17:12